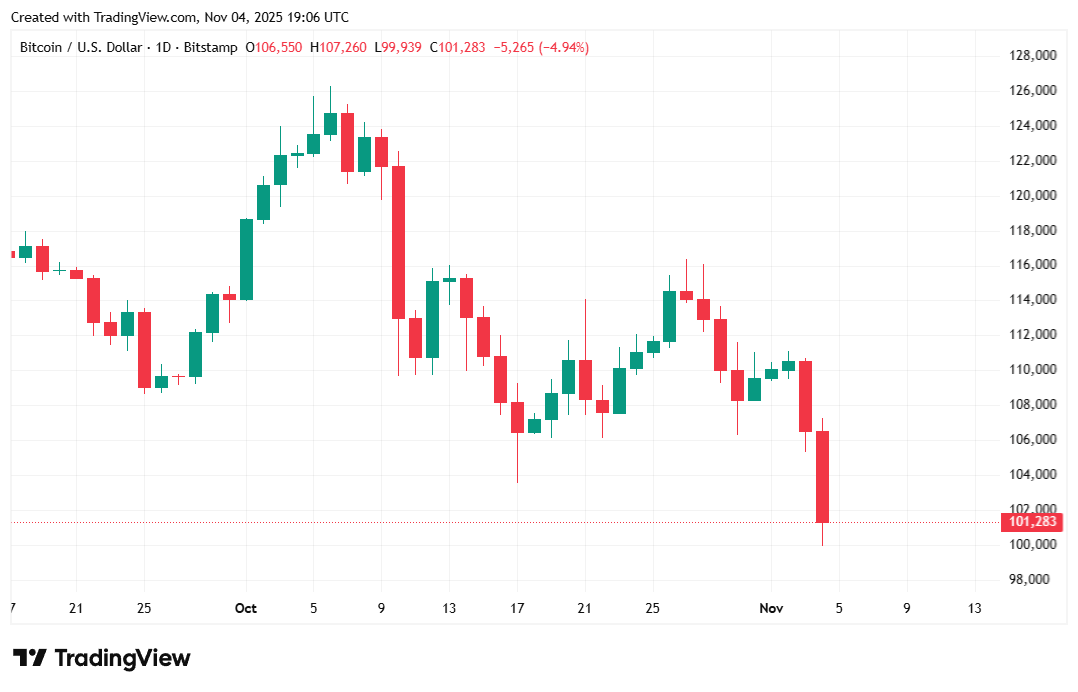

“A dip below 100k seems inevitable,” said Standard Chartered Bank’s Geoffrey Kendrick just a few days ago. “It may be the last time Bitcoin is EVER below 100k.” Kendrick, who heads the bank’s digital assets research team, must have felt vindicated for his prediction on Tuesday as bitcoin fell 6% to $99.9K before recovering and climbing back above $101K.

Bearish sentiment instigated by what many are saying is an AI bubble, caused stocks to slip. At the time or reporting, the S&P 500, Nasdaq, and Dow had all shed 0.91%, 1.49%, and 0.43% respectively. AI firm Palantir (Nasdaq: PLTR), led the decline, tumbling 7% despite beating Q3 revenue expectations. The culprit: a sky-high price-to-earnings (PE) ratio of 623.50. In other words, investors are willing to pay $623.50 for every dollar Palantir generates. Compare that to chipmaker Nvidia’s PE ratio of 53.81 and it becomes clear why the market is calling Palantir “overvalued.” Traders like Michael Burry are even taking it a step further and shorting both Palantir and Nvidia.

“He’s actually putting a short on AI. … It was us and Nvidia,” said Palantir CEO Alex Karp, criticizing Burry during a CNBC interview. “The idea that chips and ontology is what you want to short is batsh*t crazy.”

(Socialist sensation Zohran Mamdani will likely be elected New York City’s mayor tonight. He represents an X factor that may partially explain Tuesday’s market turmoil.)

But there’s another less talked about catalyst that could be weighing down markets: New York City mayoral candidate Zohran Mamdani. The 34-year-old self-styled “Democratic socialist” will likely win the mayoral election this evening. The question becomes, how will markets fare when a socialist mayor is elected to run the financial capital of the world? For most economists, the answer will probably be a downbeat one, and perhaps that general risk-off sentiment is adding to bitcoin’s woes, at least in the short term. If the longer view is taken into account however, betting against bitcoin or AI is probably not the wisest strategy.

Bitcoin was priced at $101,138.07 at the time of reporting, after declining 5.47% over the past 24 hours, according to Coinmarketcap. The digital asset has tumbled nearly 12% since last week, fluctuating between $99,990.79 and $107,363.16 since Monday afternoon.

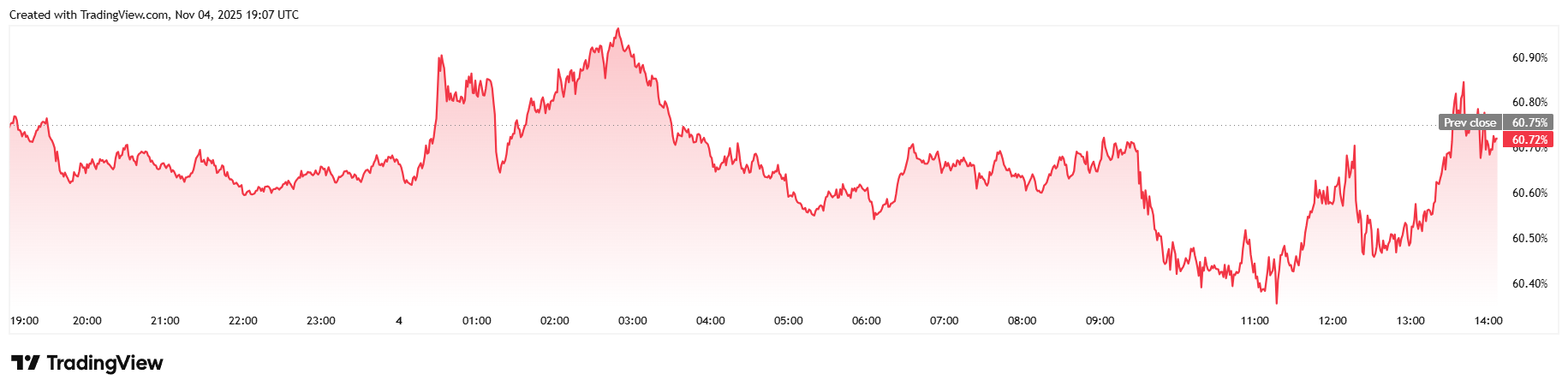

Twenty-four-hour trading volume climbed 40.24% to $93.36 billion, but market capitalization fell to $2.02 trillion. Bitcoin dominance remained largely unchanged over 24 hours at roughly 60.70%.

Total value of bitcoin futures open interest slid 3.59% to $67.37 billion, according to Coinglass data. Liquidations naturally took center stage, surging to a grand total of $468.77 million in a matter of hours, as the dip below $100K triggered $438 million in losses for long investors. Short sellers were mostly spared, save for a few overzealous traders who lost $30.77 million in margin.

- Why did Bitcoin fall today?

Bitcoin dropped nearly 6% as fears of an AI-stock bubble and political uncertainty in New York City spooked global markets. - How low did Bitcoin go?

The cryptocurrency briefly touched $99.9K before rebounding above $101K. - Which stocks led the sell-off?

AI firm Palantir plunged 7% despite strong earnings, dragging the Nasdaq lower alongside Nvidia and other tech names. - Who is Zohran Mamdani and why does he matter?

The 34-year-old socialist mayoral frontrunner in NYC is fueling investor concern that policy shifts could dampen Wall Street sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。