Original | Odaily Planet Daily (@OdailyChina)

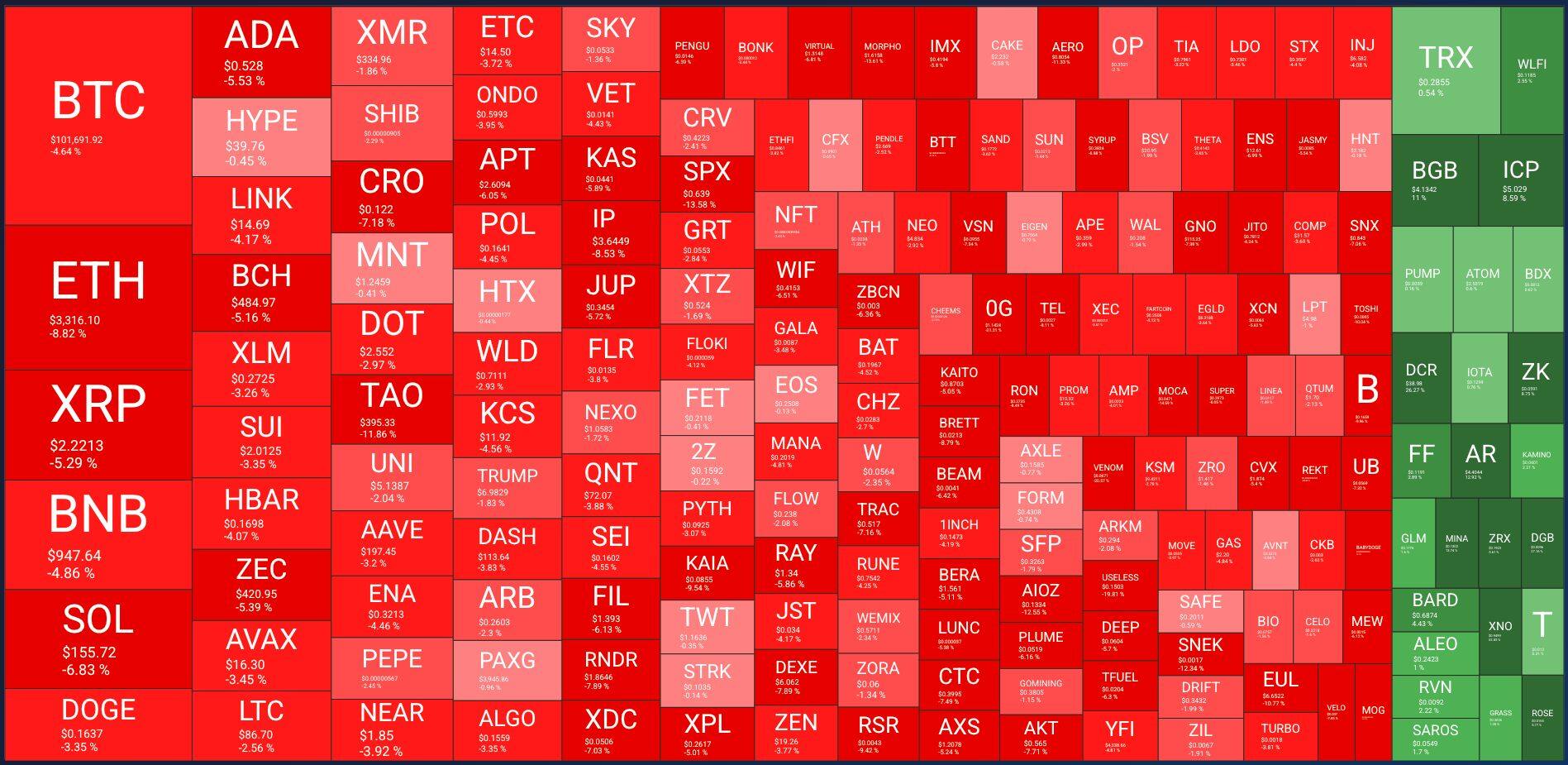

In the early hours of November 5, the cryptocurrency market experienced a significant correction. BTC fell below the $100,000 mark, with the price hitting a low of $98,944.36, a decline of 4.53%, marking a new low since June 22 of this year; other major cryptocurrencies also faced grim prospects, with ETH down 8.63% in 24 hours, SOL down 6.92%, BNB down 4.6%, and XRP down 4.75%. The altcoin market also suffered heavily, with data from Quantifycrypto showing that 90% of the top 200 cryptocurrencies by market capitalization were in a downtrend over the past 24 hours.

In the derivatives market, according to Coinglass, the total liquidation amount across the network in the past 24 hours reached $2.099 billion, with long positions liquidated amounting to $1.681 billion. BTC and ETH were the hardest hit, with liquidations of $642 million and $680 million, respectively.

The extreme volatility prompted on-chain whales to begin deleveraging, and some "slow-moving" players faced liquidation. A whale that had been cyclically borrowing wstETH on Aave (address: 0xa740…b5b6) was liquidated for approximately $23.44 million in wstETH positions, while another whale that was cyclically borrowing WBTC on Aave was also forcibly liquidated, with a liquidation scale of $31.47 million. Even the previously 100% successful Hyperliquid whale turned into a forced seller last night, having to liquidate its remaining long positions, incurring a total loss of about $39.37 million, with an overall account loss of approximately $30.02 million, swept away by the market.

However, zooming out, it wasn't just the cryptocurrency market that faced a heavy blow last night. According to msx.com data, U.S. stocks closed lower across the board, with the Dow Jones down 0.53%, the S&P 500 down 1.17%, and the Nasdaq down 2.04%; the South Korean stock market also saw a significant decline, with the KOSPI index dropping by 4%; in Japan, the Nikkei 225 index fell by 2%.

Macroeconomic Level: U.S. Government Shutdown Reaches New High, Uncertainty Over December Rate Cuts Intensifies

The collective downturn in global financial markets must have macroeconomic reasons.

U.S. Government Shutdown Duration Hits New High

On November 4, the U.S. Senate once again failed to pass a temporary funding bill for the federal government. This means that the current federal government "shutdown," which began on October 1, is about to break the historical record of 35 days of "shutdown" from late 2018 to early 2019, becoming the longest government "shutdown" in U.S. history.

The standoff between the two parties in the U.S. has caused many government functions to stagnate, affecting the release of various economic data, and the information gap has triggered panic selling in the market.

Uncertainty Over December Rate Cuts by the Federal Reserve Intensifies

In the second half of this year, the market generally believes that the Federal Reserve will shift from quantitative tightening to quantitative easing policies, with traders confident that the Fed will cut rates in the second half of 2025, with the only difference being how much. However, Fed Chairman Powell's remarks in the early hours of October 30 raised uncertainty over the expectation of a rate cut in December, with Nomura Securities even canceling its forecast for another rate cut by the Fed in December.

Powell stated in his speech that existing data indicates little change in the outlook, but inflation levels remain slightly high, and the government shutdown will temporarily drag down economic activity, making it far from certain that a rate cut in December is a done deal.

According to CME's "FedWatch," the probability of a 25 basis point rate cut by the Fed in December has dropped to 73.9%, while the probability of maintaining the current rate is 26.1%.

Microeconomic Level: Large Funds Withdraw, Crypto Industry "On Fire"

From the micro perspective of the cryptocurrency market, investor sentiment has been tortured into a state of extreme fear over the past two days. According to alternative.me data, today's Fear and Greed Index stands at 23 (down from 21 yesterday).

Institutions Withdraw from the Crypto Market

On one hand, U.S. Bitcoin spot ETFs and Ethereum spot ETFs have seen a net outflow for five consecutive days, with today's Bitcoin spot ETF net outflow reaching $570 million and Ethereum spot ETF net outflow reaching $108 million. Meanwhile, the DAT craze seems to be fading, with even the buying pace of Bitcoin treasury benchmark company Strategy slowing down, as it only increased its holdings by about 43,000 Bitcoins in the third quarter of 2025.

The withdrawal of institutional representative funds such as ETFs and DAT has caused assets like BTC to lose structural buying support, increasing the impact of short-term traders and market sentiment on BTC's price, leading to more severe market volatility. Previously, ETFs and DAT had jointly constituted the market's confidence in the gradual recognition of cryptocurrencies by traditional finance; now, their simultaneous withdrawal has severely undermined market confidence, spreading a bear market sentiment that easily leads to a downward spiral.

However, Bloomberg ETF analyst Eric Balchunas is still encouraging the market, stating that the capital growth of Bitcoin ETFs will show a "two steps forward, one step back" rhythm, and that the market is currently in a correction phase, emphasizing that short-term volatility is a normal phenomenon. "In my view, this is just part of the growth process; only children expect prices to rise every day," Balchunas added.

Crypto Industry "On Fire"

At the same time, the crypto industry itself is also "on fire." Recently, a large number of DeFi projects have collapsed, with the long-established DeFi project Balancer being hacked for $116 million on November 3, ultimately due to a vulnerability in smart contract interactions, showcasing the "shoddy" image of the crypto industry; another financial project, Stream Finance, was also hacked, resulting in losses exceeding $93 million, and has currently suspended all withdrawal and deposit operations, but the specific reasons for the hack have not been disclosed, leaving investors confused about their losses.

On-chain, the recently popular BSC Meme coin GIGGLE experienced a dramatic rollercoaster on November 3 (related reading: GIGGLE Experiences "Rollercoaster" Market, Who is Responsible for the Flash Crash in the BSC Ecosystem?), dragging down Chinese Meme coins on BSC, with investors lamenting their losses. But more dramatically, following new posts from CZ and He Yi, on November 4, GIGGLE quickly rebounded from a low of $47 to above $100; although the price has recovered, investors' sentiments are irreparably damaged.

In a critical moment, some whales are bottom-fishing ETH.

The cryptocurrency market is facing "internal and external troubles." Arthur, founder of DeFiance Capital, stated that "survival is the only goal" at present, and that the current market environment is comparable to that of 2018 to 2019, marking one of the most challenging periods for participants in the cryptocurrency market since he entered in 2017.

However, even in such a critical moment, some whales are still bottom-fishing, with a particular preference for ETH.

Yi Lihua Begins Accumulating ETH

Yi Lihua, founder of Liquid Capital (formerly LD Capital), stated that he is continuously and gradually buying ETH, saying, "Before the U.S. government reopens, it is a huge opportunity." He believes there is no need to worry about the spot performance of ETH, as its fundamentals remain robust, with the total scale of stablecoins continuing to expand, and short-term risks in U.S. stocks being limited. Yi Lihua pointed out that although market sentiment is still under pressure, the funding situation and macro environment are gradually improving, maintaining an optimistic outlook for market performance in late November and beyond.

"1011 Insider Whale" Goes Long on BTC and ETH

The previously prominent "1011 Insider Whale" is also increasing its long positions in BTC and ETH. This whale had opened short positions three days before the major crash on October 11, ultimately profiting about $200 million. Now, as the market crashes, it has chosen to continue accumulating. As of now, the total long position of the "1011 Insider Whale" has increased to $104 million, with an unrealized loss of over $3 million. Its specific holdings include 600 BTC at an opening price of $104,785.9 and 13,000 ETH at an opening price of $3,444.81.

"Maji Brother" Recharges After Account Hits Zero to Go Long on ETH

At the same time, due to the market's sharp decline, the "Maji Brother," who is not skilled in trading, had his account completely liquidated in the early hours of November 5, leaving only $1,718. However, he did not stop there; according to Hyperliquid data, Maji Brother deposited $250,000 back into his account at 2:17 AM on November 5, subsequently opening a 25x leveraged long position of 988 ETH, and later deposited another $275,000 USDC into HyperLiquid, opening another 25x leveraged long position in ETH.

Fortunately, the market rebounded this morning, and "Maji Brother" currently holds a total of 1,111.11 ETH, with an opening price of $3,276.16, already showing an unrealized profit of over $70,000.

Whales Borrow to Increase ETH Positions

Without the "Maji Brother's" infinite bullets, some whales have chosen to borrow to increase their positions. According to Onchain Lens monitoring, a mysterious address cluster known as "7 Siblings" recently borrowed $61 million USDC to purchase approximately 18,000 ETH, marking its second consecutive day of large-scale accumulation, with a total investment of about $133.49 million in ETH over the two days.

At the same time, on-chain analyst Yu Jin (@EmberCN) monitored that a whale/institution that borrowed 66,000 ETH to short and made a profit of about $24.48 million on October 20 has recently shifted to going long. Data shows that this address transferred approximately $482 million USDC to Binance from the evening of November 4 to this morning, and subsequently withdrew about 144,000 ETH from the exchange, estimating an average purchase price of around $3,341. This USDC is the source of funds it used for collateral borrowing on Aave last month.

Well-known Trader Eugene Established ETH Long Positions Since "10.11"

Crypto trader Eugene also posted on November 4, stating that he had established ETH long positions near the BTC low on October 11, claiming that the current situation is the "last line of defense" for bulls. He pointed out that market sentiment is excessively bearish, with "bearish" voices dominating chat rooms and social platforms, and he expects a wave of short squeezes to come.

Institutional Entities Suspected to Be Accumulating ETH

Although Ethereum spot ETFs have seen continuous outflows recently, on-chain traces suggest that institutional entities are still bottom-fishing ETH. According to Onchain Lens monitoring, Richard Heart, the founder of HEX and PulseChain, recently transferred 27,449 ETH to a new wallet and moved funds through Tornado Cash.

Additionally, on the morning of November 5, a newly created wallet withdrew 10,000 ETH (approximately $32.72 million) from Kraken, and on-chain indications suggest that this address may be related to Bitmine.

Although the macro environment is unclear and the crypto industry has faced setbacks, with Bitcoin falling below $100,000 and hitting a new low since June, raising concerns about a "bull-to-bear" market shift, the bottom-fishing actions of these whales still signal to us: this moment is the market bottom, not the beginning of a new prolonged bear market.

Once short-term market sentiment dissipates and the U.S. government gets back on track, the crypto market will continue to "play music and dance"!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。