Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

Editor | Planet Xiaohua

On November 4, the former whale "Machibigbrother" Huang Licheng (@machibigbrother) took action again. He used the remaining $16,700 on the decentralized trading platform Hyperliquid to open a 25x leveraged long position of 100 ETH.

24 hours later, liquidation struck again. In the early hours of November 5, monitoring data showed that the account balance was only $1,718. This operation came just 47 days after the peak of his account's assets.

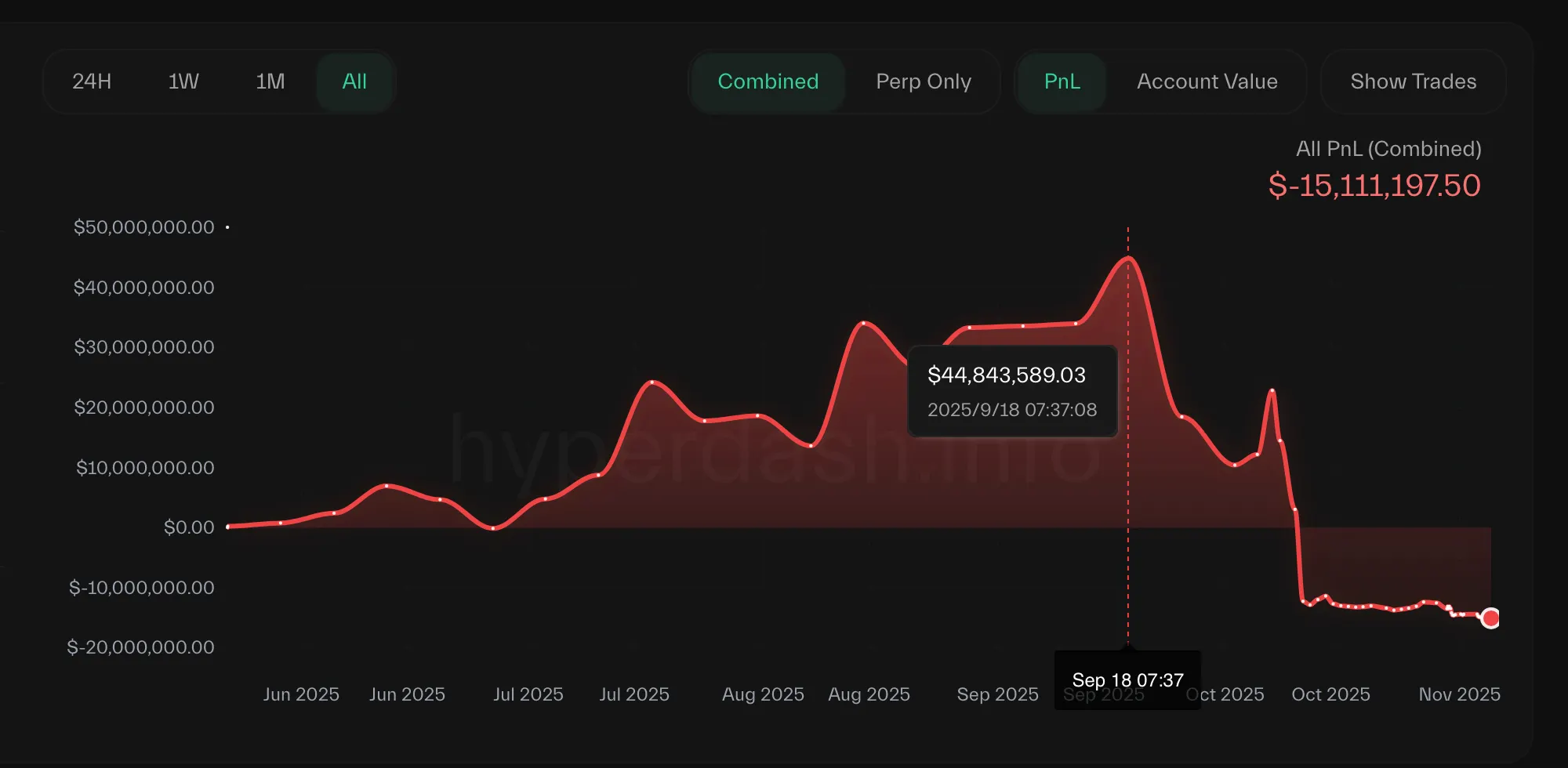

Back on September 18, by heavily leveraging long positions, he once had an unrealized profit of $44.84 million, becoming one of the most notable contract whales on-chain. However, the sudden crash on October 11 shook the market, causing crypto assets to falter, and in the following month, prices continued to decline. Amid ongoing resistance and margin calls, Hyperliquid's liquidation interface flashed red like the eye of a storm, and Huang Licheng's account "collapsed" in a series of forced liquidations: not only did he lose all profits, but the principal of $15 million also nearly went to zero, leaving only "a few scraps" from a peak account close to $60 million.

In response, he left a message on social media: “Was fun while it lasted.”

Thirty years ago, he stood in the true "spotlight."

That was Taiwan in the 1990s, when hip-hop culture first entered the Chinese-speaking world. Young people dressed in baggy denim, dancing to the beat, and screaming in excitement were the most avant-garde presence at the time. Huang Licheng, the leader of the earliest Chinese Hip-hop boy band L.A. Boyz, commanded the stage, controlled the audience's rhythm, and also captured the zeitgeist of the era.

Thirty years later, this person who craved control over the rhythm has experienced countless speculative ventures from different angles and in different ways, trying to stand at the crest of the capital tide, yet all of this has spiraled out of control amid madness and noise.

From Hip-hop Kid to Tech Entrepreneur

From a trendsetter in the entertainment industry to a serial entrepreneur in the internet space, and then to a crypto whale labeled as a "scalper," every turn of "Machibigbrother" Huang Licheng over the past twenty years has been filled with drama and controversy.

Clearly, he is accustomed to standing at the forefront, understands the economics of attention, and is unwilling to miss any opportunity.

Born in 1972 in Yunlin, Taiwan, Huang Licheng immigrated to California with his family at the age of two. He was rebellious and street-smart. **During high school, he formed a dance group called Funky Asian Buddy with his brother Huang Lihang and cousin Lin Zhiwen, spending days dancing on the streets, battling, and looking for opportunities in nightclubs. In 1991, the three were discovered for their unique style and officially returned to the Taiwanese music scene as L.A. Boyz. They swept across the island with their mixed Chinese and English singing style and American street vibe. At that time, the Chinese music scene was still dominated by Japanese idol styles, and *L.A. Boyz's American hip-hop brought a refreshing change, making Huang Licheng a pioneer of Hip-Hop culture in the Chinese-speaking world, sparking a wave of popularity.*

The L.A. Boyz of that year: Huang Lihang (left), Lin Zhiwen (middle), Huang Licheng (right)

L.A. Boyz debuted in 1992 and released 13 albums, becoming a sensation. However, as the Taiwanese music scene shifted towards "ballad" styles in the late 1990s, L.A. Boyz's cool Hip-Hop style gradually lost its mainstream market. After disbanding in 1997, Huang Licheng gradually turned to business and behind-the-scenes work, venturing into the tech industry.

In 2003, he founded Machi Entertainment, fully engaging in music production and artist management. He transitioned from artist to boss, producer, and businessman.

Huang Licheng always wanted to be the "first to eat crabs" and was well-versed in the flow of traffic. While shifting to behind-the-scenes work in the entertainment industry, he became a tech entrepreneur. He recognized the value of traffic and attention early on.

In 2015, Huang Licheng and his technical partners founded 17 Media, with the flagship product being the "17 Live App," focusing on real-time video interactive social networking. At that time, Douyu had just emerged in mainland China, and similar products like Inke and Huajiao had not yet launched. The app quickly became popular in Taiwan, attracting millions of users, with a valuation that once reached several billion New Taiwan dollars, receiving investments from Wang Sicong and LeTV Sports.

Huang Licheng speaking at MOX Demo Day as the founder of 17 Media

Due to inadequate regulation in the early years, some content from various beauty streamers on the app was too explicit, leading to 17 being temporarily removed from the App Store and Google Play. Subsequently, Huang Licheng led the team to adjust the content mechanism and shifted the market focus to Japan, Hong Kong, Thailand, and other regions. In 2017, 17 Media merged with the social app Paktor to form M17 Entertainment, and the platform was renamed 17LIVE. Although Huang Licheng served as chairman, he gradually began to divest shares and cash out.

In 2018, 17 Media attempted to go public on the New York Stock Exchange, but the listing was canceled on the day of the IPO, and the plan fell through. According to insiders, M17 ultimately failed to meet audit and reporting requirements and could not overcome its bid threshold. The company then shifted its focus to Japan, until Huang Licheng resigned from all positions in 2021, exiting management while retaining equity, with the Japanese team taking over the main operations.

Outside of 17, Huang Licheng also had several other entrepreneurial attempts, such as the "erotic chat platform" Swag and the film company Machi Xcelsior Studios, among others… but most did not enter the mainstream spotlight until he encountered the best speculative soil—the crypto space.

Crazy Machi: Not Missing Any Opportunity

With a successful experience in internet entrepreneurship, Huang Licheng seized the opportunity again during the 2017 ICO crypto wave and plunged into the blockchain industry.

2018 Targeting Social Mining and Token Issuance

At the end of 2017, he continued the product experience of 17 and led the launch of the blockchain project Mithril (MITH), focusing on the concept of "social mining," claiming to create a "blockchain version of Instagram." The core mechanism was that users could earn MITH tokens through algorithms by posting content and gaining interactions on the decentralized social platform Lit, rewarding creators.

Mithril conducted a private token sale on February 21, 2018, raising $51.6 million (approximately 60,000 ETH at the time), accounting for 30% of the total token supply. In February 2018, 70% of these private sale tokens were unlocked at TGE, with 30% unlocked in the following three months.

In February 2018, after the MITH token was listed on exchanges like OKEX (now OKX) and Binance, its price soared. However, in the following three months, the team directly sold 89% of the circulating supply at that time, leading to a rapid price drop of 80%.

Huang Licheng at a Mithril and OKEX collaboration event

After that, the bubble burst, and the market cooled. The project was conceptually empty, with numerous product flaws and no real users, causing the MITH price to continue to decline without resistance, dropping over 99%. Subsequent attempts to launch products like Mith Cash to capitalize on other trends were futile, and in 2022, MITH was delisted from platforms like Binance, nearing zero.

Clearly, the token issuers made a fortune, while the buyers lost everything. The Mithril project established Huang Licheng's initial reputation as an "early crypto pump and dump" figure.

Launching DeFi Protocols in 2020

In 2018, Huang Licheng also co-founded Baodao Finance, claiming to be a vault management platform built for blockchain companies. It raised $23 million (44,000 ETH) at one point, but the project only launched on a few decentralized exchanges before quickly going to zero.

Additionally, Huang Licheng launched the previously centralized copyright trading platform Machi X, but due to his prior "scalper" reputation, the project struggled to raise funds and was abandoned.

Until July 2020, when DeFi Summer arrived.

He turned to the booming DeFi mining sector and quickly launched the lending protocol Cream Finance. As a fork of Compound, Cream supported lending for more long-tail assets and rapidly rose to prominence with high-yield mining, peaking with a TVL exceeding $1 billion.

However, at that time, the rapid development of DeFi protocols, while promoting growth, had many flaws and vulnerabilities in mechanism design and security defenses, leading to frequent hacker attacks, with many protocols becoming cash machines for hackers. Especially the later criticized "flash loan" design—flash loans are a type of uncollateralized lending mechanism in DeFi, allowing users to borrow any amount of funds within the same block, as long as they repay the principal + interest before the block ends; otherwise, the transaction would be rolled back entirely. This design was intended to facilitate arbitrage, refinancing, and collateral adjustments, but in practice, it provided a breeding ground for hackers.

In 2021, Cream Finance suffered at least five hacker attacks.

In February, Cream Finance's "Iron Bank" cross-protocol lending integration was exploited, with attackers borrowing assets far exceeding their collateral value by manipulating asset prices (or asset value calculations). The loss was approximately $37.5 million.

In August, Cream Finance was attacked again—the C.R.E.A.M. v1 market on Ethereum was exploited, with attackers using a reentrancy bug in the AMP token contract. The estimated loss was around $34 million.

In October, Cream Finance suffered one of the largest fatal attacks at the time, with the Ethereum v1 market of Cream being breached again. This was a flash loan attack combined with price oracle/stock price valuation manipulation, resulting in losses of about $130 million.

Cream Finance also experienced security incidents that year, including domain DNS hijacking and exploitation of vulnerabilities.

Under the dual pressure of a trust crisis and technical vulnerabilities, Huang Licheng chose to hand over control of the protocol to the well-known DeFi king, Yearn founder Andre Cronje, soft-landing through strategic cooperation while stepping back from daily operations.

Afterward, Huang Licheng led and participated in various DeFi protocol fork projects multiple times, but most did not gain traction and soon failed.

Transition to the NFT Battlefield in 2021

When the NFT craze swept in, he once again stood at the forefront, transforming into an NFT OG.

In 2021, perhaps due to his familiarity with traffic strategies, Huang Licheng early on identified the NFT track and began minting and accumulating top blue-chip NFT series, especially the Bored Ape Yacht Club (BAYC). The minting price was only 0.08 ETH, and a few months later, the floor price surged over 100 ETH, creating a crazy wealth effect and breaking into the mainstream. As a celebrity, Huang Licheng leveraged this momentum to promote, gifting BAYC to stars like Jay Chou, gaining significant exposure.

In 2022, Odaily Planet Daily reported that his single address held 102 Mutant Apes (MAYC), 55 Bored Apes (BAYC), and 1.51 million APE tokens (valued at about $24 million at the time). Each time the market dipped, he would buy heavily, attracting media attention to his address, making him one of the largest NFT whales at that time.

The sudden downturn occurred during the token points event on the NFT trading platform Blur. After Blur launched its second season of airdrop points, "Machibigbrother" consistently topped the leaderboard with frequent trading actions. Huang Licheng owned a large number of BAYC and other blue-chip NFTs, earning trading points through orders and bids while increasing the liquidity of NFTs. However, as the NFT market cooled and declined in 2023, users earning points became less active, and those holding a pile of NFTs began to find ways to offload them.

Blur's liquidity created favorable selling conditions for NFT traders. Blur's market-making incentive mechanism allowed traders to list NFTs at prices close to the floor, further creating tight bid-ask spreads, making Blur's floor price lower than prices on other markets. This method continuously created a moat for Blur, increasing bidding depth.

However, "Machibigbrother" faced significant losses in this whale game, acquiring 71 BAYC and 77 CryptoPunks over several days, resulting in heavy losses. He then urgently sold over 1,000 NFTs, causing the BAYC floor price to drop by as much as 25.5%. Although it was a case of "buying high and selling low," his large-scale NFT sell-off, which drained liquidity, drew accusations of "Machi big cuts."

In summary, it was a fierce operation that ultimately led to being played by the platform. According to subsequent statistics, Huang Licheng lost at least over 5,000 ETH in this back-and-forth points game on Blur.

The NFT market continued to languish, failing to recover. In April 2023, Huang Licheng announced his exit from the NFT market.

Even now, his wallet still holds many NFT corpses.

Public Offering of Memes in 2024

In 2024, the Solana meme ecosystem welcomed a spring, with the "one contract address, send me money" model becoming a hit, and Huang Licheng once again "embraced opportunity."

He launched a project on the Solana chain named Boba Oppa ($BOBAOPPA) after his dog. The project raised over 200,000 SOL (worth over $40 million) through pre-sales within 24 hours, but on the launch day, the token price plummeted over 70%. He also transferred some of the raised funds into the DeFi protocol Staking, marking another classic "big cut" performance.

Subsequently, Boba Oppa attempted to create hype through token burns and other favorable actions, but ultimately faded quietly into the sea of many memes, returning to zero.

The Tragedy of Hyperliquid Whales—From $45 Million Profit to Total Loss

In 2025, in the highly transparent environment of Hyperliquid, under the watchful eyes of the public and real-time media coverage, becoming a whale "strategizing" may have excited Huang Licheng once again.

(The following image combines with Odaily Planet Daily reports_)

"Machibigbrother" Hyperliquid account position profit chart

Chapter One: The Glory and Undercurrents of Summer

The story begins with significant profits. In June, he made precise operations on HYPE positions, easily capturing over $6.5 million in unrealized profits; by July, his total long position on Hyperliquid climbed to $126 million, making him the top whale on the platform. However, the seeds of risk were also sown at this moment: his stubborn bullishness on PUMP projects caused monthly losses to rapidly expand to over $10 million. Although he began to cut losses at the end of July, this massive loss had already eroded his previous profit base.

In August, the market took a sharp turn downwards and then rebounded suddenly, with the account's profit and loss curve resembling a wild roller coaster. At the beginning of the month, his cumulative loss on PUMP reached $9.94 million, nearly wiping out his earlier profits; however, as ETH rebounded, his unrealized profits briefly exceeded $30 million in mid-August. On August 13, he decisively closed all positions, locking in $33.83 million in profits. But the brief rationality quickly vanished, and he immediately shorted ETH, only to be "killed" by the market's rapid rebound, leading to a significant profit retreat.

Throughout August, he hardly pressed the pause button, frequently opening, increasing, and closing positions, trying to catch up with the market at a fast pace. Although losses narrowed by the end of the month, the anxiety of "earning but unable to hold" had begun to erode his confidence.

Chapter Two: The Peak and Turning Point of September

Entering September, Machibigbrother seemed to regain his rhythm. He reduced leverage to 15x, frequently engaged in short-term operations, and made small profits in shorting ASTER. By September 19, his account's unrealized profits soared to nearly $45 million—this was the historical peak of his time on Hyperliquid.

However, peaks often signify turning points. In late September, ETH, HYPE, and PUMP all fell sharply, and his core positions quickly fell into unrealized losses, with maximum losses exceeding $20 million.

To avoid liquidation, he added $4.72 million USDC in margin to the platform on September 25. Ironically, even in the midst of crisis, he chose to heavily invest in the new target XPL, attempting to "fight to sustain the fight" to turn the situation around. By the end of the month, his total position value still reached $176 million, but behind this massive scale, the financial defenses were already on the verge of collapse.

Chapter Three: The Death Spiral of October: Liquidation, Margin Calls, and Further Liquidation

October marked the beginning of a complete collapse. The nearly $45 million in unrealized profits at the peak had almost vanished within 20 days. By October 9, the account's profit was reduced to about $1 million. The next day, he was forced to close positions like XPL, suffering a single-day loss of $21.53 million, officially turning his account from profit to loss.

For the rest of the month, he fell into a typical "death spiral": market decline → high-leverage long positions approaching liquidation → capital injection for margin calls → further liquidation → re-opening positions.

This cycle repeated at least ten times in October. Like a gambler blinded by losses, he kept "adding margin," but each time was mercilessly swallowed by even sharper declines. On October 11, 14, 23, 30… his positions were liquidated time and again. Although there were occasional market rebounds during this period, allowing him to see small unrealized profits of nearly a million dollars, compared to the massive losses, this was merely a drop in the bucket. By October 31, his total losses had reached $14.5 million.

The Endgame? Total Collapse in November

There were no miracles in the November market.

On November 3, his 25x long position on ETH was completely liquidated, resulting in a loss of $15 million.

On November 4, his Hyperliquid account balance was only $16,771. However, he still chose to enter the market again—using this remaining amount to open a 25x long position of 100 ETH.

24 hours later, liquidation occurred again. In the early hours of November 5, monitoring data showed that the account balance was only $1,718, bringing everything to zero.

From steady profits in June to a peak total asset of nearly $60 million in September, and then to total loss in November, this five-month trading war was filled with shocks, yet it was not uncommon in the crypto space.

The same story plays out every day, with different protagonists and details.

On the same day that Machibigbrother suffered heavy losses, he had previously achieved a 100% win rate with fourteen consecutive wins on Hyperliquid. Multiple long positions, dubbed "insider whales," were forcibly liquidated and actively closed, causing his account to plummet from a peak profit of over $25.34 million to a net loss of $30.02 million, leaving approximately $1.4 million. He then reversed to short, but the market began to rebound, and now his account has only $570,000 left.

Meanwhile, the former top influencer whale on Hyperliquid, James Wayne, had quickly profited over $43 million using high leverage but also faced a series of liquidations during the crash, losing all his principal. Since then, he has been moving around, piecing together a few tens of thousands of dollars to continue opening positions, only to face liquidation again. He has also become a KOL, earning commissions to accumulate the next round of "gambling chips," in a cycle that repeats.

They are now continuing to amplify leverage with small positions, and although this article is titled "The Zeroing Record," we have no doubt that the "serial entrepreneur" Huang Licheng has ways to piece together some principal to keep opening positions.

In this story, they are like Sisyphus, pushing the boulder time and again, forever unable to escape the cycle, striving once more towards the peak.

Conclusion: Accelerating each time may be the prelude to accelerated demise

Huang Licheng can be seen as the most vivid footnote of the crypto era, even referred to as a living fossil. He actively and quickly immerses himself in every wealth opportunity, only to soon shed his skin and rush to the next gold-digging battlefield. This is another dimension of the cycle.

In the crypto space, the lifecycle of each wave of hot trends is being drastically compressed.

In the sharing of top traders, we often hear the adage "slow is fast." But in this market where hot trends rotate like fire, no one believes in "slow is fast" anymore; it’s only that it’s too slow, not fast enough, and it should be faster.

Once, crafting a beautiful white paper and telling a self-consistent story might require time to polish the product prototype before a project could be listed and monetized.

Later, posting a contract address on social media and rallying the crowd could lead to millions of "fools" directly sending money; even the President of the United States did this, instantly birthing a project with a market value of $10 billion.

With each extreme acceleration, madness ensues. The "whales" become addicted to clicking a few buttons to open and close positions, amassing hundreds of millions in wealth.

Here, attention and influence have become real money, while the assets in accounts have turned into illusory gambling chips. In this distorted industry structure, losing oneself seems inevitable; narratives forever cycle, wealth is eternally created and devoured. Overnight riches and sudden falls are merely commonplace.

The ultimate irony is that there will always be another Machibigbrother in the crypto space facing zeroing, while more people still yearn to become him.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。