Although it's a bit early, I still want to talk about 2026.

As 2025 is about to end, many investors in the market are predicting the trends for 2026. Under the current circumstances, I will divide 2026 into three timelines:

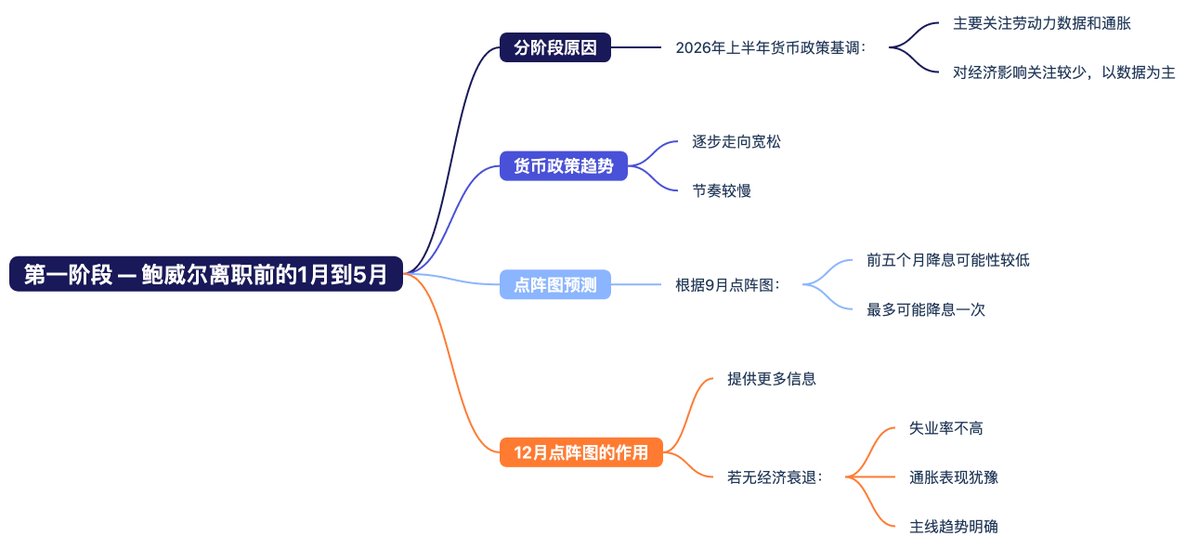

Phase One — January to May before Powell's departure

The reason for this division is that in the first half of 2026, Powell's influence on monetary policy will likely still be primarily based on labor data and inflation, with less concern for the economic impact, focusing more on the data.

Although there will gradually be a shift towards a more accommodative stance, it will inevitably be slow. According to the dot plot from September, it is very likely that under Powell's leadership, there will be no interest rate cuts in the first five months, or at most one.

Of course, the dot plot in December will provide us with more information, but if the U.S. does not enter a recession, the unemployment rate is not very high, and inflation remains uncertain, then this will likely be the main narrative.

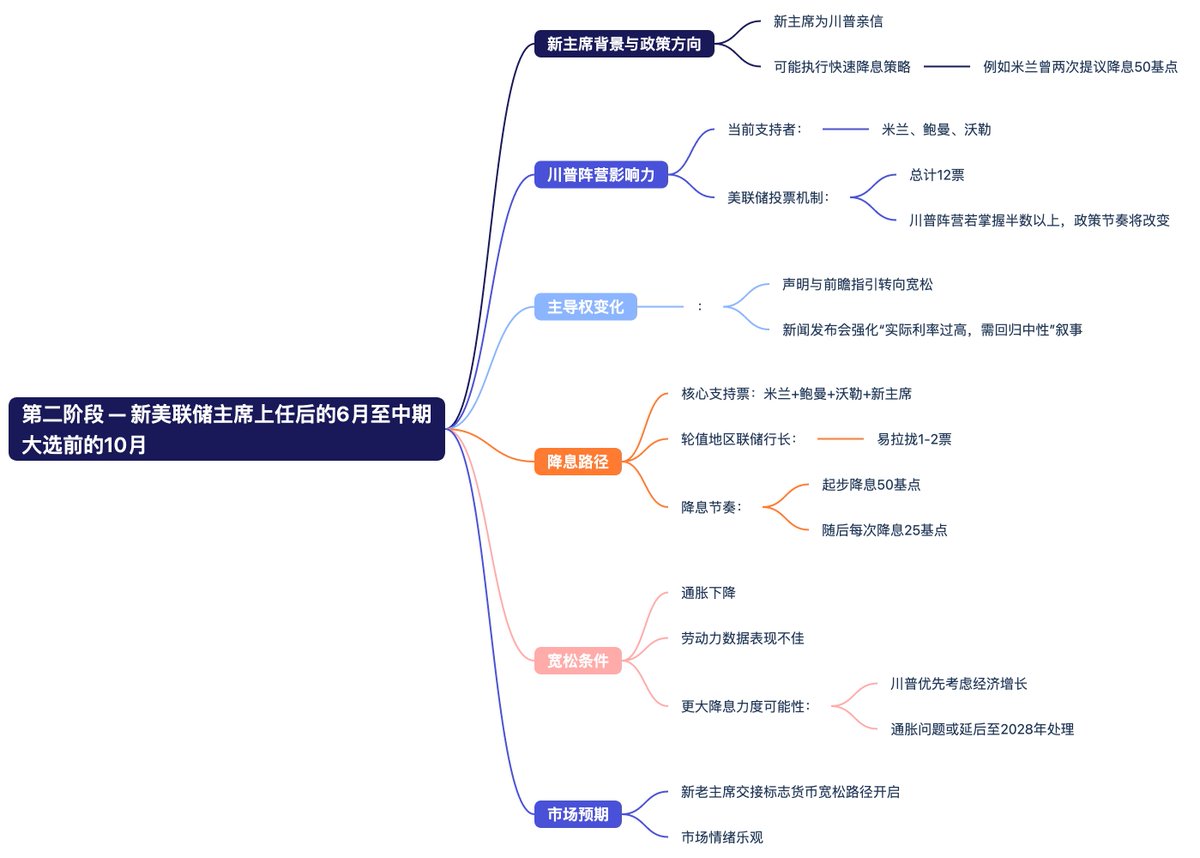

Phase Two — From June with the new Federal Reserve Chair until the midterm elections in October

After June, the new Federal Reserve Chair will undoubtedly be a close ally of Trump, likely following Trump's plan for rapid interest rate cuts. For example, Milan, who is currently temporarily replacing Kugler, has called for a 50 basis point cut in both recent meetings, which is a complete execution of Trump's strategy.

Although currently, only Milan appears to be this aggressive, Trump's camp still includes Bowman and Waller, which gives them four votes. The Federal Reserve's voting body consists of 12 members, so when Trump can secure more than half the votes, the pace will change significantly.

First, there will be control over the agenda and wording. Even with a moderate majority of just half the votes, the new chair can lead post-meeting statements and forward guidance, turning the continued assessment of employment and inflation into a narrative that suggests further easing will likely proceed unless unexpected events occur, while reinforcing the narrative that real interest rates are too high and need to return to neutral quickly during press conferences.

Secondly, regarding the path of interest rate cuts, based on the core votes of Milan, Bowman, Waller, and the new chair, it should not be difficult to garner 1 to 2 additional votes from the rotating regional Fed presidents (who are usually more sensitive to growth), forming a combination that starts with a 50 basis point cut, followed by 25 basis point cuts thereafter.

Moreover, if inflation indeed trends downward and labor data is not very favorable, increasing the rate of cuts is also a possibility. After all, in Trump's view, the priority has always been the economy, and the issue of inflation may very well be postponed until after 2028.

This period should be when market expectations are at their highest, as the transition between the new and old Federal Reserve chairs is likely seen as the beginning of the U.S. entering a path of monetary easing.

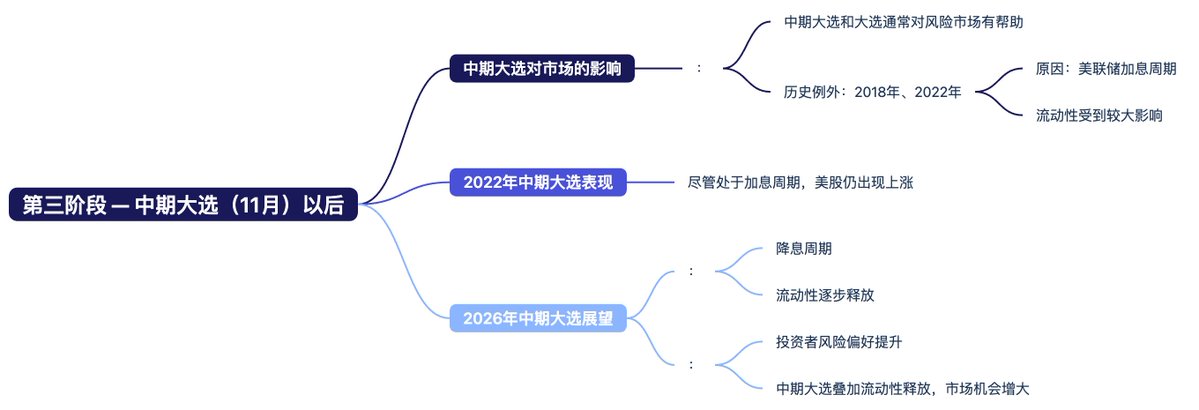

Phase Three — After the midterm elections (November)

Next comes the midterm elections. Historical data shows that both midterm and general elections significantly benefit risk markets.

Although some investors question the performance of risk markets during the midterm elections in 2018 and 2022, from a macro perspective, both 2018 and 2022 were periods of interest rate hikes by the Federal Reserve, which had a substantial impact on liquidity.

Even so, the U.S. stock market still saw a decent rise after the midterm elections in 2022. The midterm elections in 2026 are very likely to coincide with the Federal Reserve's interest rate cut cycle, leading to a gradual release of liquidity and an increasing risk appetite among investors. Coupled with the boost from the midterm elections, there should be good opportunities.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。