Author: Jasper De Maere, Wintermute OTC Strategist

Compiled by: Tim, PANews

The macro environment remains supportive, with favorable events such as interest rate cuts, the end of quantitative tightening, and stock indices approaching highs occurring one after another. However, the performance of the crypto market continues to lag, as the capital flow following the Federal Reserve's interest rate meeting is fading. Global liquidity continues to expand, but funds have not flowed into the crypto market. ETF inflows have stagnated, decentralized AI activities have dried up, and only stablecoins continue to grow. Leverage has been completely cleared, and the market structure appears healthy, but the rebound of ETF or DAT funds is the key signal for liquidity recovery and the potential start of a catch-up rally.

Macro Situation

Last week, the market welcomed the Federal Reserve's interest rate cut, the FOMC meeting minutes, and earnings reports from several U.S. tech companies, leading to inevitable volatility. We received a 25 basis point rate cut as expected, and quantitative tightening officially came to an end, with the earnings reports of the "Big Seven" in U.S. stocks performing reasonably well. However, when Powell downplayed the near certainty of another rate cut in December, the market experienced turbulence. The 95% expectation of a rate cut that had been priced in before the meeting has now dropped to 68%, prompting traders to reassess their strategies and causing the market to quickly shift towards risk aversion.

This sell-off did not seem driven by panic but rather by position adjustments. Some investors had overly bet on an increase before the event, creating a typical "good news fully priced in" scenario, as the 25 basis point rate cut had already been fully priced in by the market. Subsequently, the stock market quickly stabilized, but the crypto market did not see a corresponding rebound.

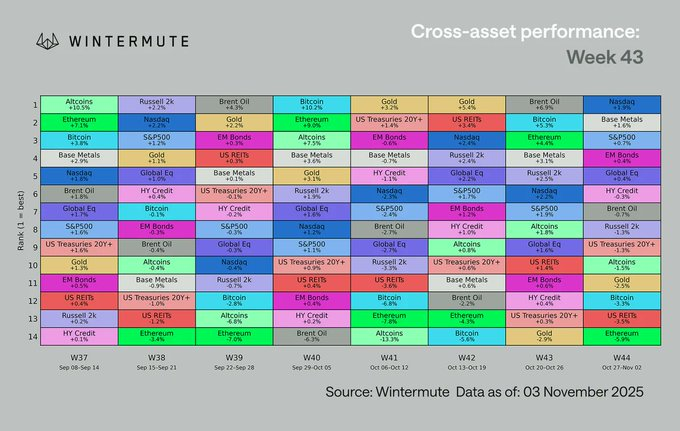

Since then, BTC and ETH have continued to trade sideways, hovering around $107,000 and $3,700 respectively at the time of writing, while altcoin markets also exhibited a fluctuating pattern, with their excess gains mainly driven by short-term narratives. Compared to other asset classes, cryptocurrencies are the worst-performing asset class.

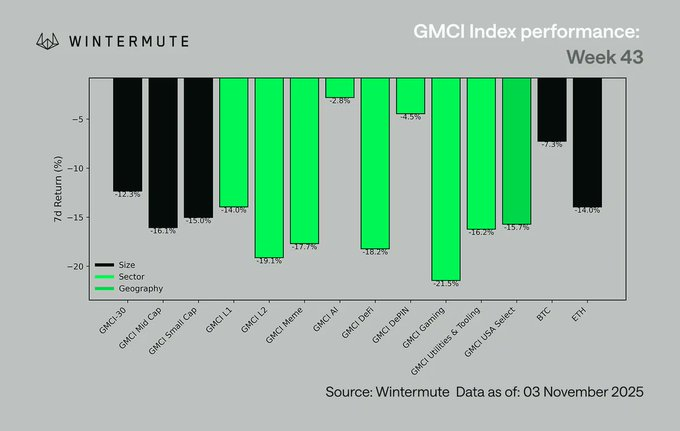

From an index perspective, broadly speaking, crypto assets faced significant sell-offs last week, with the GMCI-30 index dropping by 12%. Most sectors closed lower:

- The gaming sector plummeted by 21%

- The layer two network sector fell by 19%

- The meme coin sector declined by 18%

- Mid-cap and small-cap tokens dropped by about 15%-16%

Only the AI (-3%) and DePIN (-4%) sectors showed relative resilience, mainly due to the strong performance of TAO tokens and AI-related concept coins earlier last week. Overall, this volatility appears to be more driven by capital rather than fundamental factors, aligning with the tightening liquidity trend following the Federal Reserve's decision.

So, why is the cryptocurrency market lagging while global risk assets are rising?

In short: liquidity. But it’s not a lack of liquidity; it’s a matter of direction.

Global liquidity is clearly expanding. Central banks are intervening in a relatively strong manner rather than a weak one, a situation that has only occurred a few times in the past, usually followed by a strong mechanism for risk appetite warming. The problem is that the new liquidity has not flowed into the crypto market as it has in the past.

The supply of stablecoins has been steadily increasing (up 50% year-to-date, adding $100 billion), but since the summer, Bitcoin ETF inflows have stagnated, with assets under management hovering around $150 billion. The once-booming crypto treasury DAT has fallen silent, and the trading volumes of related concept stocks listed on exchanges like Nasdaq have significantly shrunk.

Among the three major capital engines driving the market in the first half of this year, only stablecoins are still functioning. ETF funds have peaked, DAT activities have dried up, and although overall liquidity remains ample, the share flowing into the crypto market has clearly shrunk. In other words, the faucet of funds has not been turned off; it has just flowed elsewhere.

The novelty of ETFs has faded, allocation ratios have returned to normal, and retail funds have shifted elsewhere, chasing the momentum in stocks, artificial intelligence, and prediction markets.

Our View

The performance of the stock market proves that the market environment remains strong, and liquidity just hasn’t transmitted to the crypto market yet.

Although the market is still digesting the 1011 liquidation, the overall structure is robust—leverage has been cleared, volatility is controlled, and the macro environment is supportive. Bitcoin continues to serve as a market anchor due to stable ETF inflows and tightening exchange supply, while Ethereum and some L1 and L2 tokens are showing initial signs of relative strength.

Despite the increasing voices on crypto social media attributing price weakness to the four-year cycle theory, this concept is no longer applicable. In mature markets, the miner supply and halving mechanisms that once drove cycles have long since lost their effectiveness; the core factor now determining price performance is liquidity.

The macro environment continues to provide strong support—interest rate cuts have begun, quantitative tightening has ended, and the stock market frequently tests highs, yet the crypto market lags behind, primarily due to liquidity not effectively flowing in. Compared to the three major capital inflow engines that drove momentum last year and in the first half of this year (ETFs, stablecoins, DeFi yield-bearing assets), only stablecoins currently show a healthy trend. Closely monitoring ETF inflows and DAT activities will become key indicators, as these two are likely to be the earliest signals of liquidity returning to the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。