Author: Azuma (@azuma_eth), Planet Daily

As the market continues to be sluggish, the BSC ecosystem has suffered a greater impact due to an unexpected emotional outburst.

On November 3rd, around 5 PM, the meme token GIGGlE, themed around the charity education project Giggle Academy backed by CZ, quickly surged due to a positive announcement from Binance, and then plummeted sharply following a statement from CZ, creating an exaggerated "roller coaster" market movement in a short period. This also led to a sharp decline in several representative meme tokens of the BSC ecosystem, such as "4" and "Binance Life."

The Rise of GIGGLE

The development team of GIGGLE is the BSC community team GiggleFund. Although this project is not directly related to the Giggle Academy team, it keenly captured the hype opportunity when the latter opened on-chain donations, achieving a soft "binding" of community consensus with the selling point of "transaction fee donations."

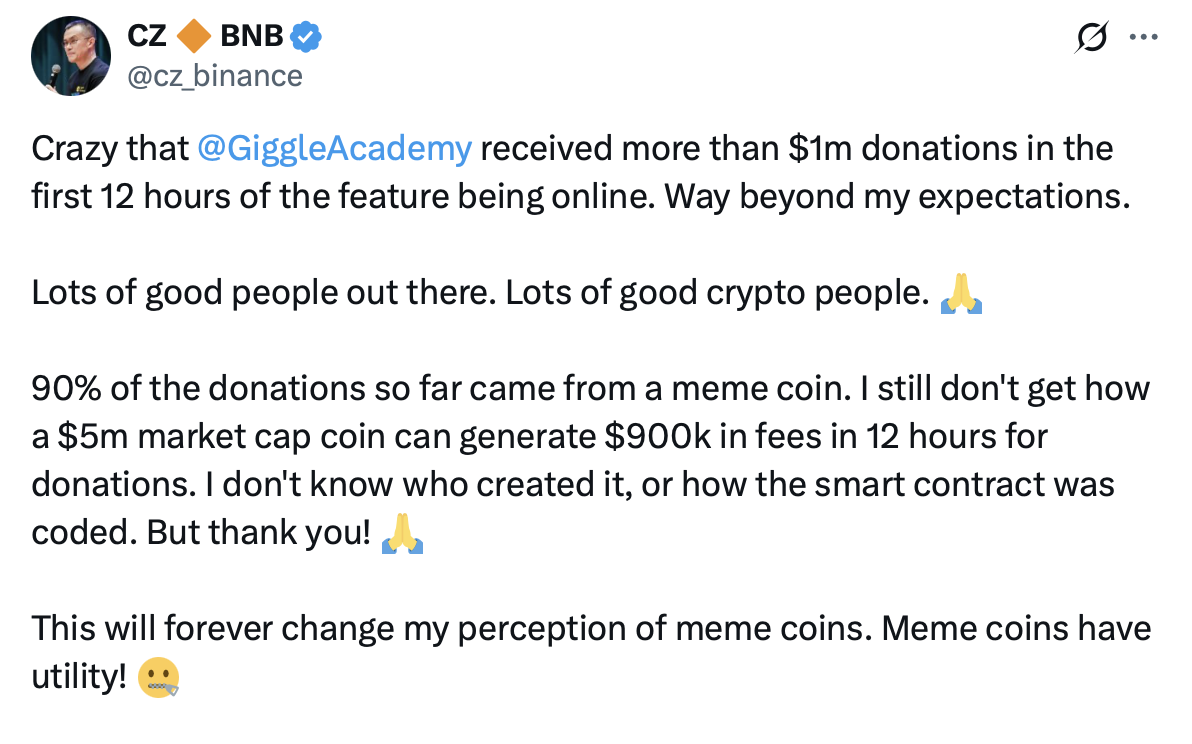

On September 21, Giggle Academy announced that it would start accepting public donations in cryptocurrency to help more children access free, high-quality education. GiggleFund seized this opportunity to launch GIGGLE and announced that all GIGGLE transaction fees would be donated to Giggle Academy. This excellent angle allowed GIGGLE to quickly explode, with Giggle Academy receiving over $1 million in donations just 12 hours after opening donations, about 90% of which came from GIGGLE transaction fees. CZ specifically praised this, stating it "changed his view on meme tokens, showcasing their actual utility," further solidifying GIGGLE's leading position in the BSC ecosystem.

While continuously contributing transaction fee donations to Giggle Academy (the latest data shows $11.2 million donated), GIGGLE also quickly launched on Binance — Alpha went live on October 3, perpetual contracts on October 9, and spot trading officially on October 25. Although on October 25, Giggle Academy clarified that it "has never issued any cryptocurrency, tokens, or smart contract addresses," the community's enthusiasm for GIGGLE reached a peak under the more explicit positive support of "launching spot trading" — on that day, GIGGLE surged to a historical high of $313, corresponding to a market cap of $313 million.

Roller Coaster Market, Crashing the BSC Ecosystem

After landing on Binance spot trading, along with the cooling of the meme sector and the entire market, GIGGLE's popularity and price began to decline continuously. During this period, GIGGLE holders started calling on the community to urge Binance to donate 50% of the GIGGLE spot and contract trading fees to continue the token's initial vision — of course, this also included the holders' expectation that "the market would interpret this as Binance once again expressing support for GIGGLE."

At 17:06 on November 3, the community's expectations were finally realized — Binance officially announced that starting in December, it would donate 50% of the fees generated from GIGGLE spot and leveraged trading to charitable projects supported by Giggle Fund. Stimulated by this positive news, GIGGLE quickly surged from around $70 to a peak of $113.99, briefly rising over 60%.

However, "good times don't last long." Perhaps to prevent excessive speculation from the community, or perhaps to help Giggle Academy clarify its relationship, CZ suddenly posted at 17:46: "GIGGLE is not an official token launched by Giggle Academy; I don't know who issued it."

Such a straightforward statement was quickly interpreted by the market as "GIGGLE has become a pawn," leading to a surge of panic, and GIGGLE's price began to plummet rapidly, quickly giving back previous gains, and at one point dropping to as low as $56.21.

Worse still, many users chose to chase the price up when the Binance announcement was made, and the sudden shift in sentiment caused many to be trapped or even liquidated. Notable on-chain trader 0xSun revealed he lost $980,000 and expressed his disappointment in the BSC ecosystem; another well-known KOL in the Chinese community, Lee Chan, also disclosed a loss of $426,000.

Subsequently, feelings of disappointment and panic began to spread to other BSC ecosystem tokens. As of the publication on November 3 at 22:40, BNB was reported at 1018 USDT, a 24-hour decline of 6.01%; 4 was reported at 0.064 USDT, a 24-hour decline of 23.66%; and Binance Life was reported at 0.154 USDT, a 24-hour decline of 27.52%.

The market also faced a new round of declines that evening…

What Caused Such Turbulence from a Statement?

Just a month has passed since the explosive market in early October, and BSC is indeed an ecosystem filled with wealth effects, but it can also face a crash due to a single "news event."

This is clearly not a question that can be answered with a few words. Looking back at this cycle, the industry's development seems to have reached a fork in the road. On one hand, the call for mainstream adoption continues, but institutions seem only interested in a few assets like BTC and ETH; on the other hand, influenced by the remnants of "VC manipulation" and "insider harvesting," old narratives have continuously collapsed, and new narratives have failed to take over, leaving retail investors unable to form a general consensus on the larger direction, with trends always being fleeting.

In this context, rather than being lost in a fragmented market, focusing on attention and liquidity has gradually become the main path for new projects to break through. With the largest user base and liquidity position in the industry, Binance's importance in the entire industry chain is becoming increasingly evident. Especially after Binance tightened its listing windows for other ecosystems like Solana and Base, and began to openly support BSC, Binance and BSC have become the central battlefield for retail trading. As central figures in this battlefield, CZ and He Yi's every word and action can easily be interpreted by the community as "oracles," leading to larger-scale collective emotional impacts.

In early October, BTC once broke through historical highs, and at that time, market sentiment was very positive, with retail investors full of imagination and confidence for the future. At that time, CZ and He Yi didn't even need to explicitly support; just a slight mention would cause community sentiment to ferment, creating one phenomenon after another, such as "Binance Life."

However, not only positive emotions can be amplified. After the epic liquidation on October 11, market liquidity quickly tightened, and retail sentiment became highly strained, with the dynamics of offense and defense having already changed. Just like today's comments about GIGGLE, CZ's intention might have been to make a statement like Giggle Academy's official clarification on October 25, but the already tight market liquidity reacted directly, leading to a collective decline in the ecosystem.

From a higher perspective, today's unexpected flash crash in BSC is less about a temporary loss of market sentiment and more about a structural distortion of the entire industry.

When attention and liquidity become the only remaining value anchors, the market's operating logic is no longer based on technology, products, or long-term beliefs, but rather relies on discourse power, social relationships, and speculative psychology. In this distorted market structure, reflexive cycles will always accelerate; rises will be glorified, while declines will be seen as betrayal — CZ may never have changed, but the image of CZ imagined within collective sentiment has always been uncontrollable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。