Written by: White55, Mars Finance

The price of Bitcoin briefly fell below the psychological threshold of $100,000 in the early hours of Wednesday Beijing time, marking the first time since June 23 that this key support level has been breached.

As of the time of writing, Bitcoin is priced at $100,470, down 6% for the day, while Ethereum has seen a decline of nearly 10%, trading at $3,236.

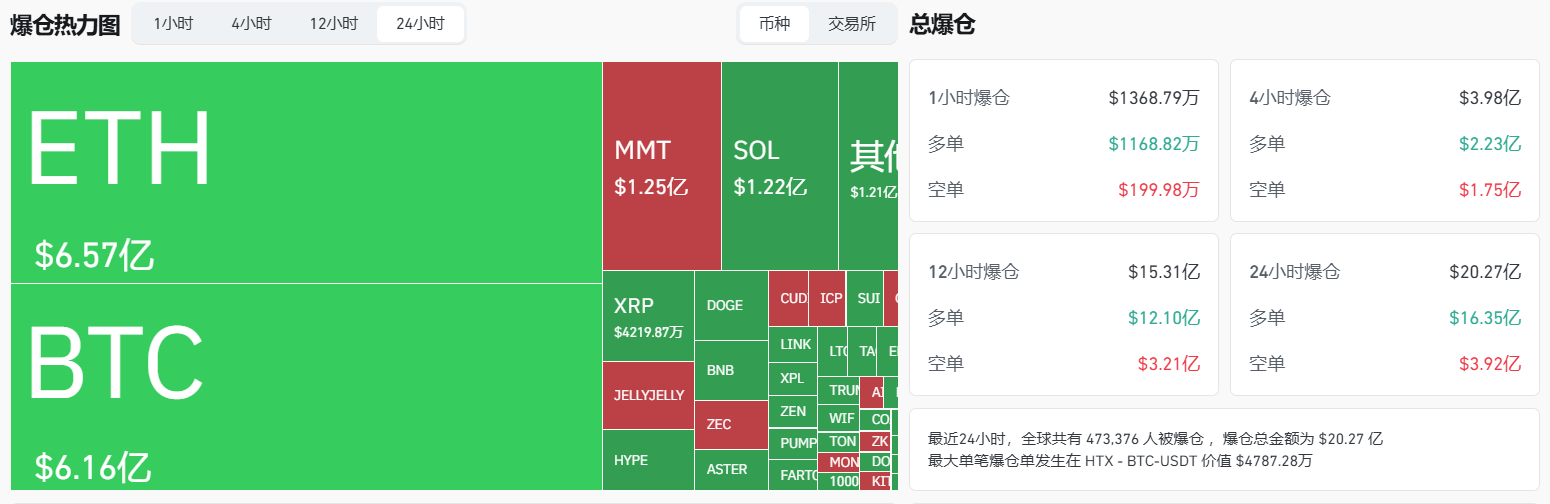

This crash has resulted in 470,000 liquidations across the network in the past 24 hours, with liquidation amounts exceeding $2 billion, of which long positions account for 85% of the losses.

The liquidation wave that began in mid-October has wiped out billions of dollars in long positions, and traders are still on the sidelines, hesitant to re-enter the market.

Market Crash, Leverage Liquidation Triggers Chain Reaction

Data shows that Bitcoin has dropped from around $112,000 at the beginning of the week to about $105,000, evaporating hundreds of billions in market value within 24 hours.

The most direct trigger for this crash was the collective liquidation of leveraged long positions. During the drop from $112,000 to $105,000, approximately $1.1 billion in futures contracts were forcibly liquidated, with 90% being long positions.

When a large number of long positions are liquidated, passive selling in the market triggers a chain reaction, amplifying selling pressure and causing prices to drop further, creating a typical "cascade effect." This crash was not caused by a specific black swan event, but rather an "automatic liquidation" due to the market's excessive leverage and inflated bubble.

Jordi Alexander, CEO of cryptocurrency trading and market-making firm Selini Capital, pointed out that the crypto market is currently in a "hangover phase" following the liquidation shock in October.

In his view, rebuilding the destroyed capital base will take time, and investor sentiment remains cautious. The market must first demonstrate that a convincing price bottom is about to form before attempting to break upward again.

Bitcoin futures open interest is still far below pre-crash levels, and even though financing costs have improved, there are still very few willing to re-enter the market.

As a result, Bitcoin has risen less than 8% this year, significantly lagging behind stock performance, and its effectiveness as a portfolio hedge has been unsatisfactory.

Macroeconomic Pressures Intensify, Institutional Demand Weakens

From a macro perspective, the recent decline is underpinned by subtle changes in Federal Reserve policy. Recent signals from several Federal Reserve officials have led to a rapid cooling of market expectations for interest rate cuts by the end of the year.

Risk assets have generally retreated, with tech stocks and cryptocurrencies being the hardest hit. XS.com market analyst Lin Tran pointed out that expectations for a December rate cut by the Federal Reserve have significantly declined, indicating that the high-interest-rate environment may persist longer, which "increases the opportunity cost of holding non-yielding assets like Bitcoin while suppressing short-term speculative momentum."

High interest rates mean tighter liquidity, leading investors to prefer reallocating funds back to bonds or cash, which naturally withdraws "hot money" from the crypto market. This macro pressure coincides with signs of weakened institutional demand for Bitcoin.

Charles Edwards, founder of Capriole Investments, noted that institutional demand for Bitcoin has fallen below the rate of new coin mining for the first time in seven months.

This shift suggests that large buyers may be retreating, pointing to a risk-averse tone across the entire cryptocurrency market in conjunction with other market activities.

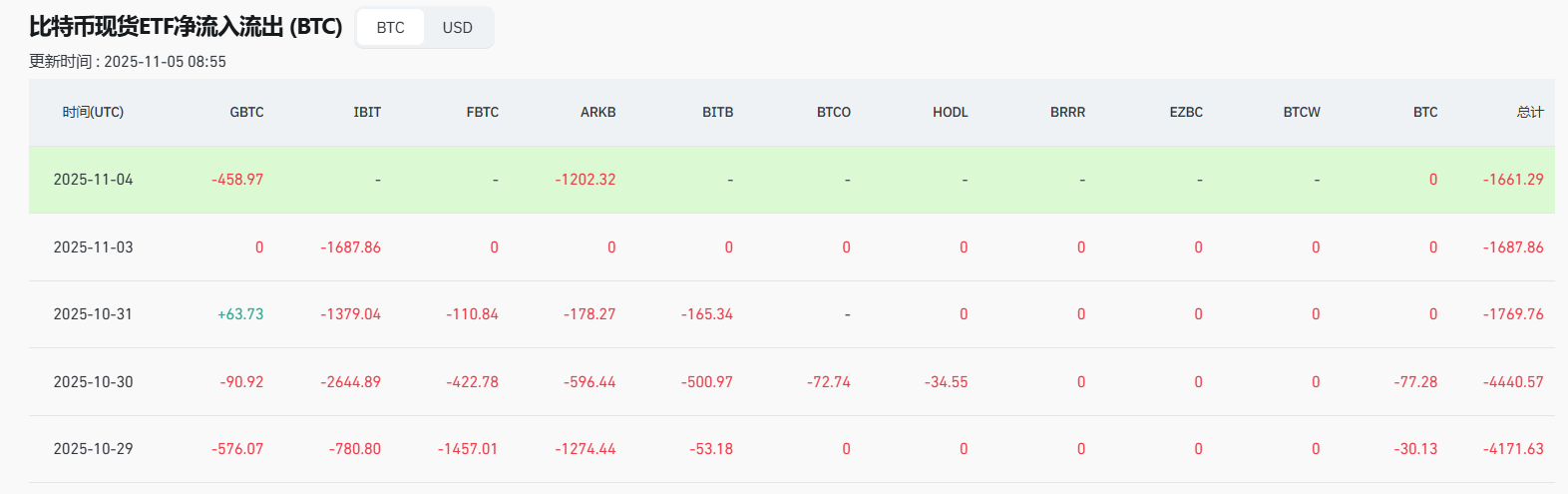

In the past five trading days, investors have withdrawn over $1.8 billion from Bitcoin and Ethereum spot ETFs. This outflow of funds highlights the temporary weakness in institutional demand, exacerbating downward pressure on the market.

Technical Breakdown, Key Support Lost

From a technical analysis perspective, Bitcoin has consolidated around the $110,000 mark for nearly two weeks, which was originally a short-term support area. However, when the price quickly fell below $110,000, stop-losses from technical traders and sell signals from quantitative models were triggered. Market sentiment turned cold, and social media began circulating predictions of "looking down to $100,000," further amplifying the bearish sentiment.

This cycle of "breakdown - stop-loss - further decline" is a common accelerated correction pattern seen in the later stages of a bull market.

Compass Point analyst Edel Engel stated that retail investors may not be as aggressive in buying the dip as they have been in previous cycles. In a report, he noted, "While long-term holders selling is a common phenomenon in a bull market, the participation of retail spot buyers is lower than in previous cycles." This analyst believes that this decline could further lower Bitcoin's price, pushing it below the critical $100,000 support level.

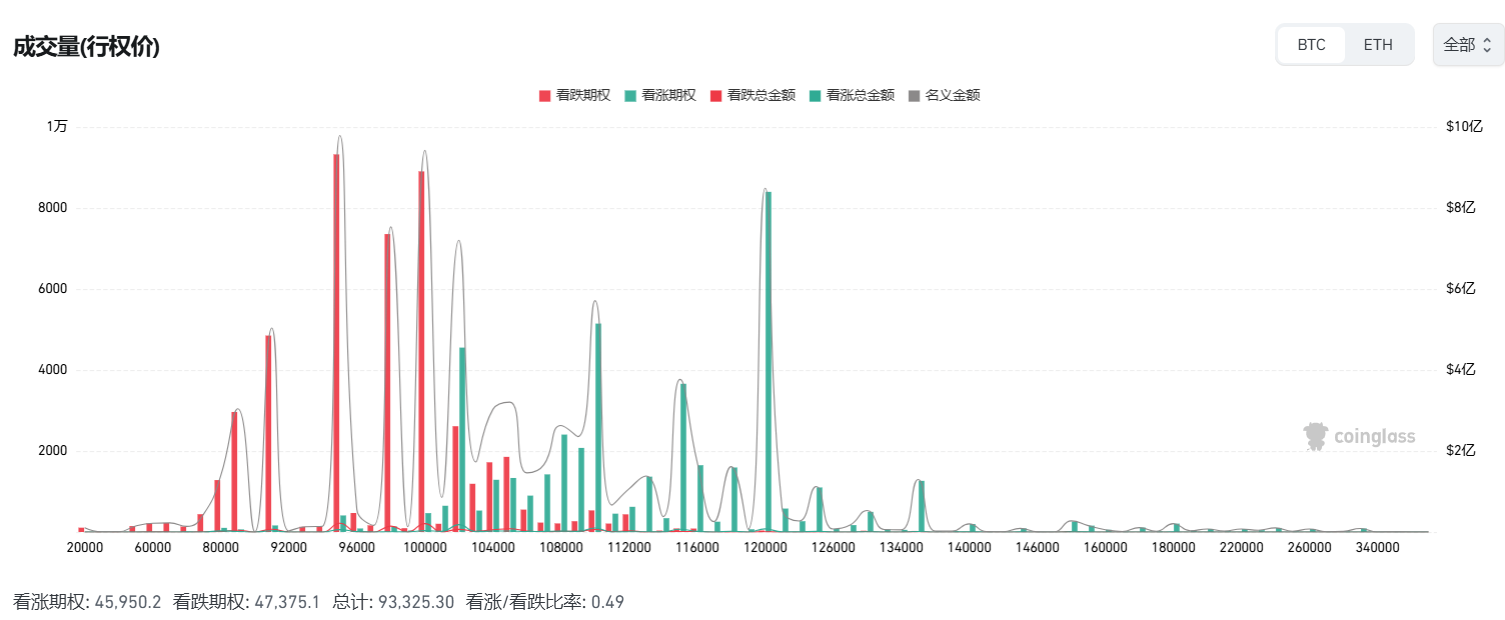

As long-term holders continue to sell, if short-term holders also sell further, there is a greater downside risk. Data from the options market also shows that traders have built a significant amount of hedging against further declines.

According to data from Deribit, demand for put options with a strike price of $80,000 expiring in late November is the strongest. This reflects the market's pessimistic outlook on Bitcoin's short-term prospects.

Historical Comparisons and Market Sentiment Indicators

Historically, Bitcoin has typically shown strong upward momentum in October, which has not been the case this year.

Edel Engel pointed out that the last time Bitcoin failed to benefit from seasonal gains was in October 2018, and in November of that year, Bitcoin's price plummeted by 37%. This historical comparison has heightened market concerns. However, current market sentiment indicators have not yet reached levels that historically mark significant tops for cryptocurrencies.

True market tops are usually accompanied by extreme euphoria and FOMO (fear of missing out), while current investors are exhibiting more caution and wait-and-see attitudes. The cryptocurrency fear and greed index has slipped into the "extreme fear" range, and historically, when the market is in extreme fear, it often presents a good opportunity for long-term investors to accumulate.

Key technical indicators for Bitcoin have not completely deteriorated. Although it has fallen below the 200-day moving average, the daily closing price has not dropped below the 365-day moving average, and it has still risen about 8% since last December.

From a longer-term perspective, each bottom for Bitcoin has formed between the 200-day and 365-day moving averages. This suggests that the upward trend since 2022—characterized by higher peaks and higher troughs—has not been broken.

Professional Traders' Perspectives on Bottom Predictions

There are differing opinions among professional traders regarding Bitcoin's bottom position.

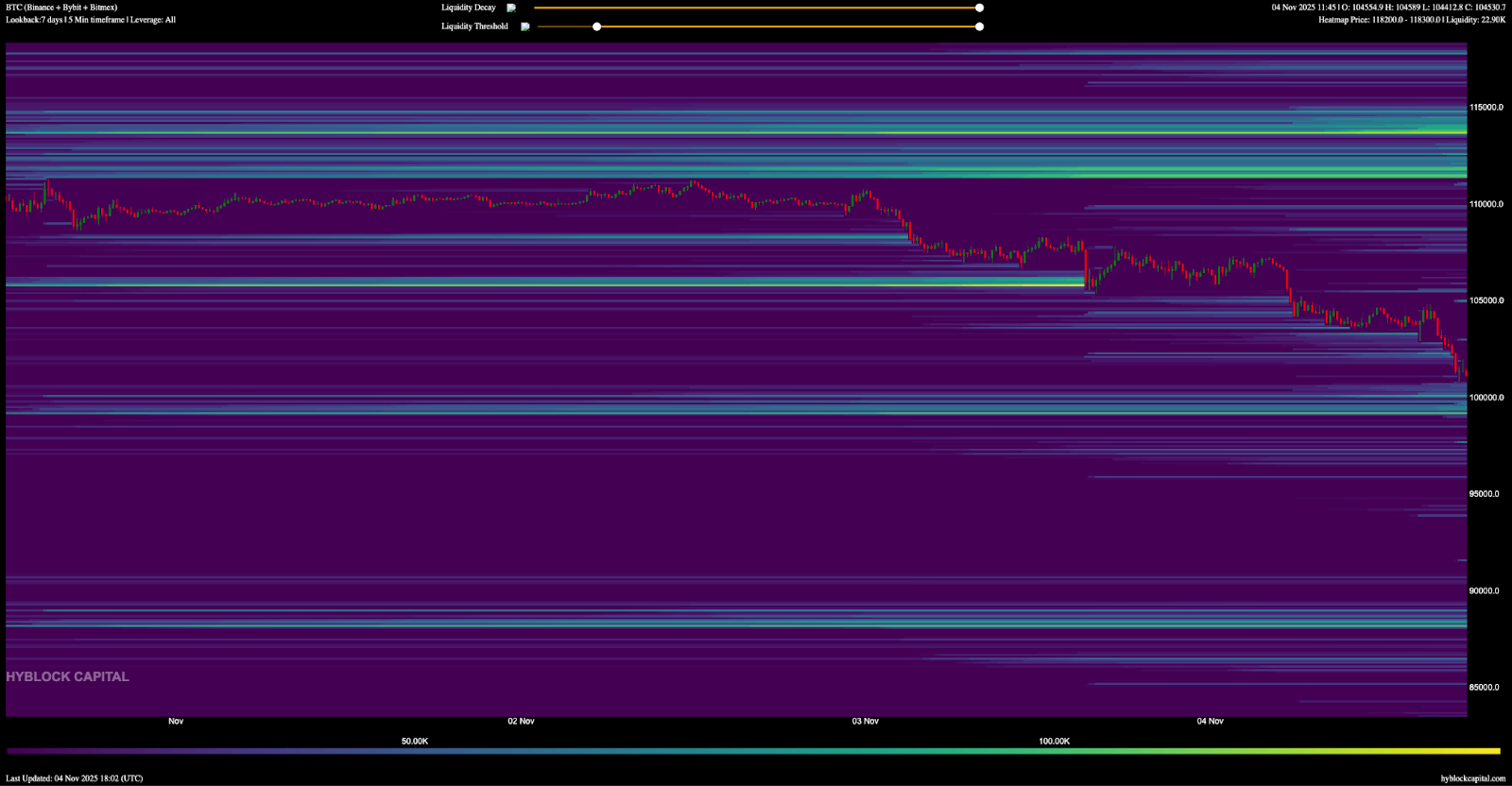

Renowned trader HORSE stated that if $100,000 proves not to be a "trap," then the bottom may be approaching. The price points he is watching for Bitcoin indicate that leveraged long positions at $100,000 are at risk of being absorbed, followed by relatively weak liquidity until $88,000.

BTC/USDT liquidation heatmap, 7-day outlook: Source: Hyblock

BTC/USDT liquidation heatmap, 7-day outlook: Source: Hyblock

Hyblock's liquidation heatmap data provides another dimension for assessing the market bottom. The data shows that there are a large number of leveraged long positions at the $100,000 mark, and once these positions are absorbed, market liquidity will become relatively thin until the $88,000 level.

Institutional Perspective: Hope Amid Despair

Despite the weak market performance, some institutional investors remain long-term optimistic.

Matt Hougan, Chief Investment Officer of Bitwise, believes that the selling pressure from retail crypto investors is nearing "exhaustion," and the bottom for Bitcoin's price is about to appear, likely sooner than expected. Hougan stated that retail investors are currently in a stage of "extreme despair," with frequent leverage liquidations and market sentiment hitting new lows; however, institutional investors and financial advisors continue to maintain a bullish outlook, consistently positioning themselves in Bitcoin and other crypto assets through ETF channels.

He believes that institutions are becoming the main driving force in the market. Strategy, which holds over 640,000 Bitcoins with a total acquisition cost of $47.49 billion, announced that it has again increased its holdings by 397 Bitcoins, costing about $45.6 million.

This move indicates that long-term holders are not panicking due to the price drop but rather see it as an accumulation opportunity.

Tom Lee of Ethereum "MicroStrategy" BMNR stated that despite recent market turbulence, he still predicts that Bitcoin could soar to between $150,000 and $200,000 by the end of 2025. This long-term optimistic outlook sharply contrasts with the short-term market panic.

As Bitcoin's price fluctuates around $100,000, both bulls and bears are fiercely competing.

The market accumulation pattern indicated by the Wyckoff method aligns with the behavior of institutions continuously accumulating positions.

Every market panic could be a good opportunity for major funds to accumulate, while ordinary investors need the ability to discern the truth of the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。