In early November, a dramatic scene unfolded in gold shops across the country: the price of gold surged multiple times in a single day, with the gold price in Shenzhen's Shuibei market even breaking the 1000 yuan per gram mark. Meanwhile, many banks suddenly suspended the withdrawal of physical gold.

Alright, no problem. I will create an engaging and structured interpretive article based on the three links you provided.

New gold tax policy introduced! Why are we suddenly paying an extra 7% for gold jewelry?

In early November, a dramatic scene unfolded in gold shops across the country: the price of gold surged multiple times in a single day, with the gold price in Shenzhen's Shuibei market even breaking the 1000 yuan per gram mark. Meanwhile, many banks suddenly suspended the withdrawal of physical gold.

The source of all this is a "new gold tax policy" that will be implemented starting November 1, 2025. The core of this policy can be summarized in one sentence: the state uses tax leverage to return gold to its original attributes—investment is for investment, and consumption is for consumption.

I. Gold on a Hot Stove: Market "Chaos" Triggered by the New Policy

After the policy was announced, the market instantly "boiled over." The most direct manifestation was the skyrocketing gold prices. For example, in a jewelry market in Hangzhou, the gold price was adjusted three times in one day, soaring from 928 yuan/gram to 1048 yuan/gram.

At the same time, several banks, including Industrial and Commercial Bank of China and China Construction Bank, announced the suspension of physical withdrawal for accumulated gold. This caught many consumers who hoped to invest in physical gold through bank channels off guard.

Why can a tax policy have such a powerful impact? The answer lies in a small "invoice."

II. Core of the New Policy: A "Tax Reform" Triggered by an Invoice

To understand the new policy, one must first understand China's "total reservoir" of gold—the Shanghai Gold Exchange and the Shanghai Futures Exchange. Almost all gold circulating domestically originates from here.

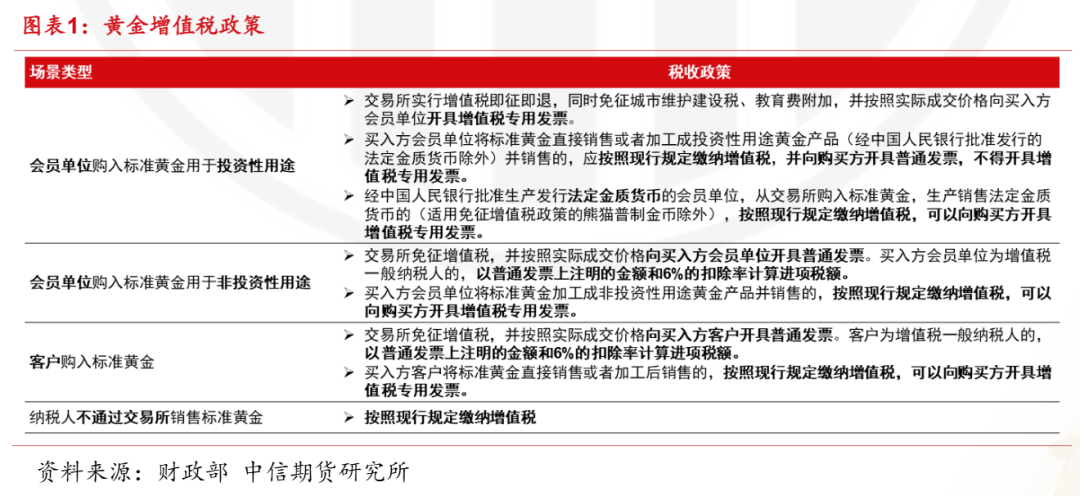

In the past, tax policies were relatively simple, generally "immediate collection and immediate refund" or tax-exempt, resulting in low tax costs. The biggest change in the new policy is the strict distinction between the final uses of gold for the first time:

● Investment Use: Refers to gold bars, ingots, etc., with a purity of ≥99.5%, used for value preservation and appreciation.

● Non-Investment Use: Refers to gold jewelry, crafts, industrial gold, etc., used for daily consumption and production.

This directly leads to vastly different tax treatments:

● If a company withdraws gold from the exchange to create investment gold bars, the exchange will issue a special VAT invoice (which allows for a 13% tax deduction), but when the company sells the gold bars, it can only issue a regular invoice, interrupting the VAT chain.

● If a company withdraws gold to create non-investment items like jewelry, the exchange directly exempts it from tax and only issues a regular invoice. The company can only deduct 6% of the invoice amount as input tax.

Here comes the key point! Previously, companies could deduct 13% tax, but now they can only deduct 6%. This 7% tax cost gap has become an additional cost that gold shops and banks must face. To ensure profits, the most direct choice for merchants is to pass this cost onto consumers—this is the fundamental reason for the overnight 7% surge in jewelry prices.

III. What Actual Impact Does This Have on Ordinary People?

1. Buying Jewelry: It has indeed become more expensive. If you plan to purchase gold jewelry for wearing, sorry, after the new policy, the price tag already genuinely includes that additional 7% cost. This is akin to an "invisible tax," adding to the cost of beauty.

2. Investing in Gold: A shift in thinking is needed.

● Physical gold bars: The purchase cost has increased, and when cashing out in the future, the recovery channels may also face the same tax issues, leading to greater price differences. The model of "Chinese aunties" buying gold bars for appreciation is no longer as cost-effective as before.

● Gold financial products: Here comes the direction encouraged by the new policy! For those who genuinely want to invest in gold, the new policy actually "points a clear path." Any investment method that does not involve physical gold delivery still enjoys tax benefits.

This includes:

○ Gold ETFs (can be purchased in stock accounts)

○ Paper gold

○ Gold futures These products are convenient for trading, have low costs, and good liquidity, making them a better choice for gold investment in the new era.

3. Cashing in Old Gold: Minimal impact. If you just want to cash in your old jewelry or gold bars, you can rest assured. Occasional, small non-business transfers between individuals currently do not involve VAT or personal income tax, so the impact is negligible.

IV. Conclusion: The Purpose of the New Policy is Not "Tax Increase," but "Regulation"

This gold tax reform, seemingly sudden, has actually been brewing for a long time. Its core purpose is not merely to increase tax revenue but to address the long-standing "one-size-fits-all" rough management issues in the gold market.

● Guiding Market Standardization: Directing transactions from opaque "private trades" to transparent "regulated trades," combating money laundering and other illegal activities.

● Enhancing International Pricing Power: Allowing China's gold exchanges to gather more trading volume, thereby gaining greater influence in the international gold market.

● Suppressing Short-Term Speculation: Ensuring that gold resources flow better into the real economy, reducing pure speculation.

In summary, the new policy draws a clear line for us: if you want to invest, go for convenient financial products; if you want to consume, pay a reasonable premium for exquisite jewelry.

As long as we can understand the rules and act accordingly, we can still achieve a win-win in asset allocation and consumption needs under the new framework of "investment for investment, consumption for consumption."

Join the community for more insider news

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。