From the basic wallet configuration and asset preparation, to the core operations of stablecoin deposits and TRX staking, and then to advanced yield strategy combinations, the TRON ecosystem provides a complete path for earning returns.

In today's diversified public chain ecosystem, TRON is becoming an important choice for more and more investors to allocate assets, thanks to its comprehensive yield advantages in the DeFi ecosystem, stablecoins, and platform tokens.

Currently, the risk-free yield rate of stablecoins on the TRON chain can reach 8%, significantly higher than the 3%-5% level of other mainstream public chains, while its platform token TRX maintains a stable staking yield of about 6.88%. Meanwhile, data from CoinGecko shows that the TRX price has achieved a 78% annual increase, forming a dual advantage of "yield + appreciation."

This performance is attributed to the solid ecological foundation of TRON. As the world's largest stablecoin circulation network, TRON carries more than half of the global USDT issuance, injecting ample liquidity into the ecosystem. Its core protocol, JustLend DAO, provides users with a continuous and stable high-yield entry through functions such as lending and TRX staking. At the same time, core protocols like JustLend DAO, SUN.io, USDD, and SunPerp are deeply integrated through functions such as staking, lending, and trading, weaving together a closely cooperative DeFi ecosystem that drives the continuous circulation of intrinsic value.

On this basis, investors can participate in TRON ecosystem yields through systematic investment strategies. From basic wallet configuration and asset preparation, to core operations of stablecoin deposits and TRX staking, and then to advanced yield strategy combinations, the TRON ecosystem provides a complete path for earning returns. The subsequent operation guide will elaborate on specific operational steps and methods, providing practical configuration references for investors.

1. JustLend DAO Energy Rental

In the TRON network, any on-chain interaction requires the consumption of "Energy," which is the basic resource for executing smart contracts and transferring funds. Regarding transaction fees on the TRON chain, if users have a high frequency of transactions, they can rent energy at the Energy Rental center on JustLend DAO. After obtaining energy, the on-chain transaction fees for each payment can be significantly reduced, saving considerable costs. This model is not only flexible and efficient, precisely meeting the interaction needs of short-term high-frequency users, but also significantly lowers the cost of acquiring energy, helping users "save as they rent," greatly enhancing capital utilization efficiency.

User Operation Guide

- Preparation Stage: Visit the JustLend DAO official website (https://justlend.org/) and connect a wallet plugin that supports the TRON network, such as TronLink, switching to the TRON mainnet.

- Rent Energy

- First, go to the "Energy Rental" page from the JustLend DAO navigation page.

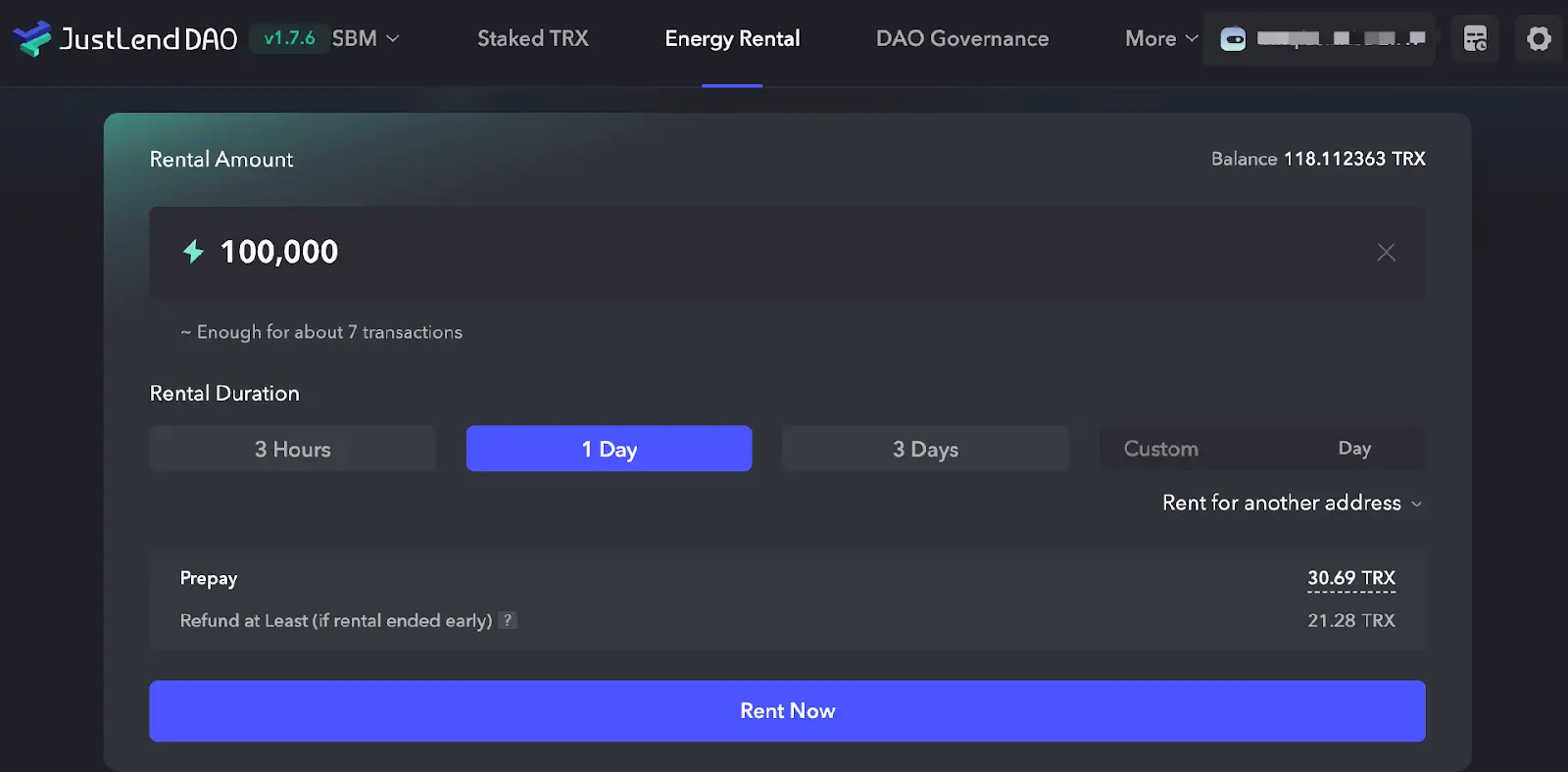

- Enter the desired amount of energy to rent and the rental duration. The system will automatically calculate the required pre-deposited TRX, the TRX to be returned upon termination, and the number of supported transactions in real-time, allowing users to rent as needed. After confirming, click "Rent Now" and authorize in the wallet.

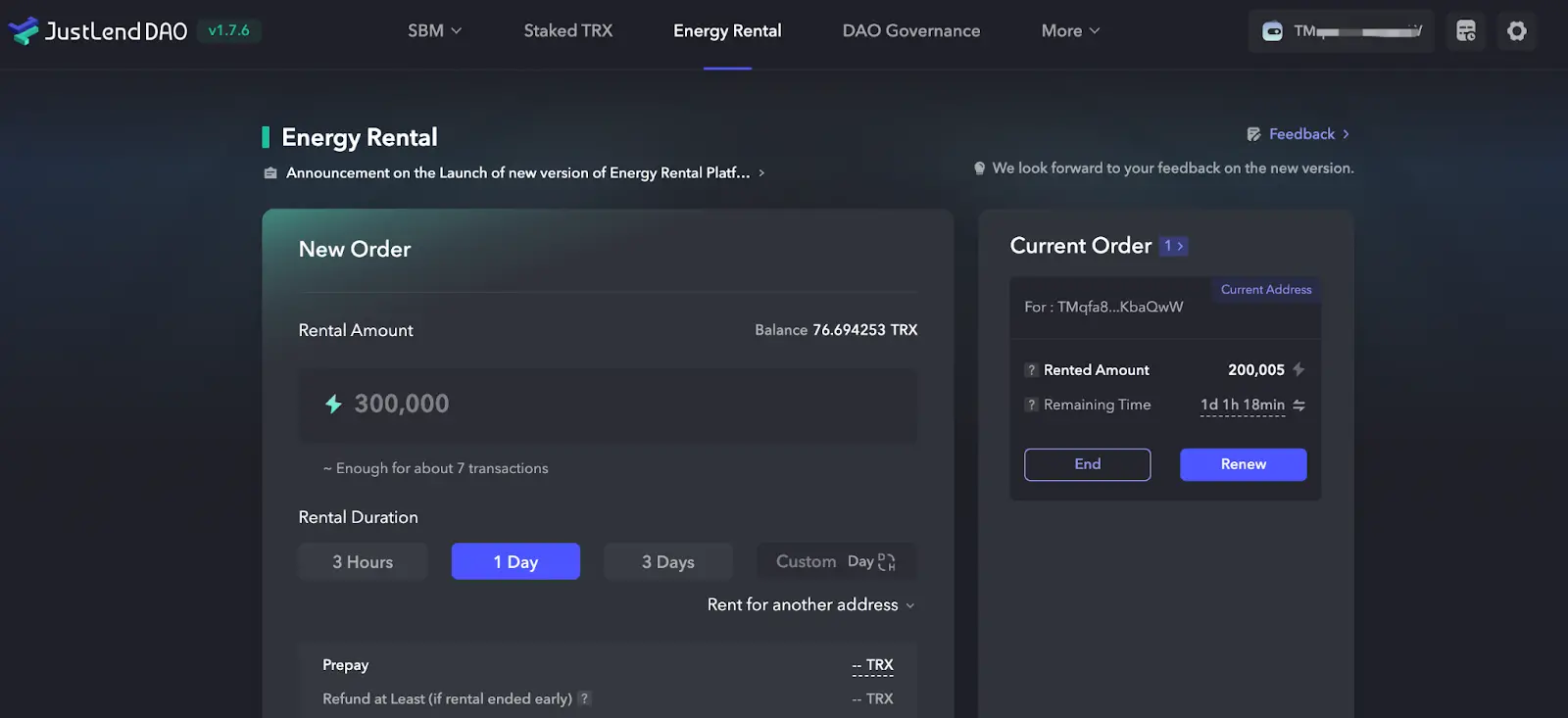

- After a successful rental, the order will automatically appear on the right side of the "Current Order" page.

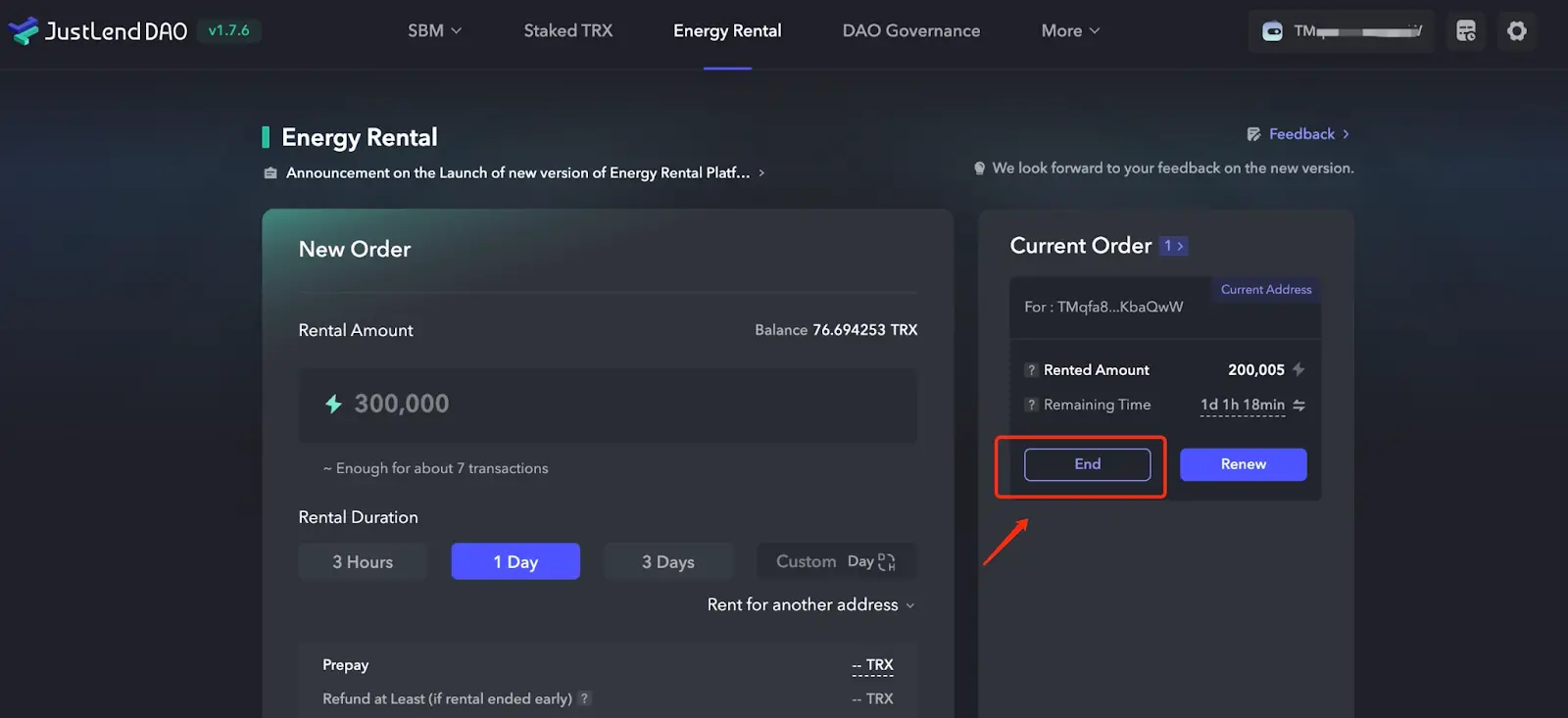

- Return Energy

Users need to terminate the rental before the rental period ends; otherwise, part of the deposit will be returned. Click the "End" button in the order, and the pop-up page will display the amount to be returned. After confirming it is correct, click "Confirm" and authorize the termination of the rental in the wallet.

Once the account has sufficient energy, users can carry out subsequent operations such as lending, staking, and adding liquidity at a lower cost, or achieve asset appreciation through circular arbitrage.

2. JustLend DAO Lending Operation Steps

In the TRON ecosystem, JustLend DAO serves as the official lending protocol, not only as the core platform for users to lend and stake TRX but also as the central hub for all DeFi activities in the ecosystem. As of November 3, data shows that the deposit scale of JustLend DAO (Top 3 tokens) reached $3.5 billion, while the borrowing scale (Top 3 tokens) was $120 million. These figures confirm its vitality and leading advantage as a top protocol in the TRON ecosystem.

User Operation Guide

- Preparation Stage

- Visit the JustLend DAO official website (https://justlend.org/), and connect a wallet that supports the TRON network, such as TronLink.

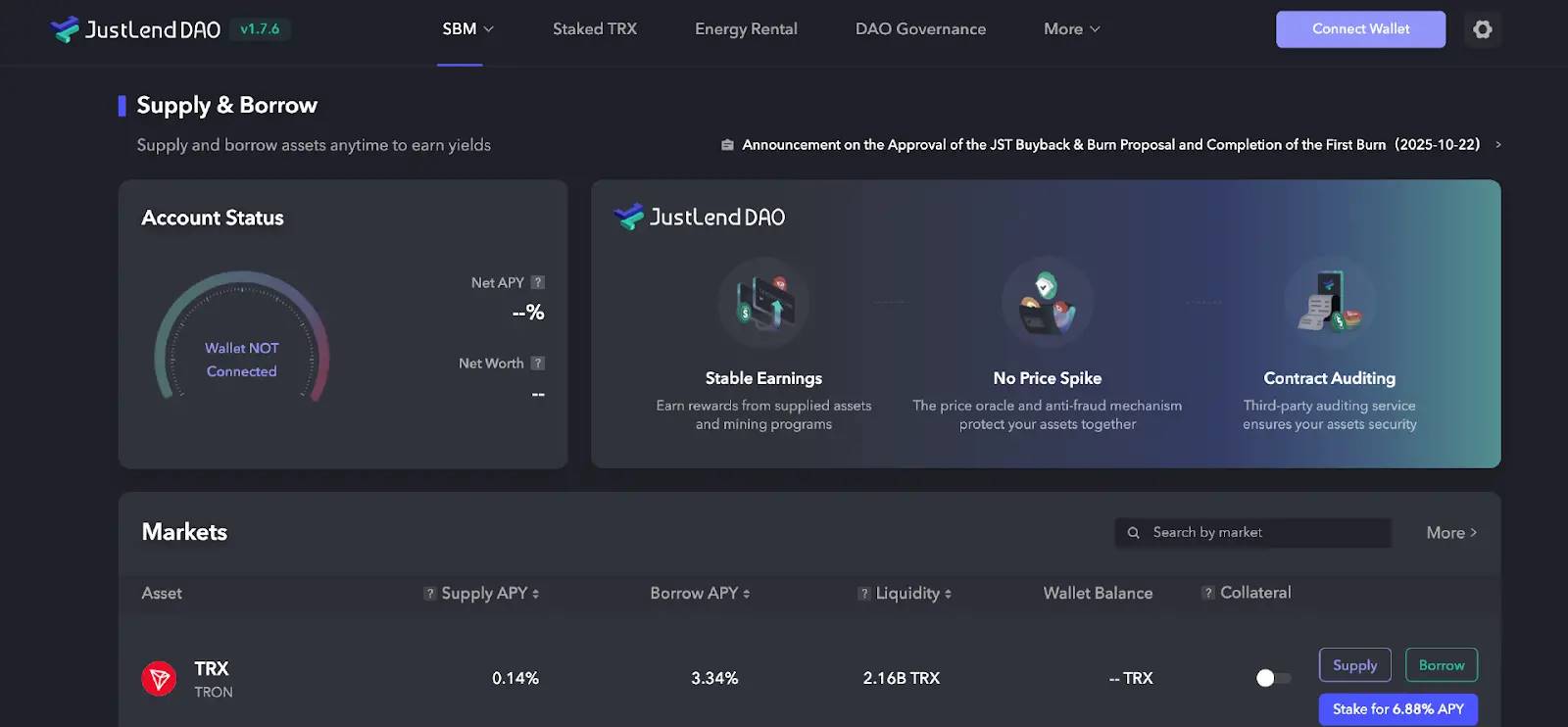

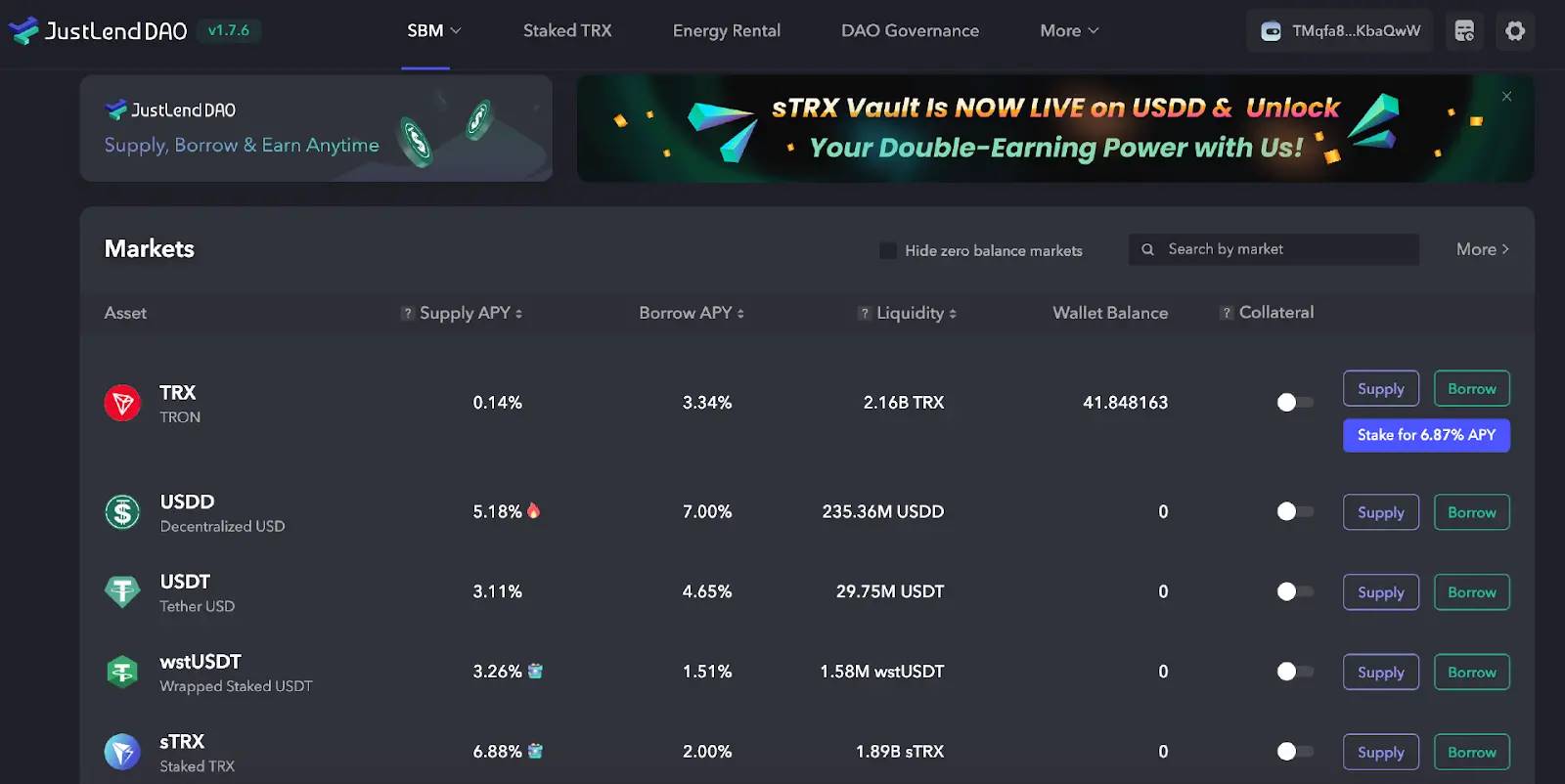

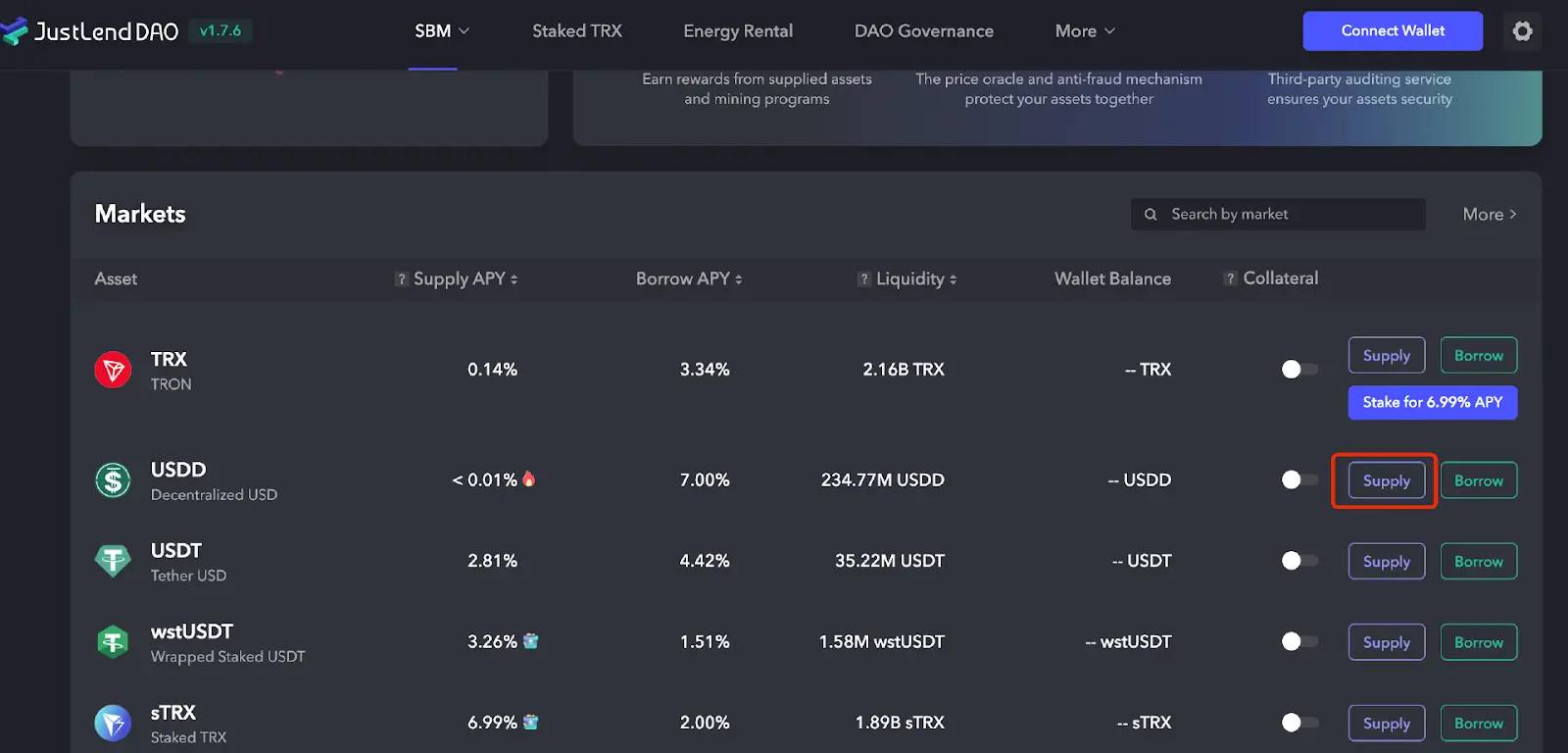

- In the platform's "SBM" interface, you can see a list of various assets supported by the platform, such as TRX, USDT, USDD, etc.

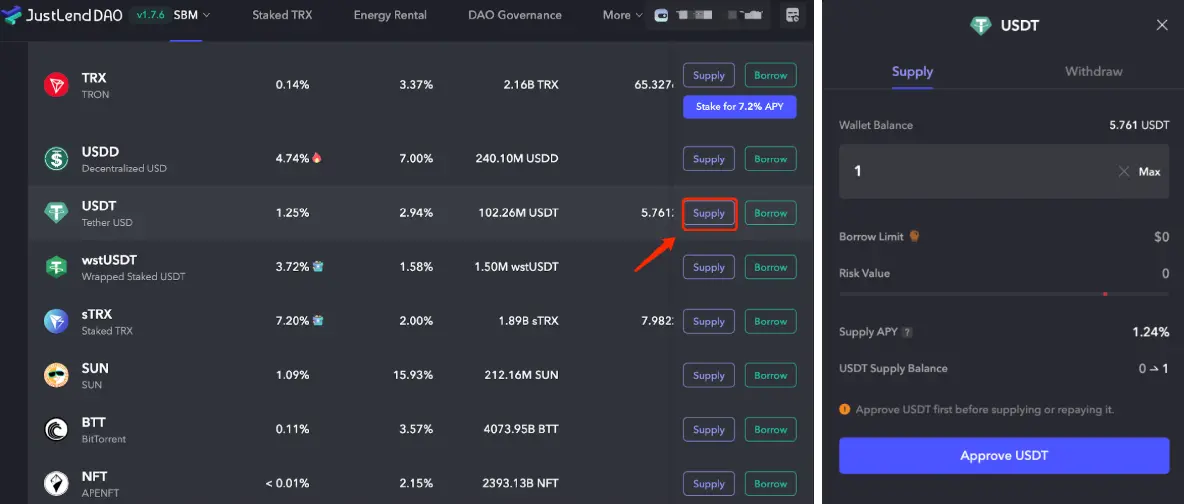

- Make a Deposit

- Choose the token you want to deposit, such as USDT, click Supply, enter the amount of the token in the pop-up page, click "Approve USDT," and sign the authorization in the wallet.

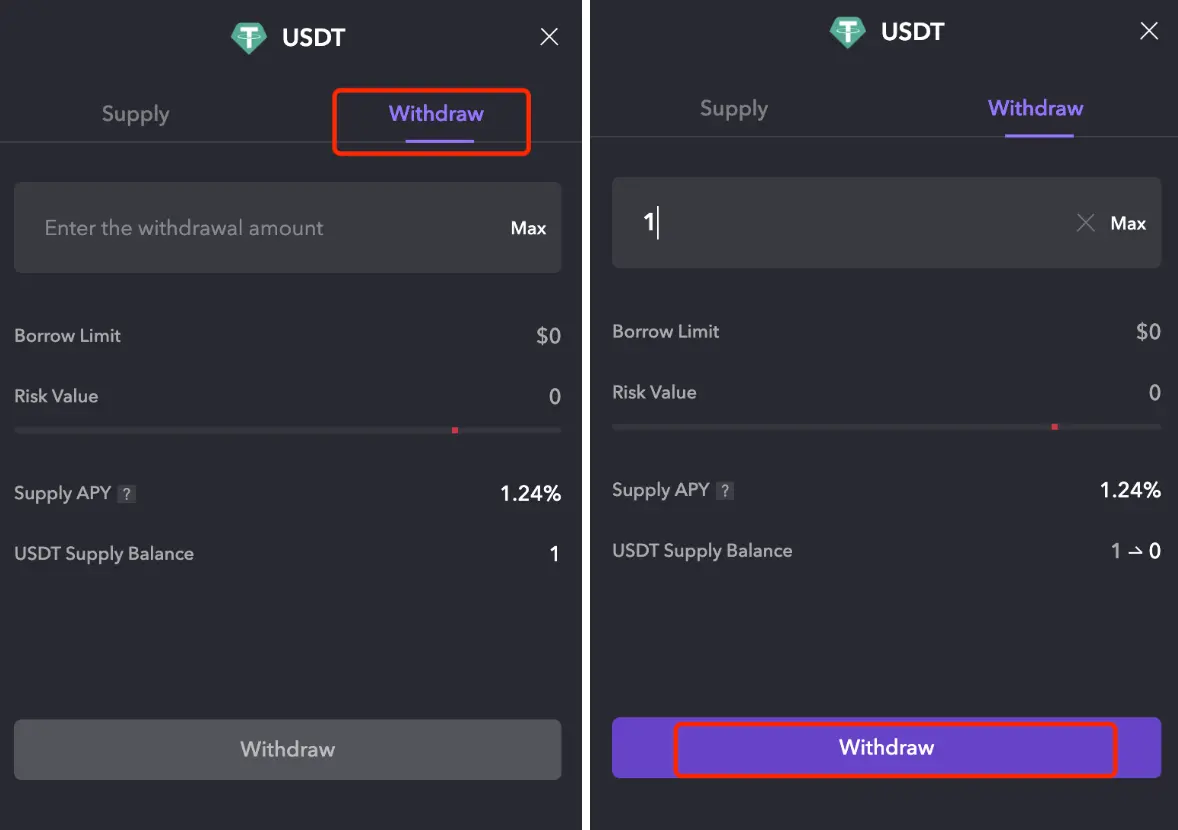

- Withdraw Deposit: On the Supply page, click to switch to "Withdraw" to perform the withdrawal operation. Enter the amount of the token you want to withdraw, click the "Withdraw" button below, and authorize in the wallet.

- Make a Loan

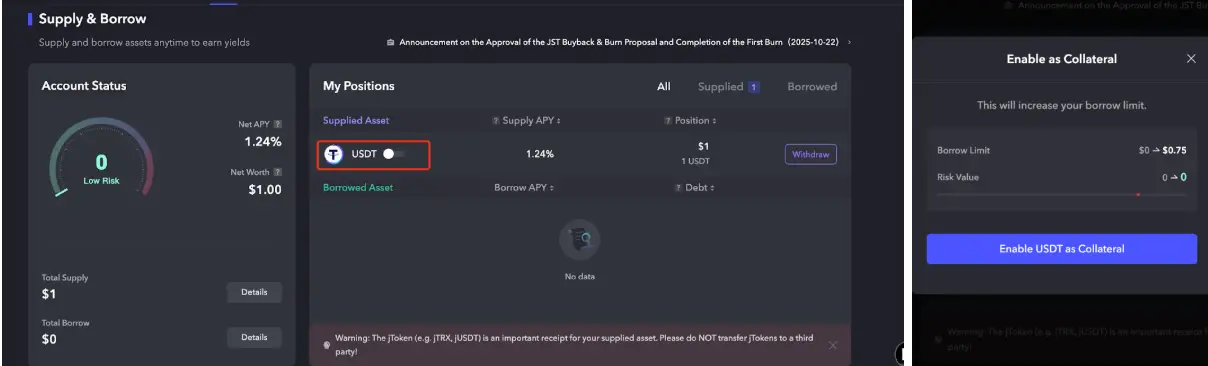

- Collateralize Assets: If users need to borrow a certain asset from JustLend, they must first deposit on JustLend, then collateralize the stored tokens to borrow any supported asset from the protocol, with the interest rate determined by the protocol's utilization rate (the percentage of current borrowed liquidity to total liquidity). After depositing, users can click the "Open" button in the "My Positions" section at the top of the SBM page to collateralize the assets.

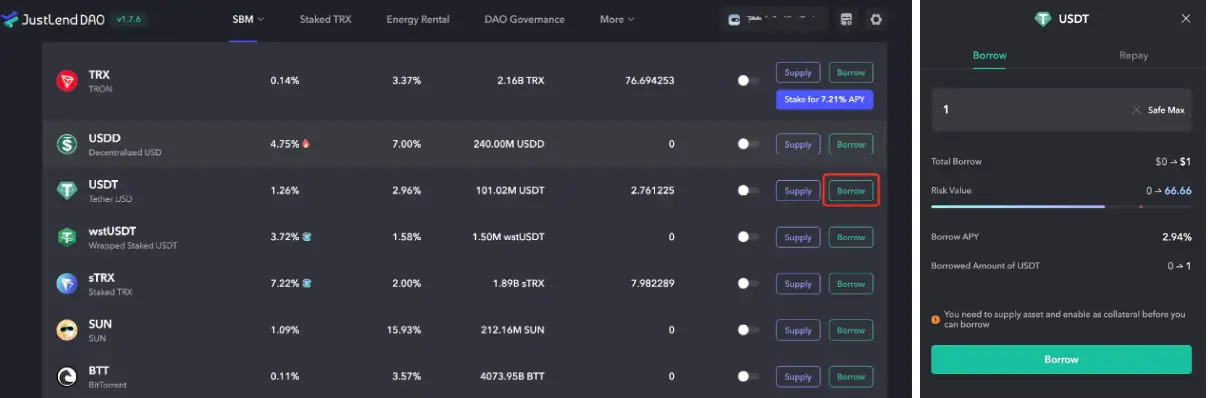

- Make a Loan: In the SBM market, select the asset you want to borrow, click the "Borrow" button, enter the loan amount, and confirm the transaction in the wallet. Note that borrowing has collateralization requirements, and users need to monitor and maintain a healthy collateral level to avoid liquidation risks.

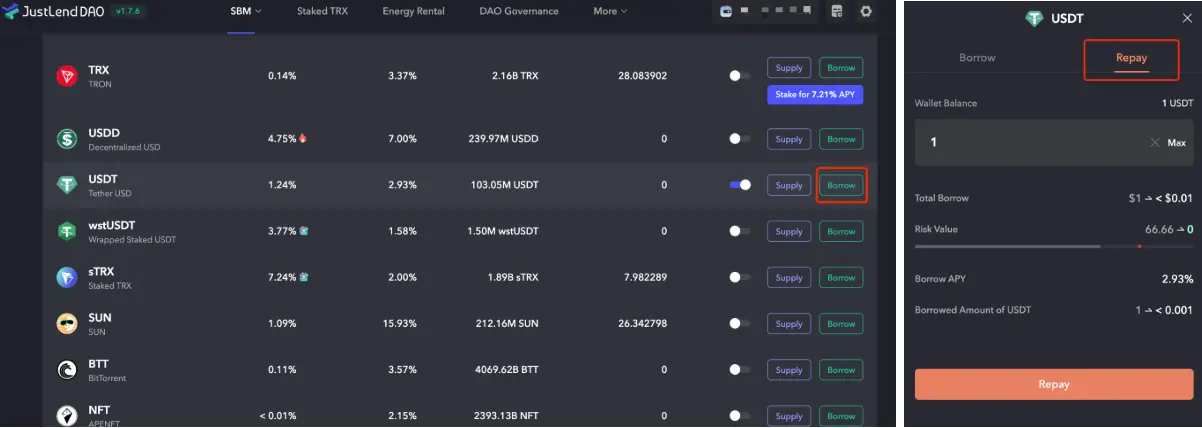

- Repayment: In the SBM market, select the asset you want to repay, click the "Borrow" button, switch to the "Repay" page, enter the repayment amount, confirm it is correct, click the "Repay" button below, and authorize in the wallet.

3. USDD Staking to Earn Returns

As the core decentralized stablecoin of the TRON ecosystem, USDD builds a unique high-yield channel for users through its innovative over-collateralization mechanism and deep integration within the ecosystem. Its circulation has exceeded $410 million. Users can directly hold its yield-bearing token sUSDD to easily obtain about 12% annualized returns, or participate in advanced strategies through sTRX Vault: stake TRX to obtain sTRX (approximately 6.88% annualized return), then collateralize sTRX to mint USDD, and deposit it into the JustLend DAO protocol for secondary earnings. This combination strategy can push the comprehensive annualized return rate of TRX beyond 13%.

User Operation Guide

- Beginner Operation: Stake USDD

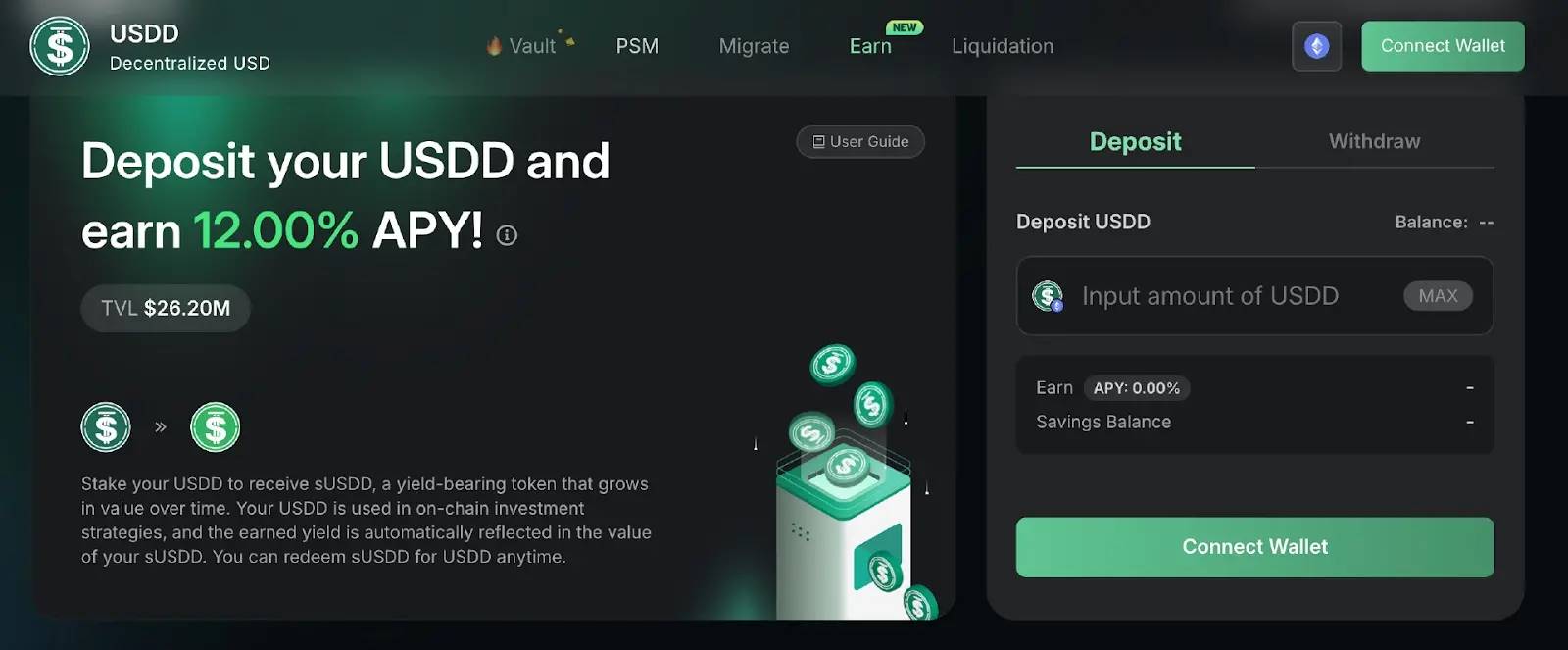

Staking USDD allows you to obtain sUSDD, which is a yield-bearing token that automatically earns interest. Users can withdraw funds at any time without waiting for a lock-up period.

- Preparation Stage: Enter the USDD official platform (https://usdd.io/) on the "Earn" page, select the Ethereum/BNB chain network, and connect your wallet.

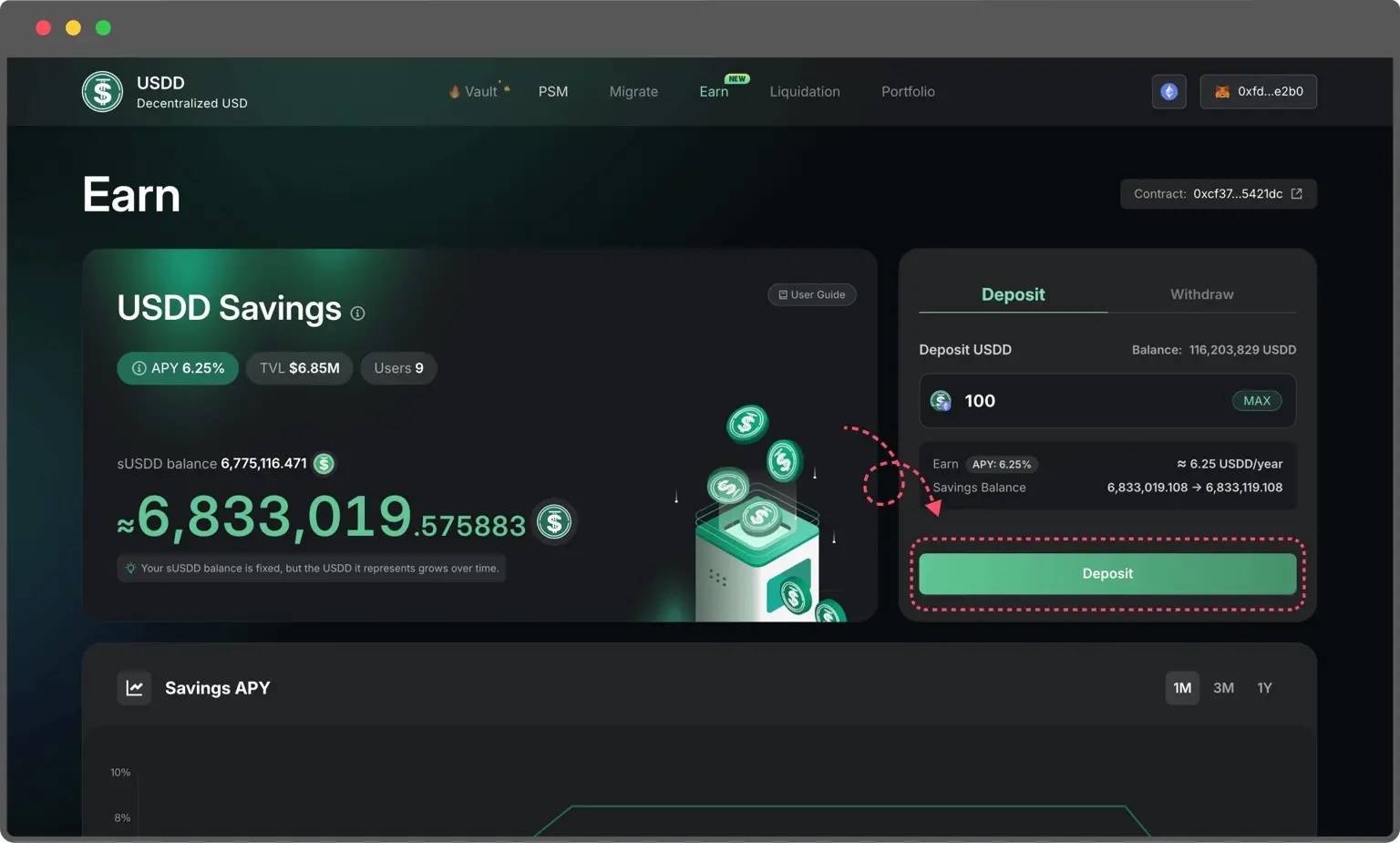

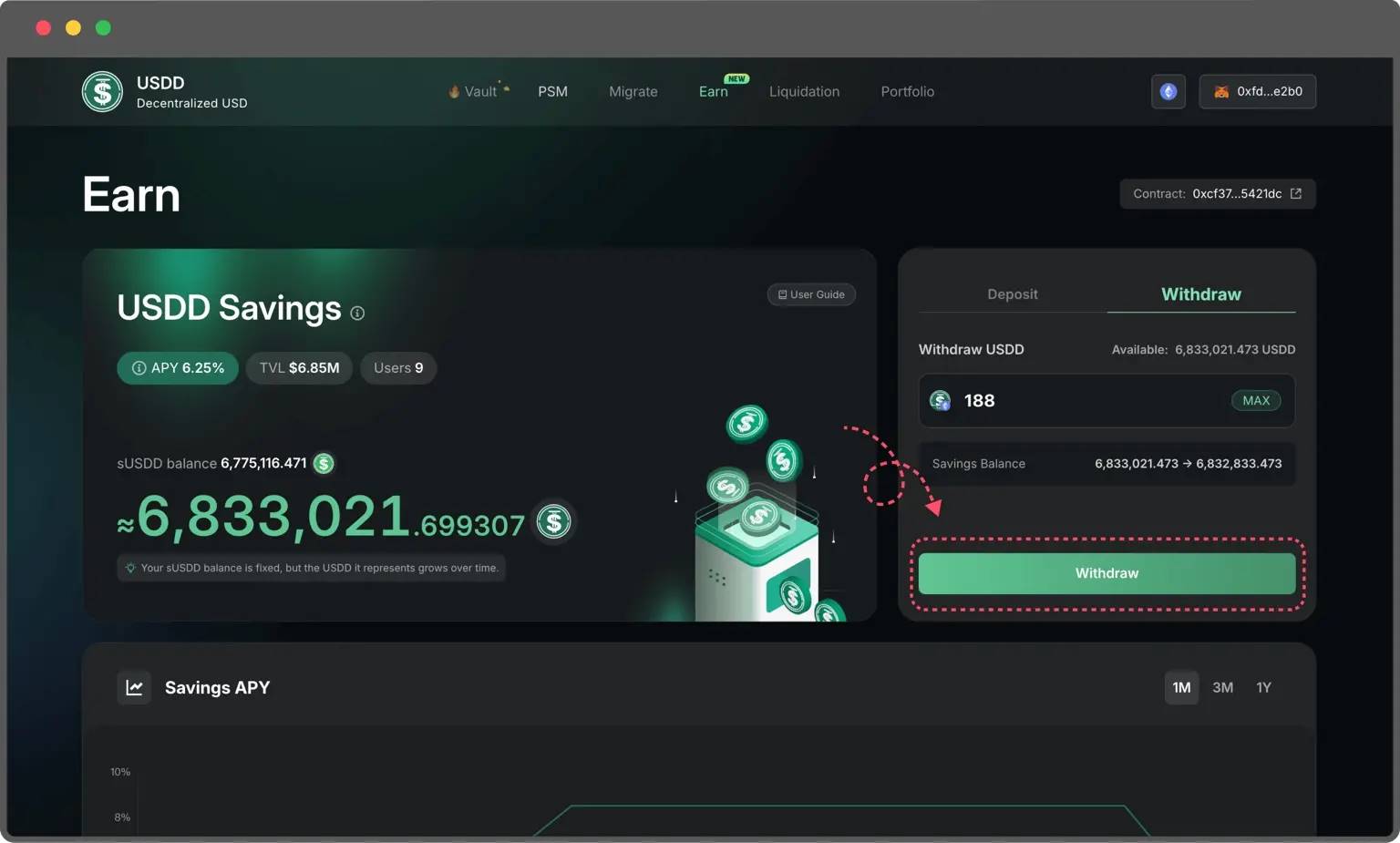

- Stake USDD: In the input box on the right, enter the amount of USDD you want to stake, click "Deposit" below, and confirm the transaction in the wallet. After the transaction is confirmed, the left box on the page will display the sUSDD balance and the corresponding USDD value. Over time, the USDD value of sUSDD will automatically increase, reflecting the earnings obtained.

- Withdraw USDD: When withdrawing, users will receive their initial deposit plus accumulated earnings. In the right "Withdraw" section, enter the amount of USDD to withdraw, click the "Withdraw" button below, and confirm the transaction in the wallet. After confirmation, sUSDD will be burned, and the corresponding amount of USDD will be received in the wallet.

- Advanced Operation: Minting USDD through sTRX and then staking for earnings

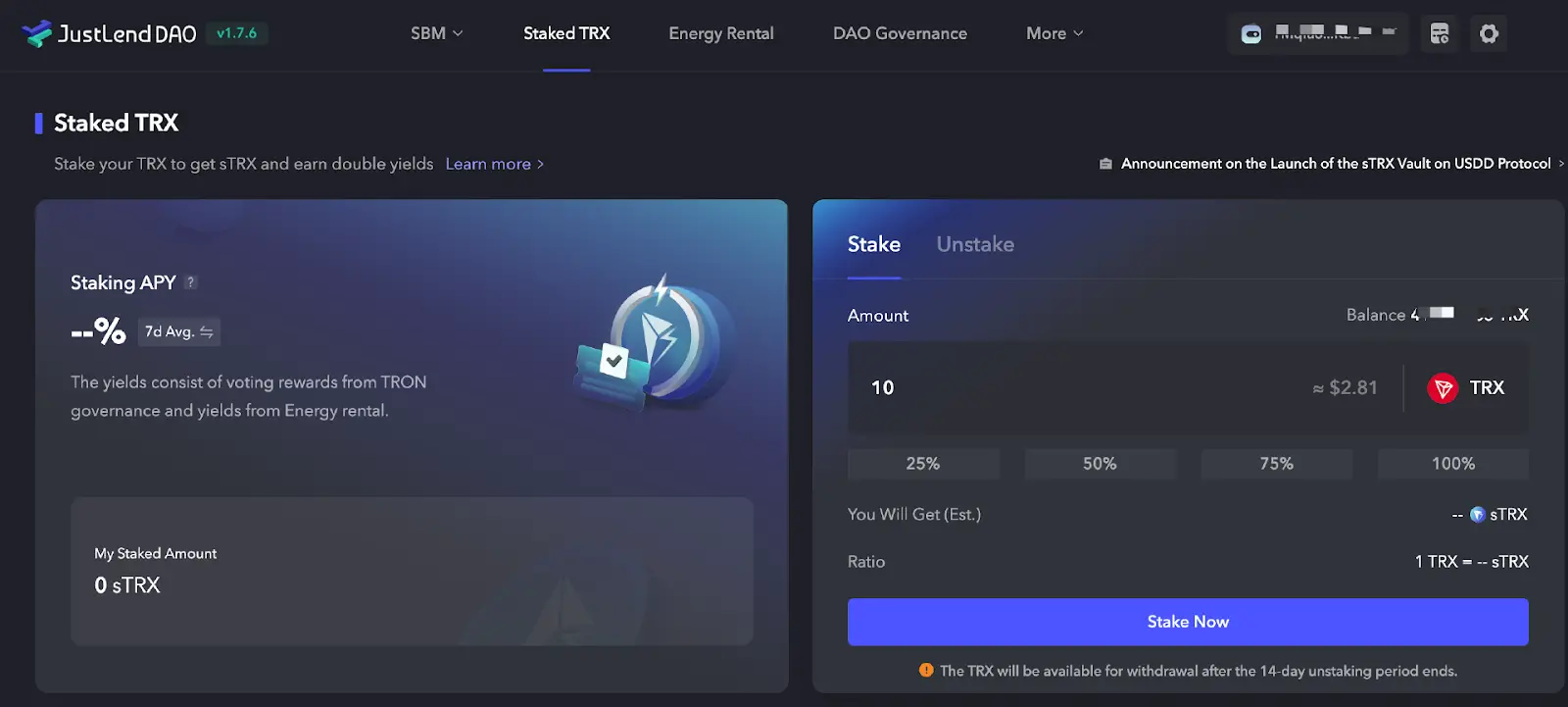

- Stake TRX for earnings: In the JustLend DAO "Staked TRX" interface, enter the amount of TRX you want to stake, click "Stake Now," and stake TRX to obtain the liquid staking certificate sTRX. This process will generate staking earnings for TRX, with an annualized return of approximately 6.88%.

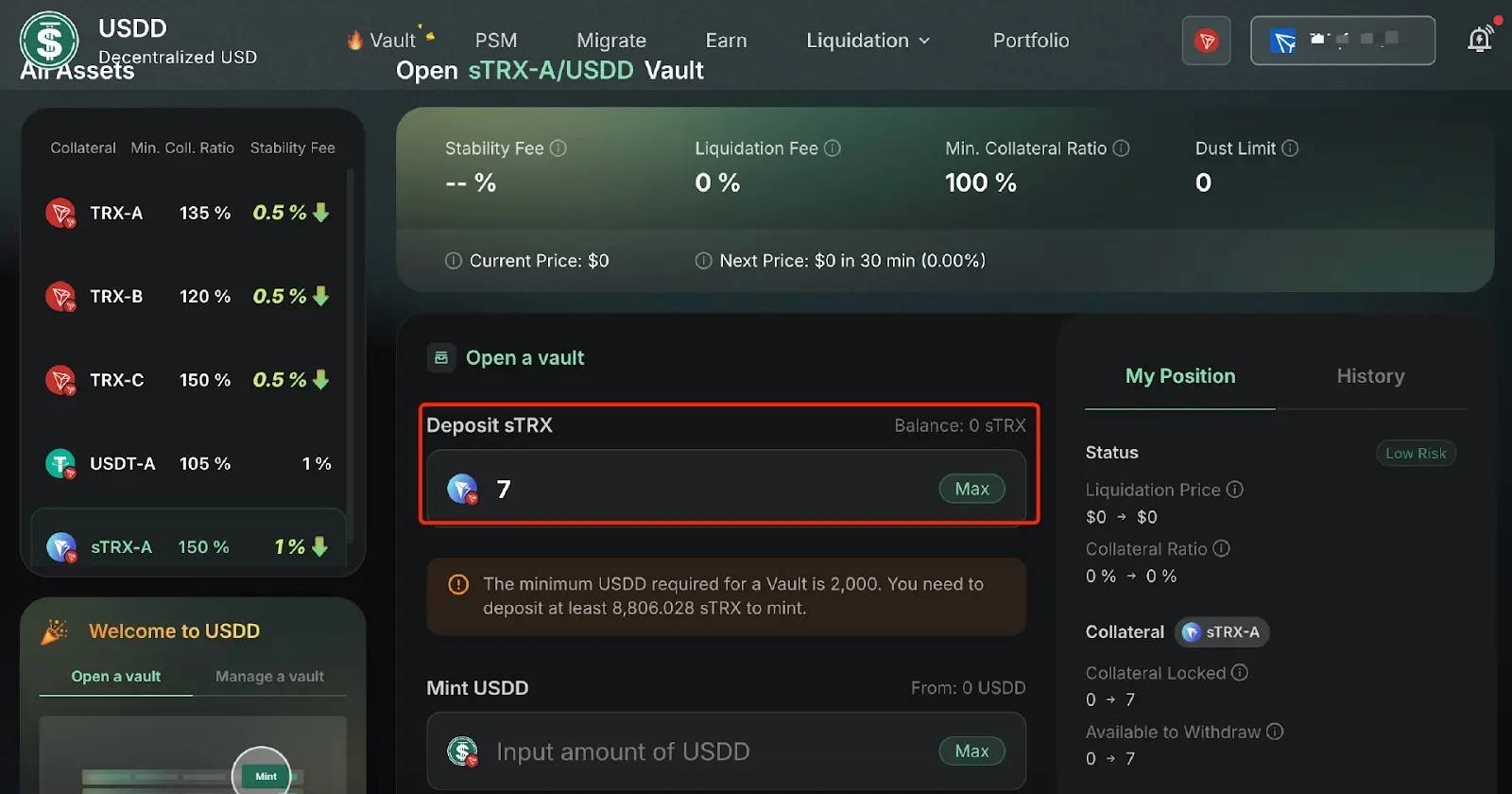

- Mint USDD: Visit the USDD official platform, find the sTRX option on the Vault page, and click the "Mint" button.

Use the held sTRX as collateral to mint USDD. In the "Deposit sTRX" input box, enter the amount of sTRX you want to deposit and authorize the confirmation in the wallet. It is important to note that the minimum minting amount for USDD is 2000, requiring at least approximately 8,806.028 sTRX to mint. This process is over-collateralized, so it is essential to maintain a stable collateralization ratio.

- Stake USDD for earnings: After successfully minting USDD, you can deposit it back into the USDD deposit market on JustLend DAO to earn deposit interest (see the specific operational steps in the second part of this tutorial). By using the combination strategy of "staking TRX to earn sTRX + minting USDD and depositing to earn interest," users can achieve a comprehensive annualized return rate exceeding 13%, which may even be higher during active market conditions.

4. SUN.io Liquidity Operations

SUN.io, as the flagship one-stop DeFi platform of the TRON ecosystem, has consistently ranked among the top three in the TRON ecosystem and among the leading global DEXs in terms of TVL. SUN.io integrates professional stablecoin exchange engine SunCurve, decentralized token exchange SunSwap, and decentralized perpetual contract trading platform SunPerp, providing users with an efficient and low-cost trading experience.

User Operation Guide

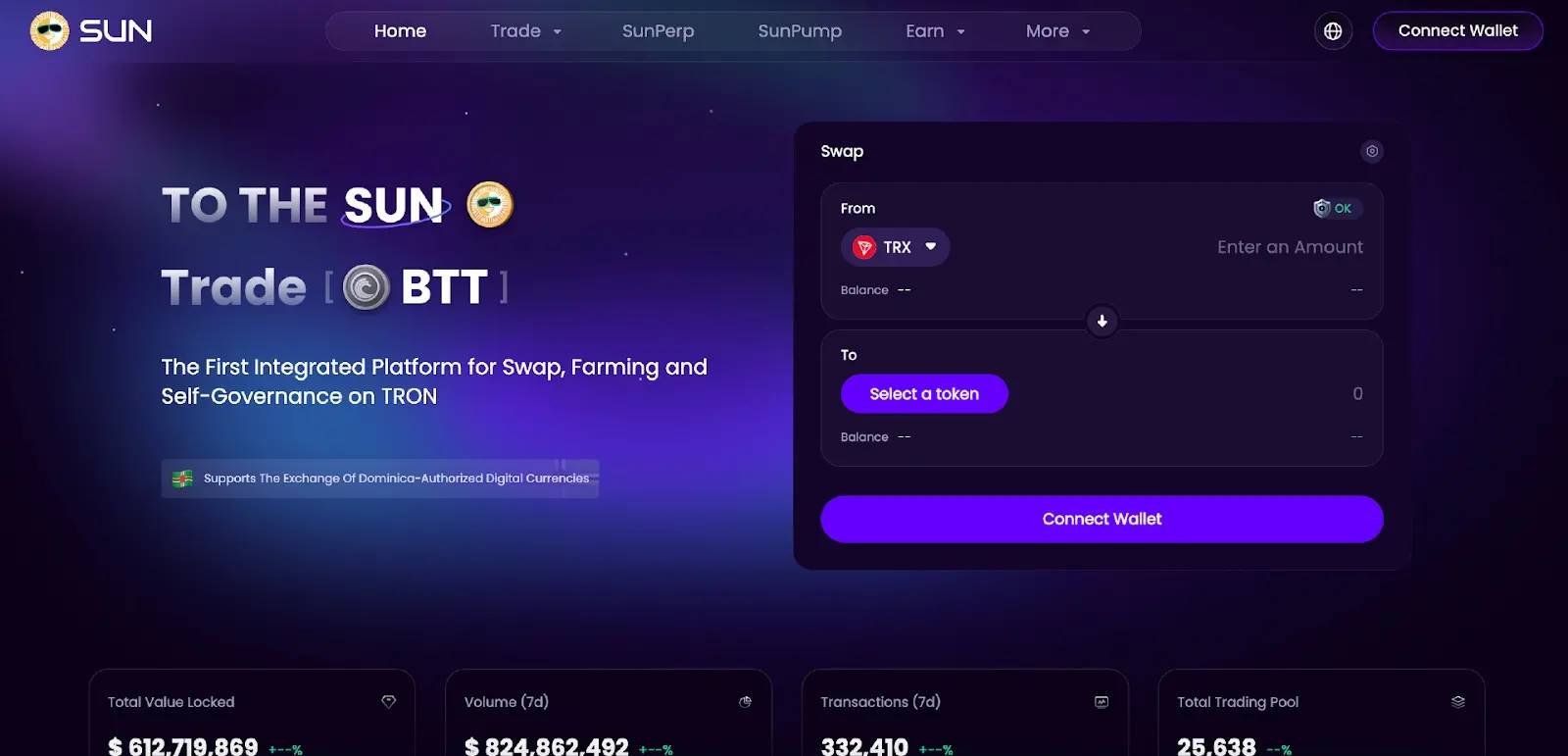

- Preparation Stage: Visit the SUN.io official website (https://sun.io/), and connect a wallet that supports the TRON network, such as TronLink.

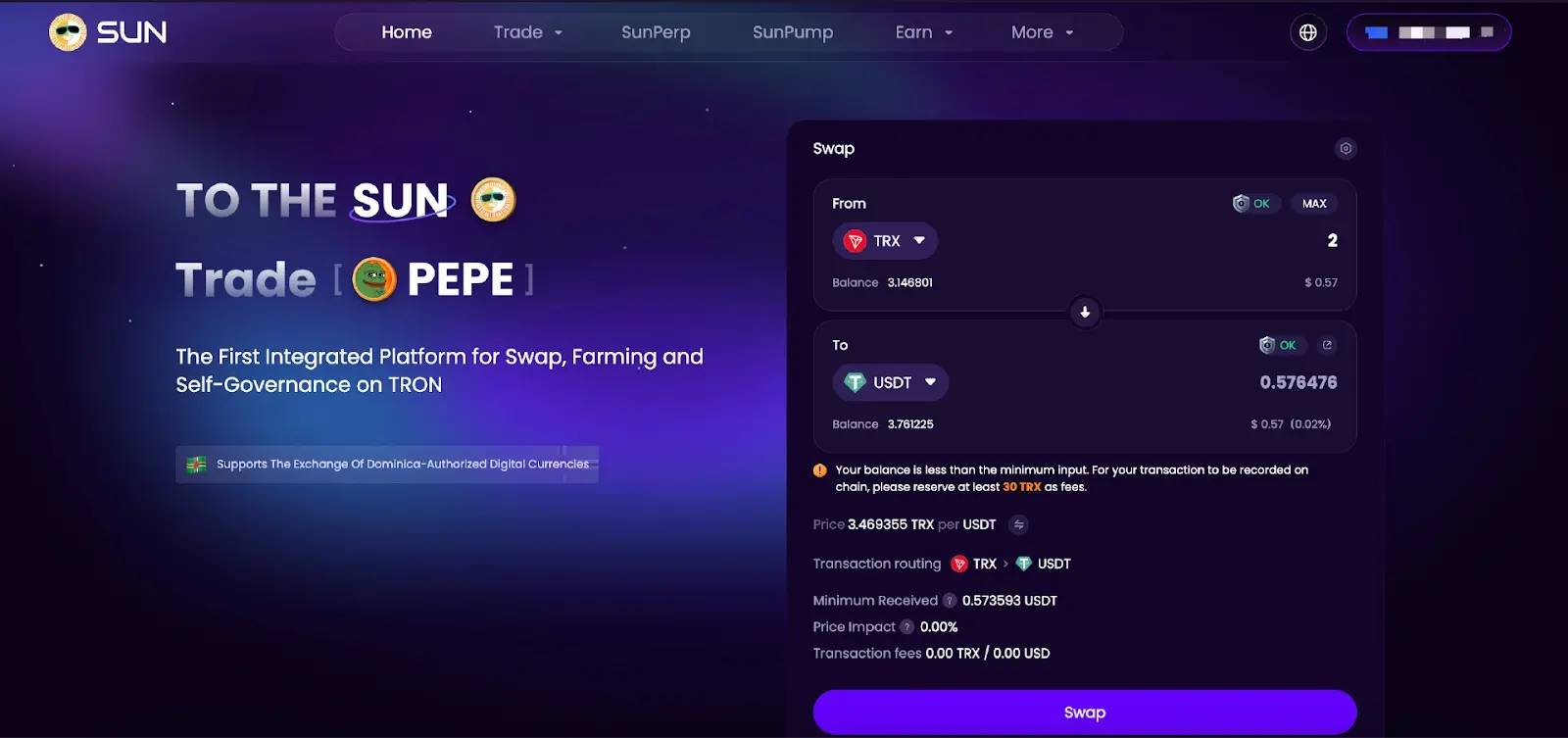

- Token Swap

In the "Swap" interface, users can exchange tokens such as BTC, USDT, TRX, SUN, JST, BTT, NFT, WIN, etc. Click the dropdown button, select the token you want to exchange, enter the token amount, click the "Swap" button, and authorize in the wallet.

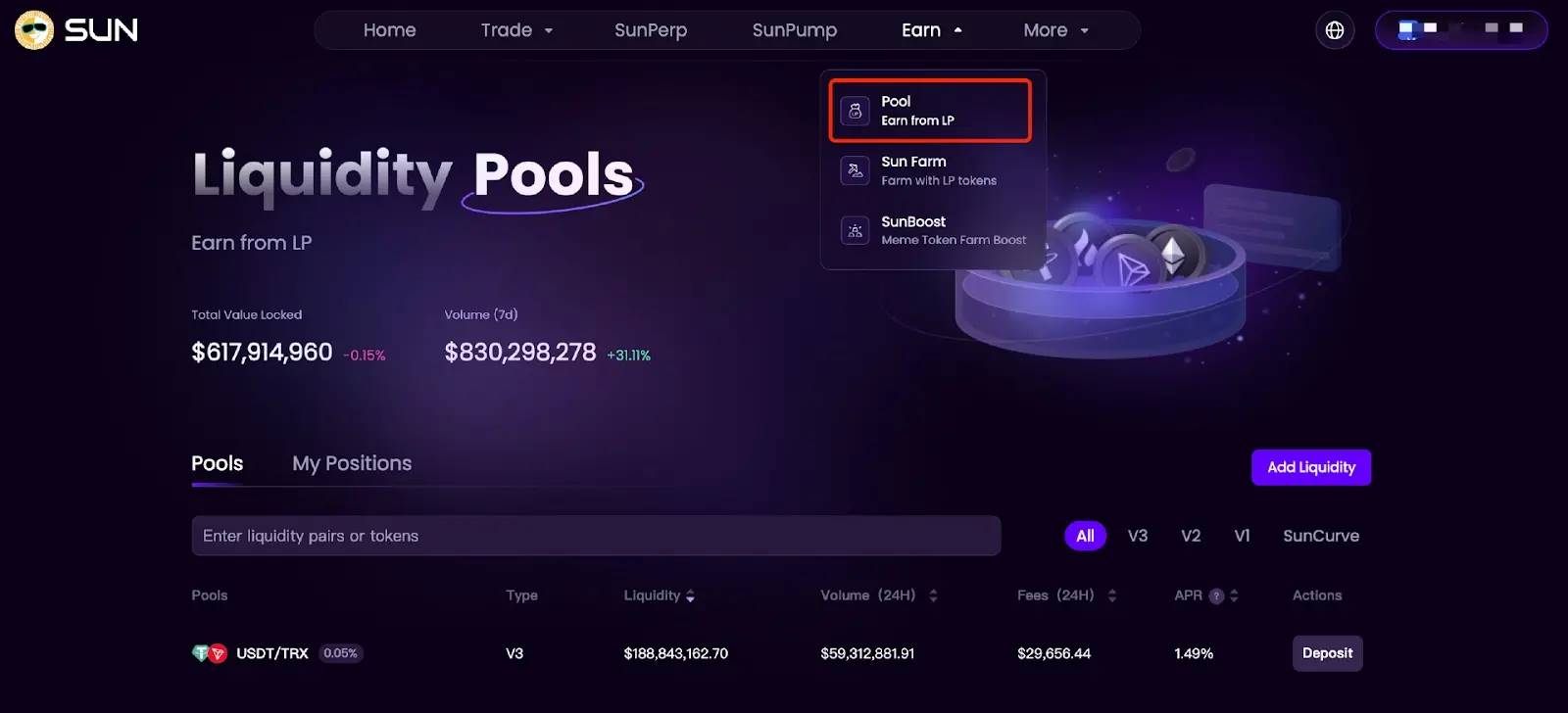

- Add Liquidity to the Pool

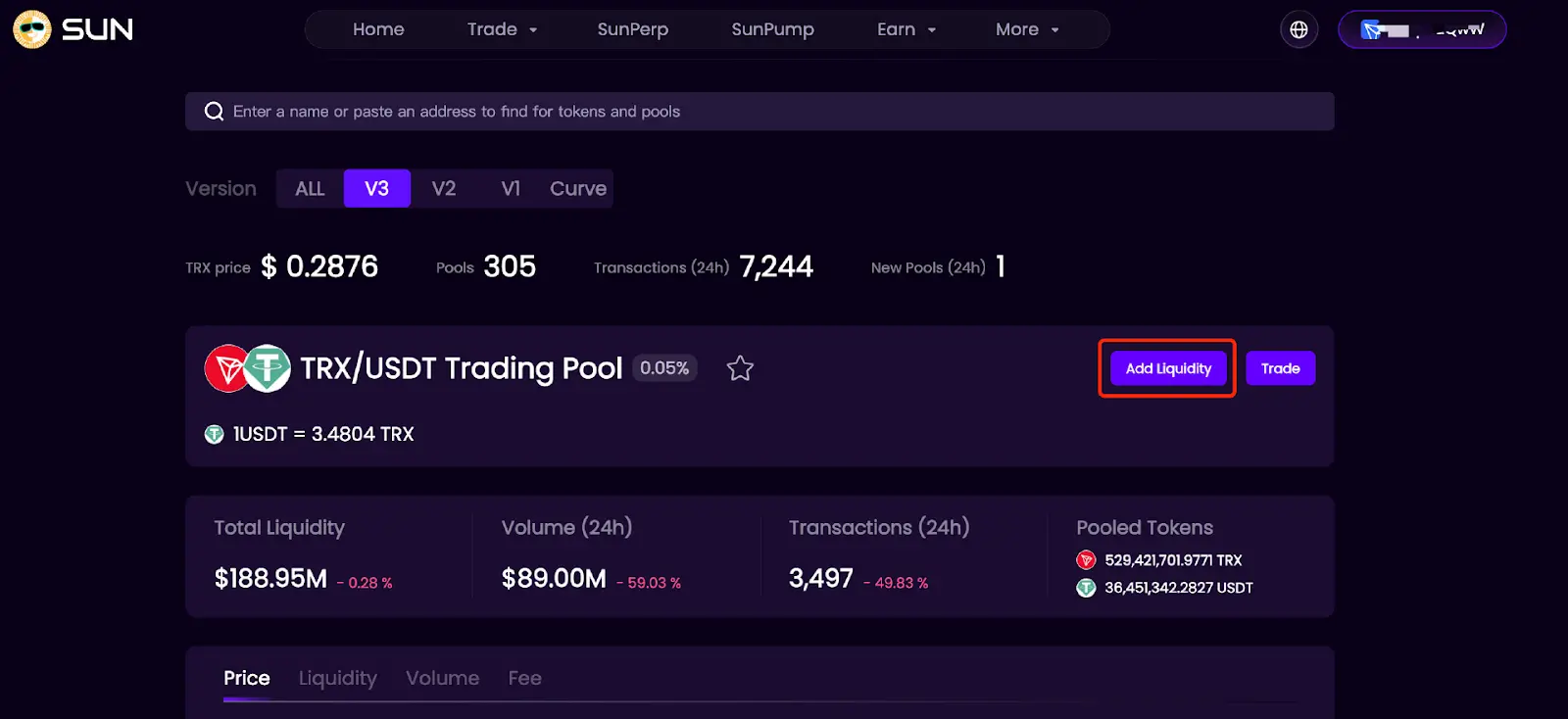

- Select "Earn" > "Pool" to enter the "Liquidity Pools" interface.

- Choose the trading pair you want to add liquidity to, such as TRX/USDT, and click the "Add Liquidity" button.

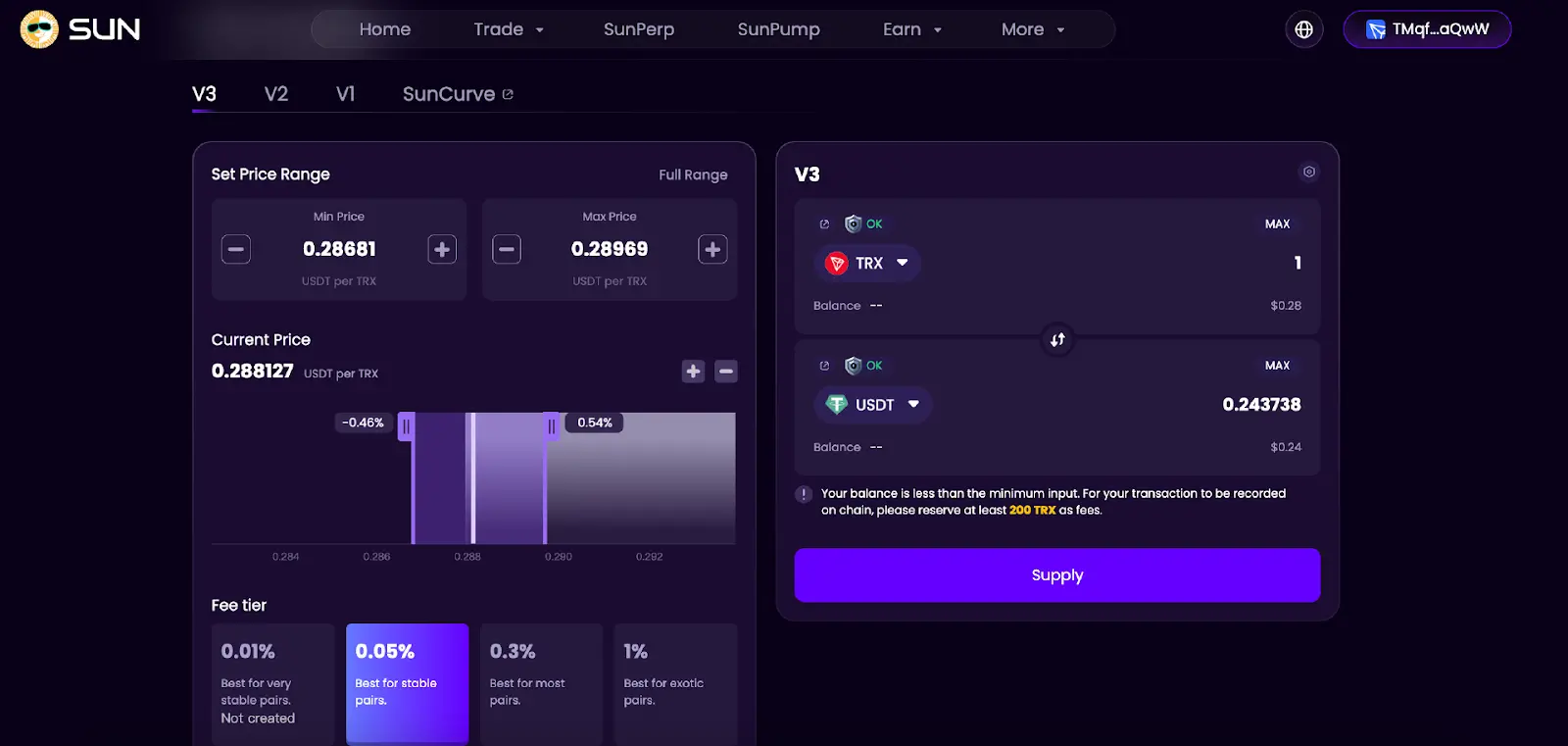

- In the input box, enter the amount of assets you want to provide; the other input box will automatically fill in the value based on the exchange rate between the two tokens. Then, set the price range in the left box and select the appropriate fee tier. Click "Supply" and authorize in the wallet.

- Add Liquidity to the Stablecoin Pool

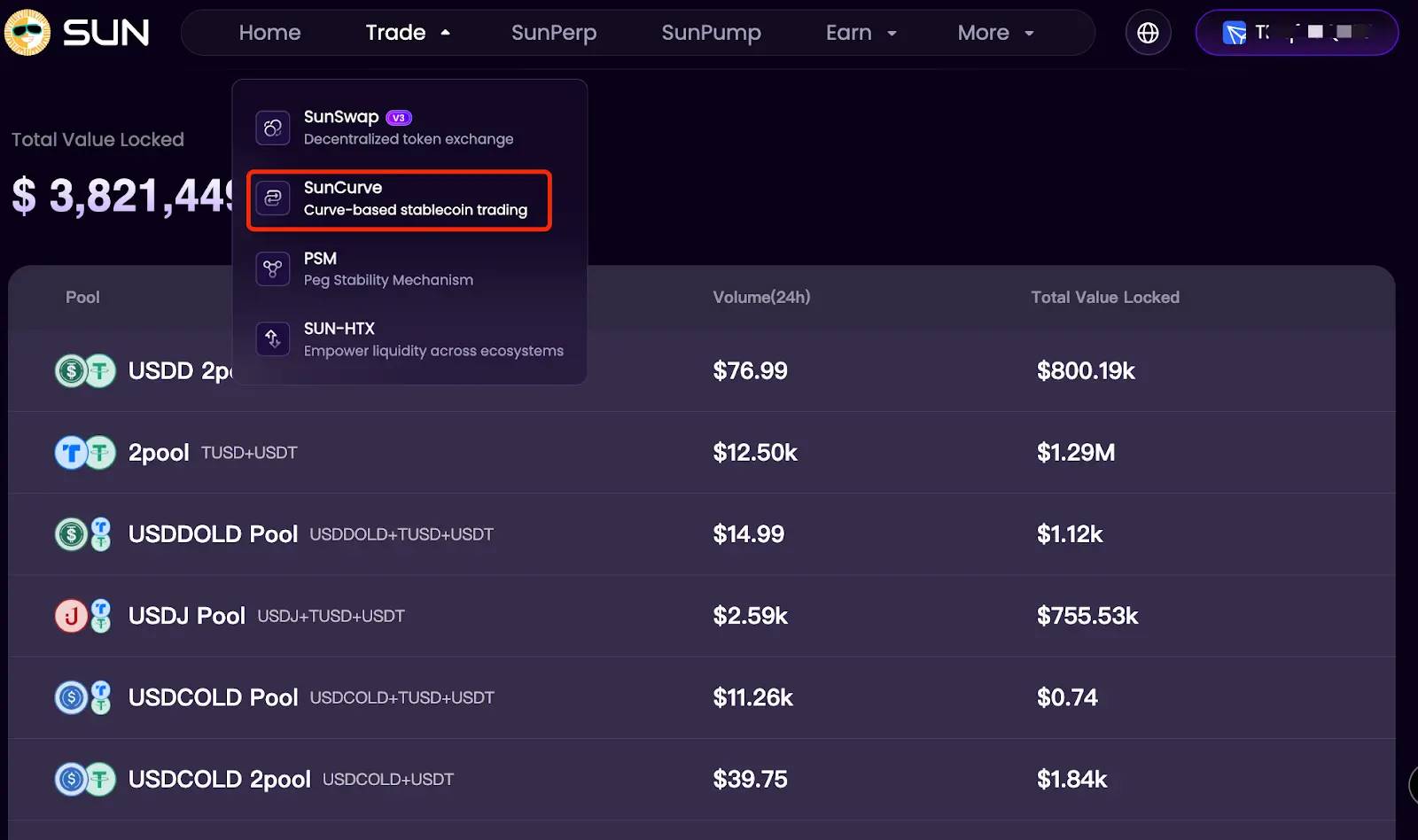

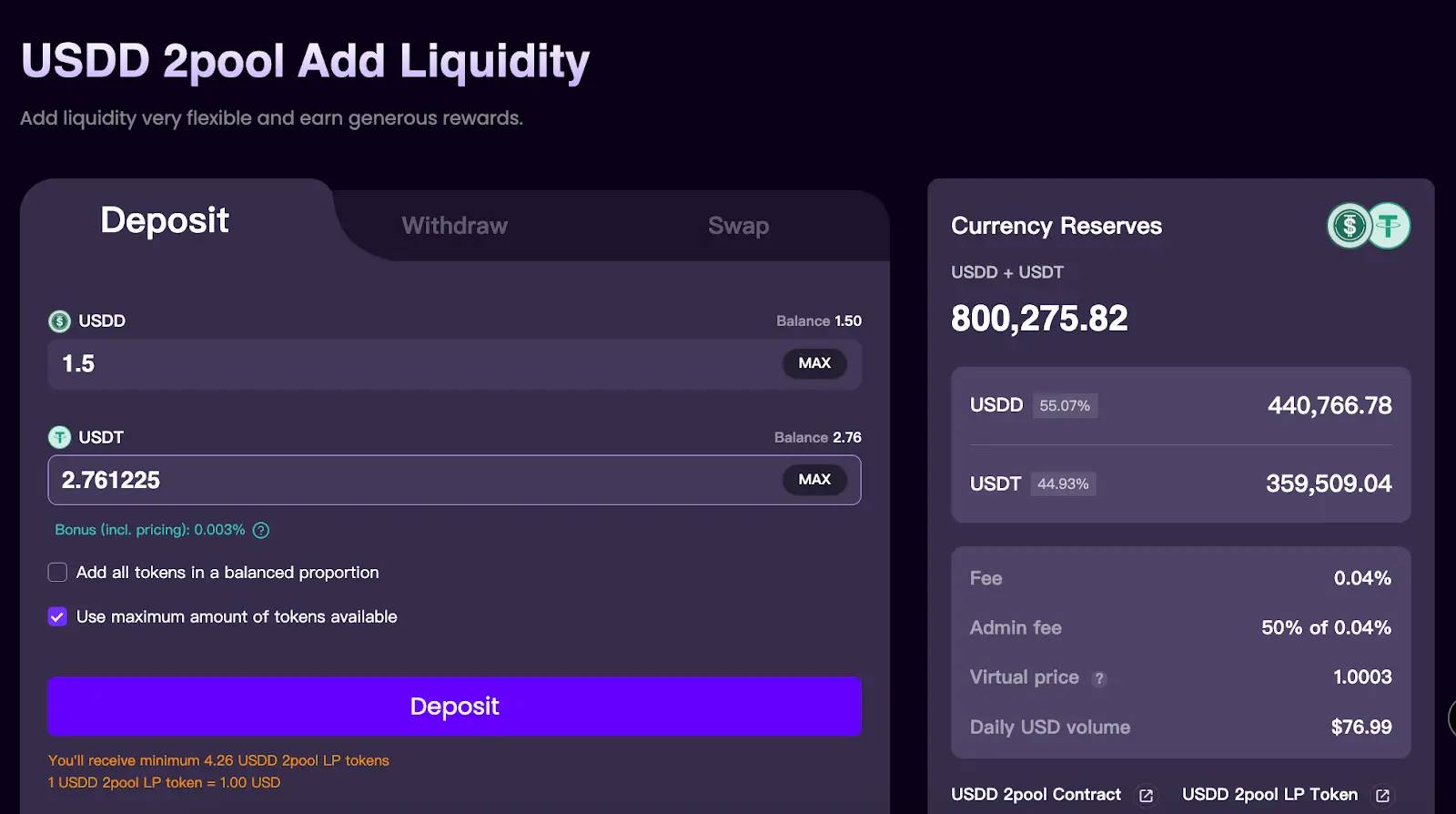

- In the navigation bar, select "Trade" > "SunCurve" to enter the add liquidity page and choose the liquidity pool you want to add to.

- In the input box, enter the amount of tokens you want to add, click the "Deposit" button below, and confirm the authorization in the wallet.

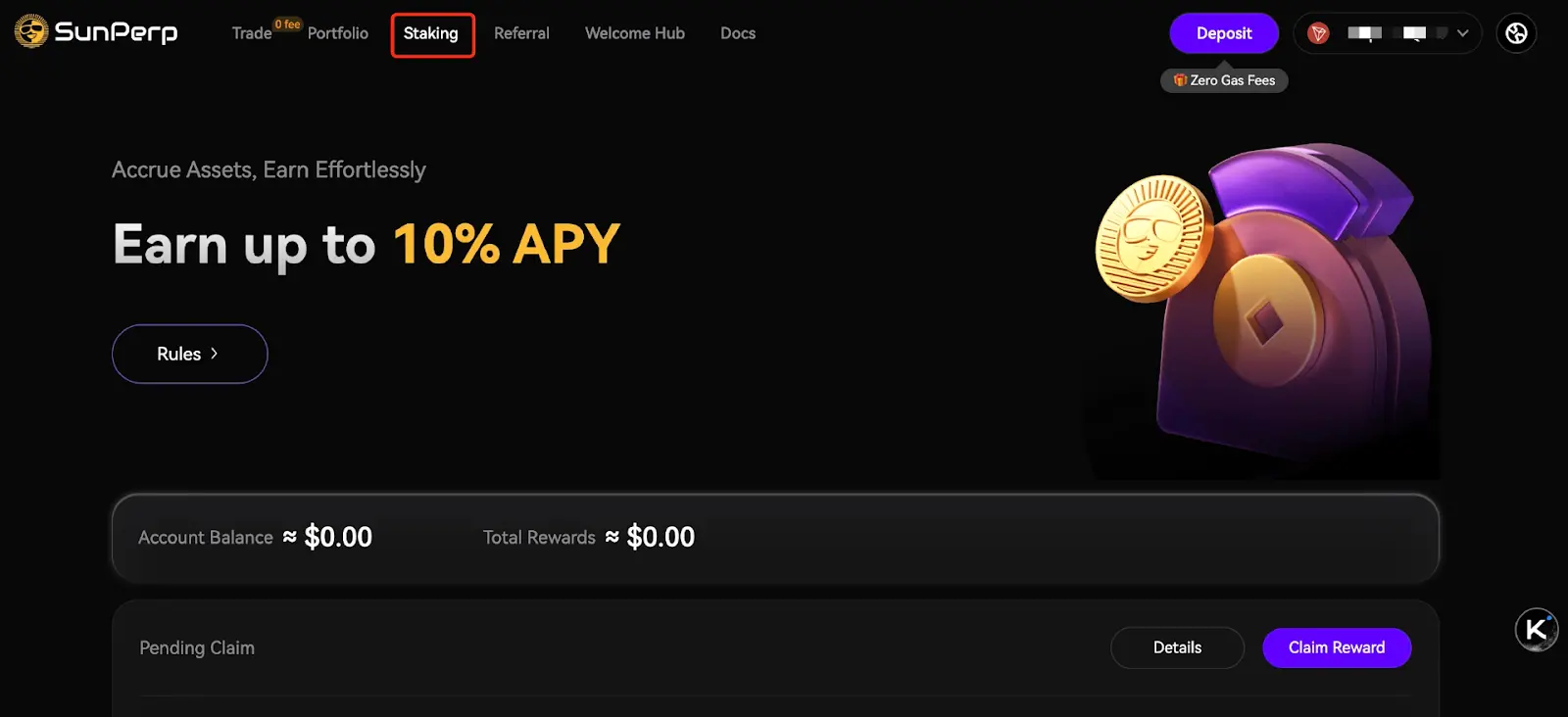

5. SunPerp USDT Stablecoin Staking

SunPerp is a decentralized perpetual contract trading market in the TRON ecosystem that allows users to stake USDT, currently offering an annualized return of up to 10%. Staking users can easily obtain passive income, as the platform will automatically distribute earnings based on account asset snapshots, with no lock-up restrictions, allowing for trading without impact.

User Operation Guide

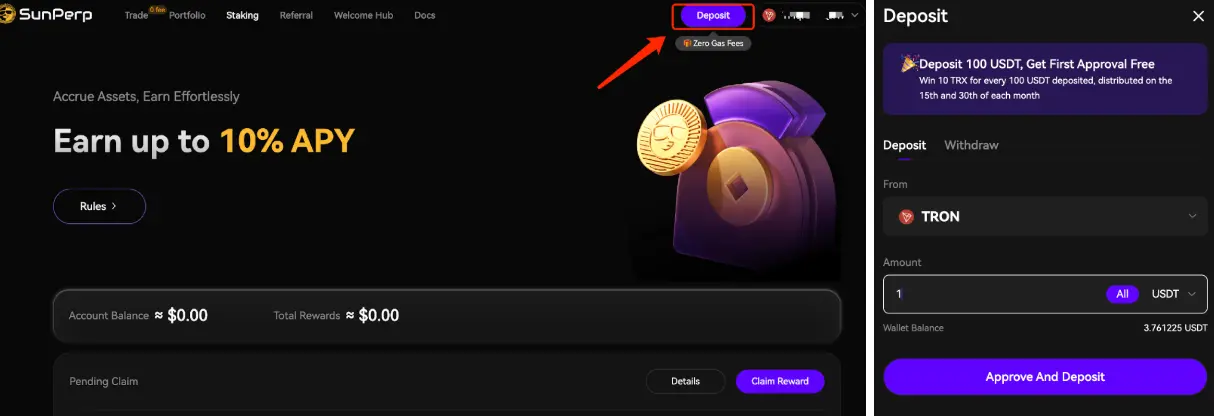

- Preparation: Visit the SunPerp official website (https://www.sunperp.com/) and connect your wallet (such as TronLink) to enter the "Staking" page.

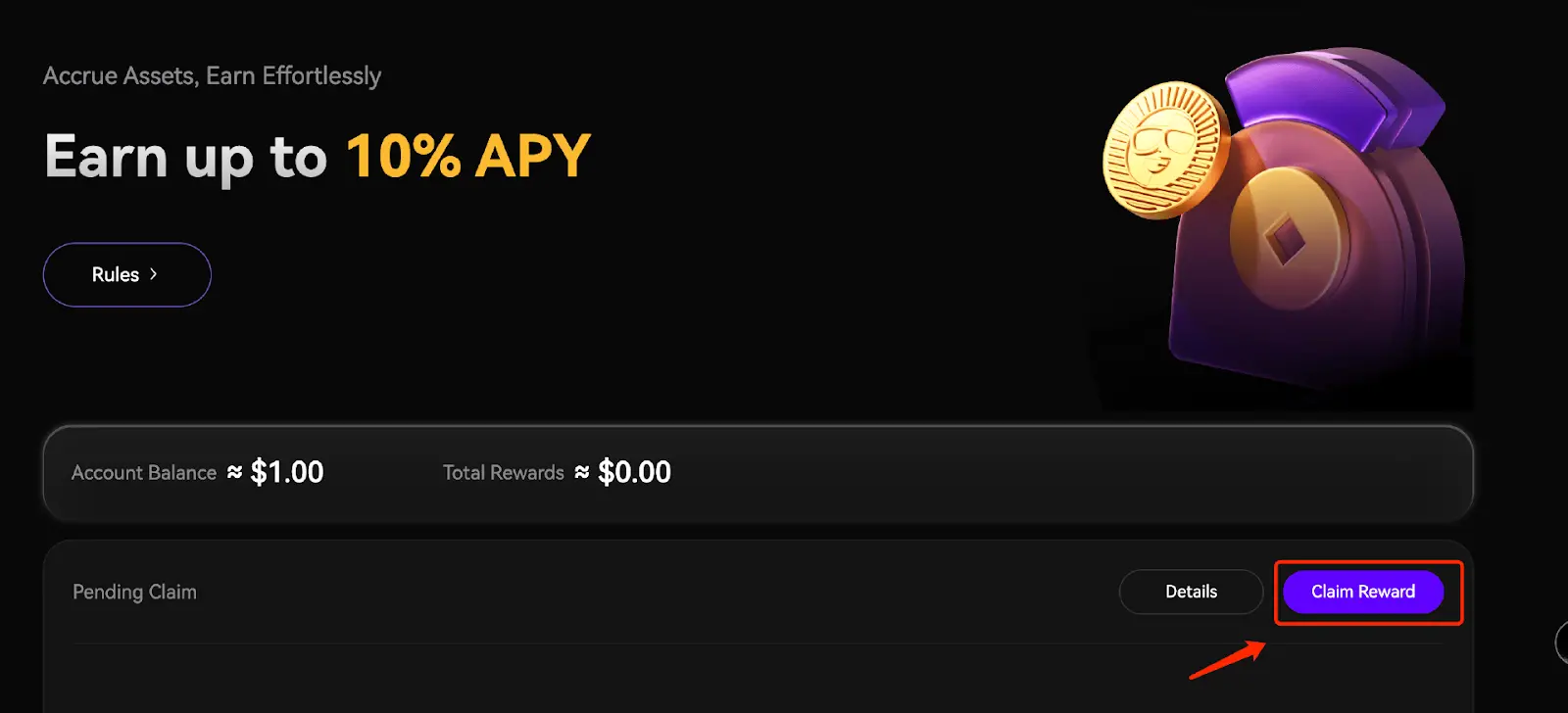

- Staking: Click the "Deposit" button in the upper right corner, enter the amount of USDT you want to stake in the pop-up window, click the "Approve And Deposit" button to stake, and confirm the authorization in the wallet. After successful staking, the Staking page will automatically display the account balance.

- Claim Earnings: Rewards will be distributed in USDT on T+2 at 09:00 (UTC). For example, if a user deposits USDT on January 1, the asset snapshot will be taken on January 2 to calculate earnings, and rewards will be distributed on January 3 at 17:00 (UTC+8). Click the "Claim Reward" button below to receive the earnings.

At this point, investors have systematically mastered the complete operational process of basic resource preparation and advanced yield strategies within the TRON ecosystem. From energy rental and deposit-lending earnings in JustLend DAO, to the stable staking and advanced minting of USDD, and finally to liquidity provision on SUN.io and derivative earnings on SunPerp, the TRON ecosystem, with its rich and interconnected product matrix, has built a value closed loop that combines high yields, high liquidity, and low trading costs for market participants.

With the continuous evolution of blockchain technology, TRON, relying on its solid ecological foundation and continuous innovative vitality, is constantly expanding the boundaries of digital asset earnings. It is recommended that investors fully understand the mechanisms and risks of each protocol, flexibly apply the operational methods in this guide, start with a small amount of assets, and gradually build an asset allocation portfolio that aligns with their risk preferences, participating steadily in this value practice of decentralized finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。