The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smokescreens!

Having talked about the big trend, today let's discuss contracts. It has been a long time since I discussed technical analysis with everyone, and you can also find common ground with Lao Cui. Let's start with Bitcoin. The line on October 10 was the decisive factor that led Bitcoin into a bearish range. The previous guiding low was at 101500, and by November 4-5, it had completely solidified, even setting a new low around 98888.8 and 99000, with not much difference between them. You can also take a look at the closing prices; both closed around 101300, only 200 points away from the new low of 101500 in October. At this stage, it can be directly judged that the "Immortal's Finger" has already solidified. Therefore, the current patterns for Bitcoin likely only have two possibilities: the most probable scenario is a sudden spike after a period of sideways movement. Once the spike begins, it will completely head into a bearish range by the end of the month. The second possibility is a long-term sideways movement, seeking a breakthrough upwards.

It can be said that if you are looking for support, it is at the current level, in the range of 101300-101800, which can now be called a battleground for bulls and bears. Especially with the opening of the Bollinger Bands, the entire pattern is damaged, with a very obvious downward opening, but showing signs of lifting, which is also influenced by the rapid recovery rate of the recent downward movement. Everyone needs to learn to find common ground and start to understand why the market makers are doing this. Bitcoin's mission this year is to deleverage; only after removing leverage will there be signs of recovery. This deleveraging was extremely evident in the first half of this year, reaching the position of 74457 in April, where the bulls were almost wiped out. Most users who bottomed out last year did not survive this wave. As our analysis shows, 74457 has already achieved this year's target in the first half, so there will be no new lows in the remaining two months of the second half.

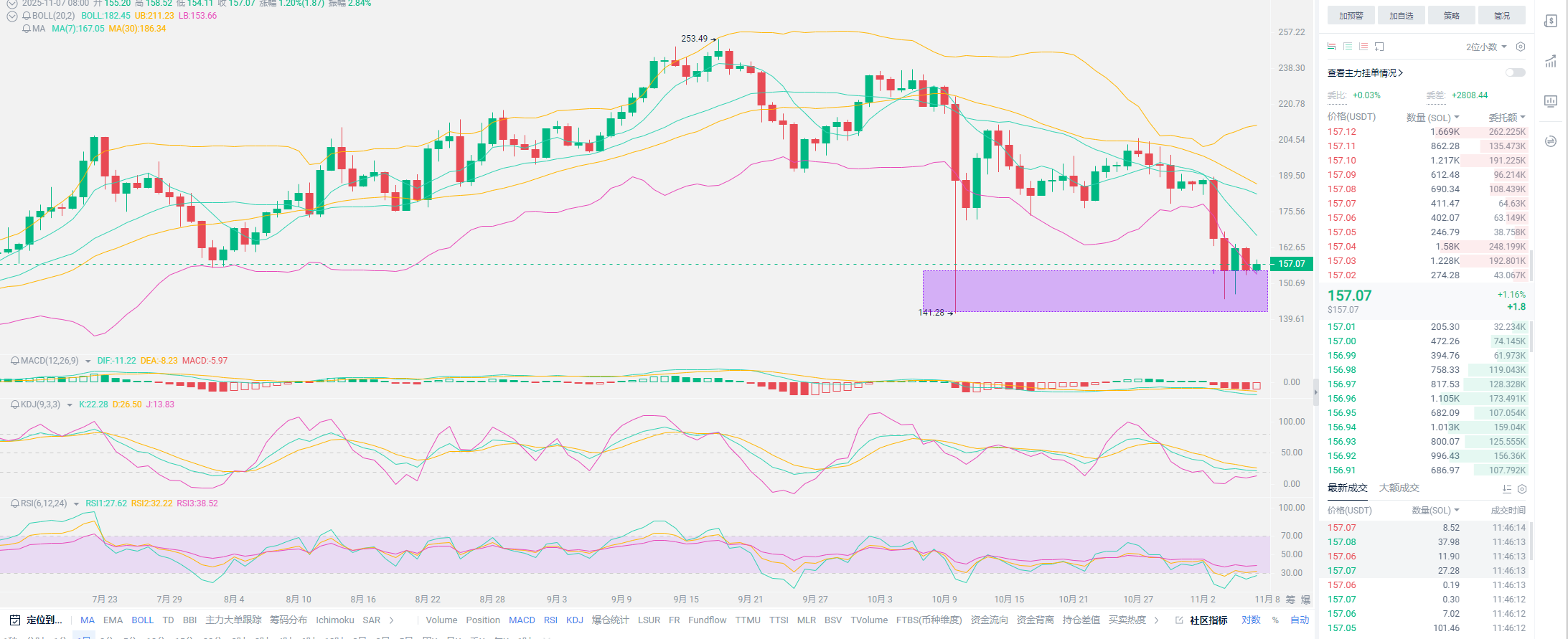

The turnover target has already been completed in the first half of this year, and the second half is almost all positive news, with only a huge problem in the connection of funds. You can see that for SOL, there has been almost no negative news in the second half; the only factor that can be considered to affect the market is the delay in listing. This is also an uncontrollable factor. Utilizing SOL's network, nearly 5.25 billion USDC has been issued, and the on-chain data is also extremely impressive. Remember not to lose confidence in SOL; it no longer belongs to the category of altcoins. When USDC is issued using SOL, it has already become a backing for the US dollar and US Treasury bonds. The listing issue will eventually be resolved, and after the listing, it will definitely attract funds. Taking Bitcoin and Ethereum as examples, after listing, it usually takes no more than half a year to enter a bullish market. At this stage, for all spot users, it is essential to hold and not sell at the lows; everyone needs to maintain a certain level of rationality.

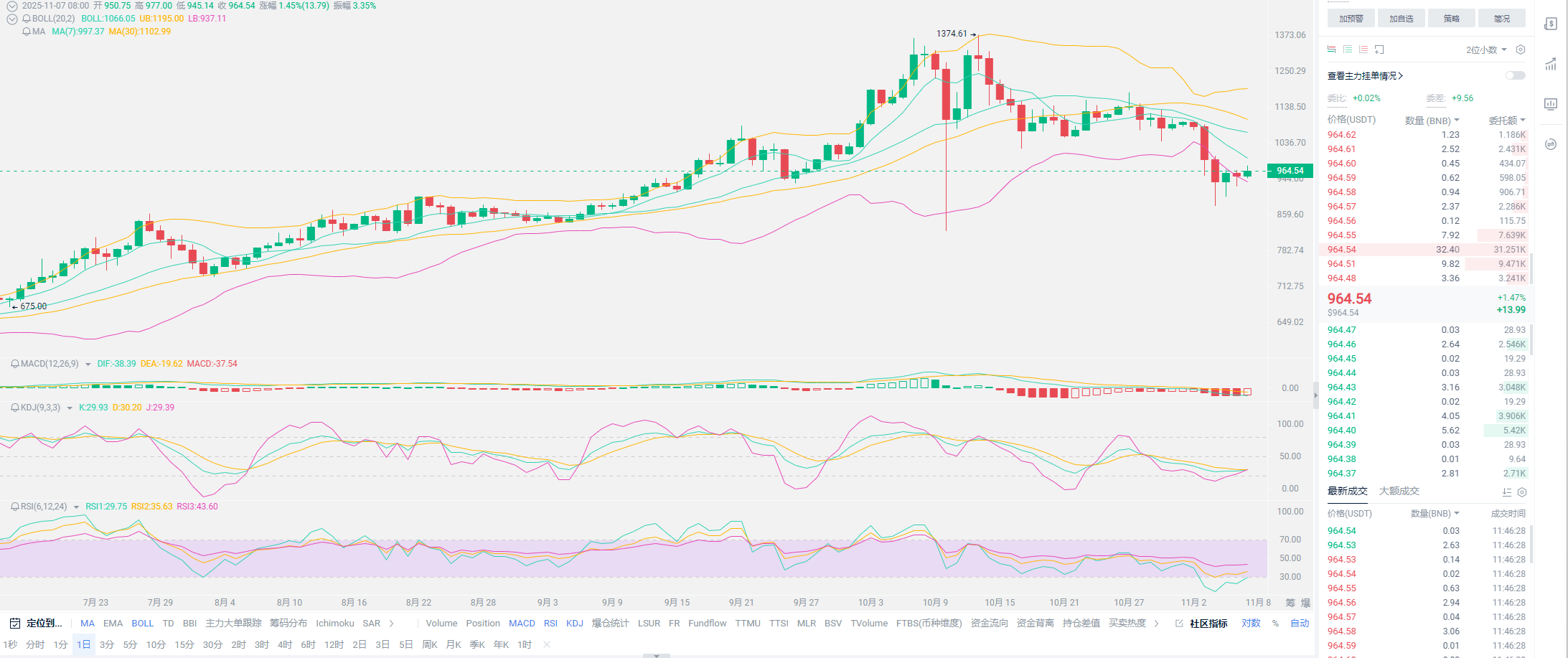

Many friends do not quite understand why the on-chain data is complete, yet the market cannot start? On-chain data cannot change the market trend. Simply put, even though 750 million USDT was issued in the short term, it will not fully circulate in the market. Currently, USDT is still the mainstream option for stablecoins in the market, accounting for over 70% of circulating data. Especially since October last year, the crazy issuance using Binance's network has been a tailwind; once all the data becomes active, it will drive trading on the network. BNB's explosion this year can be said to be due to stablecoins; only in a bull market phase will there be a strong subsequent explosion. Currently observing SOL, it already has the factors for a bull market explosion; it just depends on the timing. Regarding the speculation on interest rate cuts, it can now be confirmed that there will be a rate cut in December, with more speculation still on how many basis points, and discussions are starting about the possibility of 50 basis points.

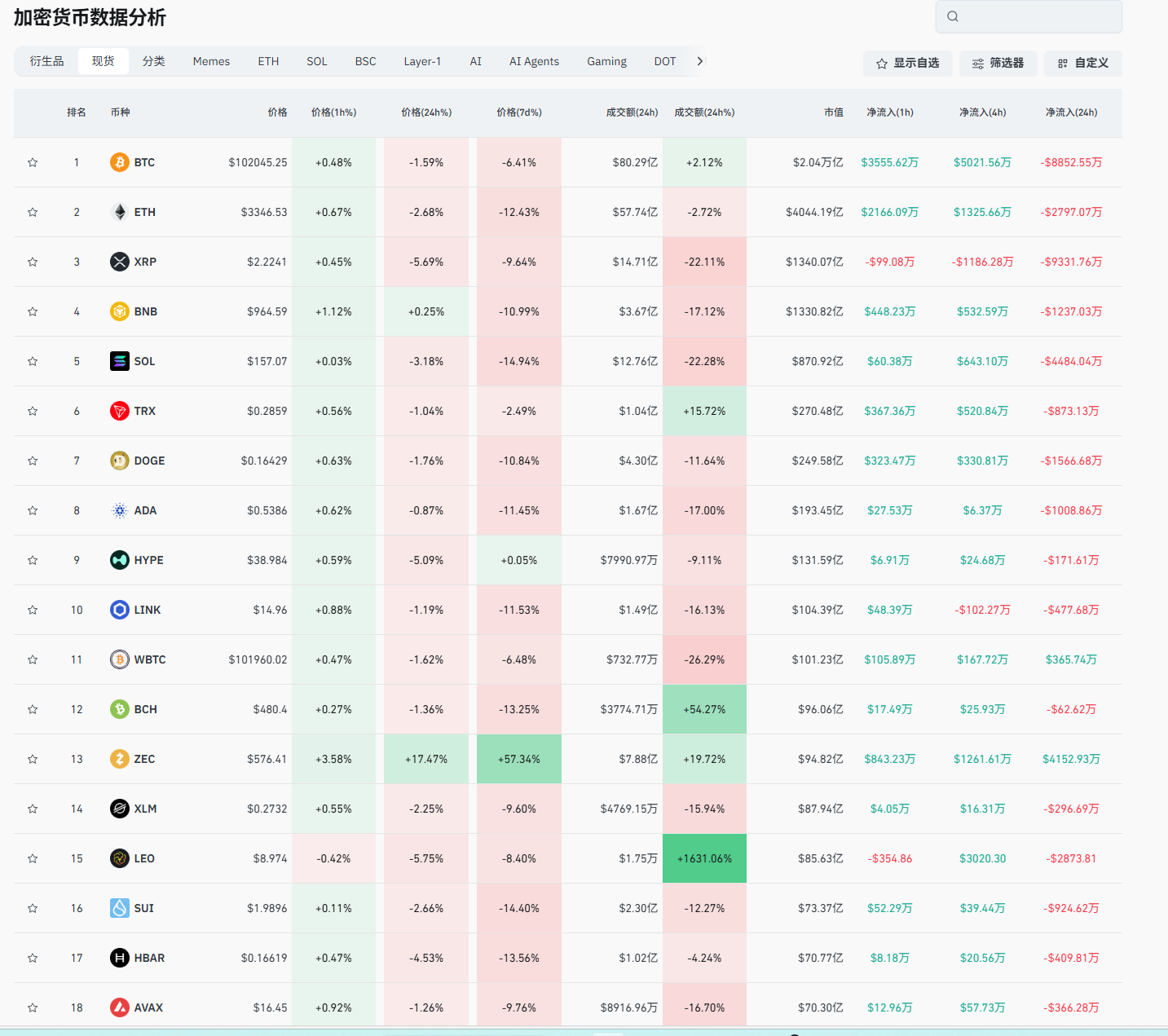

In this estimation, Lao Cui actually thinks there is indeed a possibility of 50 basis points, as the end of the balance sheet reduction is also in December, and more rate cuts will drive the end of the balance sheet reduction momentum. Overall, the decline in November is preparing for an explosion in December. If you have a certain amount of assets, you can consider bottom fishing. You can anchor Trump’s positions; in this downward market, Trump has been continuously adding to his positions, especially recently adding over 130 more Bitcoins, bringing his total holdings to 4004. The subsequent explosion will definitely exceed this year's new highs, so don't panic too much. BNB's trading volume has already completed a fivefold leap, and of course, it is mostly selling pressure. If you are trading contracts, the only indicators you need to pay attention to are three: the fear index, the fee rate, and the capital inflow situation. The current environment is one of massive capital outflow, with BlackRock depositing over 4000 Bitcoins and more than 57000 Ethers into exchanges, likely to dump, so control your risks.

Lao Cui's summary: Currently, although short-term reversal signals have appeared, it is likely to be a wave of false bullish market. To see the reversal signal in November, we may have to wait until mid-month to the end of the month. The news we need to wait for is whether the US government shutdown issue can be resolved, and secondly, the confirmation of the interest rate cut basis points and the collision with the end of the balance sheet reduction cycle. The arrival of these two will drive the cryptocurrency market back into a bull market. If you are targeting US stocks, the current US stock market is mostly downward, and the entire dollar asset is in a state of devaluation, which is undoubtedly an extremely abnormal trend for the financial sector. The response method, with a yearly limit, is that SOL below 200 is worth buying; it has now reached around 160, making it a good time to bottom fish. The advantage for contract players is even more obvious; you can short. The method explained yesterday may not be well understood; the way to judge daily new highs is actually very simple. For Bitcoin, it is 102311; as long as it rises another 500-1000 points, it is time to short, and for Ethereum, it is 50-100 points. For spot users, buying is the right choice, with no excessive requirements. If you are unsure about the timing of your purchases, you can directly ask Lao Cui.

Original content by WeChat Official Account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。