Bitcoin slipped below the six-figure club on Nov. 4, tapping $98,995 per coin on Bitstamp. At press time, BTC is down more than 6% in the past 24 hours and sitting 20% beneath its October record price above $126,000.

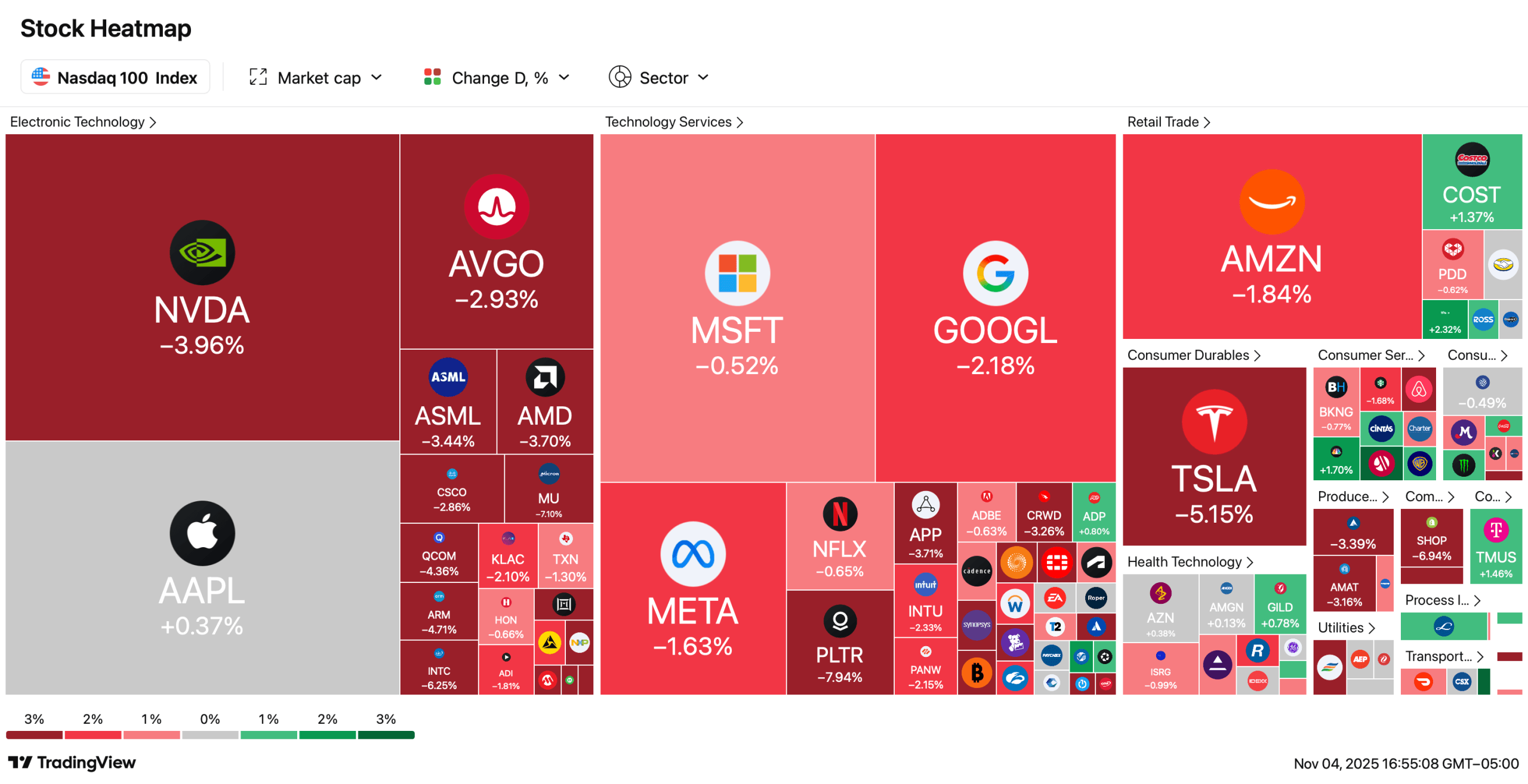

Between Nov. 3 and 5 p.m. ET on Nov. 4, roughly $289.04 billion completely evaporated from the crypto market, knocking bitcoin’s market capitalization under $2 trillion. Wall Street didn’t fare any better. The Nasdaq plunged 486 points to 23,348.64 as tech stocks bore the brunt of the carnage.

The NYSE lost 133.88 points to close at 21,282.71, while the Dow Jones stumbled 251.44 to 47,085.24. Even the S&P 500 couldn’t dodge the carnage, falling 80.42 to 6,771.55. It was a blood-red trading day — the kind that makes caffeine feel like a survival tool — with more than $730 billion wiped off U.S. equities in one brutal session.

You’d think precious metals would sparkle while stocks and crypto cratered — but nope, they joined the pity party too. An ounce of fine gold now fetches $3,933, down 1.66% since yesterday. Silver didn’t escape either, slipping 1.98% to $47.05 per ounce. Platinum, palladium, and the rest of the metallic crew are also in the red — proving that even the safe havens took a day off. Adding insult to injury, stocks tied to the crypto sector got hammered too, taking some of the day’s heaviest hits.

For one, bitcoin miners got hammered today as the sector bled across the board. Hut 8 led the meltdown with a painful 12.52% drop to $48.11, while Riot Platforms, Terawulf, and Cleanspark all cratered 6.88%. Marathon Digital and Bitdeer weren’t far behind, losing 6.68% and 6.60% respectively. Even heavyweights like IREN and Cipher couldn’t dodge the hit, dipping 1.65% and 1.09%. In short, the mining floor looked more like a minefield.

Coinbase shares slid 6.99%, Strategy’s MSTR sank 6.68%, and Circle Internet Group’s stock dumped 5.61%. Over at Bullish, the exchange’s shares dropped a hefty 8.97%, while spot bitcoin exchange-traded funds (ETFs), such as Blackrock’s IBIT, weren’t spared either — falling more than 5% before the closing bell. All told, Tuesday’s market meltdown left few survivors. From blue chips to blockchains, everything seemed to tumble in unison as investors ran for cover.

Sentiment lately has clearly shifted from greed to grit, with traders bracing for what could be a tense week ahead. Whether bitcoin rebounds or dives deeper, one thing’s certain — volatility just reminded everyone who’s boss.

- Why did markets crash on Nov. 4, 2025?

AI valuation fears and macroeconomic jitters triggered a massive global sell-off across stocks and crypto. - How far did bitcoin fall during the sell-off?

Bitcoin dropped below $100,000, hitting $99,553 on Bitstamp and losing over 6% in a day. - Which sectors were hit the hardest?

Tech, crypto-linked equities, and bitcoin mining stocks saw the steepest declines. - Did safe-haven assets perform better?

No, even gold, silver, and other precious metals slipped, showing no refuge from the downturn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。