Highlights of This Issue

This week's newsletter covers the statistical period from October 31 to November 6, 2025. The RWA market continues to show steady growth, with a total on-chain market capitalization reaching $35.83 billion and the number of holders surpassing 530,000, indicating a continuously expanding user base. The stablecoin market has entered a new phase of "high frequency and low inflation," with transaction volumes exceeding $5 trillion for the first time and monthly active addresses surging nearly 28%, demonstrating a significant enhancement in the efficiency of existing capital turnover and on-chain payment functions. On the regulatory front, two Southeast Asian countries have launched RWA tokenization plans, while the UK and Canada are following the footsteps of the U.S. "GENIUS Act" to advance stablecoin regulatory legislation, with a global regulatory framework rapidly taking shape and gradually aligning. At the project level, JPMorgan is expanding its blockchain applications to fund services, stablecoin company Zerohash has obtained an EU MiCA license in the Netherlands, and three institutions—WisdomTree, UBS, and Dinari—are collaborating with Chainlink to explore business directions such as tokenized fund trading, on-chain net asset value data, and cryptocurrency market index tokenization, indicating that institutions are deeply integrating RWA tokenization into fund operations, data flow, and on-chain settlement workflows.

Data Insights

RWA Market Overview

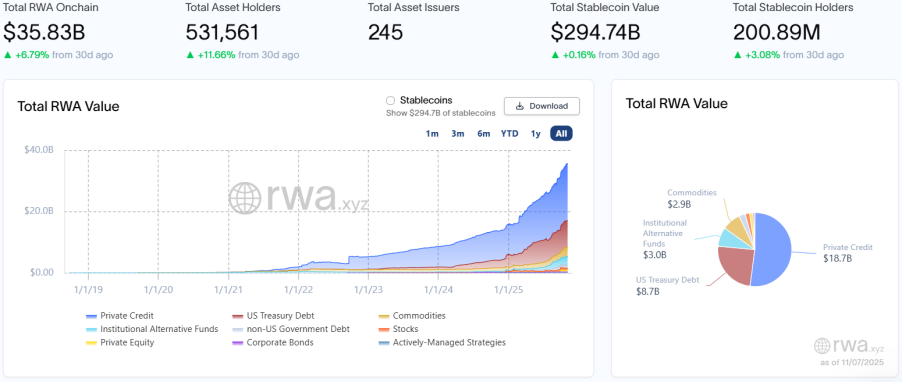

According to the latest data from RWA.xyz, as of November 7, 2025, the total on-chain market capitalization of RWA reached $35.83 billion, an increase of 6.79% compared to the same period last month, maintaining a steady expansion trend; the total number of asset holders is nearly 531,600, up 11.66% from the same period last month, indicating a continuous increase in market participation; the total number of asset issuers has rebounded to 245.

Stablecoin Market

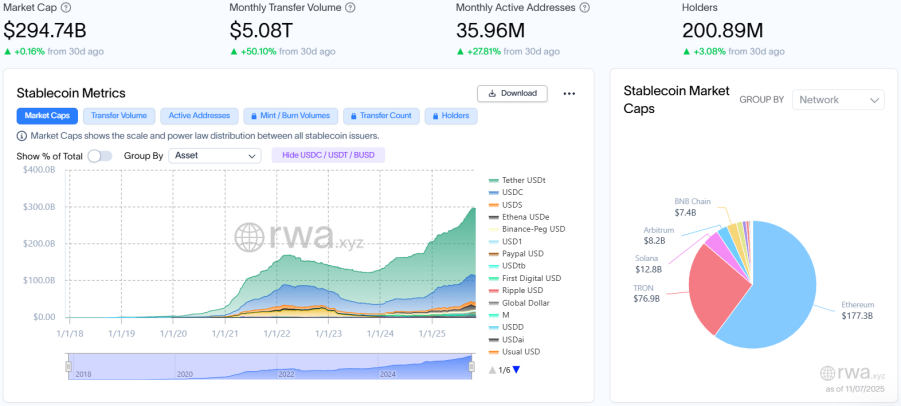

The total market capitalization of stablecoins reached $294.74 billion, a growth of 0.16% compared to the same period last month, with growth nearly stagnating; monthly transaction volume soared to $5.08 trillion, a significant increase of 50.10% compared to the same period last month; the total number of monthly active addresses rose significantly to 35.96 million, up 27.81% from the same period last month; the total number of holders steadily increased to 200 million, a slight increase of 3.08% compared to the same period last month. These figures collectively confirm that the market has entered a "high frequency and low inflation" phase, with explosive improvements in the efficiency of existing capital turnover and simultaneous strengthening of user activity and on-chain payment settlement functions. Data indicates that institutional settlements and retail trading are forming effective resonance, with transaction volume growth and active address growth far exceeding market capitalization growth, highlighting that the market is driven by liquidity efficiency rather than mere scale expansion. The leading stablecoins are USDT, USDC, and USDe, with USDT's market capitalization increasing by 2.47% compared to the same period last month; USDC's market capitalization slightly decreased by 0.73% compared to the same period last month; and USDe's market capitalization decline continued to widen, dropping by 35.13% compared to the same period last month.

Regulatory News

Bank Negara Malaysia Launches Three-Year RWA Tokenization Exploration Program

According to Ledger Insights, Bank Negara Malaysia has launched a three-year exploration program for RWA tokenization and established a digital asset innovation center and industry working group to solicit feedback on potential application cases ranging from supply chain finance to Islamic financial products.

The central bank's latest report outlines a phased implementation plan: a concept validation and pilot will take place in 2026, followed by an expansion of the trial scope in 2027. The bank invites industry participants to submit application case opinions by March 1, 2026, while also clearly defining which cases meet the experimental criteria.

Bank Indonesia Plans to Launch Digital Rupiah Based on Distributed Ledger Technology

According to Techinasia, Bank Indonesia will launch a digital version of the Indonesian Rupiah (Rupiah Digital), which is a digital version of the Indonesian Rupiah Securities (Sekuritas Rupiah Bank Indonesia, SRBI), and will be rolled out in phases before 2030.

Bank Indonesia plans to proceed gradually, first conducting trials for digital securities issuance, transfers, and withdrawals between 2025 and 2026. From 2027 to 2028, further tests will be conducted for currency operations and financial market transactions, followed by the introduction of advanced features such as programmability, composability, and tokenization between 2029 and 2030. According to Bank Indonesia's "2030 Payment System Blueprint," the digital Rupiah will be built on distributed ledger technology.

Following the U.S. "GENIUS Act," Canada Plans to Legislate Regulation of Fiat-Backed Stablecoins

The Canadian government announced plans to introduce stablecoin regulatory legislation in the 2025 federal budget, requiring fiat-backed stablecoin issuers to maintain sufficient reserves, establish redemption policies, and implement risk management measures, including mechanisms to protect personal and financial data. This plan follows the U.S. stablecoin regulatory law "GENIUS Act," which was passed in July.

The Bank of Canada will allocate a budget of CAD 10 million in the 2026-2027 fiscal year to ensure smooth implementation of the regulations, with an expected annual expenditure of CAD 5 million to be borne by stablecoin issuers regulated under the Retail Payment Activities Act.

Coinbase Canada CEO Lucas Matheson expressed optimism about the proposal, believing it will fundamentally change how Canadians use currency and the internet. Currently, the stablecoin market size is $309.1 billion, and it is expected to grow to $2 trillion by 2028.

Additionally, Canadian payment platform Tetra Digital has raised $10 million to create a digital version of the Canadian dollar, with investors including Shopify, Wealthsimple, and the National Bank of Canada. Notably, Canada abandoned its plan to issue a central bank digital currency (CBDC) in September 2024.

UK Plans to Introduce Stablecoin Regulation in Sync with the U.S.

According to Bloomberg, Bank of England Deputy Governor Sarah Breeden stated that UK stablecoin rules will be implemented "as quickly as those in the U.S.," denying that the UK is lagging in regulatory progress. She noted that due to the reliance on commercial bank lending for UK housing mortgages, the UK is in a different position than the U.S. regarding setting limits on stablecoin holdings. The regulatory framework is being advanced collaboratively by the Bank of England and regulatory bodies, aiming to strike a balance between payment and financial stability. Key areas of focus include issuer regulation, reserve asset security, and access to payment systems.

Local Developments

Zhaojin Mining Enters Gold RWA Tokenization Sector, Partners with Ant Group's SigmaLayer

According to Hong Kong Zhaojin Mining Company, on November 3, 2025, during Hong Kong FinTech Week, Zhaojin Mining signed a strategic cooperation memorandum with SigmaLayer, a subsidiary of Ant Group. The two parties will collaborate in three major areas: digitalization of gold assets, intelligent supply chain risk control, and credible value transmission in ESG, leveraging blockchain, tokenization technology, and AI capabilities to promote the digital transformation and upgrading of the traditional gold industry.

This collaboration aims to address traditional operational pain points in the gold industry through technological empowerment. The two parties plan to explore converting physical gold assets into on-chain digital assets and building a full lifecycle traceability system; simultaneously, they will utilize AI and blockchain technology to optimize supply chain risk control and enhance industry chain efficiency. Additionally, they will create a blockchain-based ESG credible tracking platform to promote the industry's move towards sustainable development.

Franklin Templeton Launches First Tokenized Money Market Fund in Hong Kong

According to The Block, Franklin Templeton has launched the first tokenized money market fund in Hong Kong, named "Franklin OnChain U.S. Government Money Fund," which is backed by short-term U.S. Treasury securities and issues shares via blockchain while recording ownership. This initiative is the first project under the Hong Kong Monetary Authority's "Fintech 2030" plan, which aims to encompass AI and tokenization ecosystem development. The fund is participating in the HKMA's "Project Ensemble" sandbox, collaborating with HSBC and OSL to test tokenized deposits and fund flows, aiming to achieve near-instant settlement between traditional and on-chain systems. A report by Ripple and BCG predicts that the scale of physical asset tokenization could reach approximately $19 trillion by 2033.

Project Updates

PeckShield: Staked Stream USD (XUSD) Depegged by Approximately 23%

According to blockchain security firm PeckShieldAlert, the stablecoin Staked Stream USD (XUSD) has currently depegged and dropped by approximately 23%. The project is managed by Stream Finance, which reminds users to be cautious of risks.

Yei Finance announced this morning on platform X that, due to the current market conditions of fastUSD, it has temporarily suspended the operation of the protocol as a precaution. The team is actively investigating and will provide updates within the next 24 hours. As of now, Yei Finance has not released further updates.

According to reports, Elixir announced last year that deUSD would be the sole support for Sei's yield stablecoin, fastUSD. Previously, analysts stated that Stream Finance's $93 million loss could lead to over $285 million in risk exposure, with the largest single risk exposure belonging to Elixir's deUSD, which lent $68 million in USDC to Stream, accounting for about 65% of deUSD's total reserves.

Elixir's official Twitter account announced that the stablecoin deUSD has officially been retired and no longer holds any value. The platform will initiate a USDC compensation process for all deUSD and its derivatives (such as sdeUSD) holders. The affected range includes collateralizers on lending platforms, AMM LPs, Pendle LPs, and others. Elixir also warned users not to purchase or invest in deUSD through AMM or other channels.

JPMorgan Executes First Fund Service Transaction on Its Kinexys Blockchain

According to The Block, JPMorgan is expanding the application of its Kinexys blockchain from payment and repurchase transactions to the back-office operations of the private equity market. The bank announced on Thursday that its Asset and Wealth Management division, in collaboration with fund manager Citco, completed its first transaction using a new system called Kinexys Fund Flow. This system automates the recording of alternative investment fund cash activities on a private blockchain. The tool tokenizes investor records and uses smart contracts to automatically transfer cash between JPMorgan brokerage accounts and fund managers, replacing the currently dominant manual reconciliation and wire transfer methods in private fund operations. The system operates on the same permissioned Kinexys network that supports JPMorgan's tokenized deposit and payment products. Kinexys Fund Flow is expected to be fully rolled out early next year, with more features to be launched gradually before 2026. Citco stated that this technology could reduce error rates and costs across the industry, while JPMorgan views it as part of a broader initiative to modernize alternative asset distribution and services.

WisdomTree Launches 14 Tokenized Funds on Plume Blockchain and Partners with Chainlink to Onboard NAV Data for Tokenized Private Credit Fund CRDT](https://www.panewslab.com/zh/articles/671b2b54-522a-456f-814a-bee81eef3d0d)

According to CoinDesk, asset management company WisdomTree has launched 14 tokenized funds on the Plume blockchain, broadening access for institutional investors to regulated on-chain investment products. Users can invest in these funds through the WisdomTree Connect platform, including the company's government money market digital fund and the CRDT private credit and alternative income fund, allowing investors to hold, transfer, and settle positions directly on the Plume blockchain network. As part of this initiative, Galaxy Digital announced it would invest $10 million in WisdomTree's government money market digital fund, highlighting early institutional investor participation. It is reported that Plume integrates KYC and AML compliance directly at the protocol level, providing built-in security measures such as wallet screening and sanctions enforcement.

According to a press release, oracle platform Chainlink and asset management company WisdomTree announced a partnership to utilize Chainlink's DataLink service to provide net asset value (NAV) data for WisdomTree's private credit and alternative income digital fund (token: CRDT) on the Ethereum mainnet. This initial collaboration starts with the CRDT fund, with potential future expansion to WisdomTree's other tokenized funds.

Stablecoin Company Zerohash Obtains EU MiCA License in the Netherlands

According to Cointelegraph, Zerohash's European branch announced on Sunday that it has obtained a license under the EU's Markets in Crypto-Assets Regulation (MiCA) from the Dutch Authority for the Financial Markets (AFM), enabling the company to offer stablecoins and crypto products to banking institutions, fintech companies, and payment platforms in 30 European Economic Area (EEA) countries. The AFM's official registry confirms that Zerohash has become a registered Crypto Asset Service Provider (CASP). This approval allows Zerohash's European branch to provide core support for organizations exploring tokenized assets, stablecoins, and other blockchain-based financial products.

According to Chainlink's official announcement, UBS today announced the successful completion of the world's first end-to-end tokenized fund workflow in a production environment using the Chainlink DTA technology standard.

The UBS Dollar Money Market Investment Fund token ("uMINT") is a money market investment fund based on Ethereum distributed ledger technology. This marks the first time uMINT has completed subscription and redemption requests on-chain, demonstrating the ability to achieve seamless and automated fund operations on-chain, thereby enhancing efficiency and utility gains. In this instant transaction, DigiFT acted as the on-chain fund distributor, successfully requesting and processing the settlement of uMINT shares using the Chainlink DTA standard.

This new end-to-end tokenized fund workflow covers every stage of the fund lifecycle, including order receipt, execution, settlement, and data synchronization between all on-chain and off-chain systems.

Pionex Launches S1 Points Season and M Credit Incentive Mechanism on MSX Platform

According to the official announcement, the world's first decentralized trading platform for U.S. stocks, Pionex MSX, has officially launched the S1 Points Season and M Credit incentive mechanism today. The platform will track points for real trading and holding behaviors in U.S. stock spot, crypto contracts, and U.S. stock contracts, with automatic settlement of the previous day's points at 10:00 AM (UTC+8) daily.

M Credit serves as a core indicator of user trading activity and contribution, and will be used in the future for the distribution and incentives of the platform token $MSX. The calculation of M Credit not only considers trading volume but also examines position duration, profit and loss performance, and team Boost levels to ensure fair incentives. The team Boost adopts a T+2 update mechanism, automatically synchronizing bonuses, with historical trading points included in community incentives.

Dinari Utilizes Chainlink to Tokenize Upcoming S&P DJI Cryptocurrency Market Index

According to CoinDesk, tokenized equity company Dinari is obtaining pricing data from the oracle network Chainlink to bring the upcoming cryptocurrency-focused index from S&P Dow Jones Indices (S&P DJI) on-chain. The S&P Digital Markets 50 Index will track 35 publicly listed companies involved in blockchain technology and 15 mainstream cryptocurrencies. Dinari will use its "dShares" product to create tokens for this index, allowing investors to access both traditional finance (TradFi) and cryptocurrency markets through a single digital asset. Each dShare token is backed 1:1 by underlying stocks and held by a regulated custodian, ensuring rights such as dividend distribution and redemption. Although S&P Dow Jones Indices does not endorse the token itself, the index provider confirmed that Chainlink's integration ensures that the supporting data meets standards of transparency and reliability.

According to the official blog, Tether's asset tokenization platform "Hadron by Tether," global asset management group KraneShares, and regulated tokenized securities platform Bitfinex Securities have reached a strategic agreement aimed at accelerating the development and application of tokenized securities in global markets. The combination of the three parties' strengths will help assess institutional demand, validate tokenized product structures, and promote the integration of real-world assets. This collaboration will focus on expanding institutional investor participation in the tokenized market, leveraging El Salvador's pioneering digital asset regulatory framework. As institutional investors' interest in real-world asset tokenization continues to grow, this partnership will lay the foundation for product innovation, operational efficiency, and cross-border investor access.

Insights

PANews Overview: The xUSD issued by Stream Finance claims to be a DeFi stablecoin using a "risk-neutral" strategy, but in reality, it is a non-transparent "tokenized hedge fund"; it invested a large amount of user funds into opaque off-chain high-risk trades (such as shorting volatility), suffering a loss of about $100 million during market black swan events like "Red Friday," leading to insolvency. At the same time, it engaged in complex recursive lending with leverage and signed off-chain agreements that granted certain privileged investors (like Elixir) priority repayment rights in bankruptcy, ultimately causing its stablecoin price to severely depeg and plummet, exposing serious flaws in transparency, risk management, and leverage control, ringing alarm bells for the entire DeFi industry.

Canton Launches Over $500 Million DAT: Foundation's Sole Support, RWA Scale Exceeds $6 Trillion

PANews Overview: Canton is attracting Wall Street giants like Goldman Sachs and JPMorgan through its unique privacy and compliance technology tailored for traditional financial institutions, pushing the on-chain processing scale of RWA to over $6 trillion. Meanwhile, Nasdaq-listed Tharimmune is deeply participating in the Canton ecosystem through a private funding round of up to $540 million to establish a digital asset treasury, marking a significant attempt by traditional capital to make large-scale bets and access this "on-chain Wall Street" central system, which aims to bridge traditional finance and the crypto world and is committed to becoming the next generation of global financial infrastructure through a regulated compliance path.

PANews Overview: In the context of tightening regulations, Figure has chosen a distinctive "proactive compliance" path for its yield-generating token YLDS—rather than attempting to evade regulation, it proactively acknowledges its "securities" nature to the U.S. SEC and, through clever legal structuring, clearly defines the token's returns as "debt interest" based on real U.S. Treasury bonds rather than "investment dividends." This successfully brings traditional financial yield assets onto the blockchain in token form within the regulatory framework, providing the entire industry with a replicable model for combining on-chain financial innovation with traditional securities regulations, moving from the gray area to transparency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。