Master Discusses Hot Topics:

Good afternoon, the beautiful week started with a decline. I'm really not surprised; the market is like this now. Last week, Old Powell's statement about not lowering interest rates in December directly broke the entire market sentiment spine.

It's laughable that everyone actually took this nonsense seriously, as if the Federal Reserve could really refrain from easing. Comprehensive easing in the U.S. is inevitable; it's just a matter of time. The economic data is in such a bad state that sooner or later, they will have to print money to sustain life.

So I don't care whether it's a bear or a bull market right now; I just focus on making every layout every day. For the medium to long term, I buy the dips. In the meantime, who rises or falls is just a game; what I want is a cycle-level harvest, not to guess the ups and downs of five-minute candlesticks.

Back to the market, the bulls are basically being rubbed down to the ground, and institutions continue to sell off in the morning. A weekly head and shoulders top cannot be washed away with just one or two bullish candles. Once the weekly trend turns bearish, every rebound above in the medium to long term is not an opportunity.

So if you're still hoping to stand back at 119K or even create new highs, that might be a bit too optimistic. After the weekly pin bar, if we get two bearish candles sandwiching a bullish one, you all understand what I mean, right? The market is telling you that if you don't run now, the next stop is below 100K.

The daily chart is even worse, languishing weakly below 112K. As long as the resistance at 111.5K is not broken, there is a risk of continuing to fall below 103.4K. And the Q4 market was already not fun; now it's purely a debt repayment situation.

Interest rates not rising, tariffs being postponed without any increase, various favorable factors seem to come with a "laughing to death" buff that prevents any rise. Is the market currently lacking favorable factors? No, it's lacking confidence; the funds have completely fled, but some people just refuse to admit it.

Speaking of Ethereum, the recent price action is really nauseating. I even feel that Ethereum is currently just the market makers whipping people's patience. Twice it tried to break 3900 but failed; this isn't weakness, it's just manipulation. Look at those small fluctuations on the 1-hour and 4-hour charts…

Currently, Ethereum has two scenarios: either it grinds at 3800 until all bullish sentiments explode, washing out the chips to leave a ground of shattered dreams, and then suddenly spikes to 4130, creating a wave of "wow, it went up again."

Or it tricks you into thinking it's going to rise at 3800, then reverses and directly crashes to 3680, leaving all bulls with no chance to even say "wait a minute." And how many long contracts have piled up around 3800 in the last three days? A bunch of self-proclaimed bottom-fishing masters are betting on a reversal. Will the main force let you go?

Of course, they will take you out first before they pull up; that's the only logic. They won't clear out these overly confident retail traders without a drop. Falling below the cost zone means a major structural shift to bearish; first, look at 3720, then down to 3660; this area is crucial for determining the next trend.

Master Looks at Trends:

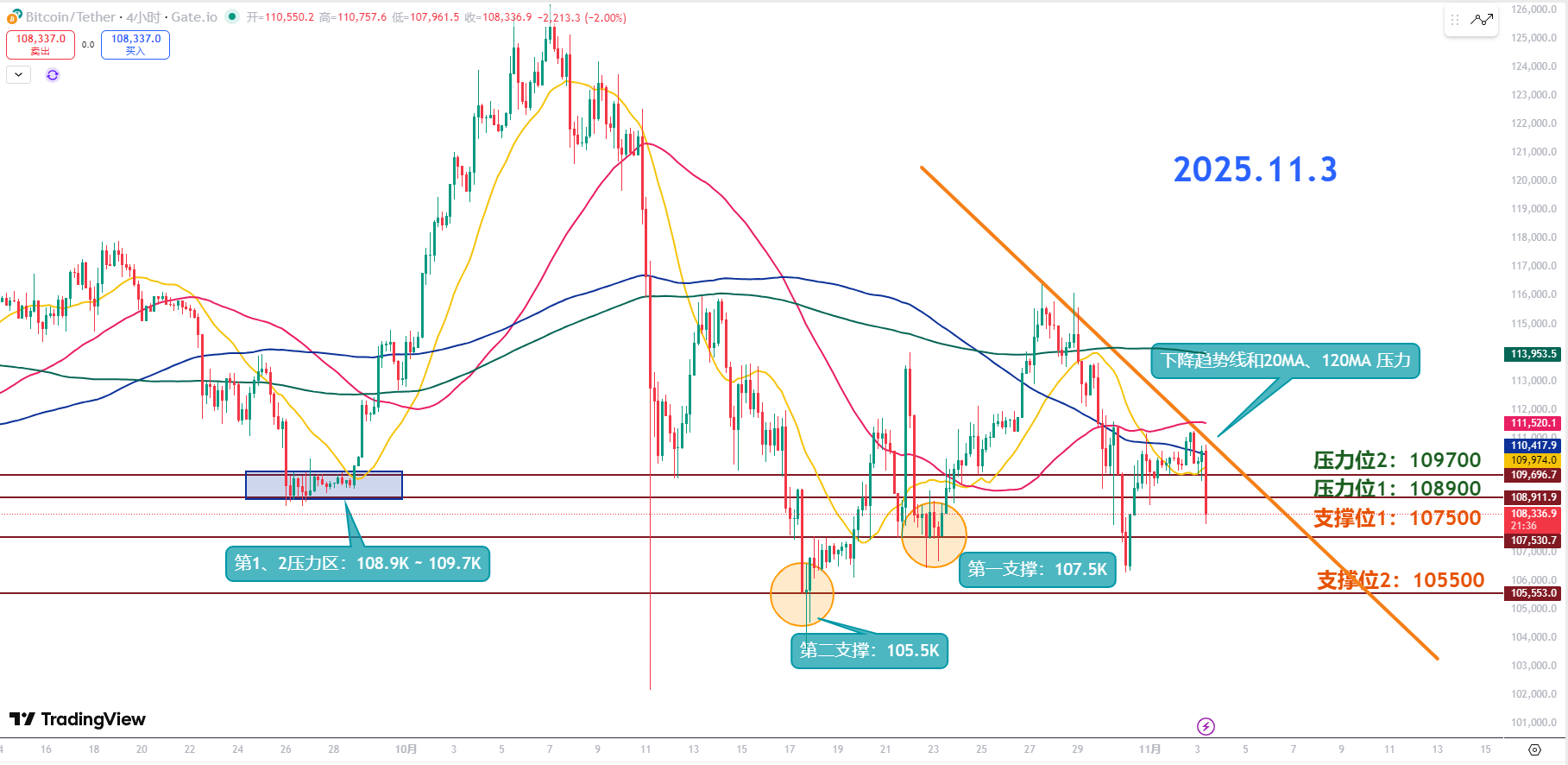

Resistance Level Reference:

Second Resistance Level: 109700

First Resistance Level: 108900

Support Level Reference:

First Support Level: 107500

Second Support Level: 105500

Currently, Bitcoin is around 1087K, and market sentiment is clearly bearish, with volatility continuously being suppressed. The short-term supply-demand mismatch caused by options expiration is also stirring the pot; the market is now a typical case of slow declines and stagnant rises.

The 4-hour downtrend structure has not successfully reversed; all moving averages are in a standard bearish arrangement, and long-term moving averages are also pressing down, with the 120 and 20MA here preventing the bulls from turning around.

More critically, the trading volume is increasing during the decline. The K-line that closes at 13:00 is very important. If it closes with a long lower shadow, it indicates that there are buyers below. If it can't close like that, don't think too much; just continue to look down.

The first support at 107.5K is the low point from the crash on October 17; if it holds, there will be a slight rebound. The second support at 105.5K is the deep pit created on October 22; if this breaks, it won't be a rebound.

The first resistance at 108.9K and the second resistance at 109.7K are areas where most long positions from earlier are trapped, with a bunch of people waiting to break even and run away.

11.3 Master’s Swing Trading Setup:

Long Entry Reference: Not currently applicable

Short Entry Reference: If it breaks below 105500 and cannot recover, go short with a target of 1500-2000 points

If you truly want to learn something from a blogger, you need to keep following them, not just look at a few market updates and jump to conclusions. This market is filled with performers; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "always catch the tops and bottoms," but in reality, it's all hindsight. A truly worthy blogger will have trading logic that is consistent, coherent, and withstands scrutiny, not just jumping in when the market moves. Don't be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are needed to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, debt repayment, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official public account (as shown above). Any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。