Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The market is facing multiple pressures, with the U.S. government shutdown entering a record 36th day, causing the Treasury's account balance at the Federal Reserve to surge above $1 trillion, withdrawing over $700 billion in liquidity from the market, with a tightening effect comparable to several interest rate hikes. The key financing rate SOFR spiked at one point, raising concerns about a liquidity crisis. However, bipartisan negotiations have shown signs of hope, with some lawmakers optimistically predicting that the deadlock may end this Thursday. Meanwhile, driven by the AI boom, global stock markets have experienced a significant pullback, as investors increasingly worry about the overvaluation of tech stocks. The U.S. stock market experienced a "Black Tuesday," leading to a sharp decline in Asian markets, with the KOSPI index in South Korea triggering a circuit breaker. The movie The Big Short prototype Michael Burry revealed that he is heavily shorting AI companies like Nvidia and Palantir, further intensifying market risk aversion. Macro analyst Raoul Pal believes that the current liquidity tightening is merely a temporary "window of pain," and with the end of the government shutdown, the Federal Reserve halting quantitative tightening and shifting to rate cuts, along with the advancement of crypto regulatory legislation, a "liquidity flood" is imminent. Additionally, the market is also watching the U.S. Supreme Court's review of the legality of Trump's tariff powers, as its ruling could become a new source of market turbulence.

Amid market turmoil, Bitcoin's price has fallen below the $100,000 mark for the first time since June, with analysts divided on the future direction. Bears point out that the price has fallen below key technical support levels such as the 21-week EMA and the 50-week moving average. Rekt Capital believes that a weekly close above $108,000 is needed to maintain the range oscillation between $108,000 and $125,000; otherwise, it may further decline. Traders Killa and CJ are focusing on the next major support levels at $92,000-$94,000 and $82,000-$88,000, respectively. Killa stated that if BTC can hold the $98,000 to $100,000 area, it may push the price to around $105,000-$106,000. However, if the price remains below the quarterly line of $108,000, it may drop to $92,000-$94,000. CJ noted that Bitcoin has reached its first major downward focus area of $98,000-$101,000. He stated that he will observe the price movement in this range before deciding on the next steps. If this support level is lost, the next important downward focus area would be $82,000-$88,000. He believes that the current range may trigger some market reactions, but the specific outcome still needs to be observed. On-chain data shows that although long-term holders have sold about 400,000 BTC in the past month, analyst Murphy pointed out that the current price is close to the "fair value" of $98,000, and the proportion of profitable addresses has entered the extreme area of a bull market correction, which may be the end of the pullback or the beginning of a bear market.

Bulls, on the other hand, believe that now is a good time to position themselves. Analyst Astronomer stated that he has doubled his long position near $99,000, believing this is a bottom signal indicating that market panic has peaked. Ash Crypto also remains bullish, arguing that the current decline is a washout before the bull market peak, and noted that macro favorable factors such as the Federal Reserve's rate cuts and the restart of quantitative easing are still in play. Additionally, Delphi Digital analyst that1618guy pointed out that historically, November has often served as a turning point in market structure for Bitcoin, with the timing of its monthly lows reflecting market conditions. Data shows that in bull market cycles (such as 2020, 2023, 2024), Bitcoin's November lows typically occur at the beginning of the month, accompanied by slight pullbacks (about -1.7% to -3.7%), followed by an average increase of 32.9% within the next 30 days. However, in bear markets or transitional phases (such as 2021, 2022), lows often occur at the end of the month, with deeper pullbacks averaging -8.2%. If the current market continues the bull market pattern, Bitcoin is expected to stabilize and rebound in early November; otherwise, it may enter a deeper adjustment phase.

Ethereum's price trend is also under pressure, nearing a drop below $3,000. From a starting point of $3,337 at the beginning of the year, it once surged 48.5% to $4,956 but has now turned to a decline. Analyst Man of Bitcoin believes that if the price continues to fall below previous lows, it may indicate a deeper correction, while holding above $3,364 is key to maintaining short-term upward momentum. Despite Ethereum's weak performance in dollar terms, analyst Krugman is extremely optimistic about its long-term prospects, believing that the ETH/BTC exchange rate chart is one of the most bullish among all assets, predicting that Ethereum will outperform Bitcoin in the next round of increases. He stated that he is holding a large amount of cash waiting for a deep market correction, at which point he will mainly buy and hold Ethereum. Trader Killa mentioned that he has set buy orders in the $2,800-$2,900 range.

Despite the strong performance of Solana's spot ETF after its launch, attracting over $400 million in inflows, the price of SOL has fallen below a rising trend line that lasted for 211 days. Analysts point out that if it cannot hold the support at $155, the price may slide further to the $120-$100 range. Meanwhile, some new projects and meme coins have risen against the trend in the overall market decline. The community-initiated Giggle Academy (Giggle) token surged over 100% after Binance founder He Yi announced that Binance would donate its trading fees and burn some tokens to enter a deflationary mode. Additionally, the recently launched MMT on Binance rose from an opening price of $0.1 to $4.47, currently retreating to $1.25, while new coins such as KITE, F, TUTTLE, YB, and ENSO have also recorded certain gains in the current market downturn. Market observers like Blue Fox Notes believe that the traditional boundaries of bull and bear cycles are becoming blurred, and the macro flow of capital is more important than cycle divisions, maintaining optimism about the long-term trend of the integration of crypto and AI reshaping the world.

2. Key Data (as of November 5, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $101,965 (YTD +8.73%), daily spot trading volume $121.11 billion

Ethereum: $3,329 (YTD -0.56%), daily spot trading volume $73.5 billion

Fear and Greed Index: 20 (Fear)

Average GAS: BTC: 1 sat/vB, ETH: 0.1 Gwei

Market share: BTC 60%, ETH 11.9%

Upbit 24-hour trading volume ranking: MMT, BTC, XRP, ETH, SOL

24-hour BTC long/short ratio: 48.05%/51.95%

Sector performance: AI sector down 4.67%, Ethereum ecosystem sector down 3.89%

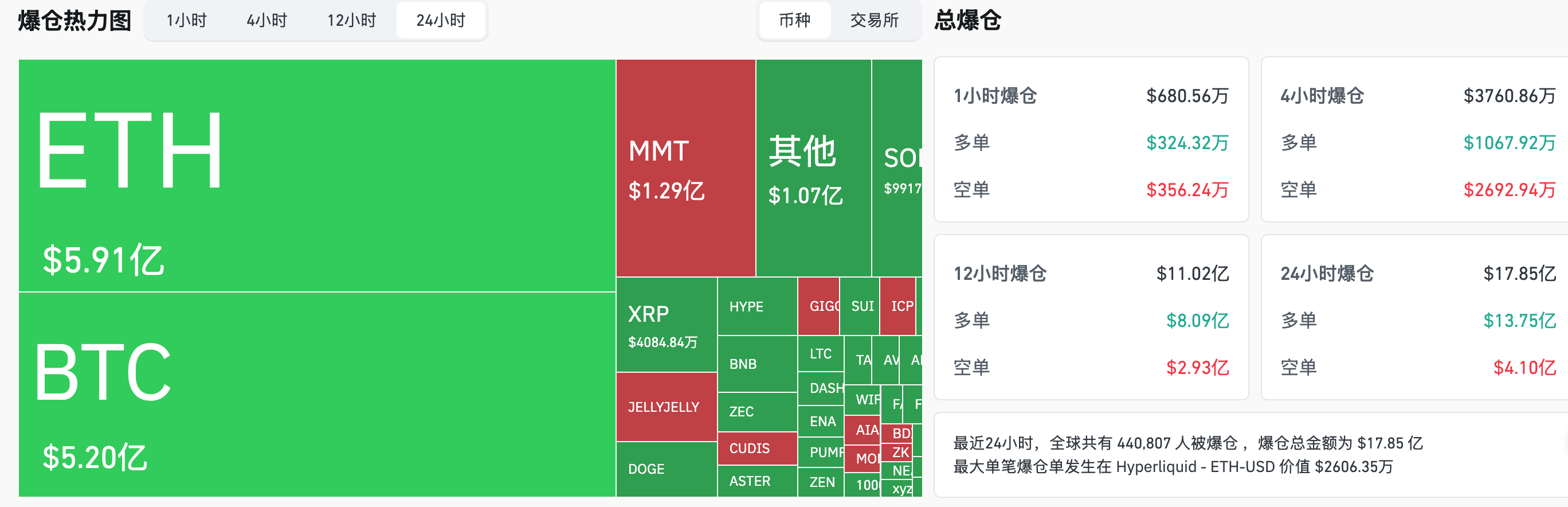

24-hour liquidation data: A total of 440,807 people were liquidated globally, with a total liquidation amount of $1.785 billion, including $591 million in BTC liquidations, $520 million in ETH liquidations, and $129 million in MMT liquidations.

*Note: When the price is above the upper and lower bounds, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of November 4)

Bitcoin ETF: -$578 million, continuing 5 days of net outflow

Ethereum ETF: -$219 million, continuing 5 days of net outflow

SOL ETF: +$14.83 million, continuous 6 days of net inflow

4. Today's Outlook

Binance Alpha and Binance contracts will launch Folks Finance (FOLKS) on November 6, UnifAI (UAI)

Ethena (ENA) will unlock approximately 172 million tokens at 3 PM on November 5, accounting for 2.52% of the current circulating supply, valued at approximately $67.1 million;

Heroes of Mavia (MAVIA) will unlock approximately 11.89 million tokens at 8 AM on November 6, accounting for 16.92% of the current circulating supply, valued at approximately $1.2 million.

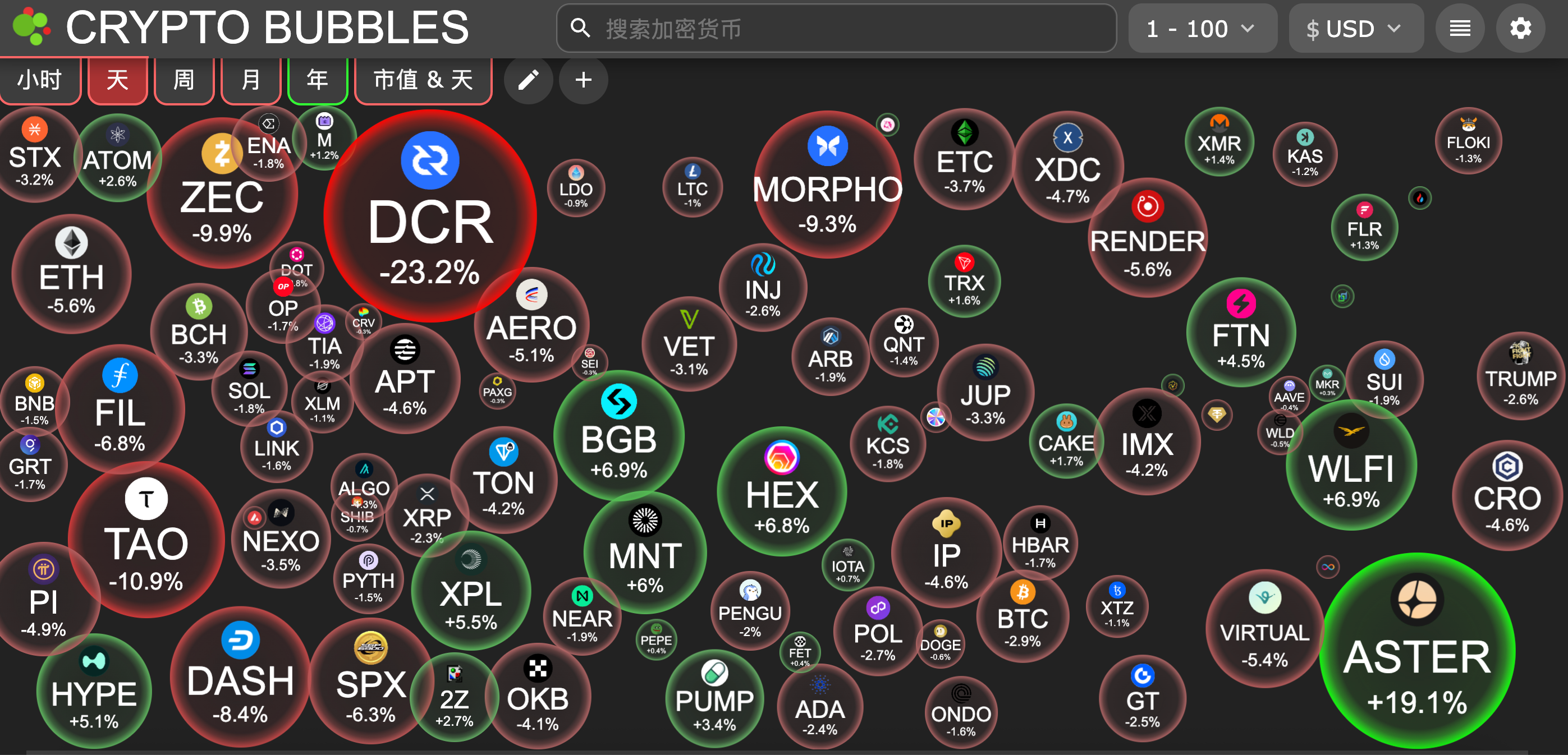

Today's top gainers among the top 100 cryptocurrencies by market cap: Aster up 19.1%, World Liberty Financial up 6.9%, Bitget Token up 6.9%, HEX up 6.8%, Mantle up 6%.

5. Hot News

Ether.Fi's $50 million buyback plan approved, trigger price set at $3

Gemini enters the prediction market, plans to launch event contracts

The probability of a 25 basis point rate cut by the Federal Reserve in December is 69%

SOL treasury company Forward Industries' board approves a new $1 billion stock buyback plan

Giggle Academy: will burn 50% of the Giggle trading fees received from Binance

Tharimmune completes $540 million private placement financing to establish Canton token treasury

Whale that sold BTC last November buys the dip, purchasing 800 BTC at an average price of $106,000

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。