Author: oxStill

While all L2s are competing for TVL, a project has quietly achieved a TPS of 100,000 transactions per second, even Vitalik Buterin has "endorsed" it — it is MegaETH, a disruptor claiming to build the "first real-time blockchain."

The public offering of MegaETH has entered the countdown, and as of the time of writing, it has been oversubscribed by 20 times, raising approximately $1 billion.

The market has voted with real money, but what do professional analysts think?

0xResearch Analysts Boccaccio & Marc Arjoon:

We believe that if you can secure an allocation above the minimum, this could be one of the best opportunities of the year.

This auction adopts an English auction format, starting at 9 AM Eastern Time on October 27 and lasting for 72 hours.

Unlike traditional token sales, this English auction format allows the market to determine a fair price through competitive bidding. The system operates by determining a clearing price — the minimum price point at which the total bids can fill the entire allocation of 500 million tokens.

All successful bidders, regardless of their individual bid amounts, pay the same clearing price, meaning that even if someone bids the highest at $0.0999 per token, they will only pay the final clearing price if it is lower.

Bidders below the clearing price will receive a full refund, while those at or above the clearing price will receive an allocation. The auction format eliminates the competition for gas fees and the first-come-first-served advantage, creating a fairer distribution mechanism.

This sale offers 500 million MEGA tokens, accounting for 5% of the total supply of 10 billion tokens, conducted entirely on the Ethereum mainnet, using USDT as the payment method.

The auction price range is from $0.0001 to $0.0999 per token, with a starting price of $0.0001, representing a fully diluted valuation (FDV) of $1 million, and a cap price of $0.0999, representing an FDV of $999 million.

The minimum bid amount for individual participants is $2,650, with a maximum of $186,282, and a bid increment of $0.0001. The structure includes a mandatory one-year lock-up period for U.S. accredited investors, who can enjoy a 10% discount, while non-U.S. participants can choose the same lock-up conditions to benefit from the discount.

After the auction ends, the allocation calculation period will last from October 30 to November 5, with refunds and withdrawal periods from November 5 to November 19, and final allocations and reallocations occurring from November 19 to November 21.

As expected, the public sale of MegaETH has been very successful so far, with an oversubscription of 14 times. As the final day approaches, this number is likely to increase further, with most deposits/bids pouring in during the last few hours.

After all, if someone offers you a free money-making machine, the only correct action is to deposit as much as possible.

Currently, MegaETH is trading in the pre-market (on Hyperliquid) with an FDV valuation of $4.5 billion, allowing depositors to achieve a 4.5x return. The main issue is that any depositor may only achieve a 4.5x return at the minimum bid amount ($2,650). The MegaETH team has publicly disclosed factors affecting allocation amounts, primarily including past wallet interactions, social media influence, and some new "social credit" platforms (like Ethos).

As with any situation involving free money-making machines, we have seen a significant amount of Sybil activity. If the minimum bid is $2,650 and you have 450 Echo/Sonar accounts, you can earn more money and have a higher earning opportunity than those savvy cryptocurrency enthusiasts with good social and DeFi/on-chain credentials.

We have discussed MegaETH multiple times on our podcast, generally holding an optimistic view of the chain. The team has taken a unique approach to ecosystem building (MegaMafia has now entered its second phase, with the third phase coming soon) and focuses on unique applications — rather than forks of Uniswap, Aave, Morpho, or Compound (which seem to dominate most other chains).

Regardless of your valuation of MegaETH, we have two key takeaways from the past few months:

Some chains are now clearly focused on revenue, while others focus on different narratives (like decentralization). Which can provide better returns is still unclear (e.g., XRP vs. Hyperliquid, or ETH vs. SOL).

Many significant returns now come from private public markets (like Echo, Sonar, etc.), pre-deposits, etc. The whitelist and Discord roles of 2021 (and the subsequent Sybil attacks, buying and selling of whitelists and Discord roles) have now evolved into Sonar and Echo (and the subsequent Sybil attacks, buying and selling of KYC-verified Sonar and Echo accounts).

Former Messari Executive Kunal G (@kunalgoel) posted:

The scale of MegaETH is staggering, and every calculation disrupts all intuitive expectations. While the market sees it as just another ordinary L2, my models show that its actual opportunities far exceed imagination.

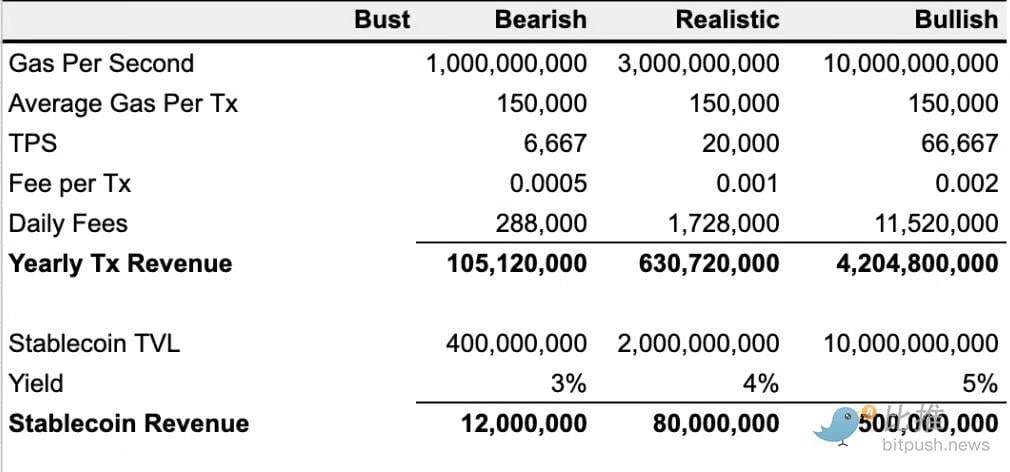

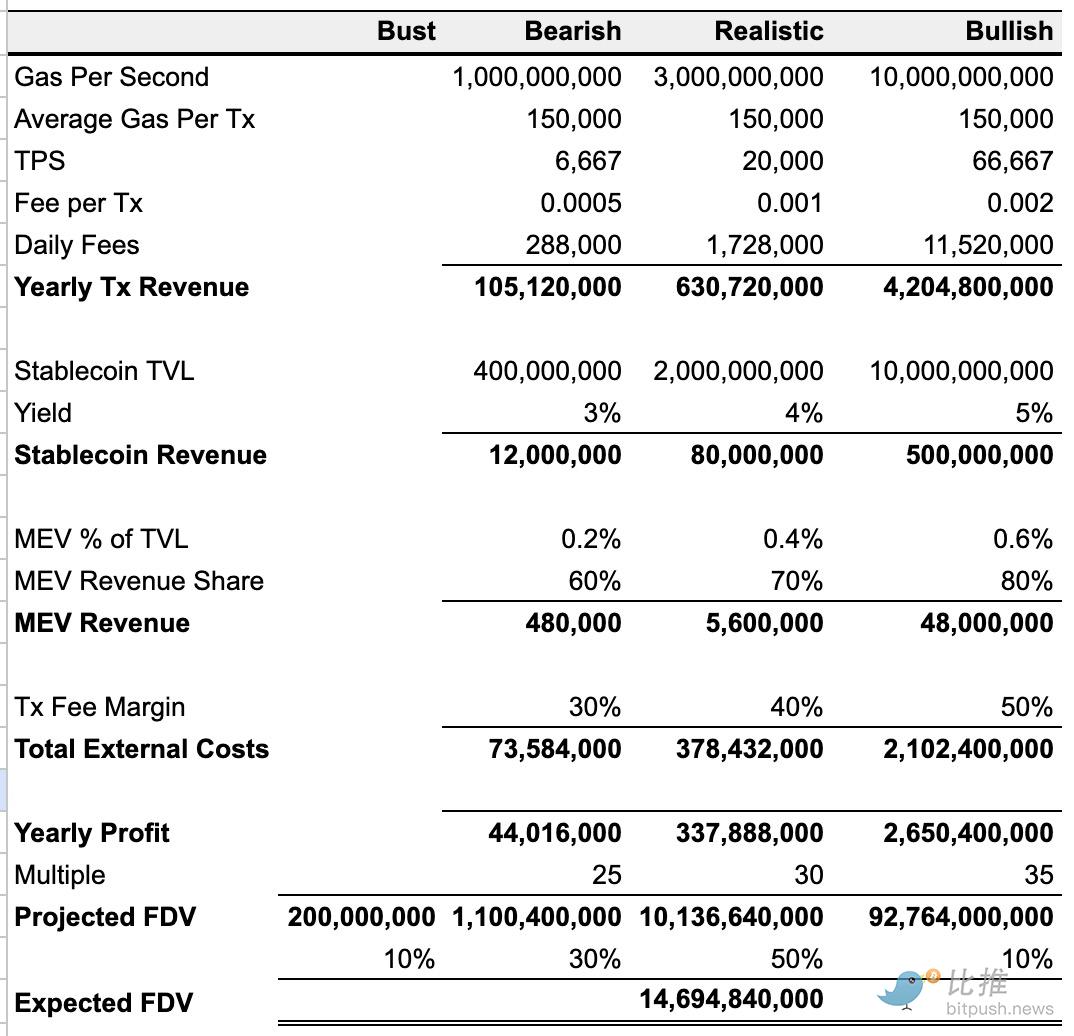

I have built four scenario models:

Optimistic Scenario – MegaETH achieves promotional performance, reaching 10 Gigagas or 66,667 typical transactions per second.

Realistic Scenario – Actual scale reaches one-third of expectations, at 3 Gigagas, 20,000 transactions per second.

Pessimistic Scenario – Scale is only 10% of the promotion, at 1 Gigagas, 6,667 transactions per second.

Failure Scenario – The project completely fails, with the final fully diluted valuation (FDV) locked at $200 million.

Even in the pessimistic scenario, assuming a transaction fee as low as $0.0005 (lower than most L1 and L2), MegaETH could generate $288,000 in daily revenue solely from transaction fees, with annual revenue exceeding $100 million.

Revenue potential skyrockets with scale:

- In the realistic scenario, annual revenue reaches $600 million.

- In the optimistic scenario, if transaction fees slightly rise to $0.001-$0.002, annual revenue could soar to $4.2 billion.

Additionally, MegaETH's native stablecoin MegaUSD can generate additional income through protocol yield. Depending on the total locked value (TVL) of the stablecoin, this portion could contribute 8-9 figure annual revenue.

The project also plans to internalize MEV revenue through sequencer permissions and cabinet custody services. The recently launched "staking for permissions" model will create a similar positive impact by reducing circulating supply and generating delegated staking yields.

The model conservatively deducts 50-70% of transaction revenue for infrastructure costs such as data availability layers (DA), sequencers, proofs, oracles, etc. Although the project has extremely high operational demands, costs scale in sync with throughput, making the calculation logic clear.

My benchmark scenario predicts annual profits exceeding $300 million, corresponding to an FDV of about $10 billion at a 30x price-to-earnings ratio.

Considering the probabilities of all scenarios, the weighted expected FDV could reach $14-15 billion — representing over three times the current price of Hyperliquid perpetual contracts and over 14 times the ICO price.

The main risks lie in the execution efficiency of the mainnet launch and the quality of ecological applications. Execution difficulty is particularly critical due to its unprecedented scale; if successfully achieved, they will set a precedent. The second concern is ecological applications, which currently do not seem problematic, as the debut list includes both newcomers and established projects, making for a relatively healthy lineup.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。