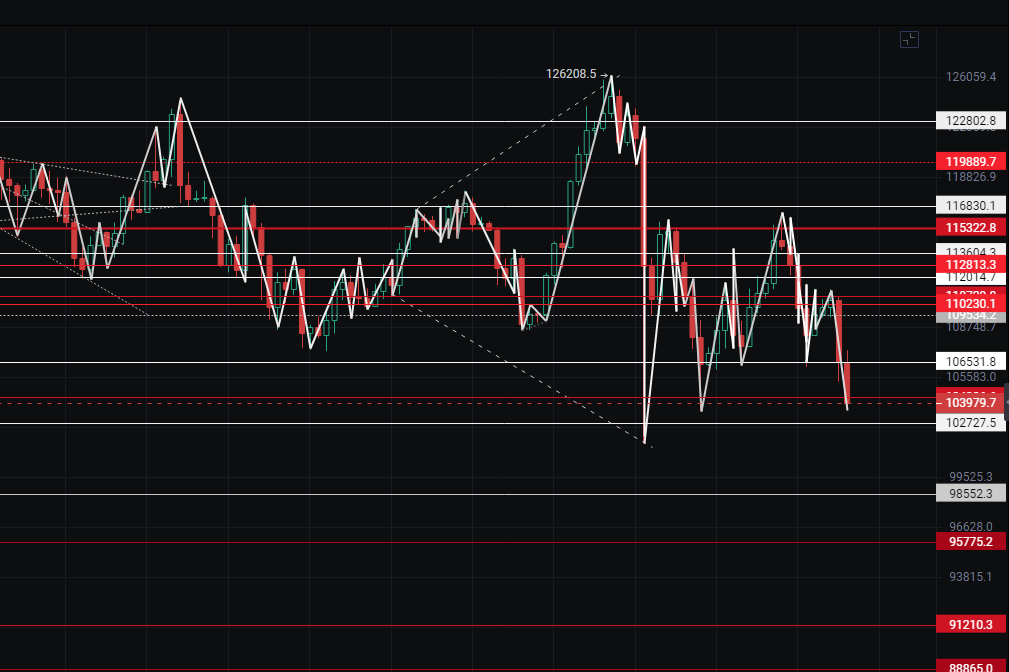

In the past few days, the pullback of BTC seems to be driven by emotional selling, but if you pay attention to the actions of the main players, you will find that—before the price turned around, the funds had already started to act. Especially the signals from Coinbase and Kraken, the two "U.S. market barometers," were very clear: one used market orders to aggressively sell, while the other used limit orders to gradually press down, working seamlessly together.

1. Kraken's Main Players Take the Lead

▪ First Wave of Signals: Night of November 1 to Day of November 2

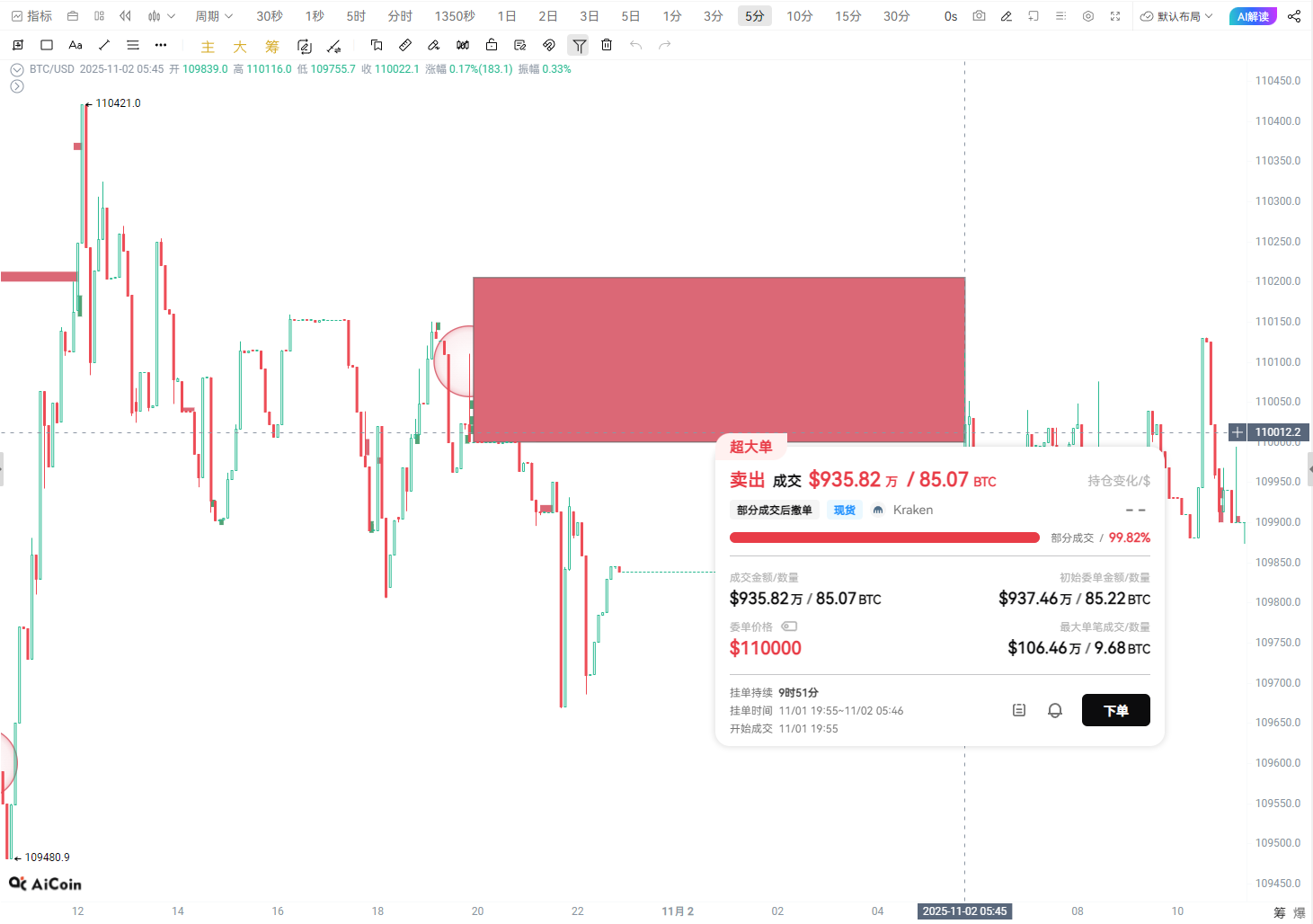

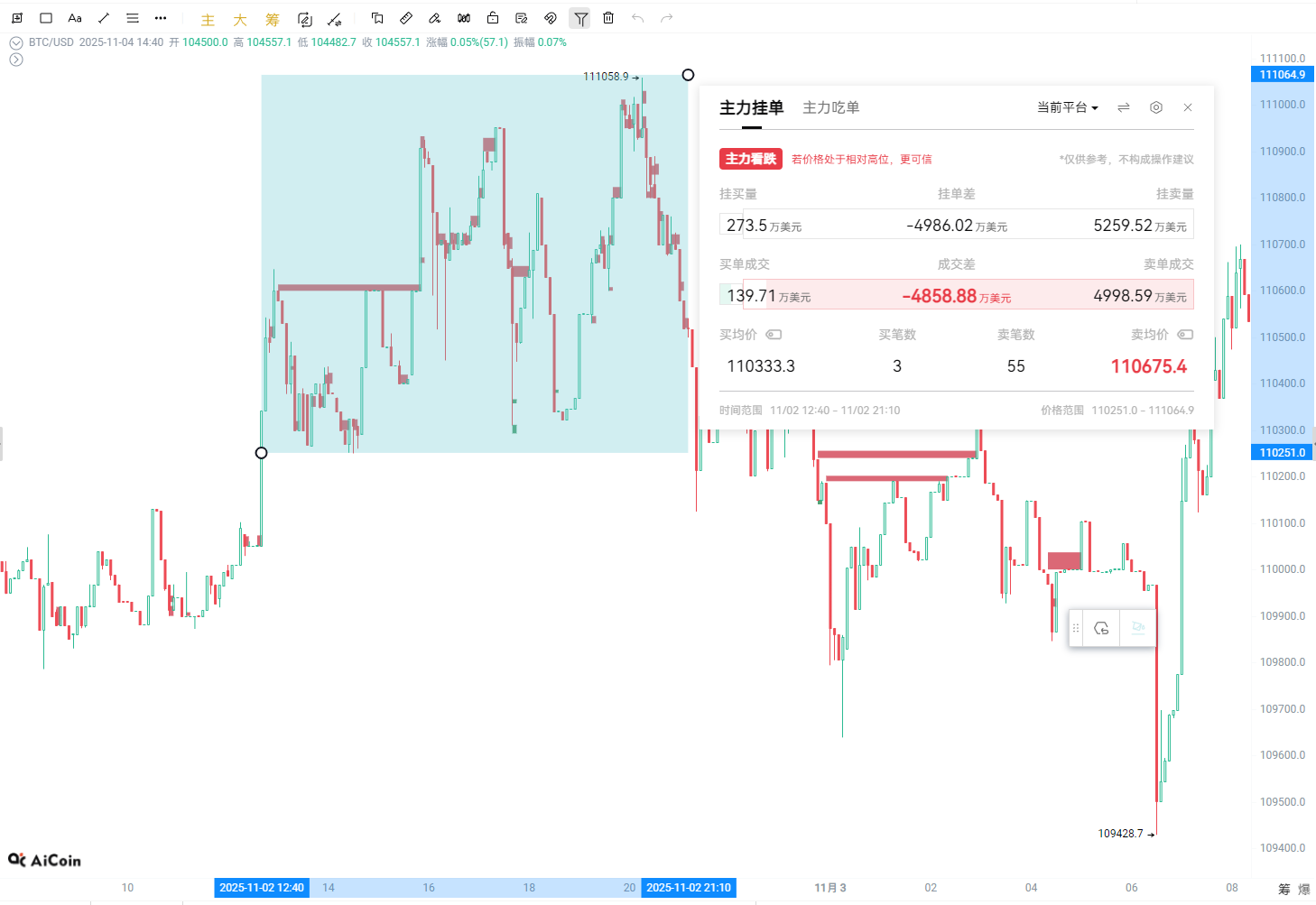

According to the PRO "Main Player Large Order Tracking" indicator (monitoring main player limit orders), we can see that Kraken's main players were the first to show unusual activity:

- A limit sell order of $9.358 million was placed at $110,000.

- Following that, within the range of $110,200 - $111,050, 55 limit sell orders appeared densely within a few hours, totaling nearly $50 million.

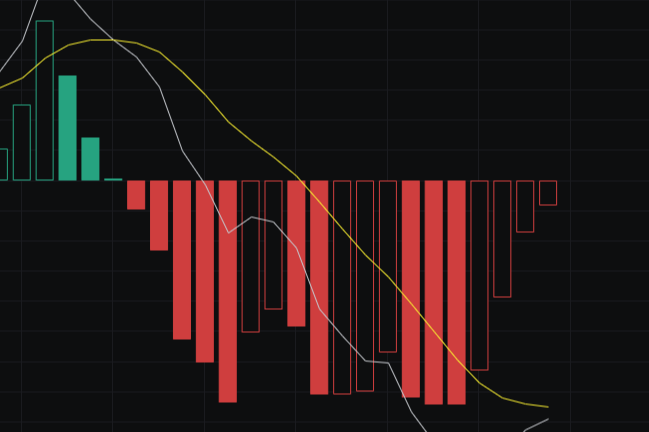

Interpretation: The appearance of such dense and large limit sell orders near key price levels usually indicates that the main players are not in a hurry to sell off instantly, but are instead setting up a solid "selling pressure wall." They are telling you: "Want a rebound? You have to get past me first." This is a typical "pressure" behavior aimed at suppressing the upward momentum of prices to create space for subsequent declines. The core signal from the "Main Player Large Order Tracking" here is: heavy selling pressure above, making it extremely difficult to break through, so bulls should be cautious.

2. Coinbase's Main Players Aggressively Sell at Market Price

▪ Second Wave of Signals: Afternoon of November 2 & Early Morning of November 3

According to the PRO "Main Player Transactions" indicator (tracking main player market transactions), Coinbase's unusual activity was particularly striking:

On November 2 at 13:34, a market sell of $7.15 million was executed at an average selling price of $110,457.51.

On November 3 at 00:03, a market sell of $8.98 million was executed at an average selling price of $110,110.

Interpretation: The market sell orders differ completely in logic from Kraken's limit sell orders. This is a cost-agnostic, speed-driven sell-off aimed at instantly breaking through market liquidity, creating panic and triggering chain stop-losses. Indeed, the second large order directly caused Coinbase's price to spike down to $108,800.

Here, a golden signal emerges that only PRO (www.aicoin.com/vip) users understand: Coinbase spiked down independently, while Binance/OKX did not follow suit. Based on past performance, such independent spikes in the U.S. market usually indicate that the market will retest this spike's low. The "Main Player Transactions" indicator here signals that the main players have begun to take the initiative, confirming downward momentum, and based on cross-market price differences, it provides an excellent reference for a "target level"—$108,800.

3. Long and Short Game and Main Player Position Changes

Main players are not a monolith; there are also handovers and support during the decline.

▪ Third Wave of Signals: The "Battlefield" at Noon on November 3

The "Main Player Large Order Tracking" shows that Kraken again had a massive limit sell order of $110 million near $107,500. This indicates that the main players believe there is still selling pressure here, continuing to suppress the rebound.

However, the "Main Player Transactions" indicator shows that almost at the same time, there was a market buy order of $102 million supporting the price.

Interpretation: At this point, the market tells us: there are main players selling, and there are also main players buying; there is capital pressing down, and there is capital supporting the bottom. The repeated fluctuations in the market here have a perfect explanation. The PRO tool allows us to see the "long and short game" behind the decline, rather than a simple one-sided sell-off.

4. Main Players Closing the Net

The closed loop of main player operations is "selling high and buying low," and the PRO indicator clearly shows us this "buying low" step.

▪ Fourth Wave of Signals: Early Morning of November 4

When the price fell to around $106,500 as expected, the "Main Player Transactions" indicator again captured a market buy order of $5.88 million from Coinbase.

Interpretation: This is a classic main player operation. They used "limit selling + market selling" at high levels to drive the price down, and then at relatively low levels, they used "market buying" to replenish their positions. The entire operational chain is clearly presented to us through AiCoin PRO's two indicators.

Special Note: During the Asian trading session, multiple market sell orders appeared in Binance's BTC spot, and a market sell order worth over $6 million also appeared in Coinbase's BTC around $105,000. The main player actions have not yet ended, and it is recommended to continue tracking with the PRO tool.

5. PRO Practical Application Guide

After reviewing, let's summarize how to use AiCoin PRO for daily decision-making:

1. Watch for Trend Initiation: "Main Player Large Order Tracking" leads, "Main Player Transaction Indicator" confirms.

▪ When there are dense limit sell orders at a key price level (such as previous highs or round numbers), be cautious as this may be a prelude to a decline.

▪ When there are consecutive large market sell orders, it indicates that downward momentum has already started, and you should consider reducing positions or going with the trend.

2. Watch Key Price Levels: Pay attention to "Cross-Market Price Differences" and "Limit Support Orders."

▪ Independent spikes in Coinbase and other U.S. markets often signal that prices are about to be tested.

▪ If a huge limit buy order appears at a certain position during a decline (like Binance's $111 million long order), that position is recognized by the main players as a short-term bottom area and is an important support reference.

3. Watch Main Player Intentions: Combine the two indicators to judge the phase.

▪ Limit sell orders piling up + market selling = Main players are actively shorting, avoid.

▪ Market selling + market buying appearing = Main players may be conducting swing trading, pay attention to bottom signals.

▪ Large limit buy orders appearing at low levels = Main player defense levels appear, consider building positions in batches.

Finally: There are countless technical indicators, but those that can directly reveal the movements of main player funds are the key. The two major functions of AiCoin PRO are to show you the main players' hidden cards. This review tells us that declines do not happen suddenly; they are the result of step-by-step operations by the main players. As long as we can use the tools well and understand their operational language, we can transform from passive victims to smart traders who follow the main players.

Appendix:

Track main player behavior: https://www.aicoin.com/vip

Coinbase Spike Radar (custom indicator, supports alerts): https://www.aicoin.com/indicator-detail/qw4VkrrKlO9kGRxK

AiCoin's only official website: aicoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。