Author: Lawyer Zhang Qianwen

Introduction

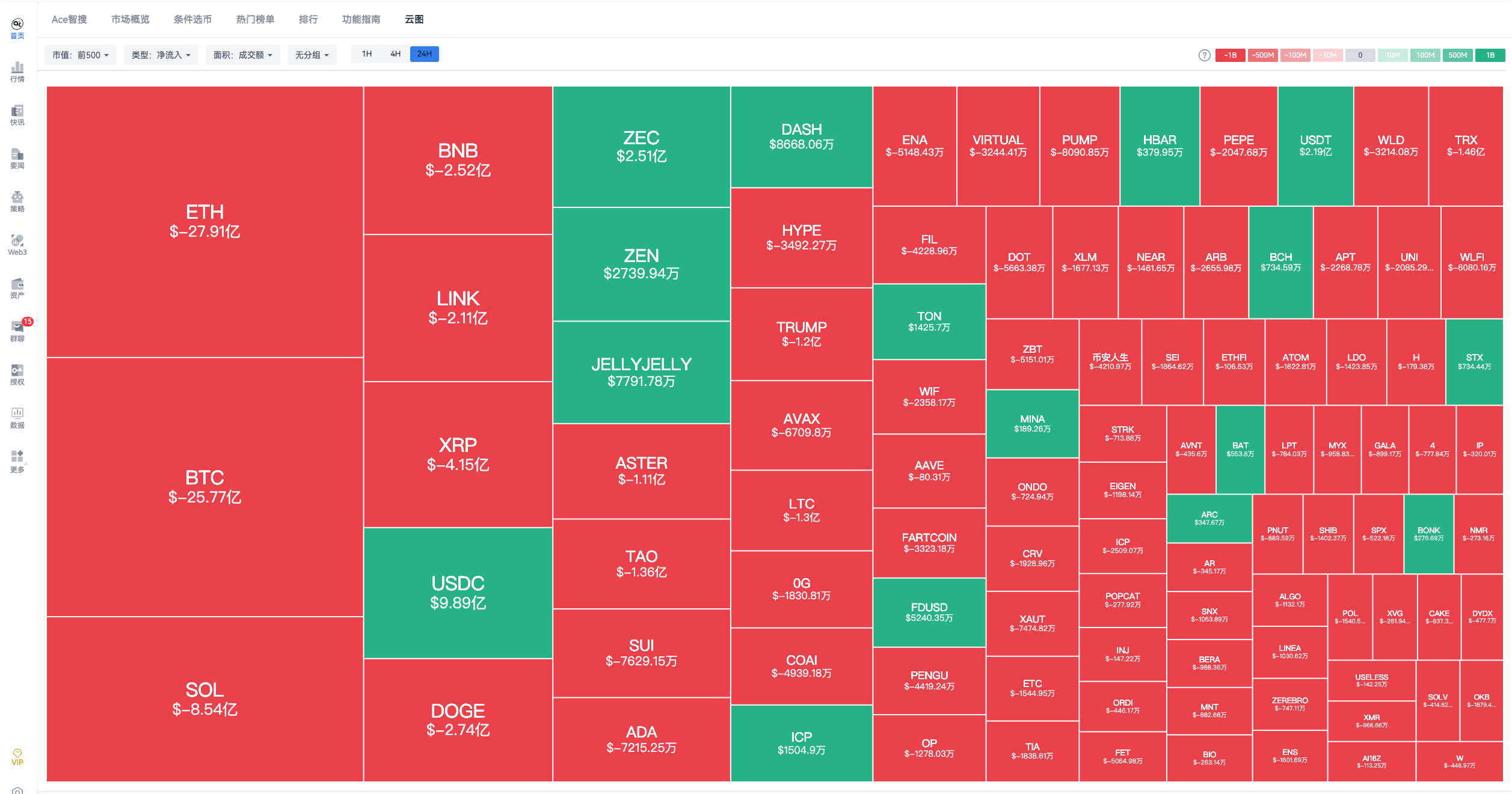

On October 14, 2025, Figure Technology Solutions (NASDAQ: FIGR) announced that its Figure Certificate Company (FCC) has registered the yield-bearing security token YLDS with the U.S. Securities and Exchange Commission (SEC), natively deployed on the Sui public chain. This marks the first time YLDS has moved from its original chain (Provenance) to another mainstream Layer-1 public chain, achieving an important breakthrough in "cross-chain compliance."

In the context of tightening regulation in the U.S. crypto market and frequent pitfalls in yield products, Figure has chosen a nearly opposite route: actively acknowledging its securities attributes and achieving yield distribution through a compliant structure. This not only makes YLDS one of the first yield-bearing on-chain assets registered with the SEC but also provides a replicable legal compliance model for yield generation in the Web3 world.

Deconstructing YLDS: The Full Process from USD Deposit to On-Chain Yield

YLDS is essentially a yield-bearing security token based on blockchain technology, with its core mechanism being the digital mapping of real-world fixed-income assets (such as short-term notes or government bonds) and issuing them in a compliant securities form on the public chain.

The operational process is as follows:

Investment Subscription: Investors subscribe to YLDS in USD, with funds deposited into an independent escrow account.

Asset Investment: The escrow account invests in underlying assets that generate stable yields.

On-Chain Issuance: Figure mints corresponding YLDS tokens on the Sui public chain, serving as proof of the investors' benefits from the asset pool.

Yield Distribution: After the underlying assets generate interest, Figure distributes the interest to investors proportionally.

Principal Redemption: Upon maturity or meeting specific conditions, investors can redeem their principal.

This model achieves a closed-loop logic from "USD deposit—asset investment—on-chain certificate—yield distribution—principal redemption," balancing traditional financial compliance with on-chain transparency and verifiability, establishing a dual-structured yield vehicle of "RWA on-chain + securities law compliance."

Legal Attributes: Stable Value YLDS ≠ Stablecoin

Although YLDS is similar to "yield-bearing stablecoins" in user experience, there are essential differences in their legal attributes and regulatory logic:

While global regulatory rules for stablecoins are still being explored and refined, there is a consensus and trend among major jurisdictions to position stablecoins as "payment and storage tools," subjecting them to payment system regulation (rather than capital markets) and requiring that "no interest or yield be paid to holders." In contrast, YLDS is based on traditional securities registration and disclosure for compliance, leveraging the public chain to achieve 24/7 transferability and programmable yield distribution. The legal essence of YLDS is that it is an investment product, with its yield structure and legal relationship distinctly different from that of stablecoins:

Therefore, stable value YLDS ≠ stablecoin. Although both serve similar functions, their attributes are vastly different—both have a nominal value pegged to "1 USD," but the core of stablecoins lies in maintaining "price stability" for short-term purchasing power and payment functionality; whereas YLDS aims to provide "yield stability" and "long-term risk control" backed by real assets. This represents a new compliance model: achieving stable yields through a securities law framework rather than pursuing stable prices through a payment law framework.

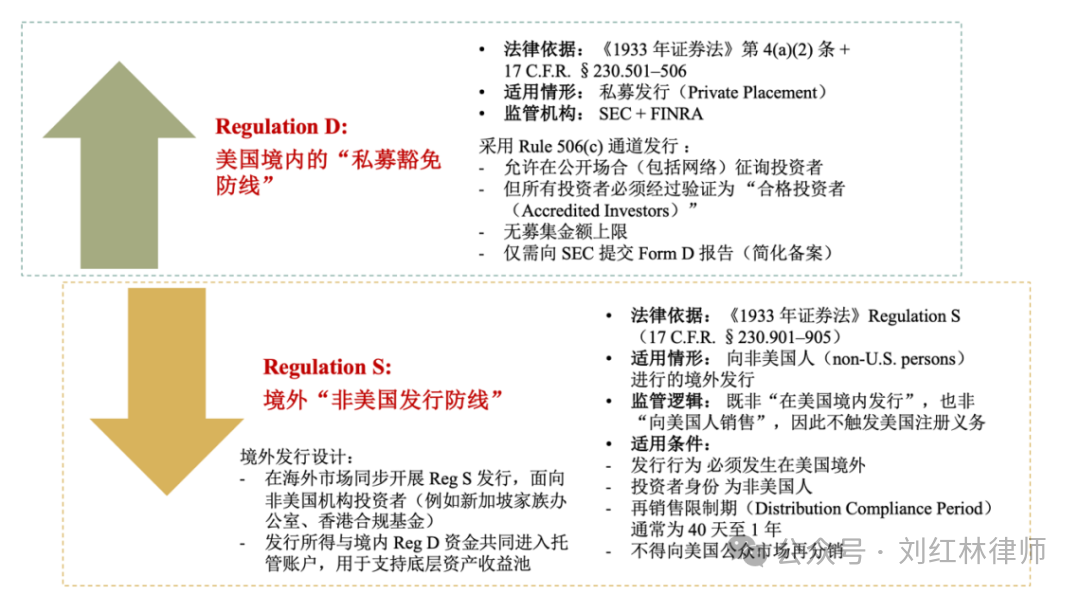

Compliance Logic of YLDS Yield Mechanism

In the regulatory context of the U.S. crypto market, yield-bearing crypto products have always been a high-risk area for enforcement. The SEC has taken enforcement actions against products like BlockFi, Celsius, and Gemini Earn, primarily due to unregistered securities issuance. According to U.S. securities law and payment regulatory logic: if yields or interest are paid to token holders, it is easily viewed as an investment contract; stablecoins and payment tokens that offer yields may lose their "payment tool" status and fall under securities regulation.

In this context, Figure has chosen the path of "acknowledging securities attributes → avoiding investment contract risks → falling under debt securities → registered compliant issuance" to construct a regulated yield-bearing securities structure without deviating from on-chain innovation.

1. Logical Starting Point: Actively Acknowledging Securities Attributes

Unlike other Web3 yield products that passively encounter regulation, Figure's strategy is to actively recognize YLDS as a security and voluntarily include it in the SEC exemption framework. This proactive acknowledgment is a self-securitization strategy: by choosing a registration path, YLDS is directly incorporated into a legitimate securities issuance system, actively entering the regulatory framework, thereby resolving the dispute over "whether it constitutes a security" and securing compliance space.

2. Core Mechanism: "Downgrading Design" from Howey to Reves

Figure's core innovation lies in its downgrading compliance strategy in legal structure design: Figure optimizes the structure to make YLDS's risk profile more akin to traditional bonds, aligning it more closely with the characteristics of "debt instruments" under the Reves Test, rather than equity investment contracts.

In the structure of YLDS, yields are defined as debt income (interest), which falls under contractual obligations for debt payment, rather than investment profits (profit), which would be dividends from managed returns. Its yield comes from real asset interest, not from platform reinvestment returns. This design cleverly avoids the "expectation of profits" and "efforts of others" elements in the Howey test, legalizing the yield mechanism.

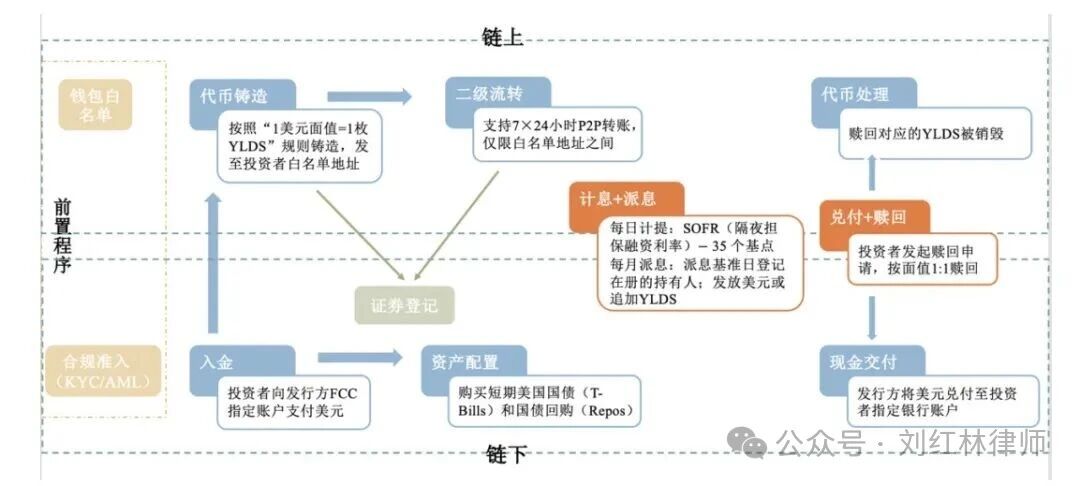

3. Issuance Path: Distinction Between Registered Securities and Cross-Border Private Placement

According to public information, the vehicle for YLDS is the Figure Certificates issued by FCC, which are face-amount certificates with debt attributes, essentially classified as interest-bearing debt securities. FCC submitted a Form S-1 registration statement to the SEC in 2025 and clearly stated in the official prospectus:

Figure Certificates are interest-bearing debt securities, issued by Figure Certificate Company, a face-amount certificate company registered under the Investment Company Act of 1940.—— [SEC Filing, Figure Certificate Company, 2025]

This arrangement means that the rights represented by YLDS are not issued through private placement exemptions but are incorporated into the SEC's formal regulation as registered debt securities. This model not only establishes the legal legitimacy of YLDS but also builds a solid legal foundation for its subsequent on-chain deployment (such as landing on the Sui public chain).

Furthermore, FCC also pointed out in SEC documents that some Figure Certificates (such as Transferable Certificates) may be traded in registered alternative trading systems (ATS) in the future for compliant transfers between holders. This arrangement breaks through the liquidity barrier of traditional securities products that are "registered but non-transferable," providing an important support point for the lifecycle compliance of on-chain securitized assets—from issuance, holding, yield distribution, to compliant transfer, all processes remain within the regulatory purview.

Of course, in the actual market operations of crypto financial products, the dual exemption structure of Regulation D + Regulation S remains a common mechanism, with many Web3 projects adopting a combination of Reg D + Reg S for token issuance in early financing, supplemented by on-chain lock-up, compliance audits, and trading platform support to achieve a dynamic balance of "on-chain compliance + cross-border coverage."

Figure's compliance path can be seen as an advanced version of this traditional dual exemption structure: by incorporating regulatory systems through registered or registered-type bond mechanisms, the compliance boundaries are more clearly defined. Of course, the widely adopted Reg D + Reg S combination continues to serve as a highly flexible private placement mechanism, providing an operable alternative path for on-chain asset issuance globally.

The path of YLDS intersects with mainstream structures, showcasing the diversity and future possibilities of on-chain compliance: it can be "registered as positive" or "exempt as a path," with the key being the precise construction of legal structures and the adaptive arrangement of issuance rhythms.

Conclusion: A Model from Gray Area Yields to Regulated Yields

Figure's compliance path is not an evasion of regulation but an embedded reconstruction achieved through legal structure design: its proactive acknowledgment of securities attributes transforms yields from investment profits to debt interest, and through registered compliant issuance, it realizes a safe transition from "potentially illegal investment contracts" to "regulated debt securities."

Figure's path demonstrates how to balance on-chain transparency with off-chain legal compliance, how to achieve equilibrium among yield, trust, and regulation, providing a replicable model for crypto financial products to move from "gray area yields" to "regulated yields," and offering important compliance references for RWA projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。