Polymarket is becoming the probability layer for reality.

But scaling from politics and crypto to every domain requires solving three problems. These solutions could determine whether Polymarket stays a prediction platform or the default source of truth.

The Liquidity Challenge

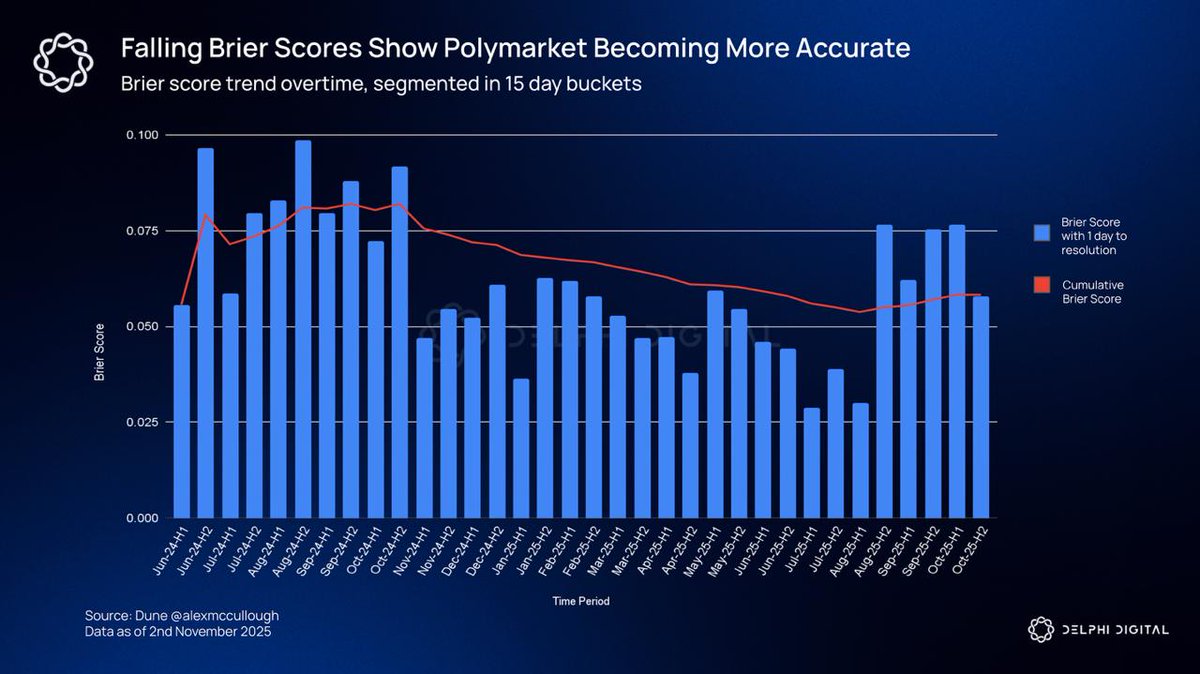

Markets need depth to be accurate. The data shows a direct correlation between volume and truth. Markets over $10M achieve near-perfect Brier scores because liquidity forces information asymmetry to surface and get priced in.

New markets face a bootstrapping problem. Thin order books mean traders get bad execution and high slippage which can deter participation.

Polymarket has spent over $10.5M on liquidity incentives. That works for high priority categories but doesn’t scale to thousands of markets across every domain. The platform needs a programmatic solution that grows with it.

The Oracle Problem

Resolution is the trust layer. When hundreds of millions depend on a market outcome, the economic security must exceed the incentive to manipulate.

UMA’s optimistic oracle uses token voting for disputes. The Zelensky suit market showed the tension. Massive volume hinged on a subjective judgment, and the theoretical attack vector existed even though the system worked correctly.

At institutional scale, oracle security can’t rely on good faith. The resolution mechanism needs to make manipulation economically irrational even when bet sizes reach nine figures.

The Expression Problem

Prediction markets must fully collateralize every position. That’s the trust guarantee. But it creates a capital efficiency problem for complex bets.

A $5 parlay at 100,000 to 1 odds requires $5k locked immediately. Sportsbooks manage net risk across millions of contradictory positions. Prediction markets can’t net like this without breaking the trust model. Every contract must be fully backed from creation. This limits the platform to simple binary markets while sports betting volume concentrates in parlays.

How The Token Unlocks Scale

The token solves these problems through coordination, not capital raising.

Emissions bootstrap liquidity programmatically across long tail markets. Staking adds economic security to oracles that scales with institutional bet sizes. Parlay vaults let token holders earn yield by collectively underwriting complex bets, solving the capital efficiency problem while maintaining full collateralization.

Bloomberg does $12B annually selling information. The polling industry is $30B. Market research is $82B. Hedge funds are already checking Polymarket before macro trades.

You’re watching the probability layer for reality get built in real time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。