After a year of record-breaking gains, the artificial intelligence (AI) sector is now flashing warning lights. These AI bubble warnings are getting the blame for the latest market nosedive, rattling everything from Wall Street’s blue chips to the wild world of crypto.

Global markets have taken a beating this week as fears grow that AI valuations are reaching unsustainable highs. The Dow dropped more than 450 points in a single session, echoing cautionary notes from Goldman Sachs, Morgan Stanley, and even OpenAI’s Sam Altman, who admitted the AI market “feels like a bubble.”

Economists and investors are now wondering whether the AI boom is heading for a dot-com-style correction. The rally that began with chatbots and data centers has spread to nearly every corner of tech, driving the S&P 500’s gains in 2025. Yet according to the International Monetary Fund and Bank of England, nearly 70% of those gains are tied directly to AI euphoria—what one analyst called “ridiculous levels” of concentration risk.

The data back up the skeptics. Bank of America’s global fund manager survey shows 54% of respondents believe AI stocks are in bubble territory. Michael Burry, the “Big Short” investor known for spotting the 2008 crisis, recently issued his own style warning—shortly before the sell-off began. Danielle DiMartino Booth, a former Federal Reserve advisor, said AI valuations are now “40% higher than the dot-com era,” with market concentration exceeding 1929 levels.

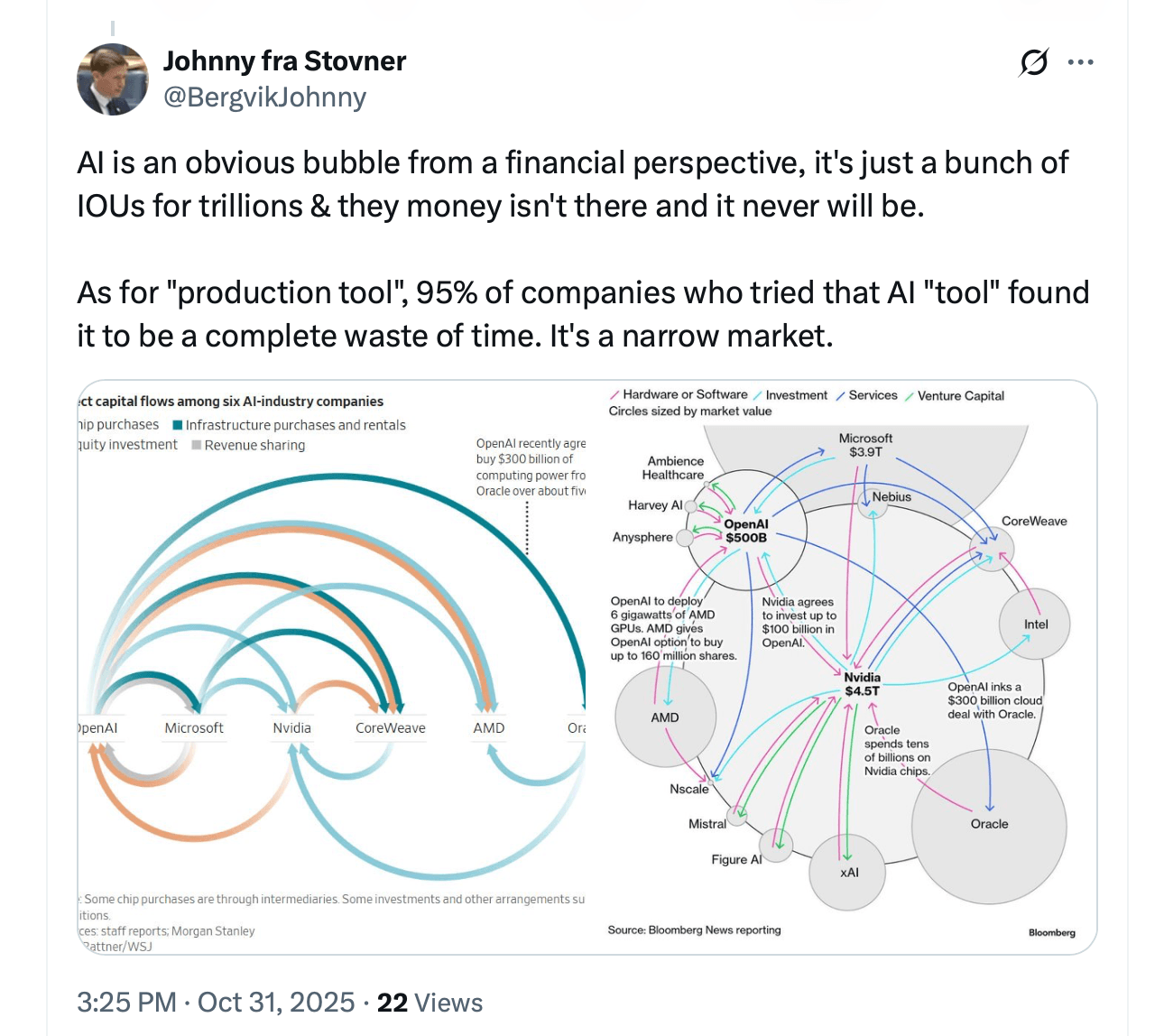

The numbers are startling. Analysts estimate that the AI infrastructure buildout has created nearly $2 trillion in potential overcapacity, with data centers consuming massive amounts of water and energy. Capacity utilization at chip foundries like TSMC has dropped below 40%, while circular investments—like Nvidia funding OpenAI to buy AMD chips—create the illusion of unstoppable growth.

For investors chasing the next trillion-dollar opportunity, the problem isn’t just hype—it’s economics. Training large models can cost up to $1 billion, yet consumer access often costs only $20 a month. The math doesn’t add up. Still, not everyone is convinced the sky is falling.

Not everyone believes AI is in a bubble.

Optimists like Daniel Newman see no bubble, predicting that AI could add up to $20 trillion to global GDP by 2030. The tension between long-term promise and short-term speculation is what makes this moment so precarious. Critics argue that markets are finally adjusting to reality. With 95% of corporate AI projects failing to produce returns, companies are freezing experimental budgets and scaling back infrastructure plans.

Investors are now re-evaluating exposure to overleveraged AI names that have dominated index gains for months. The correction may sting, but it could also be healthy. Goldman Sachs noted that this cooling period might separate real innovators from the vaporware vendors. If history repeats, some AI firms could vanish entirely—just as hundreds of dot-coms did after 2000—while the survivors redefine the next era of computing.

Whether the AI bubble bursts or merely deflates, one thing is certain: reality is catching up. The sector’s dazzling potential remains, but hype alone can’t keep the lights—or the GPUs—on forever.

- Why are global markets falling this week?

Investors are selling off tech stocks amid mounting fears that AI valuations are inflated beyond fundamentals. - Who has warned about an AI bubble?

Warnings have come from Sam Altman, Michael Burry, Goldman Sachs, and global institutions like the IMF and Bank of England. - What signs point to an AI bubble?

Analysts cite overcapacity, weak returns on investment, and circular funding between AI firms as clear red flags. - Could AI still be a long-term winner?

Many experts say yes—AI’s potential remains vast, but short-term valuations must realign with profitability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。