As Ethereum continues to garner investor interest, outpacing Bitcoin in key metrics, the second-largest cryptocurrency by market capitalization has continued to contend with the world’s largest cryptocurrency on the CME derivatives market.

According to recent data shared by the CME Group, Ethereum futures have significantly surpassed Bitcoin futures in derivatives trading activity.

Ethereum Futures sets new record in open interest

Data provided by the source shows that Ether futures on the leading derivatives exchange have outpaced Bitcoin futures in monthly average daily volume (ADV) since April 2025.

HOT Stories This Could Be Major Date for XRP HoldersCrypto Market Prediction: XRP to Avoid Bearish Crash? Shiba Inu (SHIB) Big Price Battle in Two Days, Ethereum (ETH) Tumbles Below $4,000Morning Crypto Report: Elon Musk's SpaceX Resumes Strange Bitcoin Activity, XRP Ticker Debuts on Nasdaq, US-China Talks Trigger $824,470,000 Crypto LiquidationsXRP ETF Flows Will Exceed What People Are Expecting, Analyst Predicts

While Ethereum has been in the spotlight this year, with institutions diverting from Bitcoin to owning an Ethereum treasury, its outstanding performance on the CME derivatives exchange further signifies rising institutional demand for Ethereum exposure.

Amid the growing interest among institutions, CME further revealed that open interest in ETH futures has reached a massive 53,183 contracts, while Micro Ether futures climbed to a record 335,016 contracts as of October 28, both setting new all-time highs.

You Might Also Like

Thu, 10/30/2025 - 14:56 Selling Bitcoin Now? BTC Price History Suggests November Is Worst Time to ExitByGamza Khanzadaev

The Bitcoin and Ether futures “monthly average daily volume (ADV)” disclosed by the exchange show that ETH’s trading volume broke above BTC’s for the first time in April 2025, and it has continued to lead the crypto king since that time. Notably, the move signals a growing divergence in market focus from Bitcoin to Ethereum.

While Bitcoin futures activity has leveled off after a strong first half of the year, Ethereum’s momentum has remained resilient as it continues to build—attributable to the growth in DeFi, staking yields, and surging optimism of further institutional adoption of the leading altcoin.

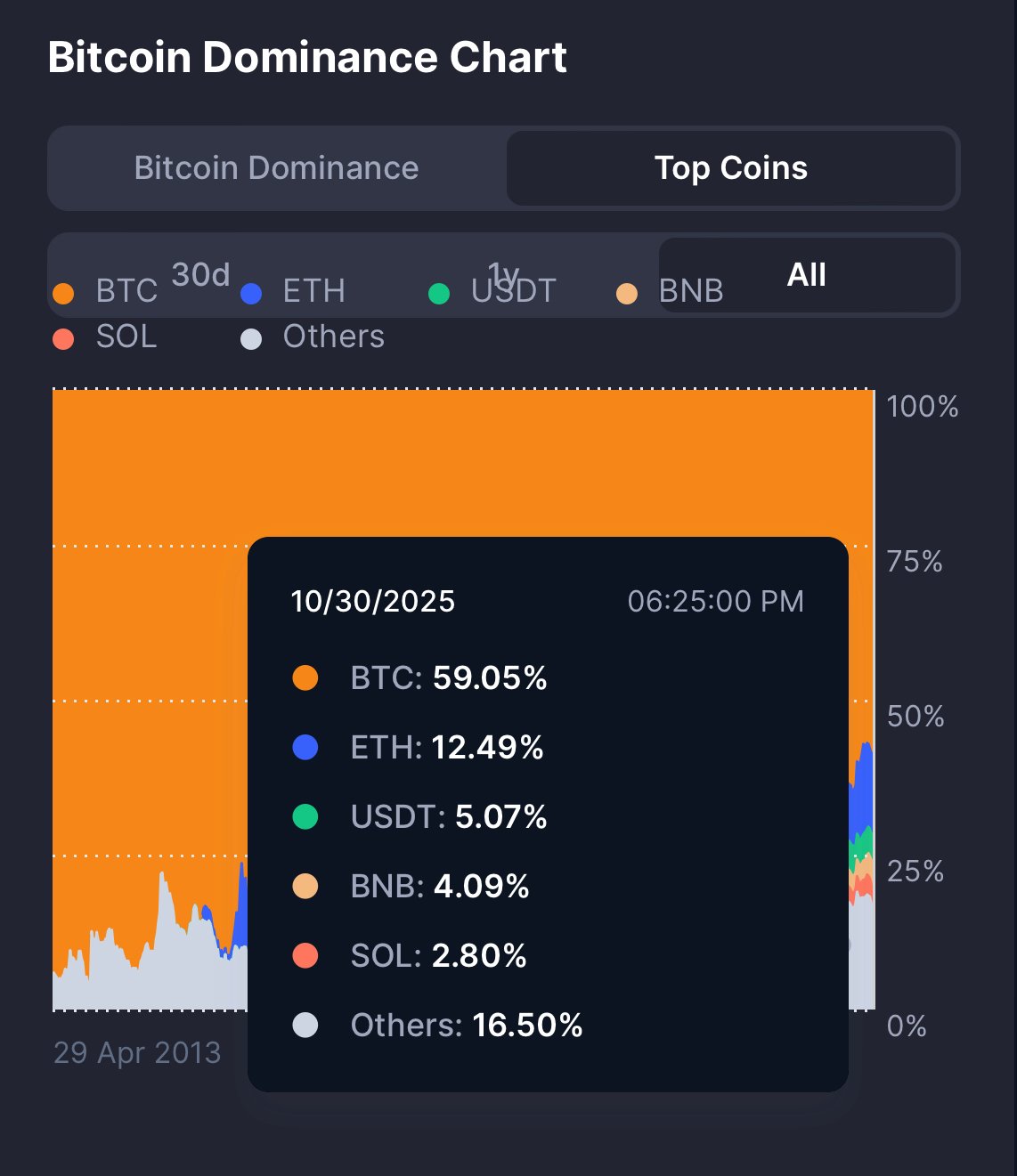

Bitcoin maintains dominance

Despite the impressive performance witnessed in Ethereum’s futures activity, Bitcoin still maintains its dominance across the broad spot trading market.

Data provided by CoinMarketCap shows that Bitcoin still holds the highest market share in the broad cryptocurrency market. As such, Bitcoin's total market capitalization is currently higher than the total market capitalization of all cryptocurrencies combined by a massive 59.2%.

Source: CoinMarketCap

This shows that Bitcoin has seen a mild increase of 0.87% in its dominance rate over the last 24 hours despite the recurring price corrections.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。