Author: J.A.E, PANews

After the disappointing "Uptober," investors are now shivering in "Red November." The once hot DAT narrative has also begun to wane, with the two largest ETH treasury companies, BitMNR and SharpLink, facing a combined unrealized loss of over $1.9 billion. However, Nasdaq-listed Tharimmune announced on November 3 that it has established a Canton Coin treasury and completed a $540 million private placement, led by DRW and Liberty City Ventures, with participation from several institutions including ARK Invest. Amid the DAT downturn, this counter-trend financing may not only be an injection of capital but also a renewed bet by traditional financial institutions on blockchain.

Tokenized assets exceed $6 trillion, Canton aims to create the first ALLFi public chain

The underlying infrastructure of traditional capital markets is undergoing a quiet transformation driven by a few leading institutions. The blockchain network Canton Network, developed by Digital Asset, has gradually become a major blockchain platform on Wall Street. It has established a thriving ecosystem that spans banks, custodians, exchanges, and market makers, actively promoting the large-scale on-chain integration of traditional financial assets.

Canton aims to be the first public chain to pioneer a new paradigm of "AllFi," focusing on integrating the advantages of DeFi and traditional finance, allowing crypto-native developers and institutions to achieve efficiency in blockchain while ensuring compliance with traditional finance without a "one-size-fits-all" approach.

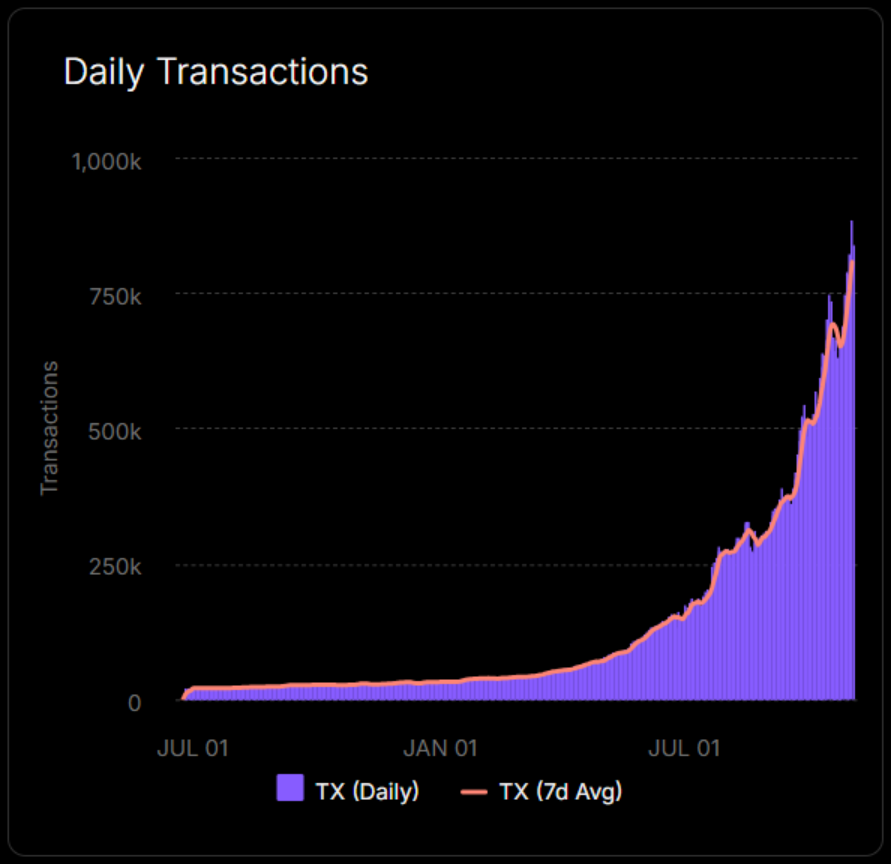

The most direct measure of infrastructure is its asset scale and transaction speed. Canton has moved past the proof-of-concept stage and entered a phase of scaled expansion. The official announcement reveals that Canton currently supports over $6 trillion in on-chain assets, with an average daily transaction volume of 800,000. This scale indicates that Canton is penetrating high-value traditional financial market workflows, equipped with institutional-level transaction speed and liquidity.

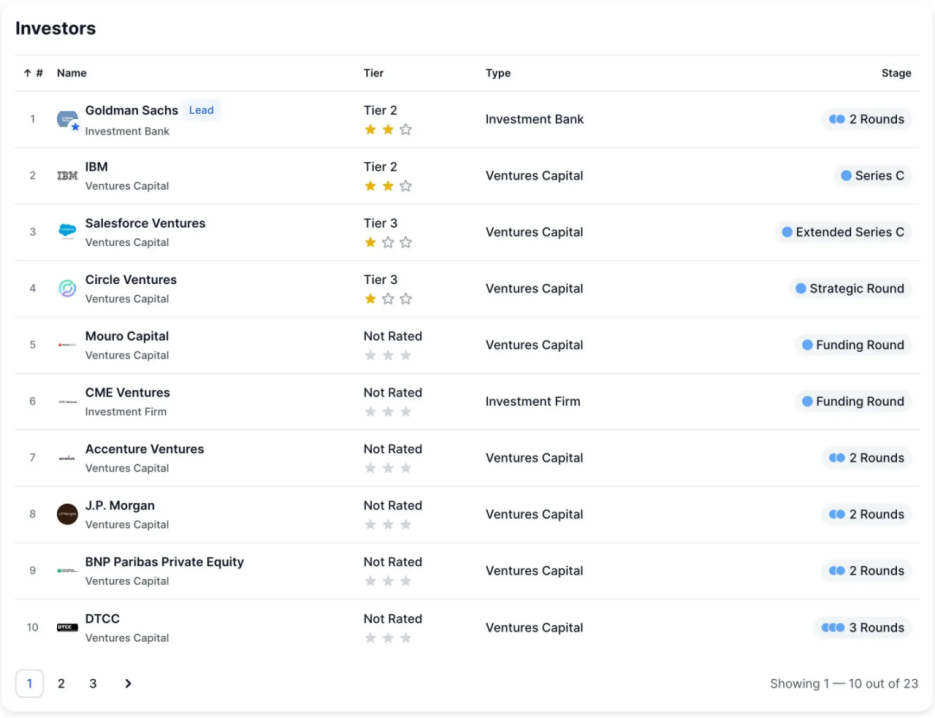

The list of investors and participants in Canton is less a capital structure of crypto startups and more akin to a board of directors on Wall Street, encompassing major traditional financial giants and core players in the crypto industry. The collective endorsement and deep involvement of these top institutions may suggest that they are all betting on Canton becoming the next generation of global financial infrastructure.

The list of investors and participants in Canton is less a capital structure of crypto startups and more akin to a board of directors on Wall Street, encompassing major traditional financial giants and core players in the crypto industry. The collective endorsement and deep involvement of these top institutions may suggest that they are all betting on Canton becoming the next generation of global financial infrastructure.

Canton is positioned as the only public chain in the financial industry with on-chain privacy features. Its advantage lies in solving the privacy and compliance challenges that have historically plagued enterprise-level distributed ledger technology (DLT), which is crucial for the flow of traditional capital in decentralized networks.

Traditional public chains typically adopt a "global replication" model, where all users in the network can view all on-chain transaction records. This model is the foundation of transparency and security for retail markets and permissionless DeFi markets, but it poses insurmountable compliance and business obstacles for the highly regulated and competitive traditional financial market.

For large financial institutions, public chains lacking privacy features generally face three main pain points, which make "complete transparency" a structural flaw:

- Trade Secret Leakage: Business data (such as customer information and proprietary trading strategies) on-chain may be captured or maliciously attacked by competitors through on-chain analysis and reverse engineering, leading to the exposure of trade secrets;

- Judicial Risks: Jurisdictions like GDPR grant users the right to delete their data. The immutable nature of public chains conflicts with such legal requirements;

- Reputation and Compliance Risks: Public historical records mean that any transaction detail may be subject to scrutiny, increasing the risk of scandals or regulatory penalties for institutions.

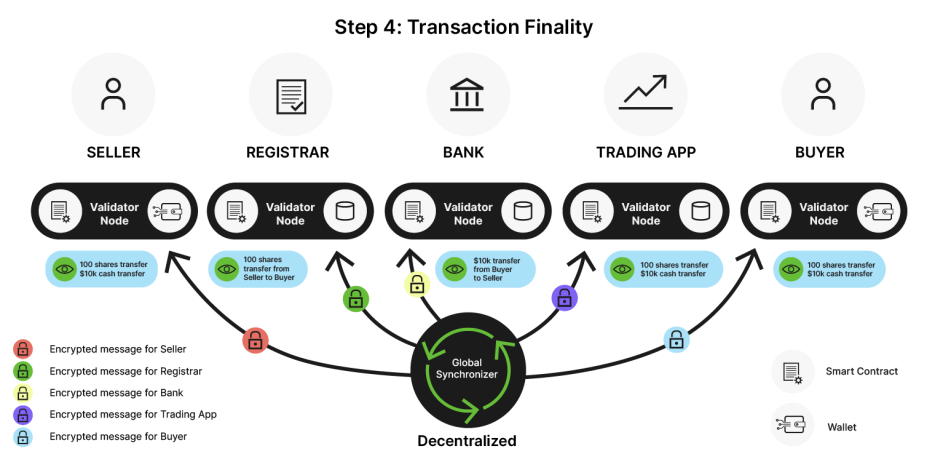

To meet the strict privacy and compliance requirements of institutions while ensuring interoperability and scalability, Canton employs three core components: Daml smart contracts, PoSH (Proof of Stakeholder) consensus mechanism, and synchronous domain protocol.

First, the underlying framework of Canton is Daml smart contracts, designed specifically for multi-party participation to ensure privacy and data consistency.

The feature of Daml lies in its support for "sub-transaction privacy." This means that in a round of multi-party transactions, each participant can only view transaction records relevant to themselves. For example, in the settlement process of an asset transaction, the buyer, seller, custodian, and bank can only receive and record important information related to their respective business activities.

Daml can define which parties are authorized to view and modify any given agreement, and this "Need-to-Know" mechanism, built on the principle of data minimization, directly addresses the GDPR compliance challenges faced by institutions.

Second, the consensus mechanism adopted by Canton is PoSH, which differs from the "global replication" model of traditional PoW or PoS.

In the PoSH model, only validators participating in specific transactions, i.e., stakeholders in the transaction, have the authority to validate it. Through privacy configurations, the protocol ensures that validators can only view data copies relevant to their users and cannot access any other information.

This mechanism separates the responsibilities of validators from the risks of data exposure, ensuring the distributed validation and integrity of transactions while maintaining the confidentiality of transaction details.

Finally, the synchronous domain architecture provides Canton with horizontal scalability, theoretically allowing for unlimited TPS (transactions per second).

The trust model of the synchronous domain is also highly flexible, allowing Canton to meet varying institutional preferences for security and efficiency while maintaining interoperability. More importantly, all transaction data transmitted between nodes will be end-to-end encrypted and only selectively shared under the "Need-to-Know" mechanism. Therefore, the synchronous domain itself cannot know the transaction content, ensuring privacy, and even in the presence of malicious participants, Canton can guarantee the integrity of the ledger across nodes.

In summary, Canton addresses the pain points of on-chain transactions for traditional financial assets through a comprehensive architectural design, achieving institutional-level privacy and compliance standards.

Deeply tied to traditional financial giants, focusing on RWA all-weather financing capabilities

The practical utility and market adoption of Canton have already been demonstrated through a series of high-value institutional use cases.

The Canton ecosystem covers various roles, including banks, infrastructure providers, and liquidity providers.

In a pilot project, Canton collaborated with 45 top financial institutions, asset management companies, and service providers to create a precedent for large-scale atomic transactions. This pilot validated that traditionally independent financial systems of various institutions could connect and synchronize through Canton while maintaining privacy controls.

Thus, the development of Canton relies on the deep involvement of numerous financial giants, who are not only users but also co-builders and investors in the infrastructure.

Canton's decentralization is primarily reflected in its validator structure, currently boasting nearly 600 active validator nodes, balancing governance and performance requirements. Super validators like Hypernative bring real-time transaction security and risk management capabilities to the network, which is crucial for a network carrying trillions in assets.

At the asset level, Canton focuses on the efficient trading of RWAs (real-world assets), particularly high-liquidity assets such as tokenized U.S. Treasuries.

A groundbreaking transaction led by an industry working group proved this point. Participants included Bank of America, Société Générale, Castle Securities, and Circle, who collectively completed a U.S. Treasury financing transaction during unconventional trading hours on Canton. This significant advancement unlocked the all-weather financing capability of the asset, overcoming the time constraints and existing settlement mechanisms of traditional markets.

Currently, the average daily repurchase transaction volume of U.S. Treasuries on Canton has exceeded $280 billion, indicating that Canton has the potential to become a key liquidity infrastructure in traditional financial markets. This scale also validates Canton's "AllFi" positioning, integrating tokenized assets with payment settlements under privacy protection into institutional-level workflows.

Launching a treasury strategy of over $500 million, becoming the only publicly listed company supported by a foundation

On November 3, Nasdaq-listed Tharimmune announced the completion of a $540 million private placement to establish a CC treasury, which may serve as a super validator in the future and develop related Dapps to support the overall utility of the network. Tharimmune is also the only publicly listed company supported by the Canton Foundation.

This strategic move carries profound institutional significance:

- Compliance Access: The DAT model provides a pathway for traditional institutions to invest in CC through the U.S. stock market, offering compliant indirect exposure for those unable to directly hold crypto assets due to strict regulations;

- Capital Acceleration: Lead investors like DRW and Liberty City Ventures are contributing most of the funds in the form of CC, while external supporters will contribute $100 to $200 million. This not only lays a solid capital foundation for Canton's development but also drives the protocol's token economic model to expand in sync with the network effects of the $6 trillion asset scale;

- Network Maturity: The advancement of DAT may coincide with the large-scale institutional adoption of Canton, transforming the technical utility of the protocol into financial products that can be integrated into traditional capital markets.

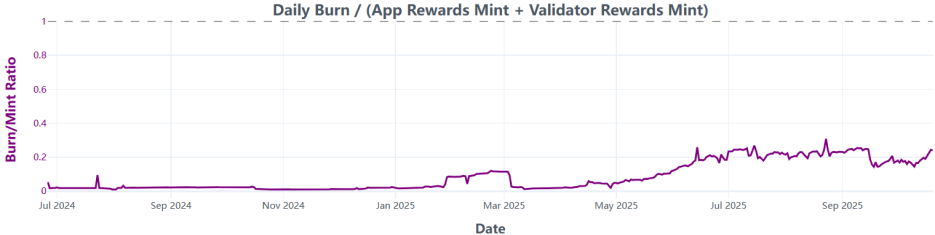

It is understood that CC (Canton Coin) is the native token of Canton, and its economic model adopts a "mint-burn" approach, directly linking network utility with economic incentives. Dapp developers and on-chain participants such as validators earn CC by providing utility to the network.

The design principles of the CC token economic model are:

- Utility-Driven Issuance: Each circulating CC is generated by participants providing utility to the network;

- No Staking Requirements: Unlike many PoS public chains, running validator nodes on Canton does not require staking, alleviating institutions' concerns about locking up large amounts of capital.

For Canton, the DAT strategy significantly reduces the concerns of institutions regarding the volatility of cryptocurrencies or complex regulatory rules by packaging the investment behavior of protocol tokens into regulated financial instruments. This not only lays the groundwork for attracting traditional capital and synchronizing network incentives but also embeds an additional layer of value accumulation model on top of the utility-driven basis for CC. As of now, the burn/mint ratio of CC has steadily increased to 0.24.

As tokenized U.S. Treasuries and other assets continue to go on-chain, Canton may gradually become the central system of "on-chain Wall Street." However, whether it can truly bridge the last mile between traditional finance and the crypto market will largely depend on its regulatory adaptability. Despite Canton's strong privacy features, regulatory uncertainties remain, such as the SEC's scrutiny of tokenized assets or the EU's stance on blockchain GDPR compliance.

Critics in the market also argue that while PoSH is privacy-friendly, it may reduce overall transparency and increase money laundering risks. Additionally, the burn mechanism of CC relies on real activity. If adoption slows, it may impact the deflationary effect.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。