Wall Street has already become on-chain, quietly undergoing transformation while you sleep. Financial giants like UBS and Apollo have tokenized hundreds of billions in assets, which now circulate 24/7, no longer limited to the traditional 9-to-5.

This report is co-authored by DigiFT and Tiger Research, providing a comprehensive analysis of the RWA ecosystem: a panoramic view of builders and users, and how tokenized stocks and bonds are gradually consuming traditional finance.

The regulatory framework is becoming increasingly refined, with institutions placing their bets. The year 2025 will mark a turning point as crypto assets bid farewell to the experimental phase and transform into core infrastructure.

Below are the key highlights of the report; the full report can be viewed and downloaded here.

Current Status: A Market Driven by Optimism

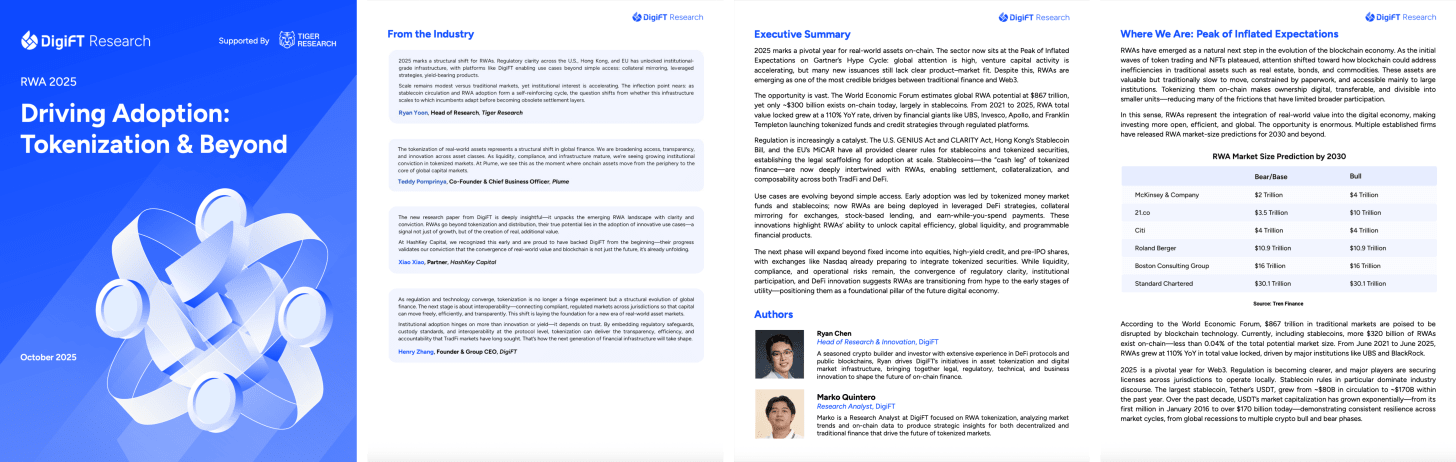

By 2025, Real World Assets (RWA) have attracted global attention, with significant institutional capital inflow and sustained public enthusiasm. Early success stories have raised expectations across the market—some projects are thriving, while others have yet to prove their sustainable value. The industry is currently at a critical juncture between hype and lasting adoption, more closely connecting traditional finance with the Web3 world than ever before.

Development History: Providing Access Opportunities and Major Progress Over the Past Year

Tokenization began with a mission: to provide access to traditional assets on-chain. This effort started as experimental exploration in a low-interest-rate environment and has now evolved into a regulatory movement driven by institutions. Over the past year, three key trends have emerged in the RWA space: global institutions like UBS, Invesco, and Apollo going on-chain; the emergence and expansion of new asset classes such as tokenized stocks and real estate; and improvements in stablecoin regulation in the U.S. and Hong Kong—these trends have collectively propelled the RWA landscape to its current state.

Adoption of On-Chain RWA Ecosystem and Its Role in the Ecosystem

The RWA ecosystem has evolved into an interdependent network, with each participant driving the process of scaled adoption. Partners in the RWA ecosystem, such as tokenization and distribution platforms, DeFi protocols, curators, and asset management companies, are key players enabling the existence and flourishing of RWA. Infrastructure contributors, such as layer 1/2 blockchains, oracle service providers, and interoperability protocols, help RWA achieve greater growth beyond its foundational capabilities. These roles together form a self-reinforcing cycle that continuously drives the widespread adoption of RWA.

Beyond Tokenization: From Accessibility to Application Scenarios

RWA has evolved from merely representing physical assets on-chain to becoming programmable financial components that empower new application scenarios.

Stock Collateralized Lending by xStocks × Kamino

Collateralized Mirrors by KuCoin × DigiFT

Earn While You Spend by Amber Premium × DigiFT

Hybrid Lending by Aave

From Fixed Income to Stocks: Why On-Chain Trading is Superior to Off-Chain Holding

Tokenization has expanded from fixed income to stocks and Pre-IPO shares. Currently, two issuance models dominate: direct issuance and structured note issuance.

Tokenized equity can be traded 24/7, offering a decisive advantage over traditional markets. Tokenized equity activates around-the-clock liquidity, allowing investors to continuously manage risk without waiting for market hours, ushering in a new era of uninterrupted equity markets where programmable assets outperform traditional holding structures.

“If existing exchanges cannot adapt to change, they risk being eliminated and ultimately relegated to functionally limited custodians of similar assets.” — Galaxy Research

Regulation is Driving Popularity

In Singapore, RWA tokens representing underlying instruments (such as bonds, equities, funds, and government bonds) are governed by existing securities rules, providing a clear regulatory pathway for licensed participants. Hong Kong requires licenses for both securities and virtual asset activities, while Dubai's approach under the VARA (Virtual Assets Regulatory Authority) framework promotes compliance innovation. Across various regions, transparency and regulatory clarity are driving the sustainable growth of RWA.

Stablecoins continue to anchor a broader RWA economy. Over the past year, new frameworks such as the U.S. GENIUS Act and CLARITY Act, as well as Hong Kong's Stablecoin Act, have been enacted, officially recognizing stablecoins as regulated digital currencies and directly linking their growth to RWA demand.

Future Outlook

In the next phase, RWA will expand from experimental scale to infrastructure. Hybrid licensed-unlicensed markets, tokenized equity exchanges, and the first on-chain IPOs will establish a new financial architecture. Asia is expected to lead this transformation, making 2025 the beginning of the era of tokenized global real economy utility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。