Bitcoin and Ether ETFs Bleed $550 Million as Solana Defies the Downtrend

The week’s mid-point brought turbulence to the crypto exchange-traded fund (ETF) market. After days of inflows and optimism, investors hit the brakes hard on Wednesday, Oct. 29, pulling nearly half a billion dollars from bitcoin ETFs and extending the pressure on ether funds. But while the two giants stumbled, solana ETFs kept the momentum alive.

Bitcoin ETFs led the market’s retreat, recording a $470.71 million outflow, one of the sharpest single-day exits in weeks. Fidelity’s FBTC bore the brunt, shedding $164.36 million, while Ark & 21shares’ ARKB saw $143.80 million leave its coffers.

Blackrock’s IBIT and Grayscale’s GBTC added to the exodus with $88.08 million and $65.01 million in redemptions, respectively. Smaller exits came from Bitwise’s BITB ($6.03 million) and Grayscale’s Bitcoin Mini Trust ($3.43 million). Despite strong trading activity of $7.07 billion, net assets fell to $149.98 billion, ending the market’s four-day inflow streak.

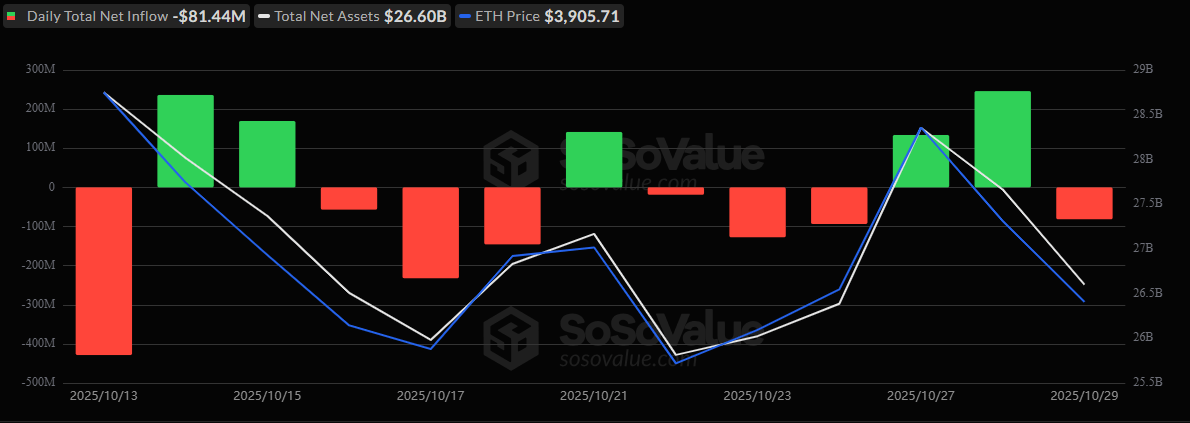

Ether ETFs have experienced mixed trading outcomes over the past two weeks, with more days of outflows than inflows. Source: Sosovalue

Ether ETFs weren’t spared either. Totaling $81.44 million in outflows, the losses were concentrated in Fidelity’s FETH, with $69.49 million exiting. Grayscale’s Ether Mini Trust and ETHE added another $16.18 million and $12.83 million in redemptions. Vaneck’s ETHV saw a modest $4.31 million loss, though Blackrock’s ETHA offered a slight positive note with a $21.36 million inflow. Trading activity reached $2.43 billion, keeping net assets steady at $26.60 billion.

Amid the red sea, solana ETFs were the day’s bright spot. Bitwise’s BSOL pulled in a solid $46.54 million, while Grayscale’s newly listed GSOL added $1.40 million in its first full trading day. With a total turnover of $79.50 million, solana’s combined ETF assets nearly doubled to $432.29 million, signaling strong early conviction in the network’s ETF debut.

While bitcoin and ether cooled off, solana stole the show, a reminder that crypto’s next wave of ETF energy may be spreading beyond the top two.

FAQ💰

- Why did bitcoin and ether ETFs see major outflows?

Investors pulled over $550 million from bitcoin and ether ETFs as profit-taking and risk aversion hit midweek trading. - Which funds were most affected?

Fidelity’s FBTC and Ark & 21shares’ ARKB led bitcoin redemptions, while Fidelity’s FETH drove most ether withdrawals. - How did solana ETFs perform amid the downturn?

Solana ETFs defied the trend with $48 million in inflows, led by Bitwise’s BSOL and Grayscale’s GSOL debut. - What does this shift signal for crypto ETFs?

The divergence shows investors are rotating beyond bitcoin and ether, with solana emerging as a new ETF favorite.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。