Author: Bootly

As November begins, the cryptocurrency market has taken a heavy hit.

Bitcoin not only fell below the key level of $108,000 but even dipped to around $105,949 at one point, with a daily drop of over 4%. With this decline, the total market capitalization of the entire cryptocurrency market has shrunk to about $3.51 trillion.

Additionally, the well-established DeFi protocol Balancer faced a significant security vulnerability today, with attackers stealing $128 million in assets from its v2 vault. This vault manages $678 million in liquidity and is a key infrastructure in the DeFi ecosystem. A series of bad news has led many veteran players to exclaim "a familiar taste," as this script resembles the prelude to previous bear markets.

According to Coinglass data, in the last 24 hours, a total of 302,364 people globally were liquidated, with a total liquidation amount of $1.164 billion, comprising $1.082 billion in long positions and about $81.58 million in short positions. Among these, Bitcoin accounted for $298 million, Ethereum for $273 million, SOL for $144 million, and other cryptocurrencies for $1.25 million.

Whale Movements

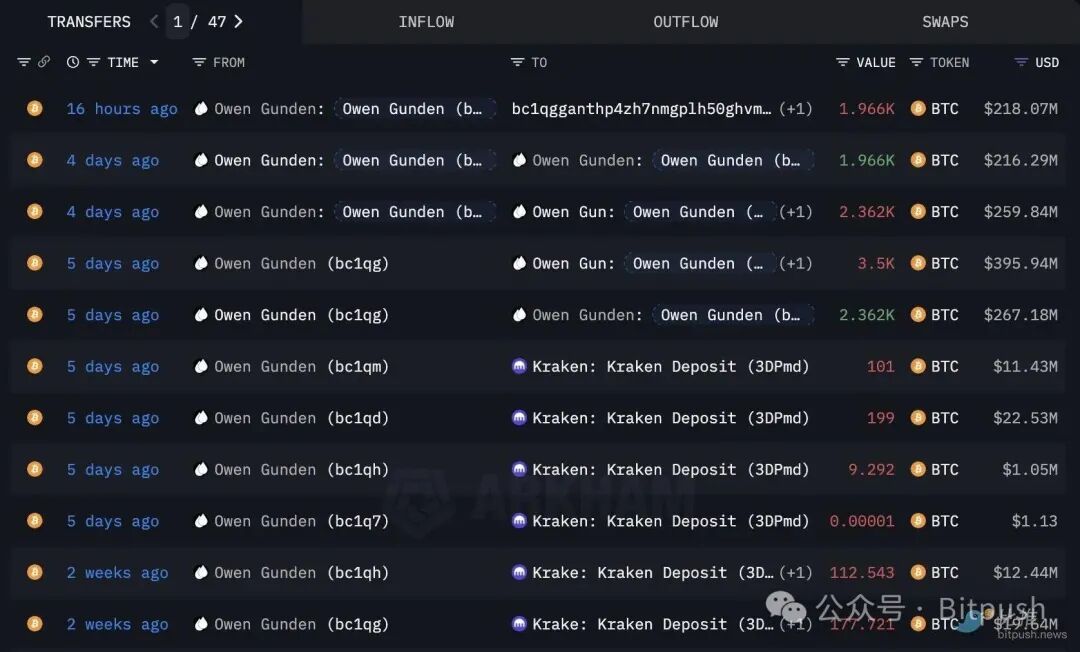

On-chain data provider CryptoQuant has monitored that there have been undercurrents in the market. The well-known short-selling whale "1011short" has been continuously transferring 13,000 Bitcoins, worth about $1.48 billion, to exchanges like Kraken since October 1. Early investor Owen Gunden from the Satoshi Nakamoto era has also begun to act after years of silence, transferring a total of 3,265 Bitcoins to exchanges.

Specifically, the wallet associated with "1011short" transferred 500 Bitcoins to Kraken on November 2, corresponding to a market value of about $55 million; at the same time, it also deposited several smaller amounts of Bitcoin to Hyperliquid, with individual transfers ranging from 70 to 150 Bitcoins.

On-chain analysts pointed out that this kind of batch and multi-channel transfer model aligns closely with the trader's past logic of establishing short positions after market rebounds, indicating that they may be preparing for a new round of shorting.

Institutional Funds Weakening

The attitude of institutional investors has also undergone subtle changes. According to data compiled by SoSoValue, the spot Bitcoin ETF recorded a net outflow of $799 million last week, with significant slowing in fund inflows for BlackRock's IBIT product. This change sharply contrasts with the previous month when institutional funds were pouring in.

Glassnode further pointed out in a tweet today that there has been a significant change in the fund flows of the recent spot Bitcoin ETF. Data shows that the weekly net inflow for BlackRock's spot Bitcoin ETF has dropped to "less than 600 BTC" over the past three weeks, contrasting sharply with the strong performance of over "10,000 BTC" in weekly inflows during this round of rising cycles, reflecting a clear slowdown in institutional demand.

QCP Capital analysts interpreted the current market supply and demand pattern from another angle in today's market review. They noted that the market has actually digested about 405,000 Bitcoins of traditional selling pressure over the past month, yet the price has not effectively broken through.

Analysts added, "Bitcoin's price is still oscillating within a similar consolidation range as before the breakout in 2024, raising speculation about whether this cycle is about to end. Whether this indicates the arrival of a new round of cryptocurrency winter remains unclear."

Macroeconomic Clouds Looming

The macroeconomic outlook is also not optimistic. U.S. Treasury Secretary Janet Yellen recently warned that the Federal Reserve's tightening policies may have already caused damage to certain economic sectors. This statement has raised market concerns about the motivations behind a potential shift in Federal Reserve policy—if rate cuts are due to a deterioration in the U.S. economy, risk assets may face greater pressure. Although economists generally believe that the U.S. will not experience a full-blown recession in the short term, this macro pressure is indirectly suppressing BTC demand by lowering overall market risk appetite.

Analyst Opinions

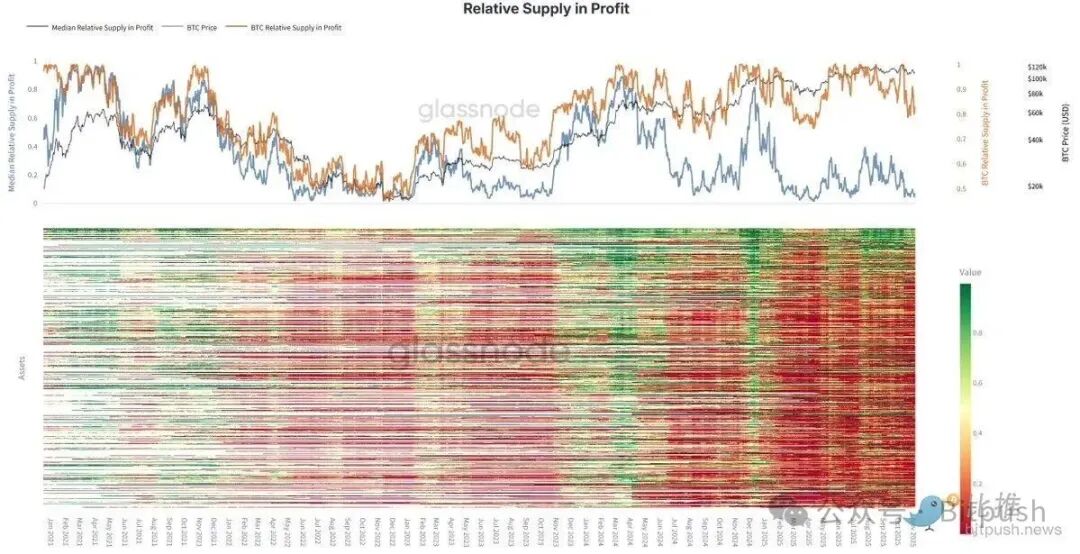

The altcoin market is undergoing a severe test. Glassnode analysts pointed out on the X platform that most altcoins continue to perform weakly relative to Bitcoin, with their supply and profit levels "only seen during the tariff war and the 2022 bear market." Analysts emphasized that if investors adopt a passive holding strategy for altcoins, "they are very likely to have underperformed the Bitcoin benchmark."

Emir Ibrahim, an analyst at digital asset trading firm Zerocap, stated that after the liquidation turmoil at the end of October, Bitcoin is currently in a "consolidation phase," with the trading range narrowing to $108,000-$110,000. However, he also noted, "From a broader perspective, the current consolidation remains constructive. Historical data shows that November is the strongest month for Bitcoin, with an average return of over 40% in the past decade."

Shawn Young, chief analyst at MEXC Research, believes that Bitcoin's key resistance level is in the $111,000-$113,000 range. He analyzed, "If it can effectively break through this resistance band, it is expected to trigger a new round of upward momentum, with an initial target of $117,000. If combined with a favorable macro environment, it may even retest the historical high of $126,000. We maintain that Bitcoin will reach the target range of $125,000-$130,000 by the end of the year, followed by a high-volatility consolidation phase."

Although historical data shows that November is usually a strong month for Bitcoin, this year's situation is clearly more complex. Multiple factors, including Federal Reserve policy expectations, institutional fund flows, and technical signals, intertwine to create uncertainty in the market outlook.

As of the time of writing, Bitcoin is temporarily priced at $105,862.19, and the market is closely monitoring subsequent developments. For investors, this November is bound to be anything but calm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。