ChatGPT is best suited as a risk detection tool, identifying patterns and anomalies that often occur before significant market downturns.

In October 2025, a wave of liquidations was triggered by tariff-related headlines, wiping out billions of dollars in leveraged positions. AI can flag the accumulation of risks but cannot accurately predict the timing of a market crash.

An effective workflow integrates on-chain metrics, derivatives data, and community sentiment into a unified risk dashboard that is continuously updated.

ChatGPT can summarize social and financial narratives, but each conclusion must be validated against primary data sources.

AI-assisted predictions raise awareness but can never replace human judgment or execution discipline.

Language models like ChatGPT are increasingly being integrated into the analytical workflows of the crypto industry. Many trading desks, funds, and research teams deploy large language models (LLMs) to process vast amounts of headlines, summarize on-chain metrics, and track community sentiment. However, a recurring question when the market begins to bubble is: Can ChatGPT truly predict the next crash?

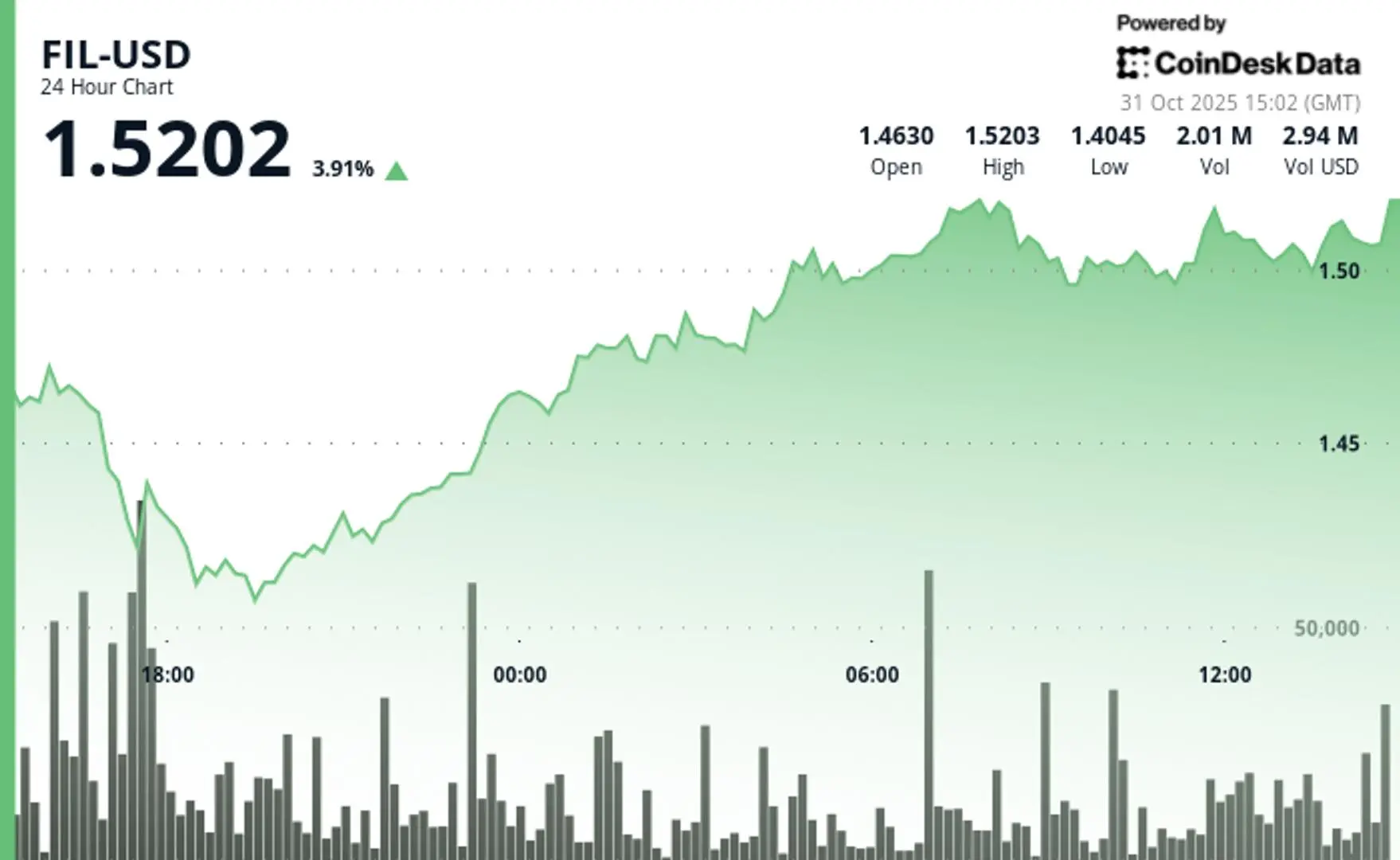

The liquidation wave in October 2025 was a real-time stress test. Within about 24 hours, over $19 billion in leveraged positions were wiped out as global markets reacted to an unexpected tariff announcement from the U.S. Bitcoin (BTC) plummeted from over $126,000 to around $104,000, marking one of its most severe single-day declines in recent history. The implied volatility of Bitcoin options surged and remained elevated, while the CBOE Volatility Index (VIX), often referred to as Wall Street's "fear gauge," remained relatively calm.

This mix of macro shocks, structural leverage, and emotional panic is where ChatGPT's analytical advantage lies. It may not be able to predict the exact date of a crash, but if the workflow is set up correctly, it can gather early warning signals hidden in plain sight.

Leverage saturation appears before a crash: Open interest on major exchanges reaches all-time highs, and funding rates turn negative—signs of excessive long positioning.

Macro catalysts matter: Tariff escalations and export restrictions on Chinese tech companies serve as external shocks that amplify the systemic vulnerabilities of the crypto derivatives market.

Volatility divergence shows pressure: Bitcoin's implied volatility remains high while stock market volatility declines, indicating that cryptocurrency-specific risks are accumulating independently of traditional markets.

Community sentiment shifts sharply: The Fear and Greed Index dropped from "Greed" to "Extreme Fear" in less than two days. Discussions in the crypto market and its sub-sectors shifted from jokes about "Uptober" to warnings about "liquidation season."

Liquidity disappears: As chain liquidations trigger automatic deleveraging, spreads widen, and buy-side depth thins, exacerbating sell-offs.

These indicators are not hidden. The real challenge lies in interpreting them together and weighing their significance, a task that a language model can automate more efficiently than humans.

ChatGPT can process thousands of posts and headlines to identify shifts in market narratives. When optimism wanes and anxiety-driven terms like "liquidation," "margin," or "sell-off" begin to dominate, the model can quantify this tonal shift.

Example prompt:

"As a crypto market analyst, summarize the dominant emotional themes in crypto-related Reddit discussions and major news headlines over the past 72 hours using concise, data-driven language. Quantify the change in negative or risk-related terms (e.g., 'sell-off,' 'liquidation,' 'volatility,' 'regulation') compared to the previous week. Highlight changes in trader sentiment, headline tone, and community concerns that may indicate an increase or decrease in market risk."

The generated summary forms a sentiment index that tracks whether fear or greed is increasing.

By correlating text trends with numerical indicators such as funding rates, open interest, and volatility, ChatGPT can help estimate the probability ranges of different market risk conditions. For example:

"As a crypto risk analyst, correlate sentiment signals from Reddit, X, and headlines with funding rates, open interest, and volatility. If open interest is in the 90th percentile, funding turns negative, and mentions of 'margin calls' or 'liquidation' increase by 200% week-over-week, classify market risk as high."

This scenario reasoning generates qualitative alerts that closely align with market data.

ChatGPT does not predict directly but can outline conditional if-then relationships, describing how specific market signals interact under different scenarios.

"As a crypto strategist, generate concise if-then risk scenarios using market and sentiment data.

Example: If implied volatility exceeds its 180-day average and exchange inflows surge amid weak macro sentiment, assign a 15%-25% probability of a short-term pullback."

Scenario language keeps the analysis robust and falsifiable.

After volatility subsides, ChatGPT can review signals from before the crash to assess which indicators proved most reliable. This retrospective insight helps improve analytical workflows rather than repeating past assumptions.

Understanding what AI can and cannot do helps prevent its misuse as a "crystal ball."

Capabilities:

Integration: Transforming dispersed, vast information, including thousands of posts, metrics, and headlines, into a single, coherent summary.

Sentiment detection: Detecting early changes in crowd psychology and narrative direction before lagging price actions occur.

Pattern recognition: Identifying nonlinear combinations of multiple pressure signals (e.g., high leverage + negative sentiment + low liquidity) that often appear before volatility spikes.

Structured output: Providing clear, well-articulated narratives suitable for risk briefings and team updates.

Limitations:

Black swan events: ChatGPT cannot reliably predict unprecedented, out-of-sample macroeconomic or political shocks.

Data dependency: It relies entirely on the freshness, accuracy, and relevance of input data. Outdated or low-quality inputs distort results—garbage in, garbage out.

Microstructure blind spots: LLMs cannot fully capture the complex mechanics of exchange-specific events (e.g., cascading automatic deleveraging or circuit breaker activations).

Probabilistic rather than deterministic: ChatGPT provides risk assessments and probability ranges (e.g., "25% chance of a pullback") rather than definitive predictions (e.g., "the market will crash tomorrow").

If this six-step workflow had been activated before October 10, 2025, it might not have predicted the exact date of the crash. However, as pressure signals accumulated, it would systematically raise its risk rating. The system might observe:

Derivatives accumulation: Open interest on Binance and OKX reaching all-time highs, combined with negative funding rates, indicating excessive long positioning.

Narrative fatigue: AI sentiment analysis might reveal a decline in mentions of the "Uptober rally," replaced by increased discussions of "macro risks" and "tariff fears."

Volatility divergence: The model would flag surging implied volatility in cryptocurrencies, even as the traditional stock market VIX remains stable, issuing clear cryptocurrency-specific warnings.

Liquidity fragility: On-chain data might indicate reduced stablecoin exchange balances, suggesting a diminished liquidity buffer to meet margin calls.

Combining these elements, the model might issue a "Level 4 (Alert)" classification. The rationale would point to an extremely fragile market structure vulnerable to external shocks. Once the tariff shock occurred, the liquidation cascade unfolded in a risk-accumulating manner rather than precise timing predictions.

This event underscores the core point: ChatGPT or similar tools can detect accumulated vulnerabilities, but they cannot reliably predict the exact moment of rupture.

Related: Bitcoin (BTC) faces a "20%-30%" drop risk, with $1.1 billion in liquidations in the crypto market within 24 hours.

Original article: “Can ChatGPT Really Predict the Next Crypto Market Crash?”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。