What Next For $BERA After Balancer Exploit: Berachain Price Drop 10%

The crypto world was shaken after Berachain stopped its network to control a major Balancer exploit that hit its BEX platform. The hack, worth nearly $117 million, put around $12 million of user funds on the platform at risk.

Soon after this news, the $BERA coin crash hit 10%, now trading near $1.67, as investors panicked and rushed to sell.

This article explains everything, from what happened and what’s next for token’s price prediction after this major crash.

Network Halted After Balancer Exploit: What Really Happened

The official post said that its validators had stopped the network on purpose to stop the Balancer exploit from spreading. This was a planned action, not an error, it helped isolate the affected pools and protect the liquidity providers (LPs).

The developers also said that funds recovery is already in progress, and the network will restart once everything is safe. During this time, HONEY minting, USDe deposits, and BEX vaults are paused to avoid more losses.

This quick action shows the platform's focus on user safety and network stability, even in a crisis.

Inside the Response: How Berachain Hack Is Being Treated

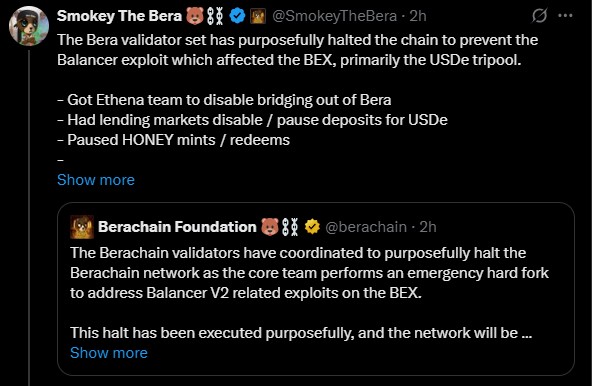

Popular validator and analyst Smokey The Bera explained how the team worked together to handle the issue. According to him, the validator set stopped the chain to prevent the berachain balancer exploit hack from spreading.

Here’s what they did:

-

The Ethena team turned off bridging to stop funds from moving out.

-

USDe deposits were paused.

-

HONEY minting and redemptions were stopped.

-

CEXs were asked to blacklist hacker addresses.

Berachain Price Drop: Fear Takes Over the Market

After the Balancer exploit was confirmed, the asset crashed by nearly 10% in one day, falling from over $1.90 to $1.67. The Berachain price drop was not only because of the Balancer hacked news, but also because of investor fear.

As seen in the TradingView price chart , RSI is at 24.4, which means the token is in the oversold zone, and MACD is also negative. If it stays above $1.60, it could bounce back to $1.80–$1.85. But if it breaks below $1.60, it might fall further to $1.45–$1.50.

This price analysis and hack news clearly explain why is berachain down today, but now the question is; how low will it go?

$BERA Price Prediction: Experts Outlook Here

As per my analysis, being a crypto analyst, for now, the asset may move sideways or slightly up between $1.65–$1.80 as the market calms down after the Balancer exploit.

In the mid term, if the hard fork works and the network returns safely, it could rise to $2.20–$2.40. Even with this setback, the token still has a strong DeFi ecosystem. If users regain trust and liquidity grows again, Berachain price prediction could reach $4–$6 in 2025.

However, if more technical issues happen, the token might stay between $1.20–$1.50 before any big comeback.

Conclusion

The Balancer exploit is a huge test for token's trust and strength. The quick actions by its foundation and validator team helped stop further damage, but investors still need confidence before re-entering the market.

The next few days are crucial for the Berachain price drop to recover. If all goes well, the price may return, so investors should keep a clean eye on the upcoming team's updates to ensure where the price moves next.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。