Original Author: Zhang Qianwen

Introduction

On October 14, 2025, Figure Technology Solutions (NASDAQ: FIGR) announced that its Figure Certificate Company (FCC) has registered the yield-bearing security token YLDS with the U.S. Securities and Exchange Commission (SEC), which is natively deployed on the Sui public blockchain. This marks the first time YLDS has moved from its original chain (Provenance) to another mainstream Layer-1 public blockchain, achieving an important breakthrough in "cross-chain compliance."

In the context of tightening regulations in the U.S. crypto market and frequent pitfalls in yield products, Figure has chosen an almost reverse route: actively acknowledging its securities attributes and achieving yield distribution through a compliant structure. This not only makes YLDS one of the first yield-bearing on-chain assets registered with the SEC but also provides a replicable legal compliance model for yield generation in the Web3 world.

Deconstructing YLDS: The Full Process from USD Deposit to On-Chain Yield

YLDS is essentially a yield-bearing security token based on blockchain technology, with its core mechanism being the digital mapping of real-world fixed-income assets (such as short-term notes or government bonds) and issuing them in a compliant securities form on the public blockchain.

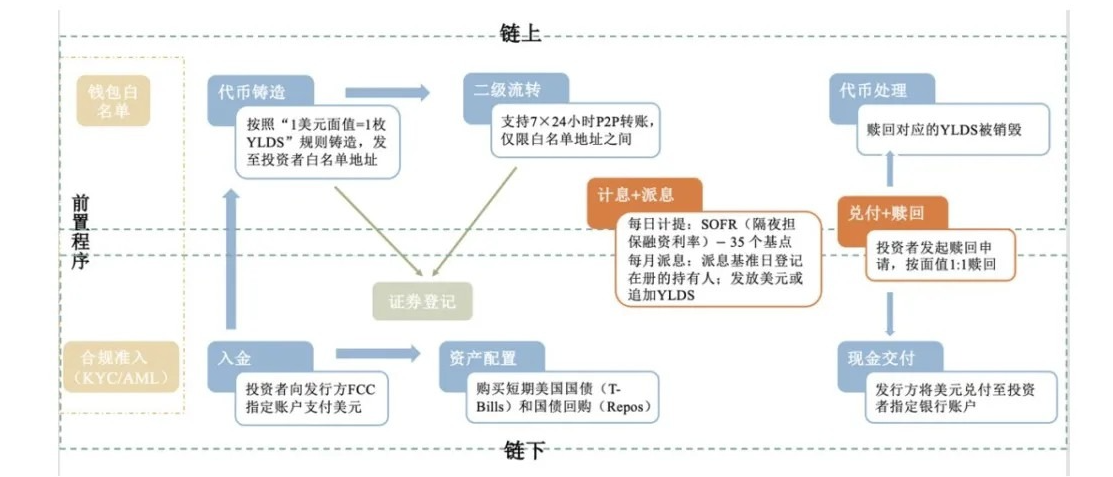

The operational process is as follows:

- Investment Subscription: Investors subscribe to YLDS with USD, and funds are transferred to an independent escrow account.

- Asset Investment: The escrow account invests in underlying assets that generate stable yields.

- On-Chain Issuance: Figure mints corresponding YLDS tokens on the Sui public blockchain, serving as proof of the investors' benefits from the asset pool.

- Yield Distribution: After the underlying assets generate interest, Figure proportionally distributes the interest to investors.

- Principal Redemption: Upon maturity or meeting specific conditions, investors can redeem their principal.

This model achieves a closed-loop logic of "USD deposit—asset investment—on-chain certificate—yield distribution—principal redemption," balancing traditional financial compliance with on-chain transparency and verifiability, establishing a dual-structure yield vehicle of "RWA on-chain + securities law compliance."

Legal Attributes: Stable Value YLDS ≠ Stablecoin

Although YLDS is similar to a "yield-bearing stablecoin" in user experience, there are essential differences in their legal attributes and regulatory logic:

While global regulatory rules for stablecoins are still being explored and refined, there is a consensus and trend among major jurisdictions to position stablecoins as "payment and storage tools," subjecting them to payment system regulation (rather than capital markets) and requiring that "no interest or yield be paid to holders." In contrast, YLDS is based on traditional securities registration and disclosure for compliance, leveraging the public blockchain to achieve 24/7 transferability and programmable yield distribution. The legal essence of YLDS is that it is an investment product, with its yield structure and legal relationship being fundamentally different from that of stablecoins:

Therefore, stable value YLDS ≠ stablecoin. Although both serve similar functions, their attributes are vastly different—both have a nominal value pegged to "1 USD," but the core of stablecoins lies in maintaining "price stability" for short-term purchasing power and payment functionality; whereas YLDS aims to provide "yield stability" and "long-term risk control" backed by real assets. This represents a new compliance model: achieving stable yields through a securities law framework rather than pursuing stable prices through a payment law framework.

Compliance Logic of YLDS Yield Mechanism

In the regulatory context of the U.S. crypto market, yield-bearing crypto products have always been a high-risk area for enforcement. The SEC has taken enforcement actions against products like BlockFi, Celsius, and Gemini Earn, with core reasons including unregistered securities issuance. According to U.S. securities law and payment regulatory logic: if yields or interest are paid to token holders, it is easily viewed as an investment contract; stablecoins and payment tokens that carry yields may lose their "payment tool" attributes and fall under securities regulation.

In this context, Figure has chosen the path of "acknowledging securities attributes → avoiding investment contract risks → falling into debt securities → registered compliant issuance" to construct a regulated yield-bearing securities structure without deviating from on-chain innovation.

1. Logical Starting Point: Actively Acknowledging Securities Attributes

Unlike other Web3 yield products that passively encounter regulation, Figure's strategy is to actively recognize YLDS as a security and voluntarily include it in the SEC exemption framework. This proactive recognition is a self-securitization strategy: by choosing the registration path, YLDS is directly incorporated into a legitimate securities issuance system, actively entering the regulatory framework, thereby resolving the dispute over "whether it constitutes a security" and gaining compliance space.

2. Core Mechanism: "Downgraded Design" from Howey to Reves

Figure's core innovation lies in its downgraded compliance strategy in legal structure design: that is, Figure optimizes the structure to make YLDS's risk profile closer to that of traditional bonds, aligning more with the characteristics of "debt instruments" under the Reves Test rather than equity investment contracts.

In the structure of YLDS, yields are defined as debt income (interest), which falls under contractual obligations for debt payment, rather than investment profits (profit), which are dividends from managed yields. Its yield comes from real asset interest, not from platform reinvestment returns. This design cleverly avoids the "profit expectation" and "efforts of others" elements in the Howey test, legalizing the yield mechanism.

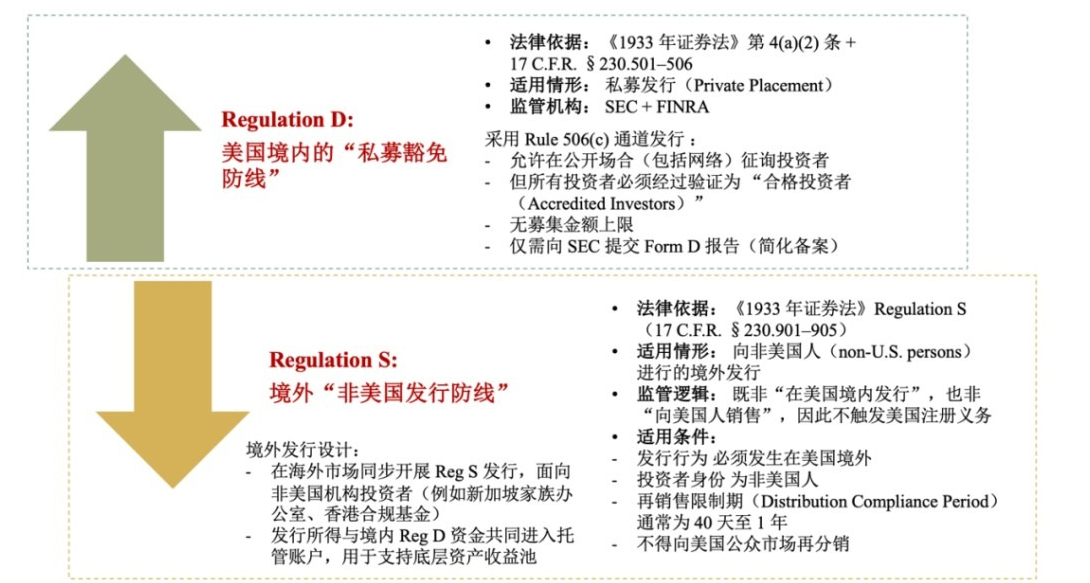

3. Issuance Path: Distinction Between Registered Securities and Cross-Border Private Placement

According to public information, the vehicle for YLDS is the Figure Certificates issued by FCC, which are face-amount certificates with debt attributes, essentially classified as interest-bearing debt securities. FCC submitted Form S-1 registration statement to the SEC in 2025 and clearly stated in the official prospectus:

Figure Certificates are interest-bearing debt securities, issued by Figure Certificate Company, a face-amount certificate company registered under the Investment Company Act of 1940.—— [SEC Filing, Figure Certificate Company, 2025]

This arrangement means that the rights represented by YLDS are not issued through private placement exemptions but are incorporated into the SEC's formal regulation as registered debt securities. This model not only establishes the legal legitimacy of YLDS but also builds a solid legal foundation for its subsequent on-chain deployment (such as landing on the Sui public blockchain).

Furthermore, FCC also pointed out in SEC documents that some Figure Certificates (such as Transferable Certificates) may be traded in registered alternative trading systems (ATS) in the future for compliant transfers between holders. This arrangement breaks through the liquidity barrier of traditional securities products that are "registered but non-transferable," providing an important support for the compliance of the lifecycle of on-chain securitized assets—from issuance, holding, yield distribution, to compliant transfer, the entire process is within the regulatory view.

Of course, in the actual market operations of crypto financial products, the lightly compliant structure of Regulation D + Regulation S dual exemptions remains a very common mechanism. Many Web3 projects have adopted a combination of Reg D + Reg S for token issuance in early financing, supplemented by on-chain lock-up, compliance audits, and trading platform support, achieving a dynamic balance of "on-chain compliance + cross-border coverage."

Figure's compliance path can be seen as an advanced version of this traditional dual exemption framework: incorporating regulatory systems through registered or registered-type bond mechanisms, with clearer compliance boundaries. Of course, the widely adopted Reg D + Reg S combination continues to serve as a highly flexible private placement mechanism, providing operational alternative paths for on-chain asset issuance globally.

The path of YLDS intersects and learns from mainstream structures, showcasing the diversity and future possibilities of on-chain compliance: it can be "registered as positive," or "exempt as a path," with the key being the precise construction of the legal structure and the adaptive arrangement of the issuance rhythm.

Conclusion: A Model from Gray Area Yields to Regulated Yields

Figure's compliance path is not an evasion of regulation but an embedded reconstruction achieved through legal structure design: its active acknowledgment of securities attributes transforms yields from investment profits to debt interest, and through registered compliant issuance, it realizes a safe transition from "potentially illegal investment contracts" to "regulated debt securities."

Figure's path demonstrates how to balance on-chain transparency with off-chain legal compliance, achieving a balance among yield, trust, and regulation, providing a replicable model for crypto financial products to move from "gray area yields" to "regulated yields," and offering important compliance references for RWA projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。