Investors speculate that after the "suspense" of high inflation fades, ZEC may develop along the early trajectory of Bitcoin.

Author | Max Wong @IOSG

Introduction

In recent months, Zcash ($ZEC) has become the focus, rising from $47 to $292 within 30 days in September 2025, an increase of up to 620%. It has currently reached its highest price in 8 years at $429, pushing its FDV over $8 billion.

In an era of increasing financial regulation, privacy-focused projects have once again become the spotlight in cryptocurrency. As one of the pioneers of privacy coins, Zcash (ZEC) has rekindled interest. This wave has reignited enthusiasm for "free money," a term often used to describe private, censorship-resistant digital cash. Zcash, as a rapidly growing privacy coin, brings true financial privacy through cryptographic technology, expanding the vision of Bitcoin.

This report aims to delve into the technology and infrastructure of Zcash, compare it with other privacy participants, and analyze the catalysts behind the recent resurgence of the Zcash ecosystem.

Zcash - What is it and how does it work?

Zcash is a privacy-preserving digital currency launched in October 2016, a fork of the Bitcoin codebase. It deliberately mirrors many of Bitcoin's monetary principles; Zcash operates on a proof-of-work blockchain, with the following features:

Fixed Supply: A cap of 21 million and a predictable halving schedule.

Fair Distribution: No pre-mining, similar to Bitcoin's issuance model.

Decentralization: Permissionless, no central authority, and no reliance on intermediaries.

Privacy Standards

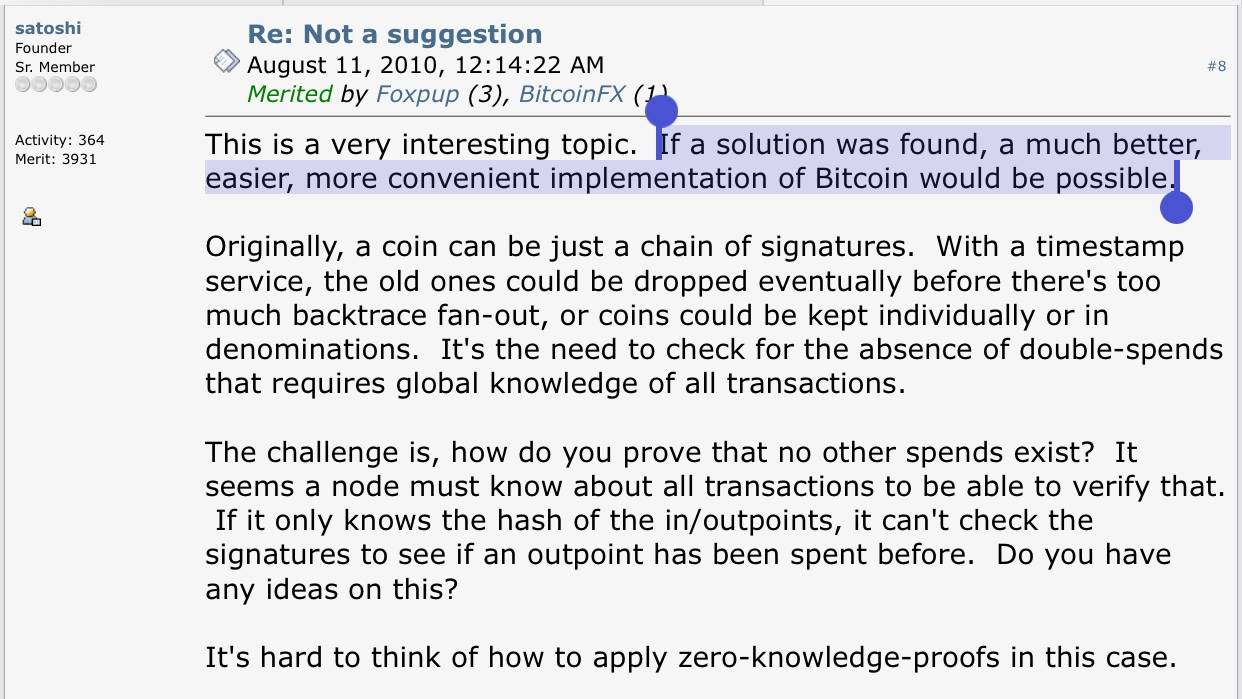

Zcash uses zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge), which allow transactions to be verified without revealing any details about the sender, receiver, or amount. In simple terms, Zcash provides users with fully encrypted transactions, obscuring on-chain data that Bitcoin's transparent ledger cannot achieve. In fact, this privacy mechanism of ZK is what Satoshi Nakamoto wanted to explore in Bitcoin but was technically unfeasible at the time.

#Transaction Details Encryption

When users conduct shielded transactions, key details such as the sender's address, receiver's address, and transaction amount are fully encrypted on the chain.

#Creating ZK Proofs

The sender (prover) uses their private key to generate a zk proof (zk-SNARK), confirming that several conditions are met, all without leaking sensitive data:

The sender has sufficient funds to pay for the transaction.

The funds spent were generated legally in previous transactions.

The transaction input values equal the output values, preventing the creation of counterfeit coins.

The sender has the right to use the funds (possesses the correct private key).

The funds have not been used before (using a mechanism called "invalid").

#Instant Verification

Other nodes on the Zcash network (validators) use a public verification key to instantly verify the zk-SNARK proof. The proof is very small (a few hundred bytes) and can be verified in just a few milliseconds, making the verification process highly efficient.

Dual Transaction Types

It is worth noting that Zcash's privacy is optional—users can remain transparent to meet compliance or auditing needs, or they can choose to keep everything completely confidential.

ZEC uses a dual address system, including transparent addresses (t addresses) and shielded addresses (z addresses). Transactions between transparent addresses are similar to transactions on any non-private chain, but transactions involving shielded addresses are encrypted and private. When sending ZEC, the ledger does not display any information about the parties involved or the value; it only shows that a valid transaction occurred. Only the participants (and those with whom they share optional viewing keys) can see the details.

This allows Zcash to maintain fungibility (each unit is interchangeable) and not be affected by past history, thus achieving true financial confidentiality when using shielded transactions.

Three Major Funding Pools

The large-scale implementation of private transactions is a significant technical challenge. Zcash has undergone three major upgrade iterations to enhance its cryptographic technology and efficiency:

#Sprout (2016)

-- The initial release version -- demonstrated that zk-SNARK-based privacy is feasible on public blockchains. However, Sprout transactions were computationally intensive (requiring several gigabytes of RAM, making it impractical on mobile devices) and required a trusted setup (one-time parameter generation). Edward Snowden, under the pseudonym "John Doe," participated in this well-known setup, aimed at ensuring that no party could compromise the parameters. The traditional Sprout z addresses (usually starting with zc…) are now deprecated but still usable.

#Sapling (2018)

-- A major upgrade that significantly improved performance and usability. Sapling reduced proof times and memory requirements by over 100 times, ultimately making private ZEC transactions feasible on everyday devices (even smartphones). It also introduced important features such as diversified addresses (allowing one key to have multiple shielded addresses, enhancing privacy) and viewing keys (enabling users to share read access to their transaction details for auditing or compliance). Sapling still relied on a multi-party trusted setup, but it made a significant step towards practical private payments. Sapling z addresses (Bech32, zs……) are still supported, allowing users to use older tokens.

#Orchard (2022)

-- The latest generation product, achieving trustless privacy. Orchard utilizes the Halo 2 proof system (developed by Zcash engineers), eliminating the need for any new trusted setup. It further enhances efficiency, supporting batch transactions and improved synchronization. With Orchard, Zcash's privacy not only becomes stronger (no setup assumptions) but also more scalable—it is designed to support future second-layer solutions like ZK-rollups. It also introduces Unified Addresses (UA, u1……), which can bundle Orchard (and optionally Sapling + transparent) receivers into one address; wallets typically default to routing new funds to Orchard. Thus, Orchard is now the default shielded pool for modern Zcash wallets.

A common summary of Zcash's development history is: Sprout proved the possibility of private funds, Sapling made it usable, and Orchard made it trustless and scalable.

Upcoming Upgrades

Crosslink: The technical infrastructure of Zcash is continuously evolving. The project is currently undergoing a significant upgrade called Crosslink, which will introduce a hybrid proof-of-stake (PoS) layer on top of the proof-of-work consensus. This will allow ZEC holders to stake their coins for rewards and participate in block finalization while miners continue to produce blocks—combining the advantages of PoW and PoS. This hybrid approach is expected to improve network throughput and security (by providing fast finality and making 51% attacks more difficult).

Tachyon Project: Zcash developers (especially cryptographer Sean Bowe) are leading the implementation of the Tachyon Project—aimed at significantly enhancing the scalability of Zcash's shielded protocol. The goal of the Tachyon Project is to eliminate performance bottlenecks (such as each wallet needing to download and scan every coin) through innovative techniques like proof-carrying data, achieving "planet-scale" private payments.

ZCash vs. Monero Comparison

Zcash (ZEC) positions itself as a Bitcoin-like currency but with optional encrypted privacy. Its shielded transfers use zk-SNARK, allowing validators to check the correctness of transactions without seeing the sender, receiver, or amount. With UA, wallets can send funds to the correct recipient while maintaining auditability: users can still conduct transparent transactions or share viewing keys with accountants/regulators. The trade-off results in user choice; when you actually use the shielded pool, privacy is maximized.

Monero (XMR) uses a different toolkit, providing privacy by default in every transaction: ring signatures (mixing the original transaction with many decoy transactions, making it impossible for observers to discern which wallet actually sent the funds), RingCT (hiding amounts), and stealth addresses (the recipient receives payments through a one-time hidden address that cannot be linked back to their real wallet). This makes usage straightforward, but privacy is probabilistic: the strength depends on the size of the ring (e.g., 16), the choice of decoys, and user behavior. In practice, it has high privacy, but there is no selective disclosure for auditing, and some exchanges avoid listing it due to compliance friction.

In general: ring signatures achieve transaction anonymization by placing transactions among multiple decoy transactions (one could argue that Monero merely adds a semblance of plausible deniability), while zk-SNARK proves the validity of claims without revealing any information beyond the validity of the claim itself. The initial hesitation towards ZCash was due to the need for a trusted setup, but with the recent release of the Halo upgrade, ZCash can generate zero-knowledge recursive proof combinations without a trusted setup. Despite the challenges, Monero has been shown to have some traceability in the paper "Monero Traceability Heuristics": "Wallet Application Bugs and Mordinal-P2Pool Transparency."

So, why did the market choose ZCash?

What happened?

In the past two months, from early September to now, $ZEC has been in a mode of only rising, starting from a low of ~$40 to ~$429, an increase of over 1000%. So, what are the catalysts for this rise? What are the reasons?

Introducing Zashi

One of the biggest contributors to Zcash's recent growth is ECC (Electric Coin Co’s) focus on consumers. Previously, the protocol mainly focused on the Zcash core—establishing cryptography and technology—but now they are more focused on user experience and user onboarding. A significant part of this work is the development of Zashi, the official Zcash wallet.

Josh Swihart—CEO of ECC:

"When I took over as CEO of ECC in February 2024, we decided to really focus on user experience… We built a wallet called Zashi. After Zashi was launched, you could see the total number of shielded transactions and the amount of ZEC in the shielded pool grow exponentially.

The launch of Zashi has greatly improved the user experience of Zcash. It offers a smooth interface comparable to popular EVM wallets, supports security storage features like viewing keys and hardware wallet integration, and even plans to enable shielded monitoring and delegation features after launch. More importantly, Zashi is designed specifically for ZEC shielded transactions, meaning that all tx sent on Zashi are private by default. If users receive transparent ZEC, the wallet will prompt them to shield it before spending. Additionally, Zashi supports single address multi-pool support for all different funding pools (Sprout, Sapling, Orchard), meaning users can easily migrate funds from different pools.

This is a huge change compared to a few years ago when using Zcash privately required multiple dedicated software across different products. Due to these breakthroughs in user experience, the usage rate of the shielded pool has seen parabolic growth, indicating that many users would indeed choose privacy if there is a convenient option.

By making private transactions simple, requiring just a few taps, and abstracting the technical complexity, these wallets have driven adoption among less tech-savvy users. The improvement in wallet user experience is considered a major driving force behind Zcash's recent growth.

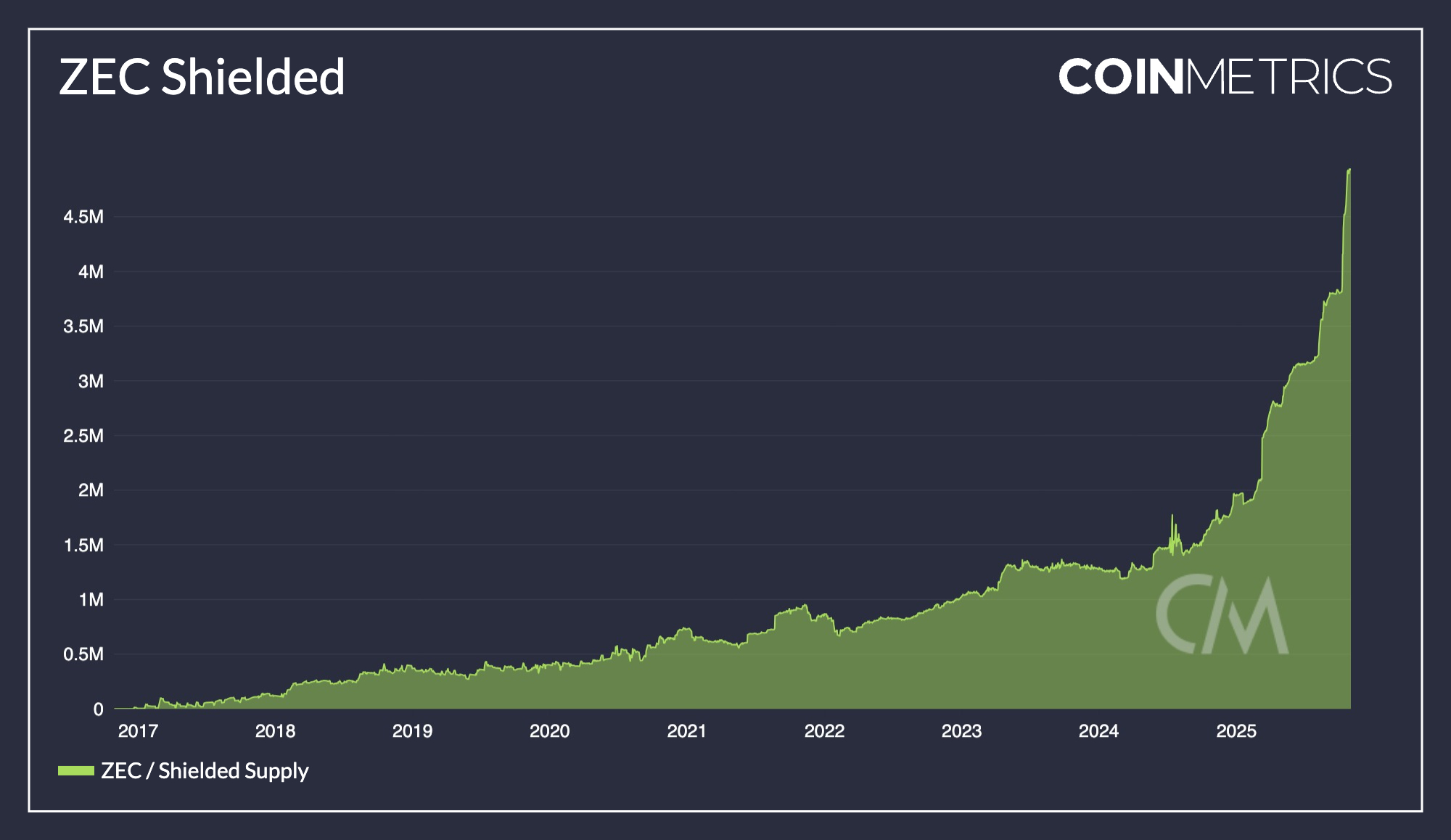

One of the most obvious signs of Zashi's contribution to the momentum of Zcash's ecosystem development is the explosive growth in on-chain shielded usage. As of Q4 2025, over 4.5 million ZEC are stored in shielded addresses, accounting for about 28% of the total supply. This is a record high, while a few years ago this ratio was only 5%. The above chart illustrates how the shielded pool began to see growth around 2024, directly coinciding with the launch of Zashi.

This means more ZEC is entering Zcash's cryptographic pool, which in turn strengthens the network's privacy protection for everyone (a larger anonymity set). In practice, this also tightens the liquidity in circulation (as shielded funds are harder to trace and are often held long-term to protect privacy), thus positively impacting price dynamics.

Introducing NEAR Intents - Crosspay

Zashi's CrossPay also serves as a mechanism for mass onboarding into Zcash, fundamentally achieving interoperability within the Zcash ecosystem.

Crosspay is a cross-chain bridging/exchange solution that utilizes NEAR intents, allowing users to swap in or out ZEC from another chain while still maintaining privacy; Zashi also integrates decentralized off-chain capabilities via NEAR, allowing users to swap ZEC to another chain (or to fiat gateways) without revealing their ZEC address—completely eliminating the need for CEX. This has driven a significant influx of capital and users into the ZEC ecosystem.

NEAR Intents is a chain abstraction protocol: users (or agents) specify what they want (e.g., "swap BTC→ZEC" or "pay 50 USDC to this address"), and a decentralized network of solvers competes to execute across chains; users only need to sign an approval. It hides the bridge/DEX hops and optimizes for the best price/liquidity routes.

Users request "swap X → ZEC" or "pay Y USDC on Z chain".

NEAR Intents solvers compete and return the best quotes.

Users approve once in Zashi; solvers execute the cross-chain route; ZEC is shielded or the recipient receives the correct tokens.

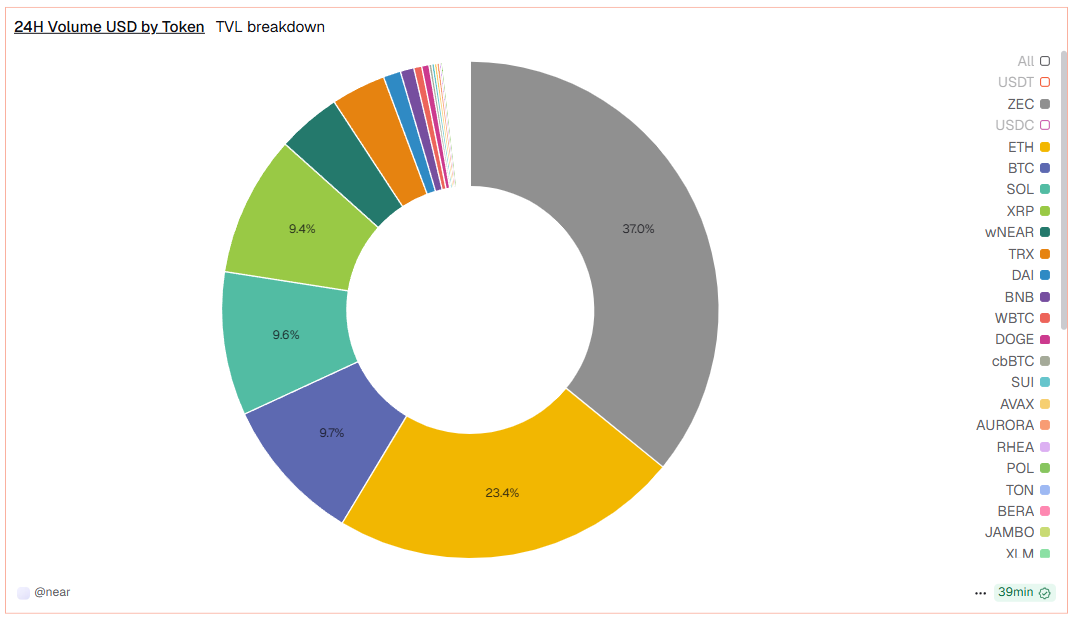

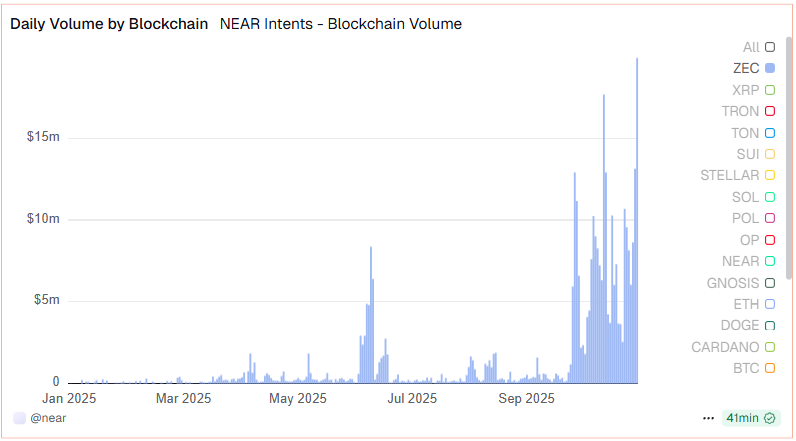

Excluding the number of USDC and USDT; currently, the number of ZEC NEAR intents accounts for over 30% of the total NEAR intents.

Overall, we can infer that the integration of Zashi with Crosspay is also one of the main driving forces behind market share growth, with the number of ZEC NEAR intents set to increase significantly starting in September 2025, which coincides with the launch of Crosspay.

The New Importance of Dual Transaction Type Privacy—The Story

As governments and regulatory bodies vigorously implement monitoring measures (from stricter KYC/AML to tracking central bank digital currencies), the spirit of crypto-punk has once again come to the forefront. Zcash provides a hedge for those concerned about these trends: a form of encrypted, unmonitorable currency.

Arjun Khemani - https://www.arjunkhemani.com/

“They only focus on the digital rise, but fail to notice the fall of freedom.”

As mainstream cryptocurrency users become aware that their privacy is being eroded (e.g., Tornado Cash and other mixing currencies being blacklisted), many are starting to look for on-chain privacy alternatives. Zcash stands out as a battle-tested L1, with stronger privacy protection capabilities than mixing coin protocols (reportedly, Zcash has a broader usage than Tornado Cash).

In short, the rise of the "freedom narrative" has shaped Zcash into a key asset for maintaining financial freedom—this narrative resonates with both ideological investors and those simply seeking to hedge against "Big Brother."

Supply Dynamics Post-Halving

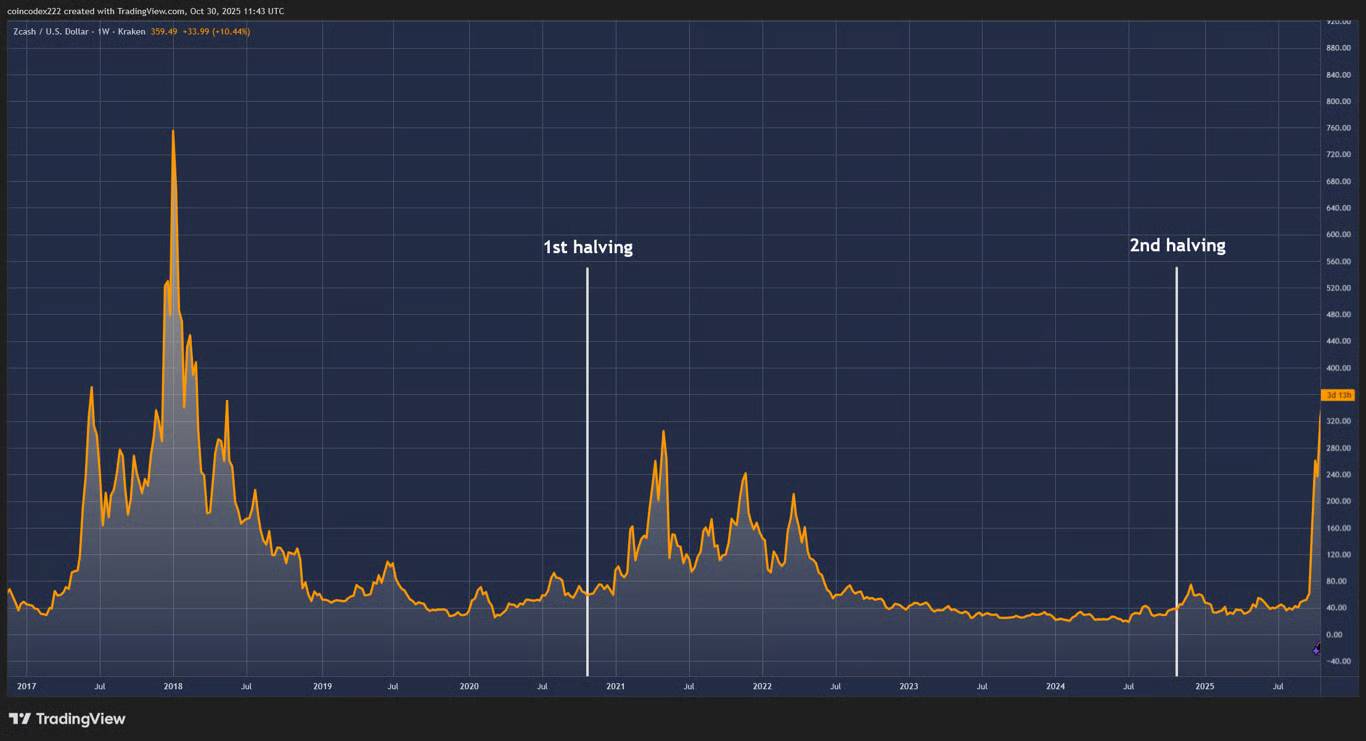

Zcash's second halving (November 2024) significantly reduced its new coin issuance, and we are now seeing its effects. The block reward has dropped from 3.125 ZEC to 1.5625 ZEC, halving the annual inflation rate. Historically, Bitcoin's price did not consistently exceed $1,000 until after its second halving—after which Bitcoin's price rose parabolically. Zcash's supply curve is identical to Bitcoin's, just shifted by a few years, and has just crossed the same milestone.

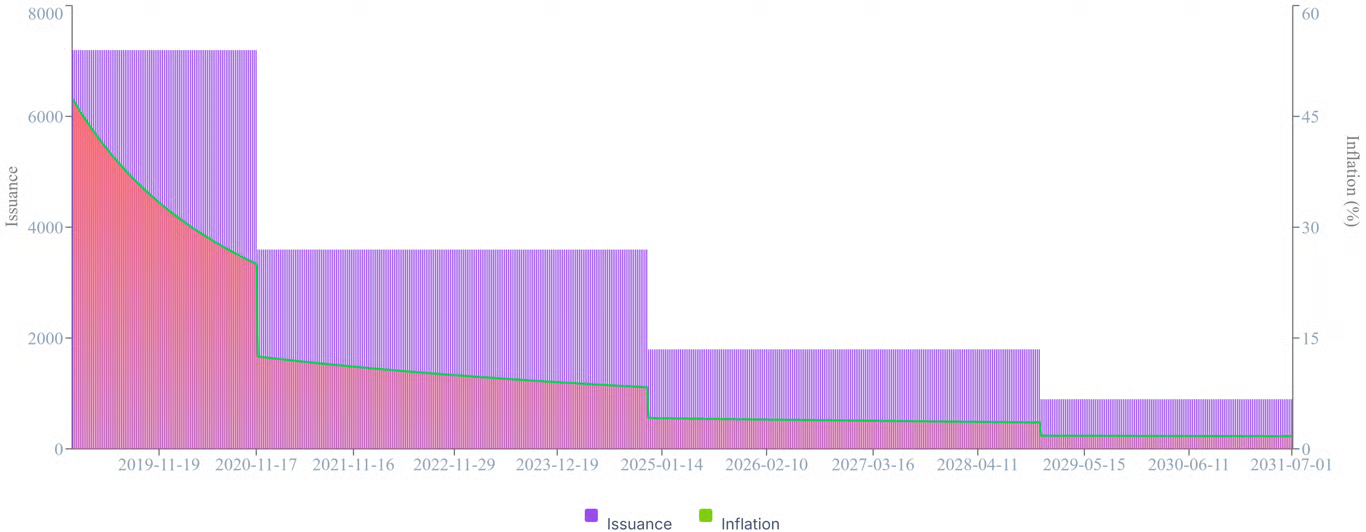

▲ ZEC USD issuance and inflation timeline

As demand rises, the circulating supply is tightening, which is a typical supply-demand squeeze. Investors speculate that after the "suspense" of high inflation fades, ZEC may develop along the early trajectory of Bitcoin. In fact, in Q4 2025, ZEC's market performance has already outperformed most major coins. Some of this is simply a matter of market timing, but fundamentally, Zcash's tokenomics is becoming increasingly attractive as it matures: it has a fixed cap, decreasing issuance, and the end of miner rewards is approaching, similar to Bitcoin's development path.

▲ ZEC USD price and halving timeline

The narrative around halving—even if misunderstood by some traders (the rumors of a 2025 halving are incorrect)—still draws attention to the Zcash story.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。