Written by: Xiao Za Legal Team

On November 3, the Hong Kong Securities and Futures Commission (SFC) issued two important circulars: "Circular on Expanding the Products and Services of Virtual Asset Trading Platforms" and "Circular on Sharing Liquidity of Virtual Asset Trading Platforms."

These two circulars significantly relax the regulations for licensed (VATP licensed) cryptocurrency trading platforms regarding "the products and services they can offer" and "connecting to overseas cryptocurrency market liquidity." They not only update and clarify a series of rules but also establish a new "shared order book" system to achieve the goal of connecting to global virtual asset liquidity.

Notably, the "Circular on Expanding the Products and Services of Virtual Asset Trading Platforms" provides a clearer explanation of the concept of "digital assets," which is quite complex under Hong Kong law:

"The term 'digital assets' includes 'virtual assets,' 'tokenized securities' (a category within digital securities), and stablecoins. 'Digital asset-related products' refer to investment products related to digital assets." This greatly facilitates market participants' understanding of regulatory requirements.

Due to the limited length of this article and the numerous points that can be discussed regarding the new regulations, today, the Xiao Za team will first provide a detailed analysis of the new changes brought by the "Circular on Expanding the Products and Services of Virtual Asset Trading Platforms," as well as noteworthy content, while the "Circular on Sharing Liquidity of Virtual Asset Trading Platforms" will be discussed in a couple of days.

1. Licensed Exchanges: Trapped in the "Impossible Triangle" of Regulation?

The so-called "impossible triangle" of regulation simply means that regulatory authorities cannot "want to… and also want to… and still want to…" The current licensed exchanges in Hong Kong seem to embody this sentiment.

Previously, the Xiao Za team discussed the operational status of licensed virtual currency exchanges, summarizing it in one sentence: "not very profitable." One reason for this is the overly strict compliance requirements from the SFC—licensed exchanges face strict limitations on the clients they can serve, the products they can trade, and the services they can offer, akin to the saying "clear water has no fish."

In fact, the SFC has noticed this issue and is actively seeking a "suitable path" that balances compliance requirements while stimulating market vitality. The "Circular on Expanding the Products and Services of Virtual Asset Trading Platforms" is a product of this effort, with specific "relaxations" detailed below.

2. Relaxation of "Token Listing" Regulations for Licensed Exchanges

The SFC has always required that licensed exchanges can only list virtual currencies with a "12-month track record" (including stablecoins).

In simple terms, the tokens you list must have been alive for at least a year, keeping away dubious projects and rug pulls, emphasizing stability and comprehensive protection for investors. However, this also leads to a problem: one year may indeed be too long for the virtual currency market, where "one day in the human world equals one year in the crypto world," making it extremely difficult for licensed exchanges to list market-cap tokens, thus dragging down the overall liquidity of the exchanges.

The new regulations have significantly modified this requirement.

First, the relaxation policy for virtual currencies sold to "professional investors." The new regulations completely remove the "12-month track record" review requirement for virtual currencies sold to "professional investors," whether stablecoins or market-cap tokens, no longer requiring them to have been alive for one year. This means that cryptocurrency exchanges can now offer a broader range of crypto asset investment services to "professional investors."

Second, the relaxation policy for virtual currencies sold to "retail investors." Considering that "retail investors" have less investment experience and risk tolerance than "professional investors," the "12-month track record" review still partially applies to virtual currencies sold to "retail investors."

On one hand, licensed exchanges can directly sell stablecoins to "retail investors," while on the other hand, other virtual currencies (market-cap tokens) still need to adhere to the "12-month track record" limitation.

However, it is important to note that this does not mean a significant reduction in the "token listing" review requirements. Licensed exchanges still need to conduct "reasonable due diligence" on the tokens they intend to list according to the "Guidelines for Virtual Asset Trading Platforms." If a token has not been alive for a year, it still requires full disclosure; otherwise, it would still be considered a violation of the listing rules.

3. Confirmation of Compliance for Licensed Exchanges Distributing Digital Asset-Related Products and Tokenized Securities

Can VATP license holders engage in the distribution of digital asset-related products and tokenized securities (limited to virtual assets approved for trading on licensed exchanges)? This question previously lacked a clear answer.

This is mainly because the "standardized licensing regulations" in Hong Kong, formed by a series of laws, codes, regulations, manuals, guidelines, circulars, etc., did not clarify this matter.

According to the "Licensing Handbook for Operators of Virtual Asset Trading Platforms" and "Guidelines for Virtual Asset Trading Platforms," license holders can provide virtual asset trading services and ancillary services to clients outside the platform (limited to virtual assets approved for trading on licensed exchanges).

However, this regulation was too vague. Does the virtual asset trading business outside the platform include trading in virtual asset financial derivatives? Does it include crypto asset custody services? Market participants had varying interpretations of these issues, generally leaning towards the belief that it was permissible but hesitant to take action.

The new regulations clarify the regulatory rules concerning this issue.

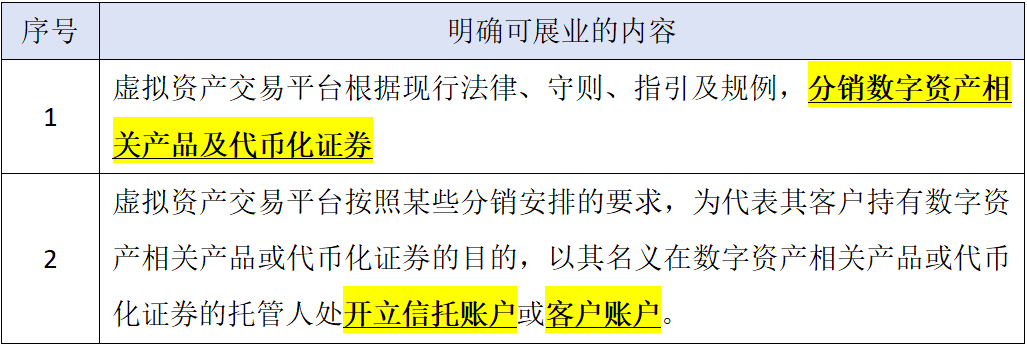

First, licensed exchanges are explicitly allowed to engage in the following two businesses:

Second, the businesses that licensed exchanges are explicitly prohibited from engaging in: Providing custody services for digital assets that are not traded on the virtual asset trading platform, either independently or through their affiliated entities.

However, this prohibition does not completely close the door; in principle, the SFC currently allows exchanges to submit applications to modify relevant licensing conditions or conduct case-by-case reviews of the projects to be custodied. If a project is truly exceptional, an exemption may be granted.

In Conclusion

Change is never instantaneous. The current slight step taken by the Hong Kong SFC in regulatory requirements is indeed a milestone in the history of virtual asset regulation in our country.

After all, this is the first meaningful rule update in Hong Kong after the completion of standardized licensing rules, and it genuinely considers the pain points and challenges faced by market participants in their operations, making every effort to respond.

The Xiao Za team appreciates this regulatory progress and looks forward to further "relaxation" measures from the Hong Kong SFC. In the future, we will update you with an analysis of the "Circular on Sharing Liquidity of Virtual Asset Trading Platforms" to provide a complete interpretation of the new regulations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。