The U.S. government shutdown has entered its 36th day, and the market is most concerned about whether the non-farm payroll report scheduled for the evening of November 7 can be released as planned.

"We have the strongest economy in history." Trump tried to soothe market sentiment. However, he also had to admit that the shutdown is having a "negative impact on the stock market, the airline industry, and food assistance." As of the time of publication, the three major U.S. stock indices have collectively surged amid volatility, with the Nasdaq rising over 0.6%, seemingly providing a footnote to Trump's optimistic forecast.

1. A record 36 days, losing $15 billion each week

The U.S. government shutdown has now lasted 36 days, surpassing the 2018-19 shutdown record and becoming the longest federal agency closure in U.S. history. The impact of this crisis extends far beyond the political realm. Analysts estimate that the government shutdown is costing the U.S. economy about $15 billion per week, with most predictions centered around this figure.

Chief economist Mark Zandi pointed out, "For every week the shutdown continues, GDP growth is reduced by 0.1 to 0.2 percentage points. If it extends into an entire quarter, it could completely change the trajectory of economic growth."

Compared to the 2018-19 shutdown, the economic environment during this shutdown is more fragile. The American public is currently facing inflationary pressures and employment uncertainty, making the impact of the shutdown more profound. In addition to direct economic losses, approximately $24 billion in federal procurement spending has been frozen, putting thousands of businesses reliant on government contracts at risk of cash flow disruptions.

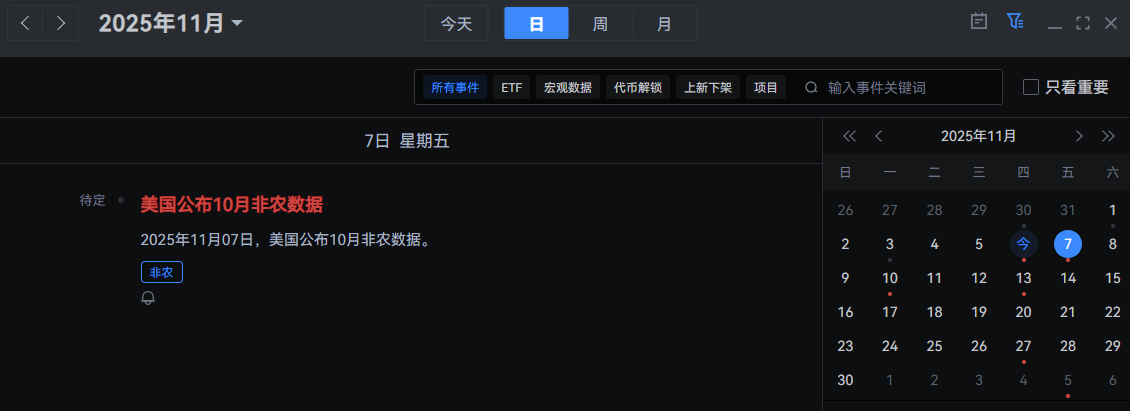

2. Tomorrow's non-farm report becomes the biggest suspense

In the shadow of the government shutdown, a key question has emerged: will the non-farm payroll report for October, scheduled for release tomorrow evening, be published on time?

The Bureau of Labor Statistics, one of the federal agencies affected by the shutdown, has had its normal data release process completely disrupted. According to insiders, "Currently, only core personnel are on duty in the team responsible for compiling non-farm data, and there are technical difficulties in releasing the complete report."

This uncertainty has triggered a chain reaction in the financial markets. The Chicago Board Options Exchange's volatility index shows that the options market's expectations for volatility on the day of the non-farm data release have risen to a yearly high.

"If the non-farm data is delayed, the market will fall into a 'data vacuum,'" said former Federal Reserve economist Julia Coronado. "Investors will trade without key economic coordinates, which could lead to abnormal fluctuations in asset prices."

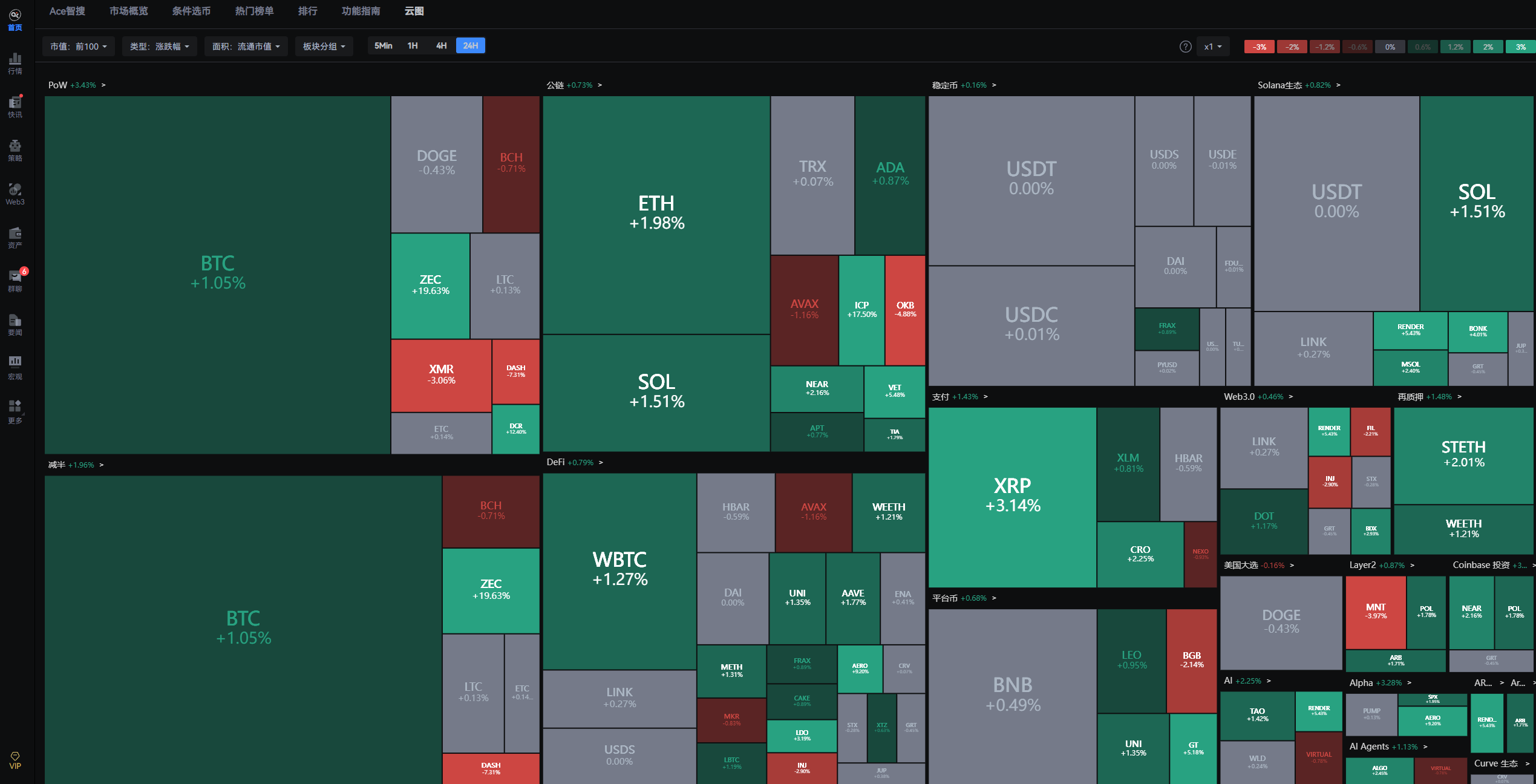

3. U.S. stocks fluctuate, crypto assets show resilience

U.S. stocks initially fell before rising. After Trump's optimistic remarks, market sentiment was boosted. As of the close on November 5, the Nasdaq was up 0.65%, while the Dow and S&P 500 rose 0.48% and 0.37%, respectively. In contrast to the volatility in U.S. stocks, the cryptocurrency market has shown remarkable resilience. Major crypto assets have gradually stabilized and rebounded gently after an initial slight decline.

Chief economist Philip Greedwell believes, "Cryptocurrencies are beginning to show a different trend from traditional risk assets. For some investors, their decentralized nature has become an advantage in the current political deadlock."

4. Economic resilience vs. recession risk

Optimists argue, "This is just a temporary market fluctuation, and we expect a quick recovery. While the economic cost of the shutdown is $15 billion per week, strong private data shows that economic resilience is sufficient to offset short-term shocks." Similarly optimistic, BNN Bloomberg chief economist Bill Adams pointed out, "Despite the government shutdown being the longest in history, economic growth will continue. The core argument is that the October service sector survey shows strong demand and job growth, proving that the shutdown has a limited impact on the overall economy."

Cautious voices warn, "The shutdown will lead to a short-term decline in the stock market, and an extended shutdown will reduce economic activity, delay spending, and amplify investor uncertainty."

Hedge fund manager Stanley Druckenmiller takes a more neutral stance: "Trump's remarks will disturb market sentiment in the short term, but they won't change the long-term trend. Investment decisions should focus on economic fundamentals and policy execution, rather than political rhetoric."

5. Non-farm data and legislative breakthroughs are key

How will the government shutdown end? Where will the market head? Investors should closely monitor the following two key dynamics:

First, will the non-farm payroll report be released on time tomorrow? This is not only a technical issue but also a barometer for assessing the depth of the shutdown's impact. If the report confirms a delay, it will mean that the government shutdown has begun to erode the infrastructure of the financial market.

Michael Feroli, chief U.S. economist at JPMorgan, stated, "Non-farm data is a core basis for Federal Reserve decision-making. If this data cannot be obtained on time, the policy-making for the December Federal Reserve meeting will face greater uncertainty."

Second, can the two parties break the legislative deadlock within the next week? Currently, Trump has urged Republicans to end the "lengthy debate" procedure, which requires the vast majority of bills to receive at least 60 votes in the Senate's 100 seats to advance.

Since the Republicans currently hold only 53 seats in the Senate, they do not meet the 60-vote threshold, allowing Democrats to effectively block bill votes through "lengthy debate." As of the 5th, a temporary funding bill aimed at ending the government "shutdown" has already failed to advance in the Senate 14 times due to not reaching the 60-vote support.

The warning from Jonathan Miller, senior U.S. economist at Barclays, is thought-provoking: "Historical experience shows that shutdowns do not lead to disaster. But this time may be different."

All eyes are on tomorrow's non-farm report—this economic data, which may not be released on time, has become a litmus test for whether the U.S. democratic system can function normally under pressure.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。