Written by: rekt

Translated by: Yangz, Techub News

Using a second stablecoin backed by the first stablecoin is not revolutionary finance, but rather an expensive performance art.

Stream Finance (xUSD) and Elixir Network (deUSD) have created a "perpetual motion machine": minting deUSD, borrowing against it, minting xUSD, re-borrowing, cross-chain transferring, and looping operations, all while bestowing it with the grand title of "institutional-grade returns."

It is rumored that the two minted 14.5 million xUSD with just a $1.9 million principal. This mathematical model, which makes Terra look modest, has been carefully wrapped in the jargon of "market-neutral strategies" and "delta-neutral positions." By October 2025, evidence began to emerge: on-chain transaction hashes, fund flow diagrams, and the yield management platform Hyperithm quietly withdrew all risks, absconding with $10 million of user funds.

While retail investors chase 95% annualized returns, savvy capital has long been building an exit strategy in the shadows.

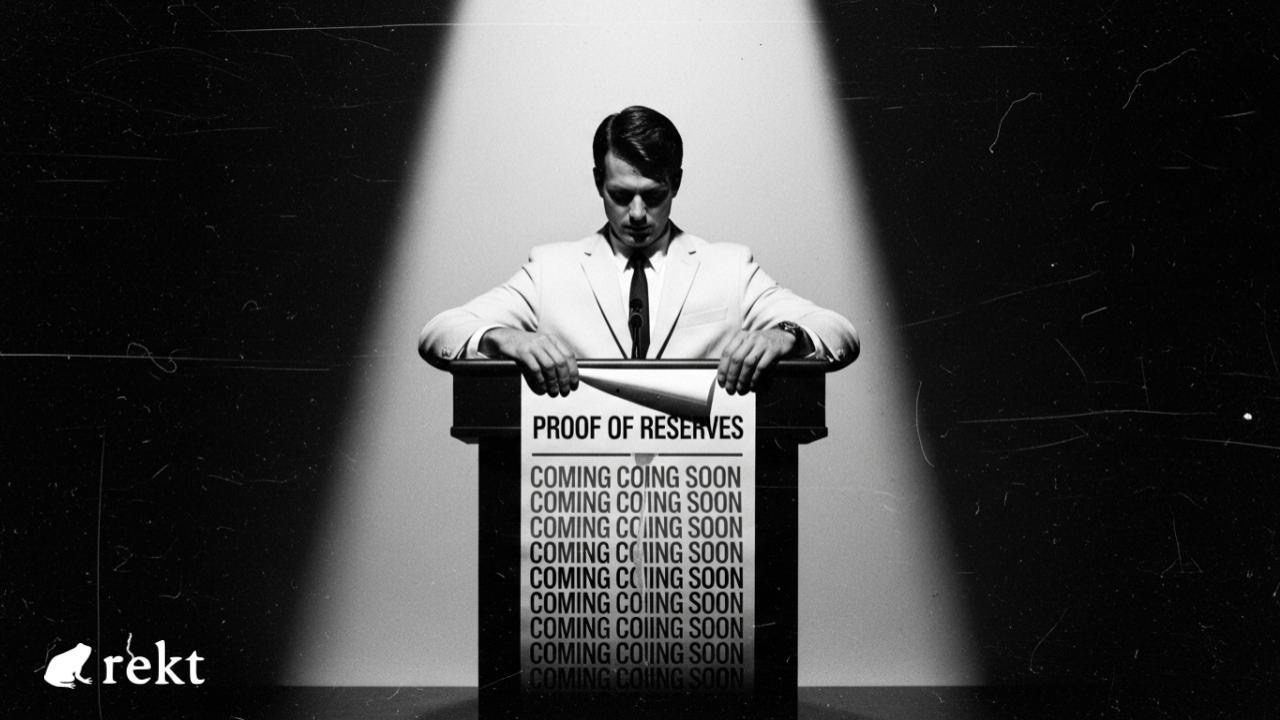

When your "stable" asset relies on insurance funds and proof of reserves (to be announced) to maintain confidence, and institutional investors flee under the cover of night, what exactly remains stable?

Stream Finance does not present itself with the lofty goals of a hoodie-wearing youth promising "to the Moon." They speak the language of a JPMorgan trading desk: "market-neutral funds," "lending arbitrage," "hedged order book market-making."

Elixir Network positions deUSD as the "only dollar channel serving institutional assets in the DeFi space"—backed by staked Ethereum and U.S. Treasury bonds, and has formed a partnership with BlackRock's BUIDL fund and Hamilton Lane.

Both protocols turn credibility into armor. Stream Finance offers "incentivized mining lending arbitrage 'to provide' high-yield market-neutral strategies"; Elixir Network creates returns for its supposedly stable assets through perpetual funding rate arbitrage.

When the two are combined, retail investors seem to see a golden ticket—an opportunity to enjoy institutional-level returns without crossing institutional thresholds.

Delta-neutral positions, fully collateralized, transparent and reliable, safe and worry-free. This grand play of credibility is most effective when no one is checking the stage backdrop.

Stream retains direct minting rights to xUSD through its StreamVault contract, while Elixir firmly controls the support mechanism for deUSD. Both parties promise transparency, but Stream's proof of reserves is always “to be announced”, while Elixir's documentation cautiously notes that deUSD "is not pegged to the dollar through a 1:1 reserve" and "no centralized issuer holds real-world assets as support."

No one reads the manual closely enough to discover that what they purchased is actually a "perpetual motion machine." But how exactly do you create a machine capable of deceiving institutions, resembling a legitimate money printer?

The "Art" of Looping

On October 28, Schlag began to expose this looped minting scam.

Users deposit USDC into Stream's xUSD wallet, believing they are investing in a conservative yield vault. What happens next—whether it is genius design or a scam—depends on whether you are the operator or the victim.

The funding loop path tracked by Schlag is as follows. All transaction records can be verified on-chain.

Step 1: Exchange "Dance Steps"—Stream transfers USDC to a secondary wallet, places an order to buy USDT through the CoW protocol, and then generates deUSD using Elixir's on-chain minting tool. deUSD flows back to Stream's main wallet.

At this point, it is still a standard DeFi process—holding collateral, generating tokens, and no one is suspicious.

Step 2: Leverage Spiral—Cross-chain the deUSD to Avalanche or World Chain (as long as there is an sdeUSD lending market). Use deUSD as collateral to borrow stablecoins, then exchange the borrowed stablecoins for USDC. Then cross-chain back to the mainnet, repeating the process. On October 28 alone, three rounds of operations were completed, minting approximately $10 million of deUSD from the initial funds.

Degen attributes? Of course. But is it fraud? The verdict is still out, as Aave performs such leveraged loops daily. Users chase yields, protocols provide liquidity, and leverage amplifies returns. This is merely standard operation in the DeFi casino economy.

Step 3: Recursive Trick—From this step onward, everything begins to get nauseating. Most leveraged loops end with idle collateral earning interest, while Stream's loop concludes with minting, using the final borrowed USDC to mint its own token xUSD. It is claimed that the same $1.9 million of USDC ultimately spawned $14.5 million of xUSD.

Whether through leveraged returns or recursive leverage, the outcome resembles less of a financial operation and more of an alchemical process. According to Schlag's research, if Stream controls 60% of the xUSD circulation (this claim is unverified, but becomes more credible when combined with token price trends and low trading volumes), then each xUSD token is actually supported by only about $0.4 of real collateral. Schlag points out that if we exclude the accounting games of the protocol's own liquidity, the direct collateral value of the entire system may be less than $0.1.

Step 4: Loop Closure—The most ingenious part of this scam is who would accept tokens conjured out of thin air by a protocol as collateral to lend out millions in stablecoins? It is precisely this step that elevates ordinary Degen mining to an almost artistic act. And the answer is Elixir, which just received $10 million in USDT here.

These USDT were transferred to the "Elixir's sUSDS multi-signature wallet" marked with a “transparency dashboard” (if it weren't holding eight-figure funds, this name would seem ridiculous), then part of the USDT was exchanged for USDC through the CoW protocol, and then cross-chained to the Plume network, injecting USDC directly into the Morpho lending market that accepts xUSD as collateral. This process was repeated multiple times. According to Schlag here, this market was not displayed on the standard Morpho interface. A permissionless market means anyone can create independent lending pools with custom parameters. Accusations show: $70 million USDC deposited, over $65 million borrowed. Elixir is the only depositor. Stream uses its freshly minted xUSD as collateral to borrow, then cross-chains back to the mainnet.

Thus, the cycle continues: USDC becomes deUSD, using deUSD as collateral to borrow USDC, then using the borrowed USDC to mint xUSD, and through the Morpho market, using xUSD to borrow more USDC. Then using the borrowed USDC to mint more deUSD.

Stream and Elixir are not supporting stablecoins—they are playing a game of musical chairs with the same pile of USDC here, packaging it as two independent dollar-pegged assets.

As long as no one demands a full redemption simultaneously, this looped minting banquet continues with "the music plays on." In one day, three rounds of operations minted 10 million deUSD. Less than $2 million in actual capital created over 14 million xUSD. All transaction hashes are recorded on-chain, waiting for the discerning to verify. In the end, who sent the signal?

Warning Signals

On October 28, influential crypto KOL CBB issued a warning that should have triggered a mass withdrawal of funds: "If you have funds in Morpho or Euler, please withdraw positions involving mHYPER and xUSD. This is extremely opaque finance. The leverage level of xUSD is nearing madness."

This dangerous signal was no longer a mere warning but a raging fire. The trading price of xUSD continued to fluctuate between 1.20 and 1.29 dollars, always above its claimed dollar peg. The limited supply was enough to indicate manipulation suspicions. Looking at deUSD, its daily trading volume often falls below $100,000, which is indeed lacking liquidity for a so-called "stablecoin" with a market cap of $160 million.

Prices are unstable, trading volumes are exhausted, yet no one questions the reasons.

In fact, a technical failure in May 2025 should have ended all this, when a Chainlink oracle malfunction led to over $500,000 in liquidations for deUSD users on Euler Finance on Avalanche. The oracle failure was not a system flaw but an inevitable characteristic of an unstable foundation.

By August, deUSD hit a historical low of 0.9831 dollars, a 1.7% de-pegging that seemed minor, but it must be noted that the premise of stablecoin trading is to never de-peg. In the same month, the Inverse Finance community voted to completely terminate the deUSD market, citing "risk and operational concerns" here. When DeFi protocols begin to refuse an asset as collateral, it is no longer ordinary market volatility but a complete collapse of credibility.

What is perplexing is that, in the face of these layered warning signals, retail investors continued to deposit funds. Everyone chose to ignore the risks until the bill finally came due.

Market warnings only become meaningful when they are taken seriously and acted upon by authoritative figures. So, what happens when a professional investor managing $160 million in assets ultimately determines that this mathematical model has completely failed?

Risk Spread

As the market's attention was drawn to the circular tricks of Stream and Elixir, YieldFi's yUSD quietly became a pressure point for risk.

On October 26, analyst Togbe began to piece together clues:

YieldFi's largest position is concentrated in the ABRC vault on the Morpho platform.

In its main position in the yUSD/USDC market, borrowers are layering leverage across multiple platforms.

The second-largest position, mHYPER, has a negative yield but accounts for over 10% of the total locked amount in that pool.

On Arbitrum, mHYPER accepts yUSD as collateral for lending.

Yet, mHYPER's second-largest asset allocation is actually Stream's issued xUSD.

This design is quite ingenious: Stream mints xUSD, Elixir mints deUSD, and both flow into the Morpho and Euler lending markets. YieldFi's yUSD borrows from these markets while simultaneously serving as collateral for mHYPER. mHYPER then lends the funds back to the same ecosystem, forming a closed loop—each protocol's solvency is tightly linked to the others.

Guiding liquidity through circular dependencies seems perfect until one link breaks. Perhaps it is just that users, after reading on-chain data, decide not to be the last ones holding the bag; within 24 hours, yUSD's market cap evaporated by 24%, yet the team remained silent.

It wasn't until October 28 that Hyperithm's announcement triggered the final judgment.

Hyperithm announced it manages mHYPER—a market-neutral vault operated by Forbes' 30 Under 30 elite founders, with operations in Tokyo and Seoul. In their announcement, they stated, "We appreciate the feedback and are willing to maintain complete transparency regarding this situation." Translated, this means: we have completed our calculations and decided to exit. Their specific actions include: clearing all yUSD risk exposure, liquidating all xUSD holdings, and deploying dedicated non-recursive lending vaults in Morpho and Euler, expecting to complete the entire liquidity migration next week. Of course, they also hold a $10 million unleveraged mHYPER position as a commitment from general partners—proving they are not running away but are avoiding systemic risk.

Hyperithm even provided wallet addresses to prove transparency, stating that anyone can verify their holdings, operations, and timing.

0x7C1d52A3459f2Eee78DA551b8C3D13FdF61fbc93

0xEa036F911b312BC0E98131016D243C745d14D816

Savvy institutions never exit opportunities merely to avoid risk. They exit because stress tests reveal that when borrowing costs soar and liquidity dries up, forced liquidations will sweep through each protocol like a domino effect.

Liquidations trigger more liquidations, collateral assets are sold off, and seemingly independent markets reveal their connections. Morpho's permissionless market structure means risk is omnipresent. Meanwhile, Euler Finance has been on high alert since the oracle incident in May and is now deeply entangled in this web of risk. The carefully designed vaults are nested—accepting xUSD as collateral (backed by deUSD), while deUSD provides guarantees for yUSD, which funds mHYPER, and mHYPER lends back to the same market.

As for those retail investors in the vaults, they are completely unaware that they are only three layers away from this recursive minting loop—once interest rates change or a particular protocol faces a wave of redemptions, the entire system will collapse. And Hyperithm, well aware, withdrew $10 million and recorded every step.

However, being informed does not equate to being able to prevent it—when the dominoes start to fall, what justifications do the designers of this system offer?

Justifications

DCF God commented on the matter.

This crypto investor did not hide his vested interest in Stream, stating, "xUSD has Degen attributes, but it is not without value support." His logic is simple: "If a token offers X% annual yield, and you can cycle arbitrage at a cost of 0.5X%, you should operate around the clock. Even if the cost reaches 0.95X%, you should continue, because this is not just about earning yields; you might also acquire more tokens through private agreements." In other words, "If custodians or other lenders are willing to lend $10 million USDC against xUSD as collateral, they only need a $2 million deposit to absorb the entire $10 million, and then use that $10 million for mining, yielding far more than their borrowing costs." DCF God stated, "This is not about pursuing superficial glamour, but a game to secure the highest returns for enterprises and vault depositors."

However, the so-called capital efficiency and yield maximization are merely a cover for a leveraged gamble disguised in financial terminology.

While DCF God admits this is "a high-risk leveraged game that could lead to total failure," he insists it is "not a scam of uncollateralized assets." Furthermore, he stated, "I have never advised anyone to deposit in xUSD (and I won't in the future), but we hold a small position because the yields are attractive… We are not just investors but participants, which is a different nature."

Clearly, being a participant is different from merely talking about it.

DCF God also claimed, "When we mine personally, we usually keep leverage within 5 times because we don't want to deal with interest rate fluctuations, redemption timing, and other troubles." As for Stream, DCF God stated, "That is their business—extreme mining mode. If you choose to invest, you should expect them to do so." His leverage philosophy is, "Since you choose Degen, why not go all in? What’s the difference between 80% and 90% collateralization? The outcome is liquidation when the underlying asset collapses… better to squeeze out all the value."

Additionally, the Stream team also provided their own risk management explanations.

On October 28, team member 0xlaw responded that the team has a $10 million insurance fund. All operations outside the main wallet are "zero-leverage and can be liquidated instantly." The team has always ensured user assets while managing the protocol's own leverage and has never encountered liquidations or exploits. Additionally, proof of reserves will be announced soon, with updates being made in collaboration with a third party every 24 hours. 0xlaw stated that due to rapid development, public positions would weaken competitive advantages, but "in light of Twitter users' concerns about the protocol's own liquidity holding leveraged positions—despite maintaining transparency since day one—we will close these positions and set limits based on the size of the insurance fund."

According to the Stream team, the protocol's own liquidity for leveraged operations has allegedly been "transparent" since day one. However, when professional managers began to withdraw and investigators published transaction hashes, this "transparency" suddenly took on a different flavor. Stream promised to unwind the questioned positions while insisting that everything is normal. But consider this carefully: they are unwinding leverage they claim has no issues, restricting positions they claim have always been transparent, and preparing to announce proof of reserves they claim has existed for a long time.

This is not a defense but a confession wrapped in a press release. "Coming soon" has become a repeated mantra. Composition of the insurance fund? Coming soon. Verification of reserves? Coming soon. Purchased exchange insurance? Coming soon. Substantive evidence beyond tweets? Coming soon.

DCF God also cited XPL pre-liquidation as an example (when the system collapses, traders maintaining 2x over-collateralization face the most severe liquidations, even though these positions appear "safest" on paper), proving that when the underlying logic fails, risk control measures are meaningless. His implication is that when systemic risk arrives, remaining conservative within a collapsing system merely means a slow demise.

DCF God described xUSD as having Degen attributes. Stream acknowledged that it would unwind the protocol's own leverage. However, neither party denied the existence of circular minting; they only debated its significance. Yet, if this cycle is to "farm" legitimate yields rather than systemic fraud, why do the price trends and capital flight patterns resemble those preceding a collapse so closely?

Summary

Stream and Elixir have indeed built a robust protocol, with smart contracts executing perfectly and the circular mechanism operating entirely as designed. However, the distinction between innovation and fraud often lies not in the code itself but in what you choose to disclose.

When a protocol secretly controls 60% of the supply, when circular minting magically turns $1.9 million into $14 million in stablecoins, and when proof of reserves remains perpetually in a "coming soon" state—at this point, branding itself as "institutional-grade" is no longer marketing jargon but outright dereliction of duty. They may be able to print money madly for now, but financial gravity will ultimately cause all who ignore the rules to fall.

Hyperithm insightfully interpreted on-chain data to recognize the crisis and timely withdrew $10 million to exit. But most depositors do not have this choice because they are completely unaware that the risk has arrived.

DeFi once promised a trustless system, yet Stream and Elixir prove: you do not need to eliminate trust; you only need to eliminate information disclosure before smart money completes its reallocation. When stability relies on no one questioning it, what exactly are you building—protocols or performance art?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。