Author: FinTax

Chile is one of the countries with the highest economic stability and financial maturity in Latin America, playing an important role in the current cryptocurrency market. Although its overall trading volume is not as large as that of Brazil and Argentina, market activity remains significant. According to the latest industry report, Chile's annual cryptocurrency trading volume in 2024 is approximately $2.38 billion, ranking among the top in Latin America. In terms of user acceptance, Chile also performs outstandingly, with a cryptocurrency ownership rate of about 13.4%, placing it among the leaders globally.

It is noteworthy that as the Chilean cryptocurrency market becomes increasingly active, the Chilean financial regulatory authorities are also adapting to the trend by viewing crypto assets as an important component of promoting financial innovation. On January 4, 2023, Chile's "Fintech Law" (Ley Fintech, Law No.21,521) was officially published in the official gazette, regarded as one of the most significant reforms in Chile's capital market in the past decade. The law aims to promote competition and inclusiveness in the financial system through technological innovation, establishing clear regulatory boundaries for unregulated fintech services, including crowdfunding platforms, alternative trading systems, credit, investment consulting, and financial instrument custody. Subsequently, on January 12, 2024, "General Rule NO.502" (NCG 502) further clarified the registration, authorization, corporate governance, risk management, capital, and collateral requirements for financial service projects, including platforms that genuinely handle crypto assets. Regarding crypto assets, although Chilean authorities currently maintain a cautious regulatory stance, considering virtual currencies neither to have legal tender status nor to be regarded as foreign currency, they recognize crypto assets as "intangible assets." The Chilean Financial Market Commission (Comisión para el Mercado Financiero, CMF) includes them in service categories such as "custody of financial instruments" under the "Fintech Law" (Law NO.21.521, 2023), thereby providing market participants with stable and predictable behavioral guidelines.

It is evident that with the continuous expansion of the Chilean cryptocurrency market and the ongoing updates to regulations, it is necessary to systematically understand the latest system of Chilean crypto assets, the tax compliance framework of the Chilean Internal Revenue Service (Servicio de Impuestos Internos, SII), and the latest regulatory system implemented by the CMF based on the "Fintech Law."

1 Chile's Basic Tax System

The SII implements tax regulation on the income from cryptocurrency transactions based on current regulations such as the "Income Tax Law" (Ley sobre Impuesto a la Renta) and the "Sales and Services Tax Law" (Ley sobre Impuesto a las Ventas y Servicios). Chile's tax system primarily consists of three core tax types: First Category Tax (Impuesto de Primera Categoría, corporate income tax), Global Complementary Tax/Additional Tax (Impuesto Global Complementario / Impuesto Adicional, for resident/non-resident personal income), and Value Added Tax (Impuesto al Valor Agregado, IVA).

1.1 First Category Tax (Corporate Income Tax)

The First Category Tax is a core component of Chile's corporate income tax system, primarily applicable to corporate entities engaged in industrial, commercial, mining, agricultural, financial, and other economic activities in Chile. This tax was established by the "Income Tax Law" (Ley sobre Impuesto a la Renta, Decreto Ley NO. 824) and is levied on an accrual basis, meaning taxable income is recognized in the accounting period when revenue is earned or expenses are incurred. It is important to note that the Chilean companies defined in this law generally include local companies and foreign companies with a permanent establishment in Chile, both of which are required to pay corporate income tax.

The standard corporate income tax rate is 27%. This rate applies to most general enterprises, especially large or multinational companies. However, to support economic recovery and the sustainable development of small and medium-sized enterprises, the Chilean Ministry of Finance (Ministerio de Hacienda, MH) has introduced temporary tax incentives starting from the 2025 fiscal year. According to the "Law No.21.755 on Simplified Regulation and Promotion of Economic Activity" (Ley NO.21.755), corporate entities that meet the Chilean small and medium-sized enterprise standards will have their income tax rate temporarily reduced to 12.5% for the fiscal years 2025, 2026, and 2027; it will return to 15% in the 2028 fiscal year.

1.2 Global Complementary Tax/Additional Tax (Resident/Non-resident Personal Income Tax)

Chile's personal income tax system consists of two complementary tax types: Global Complementary Tax and Additional Tax. The former applies to tax residents (i.e., individuals residing in Chile for more than 183 days or having a center of residence) and taxes their global income; the latter applies to non-resident individuals, taxing only their income sourced from within Chile.

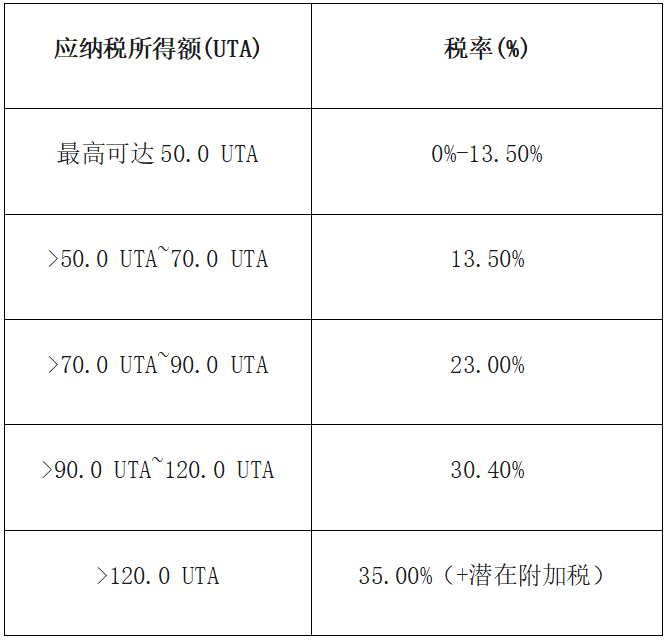

The Global Complementary Tax implements a progressive tax rate system (impuesto progresivo), with rates ranging from 0% to 40%, based on the annual tax unit (Unidad Tributaria Anual, UTA). Each year, the SII adjusts the UTA value based on inflation and exchange rate factors. The personal income tax brackets for the 2025 fiscal year are as follows:

1.3 Value Added Tax

Chile's Value Added Tax (Impuesto al Valor Agregado, IVA) was established by the "Sales and Services Tax Law" (Decreto Ley NO.825, 1974) and is managed by the tax authority, with a standard tax rate of 19%. IVA applies to the sale of domestic goods, the provision of services, and imports, and taxpayers must register before providing taxable transactions, with no minimum turnover threshold. The system employs a deduction mechanism of output tax minus input tax to avoid double taxation, typically reported and paid monthly.

According to Chile's "Sales and Services Tax Law," the scope of VAT taxation includes: first, the sale of movable property or part of immovable property for consideration; second, various services provided for remuneration; third, goods imported into Chile. This means that both domestic transactions and cross-border imports must pay VAT as long as they meet the above conditions. Exported goods and certain services (education, healthcare, finance) enjoy zero tax rates or exemptions, while low-value imports, second-hand vehicle sales, and international transport are subject to simplified collection systems.

It is noteworthy that since 2020, non-resident digital service providers offering online services to Chilean consumers are also required to register and pay IVA. Whether this also applies to IVA will be discussed in the next section.

2 Tax Treatment of Crypto Assets

The SII has positioned crypto assets as intangible/digital assets through multiple administrative rulings and FAQs, clearly stating that they are neither legal tender nor foreign currency, while including the income generated from them within the scope of taxation on general income under the "Income Tax Law" (i.e., classified as "other general income" as shown in Art.20 N°5). This determines the applicability of the three types of taxes, including First Category Tax (corporate income tax), Global Complementary Tax or Additional Tax, and the treatment of Value Added Tax, based on this intangible asset positioning.

2.1 First Category Tax

The SII clarifies that the "appreciation/profit" (mayor valor/capital gain) generated from the buying and selling of crypto assets should be classified as general income under Article 20, Paragraph 5 of the "Income Tax Law," thereby affecting the taxation of First Category Tax (for corporations) and final personal tax (IGC/IA). Corporations include business income recognized under accounting or tax systems in their taxable benefits; individuals apply the corresponding final tax burden based on their tax resident/non-resident status.

2.1.1 Sale/Transfer (including "coin-to-coin" exchanges, purchasing goods/services with crypto)

Sale (i.e., exchanging for legal tender): The sale price is confirmed at the time of sale (valued at the fair value in Chilean pesos on the day of sale), and taxable income = sale price - purchase cost. In this regard, the SII requires documentation such as transfer receipts or invoices to prove the existence of costs and transaction records.

Coin-to-coin exchanges/purchasing goods or services with crypto (considered barter/transfer): The official Q&A does not provide specific details on this. However, the SII views the disposal of general crypto assets as a transfer (enajenación) event, and income gains should be calculated based on the transaction price on the day of the transaction for income tax declaration and payment. Therefore, some scholars believe that this principle applies not only to the sale of cryptocurrencies for fiat currency but can also be extended to coin-to-coin exchanges or using cryptocurrencies to pay for goods or services, meaning that any outflow of crypto assets may trigger capital gains taxation.

2.1.2 Mining/Staking/Airdrop

Mining: Income from mining should be recognized at the market price on the day of "acquisition" as the recorded value of the asset, and direct costs incurred during mining (such as electricity, hardware depreciation, etc.) can be deducted or calculated as costs at the corporate/individual level (depending on whether it is a business activity) according to relevant rules.

Staking/Airdrop: The SII has not made a clear statement; some scholars believe that tokens obtained for free through staking or airdrops can be recorded with a zero acquisition cost; subsequent sales should calculate taxable income based on the sale price minus that (zero) cost; if it is a business acquisition, it should be treated separately according to accounting and tax rules.

2.1.3 Transaction Fees/Brokerage Commissions

The SII determines that when determining taxable income, commissions charged by brokers/exchanges can generally be treated as "necessary expenses incurred to generate that income" and deducted in the current period (i.e., treated as business expenses or deductible expenses), but transaction fees cannot be directly capitalized as asset costs (i.e., fees are not part of the "tax cost" of that crypto asset but are treated as expenses), which specifically depends on the accounting and tax rules applicable to the taxpayer.

2.2 Global Complementary Tax/Additional Tax

For resident individuals, income from cryptocurrency transactions is generally included in annual comprehensive income and taxed by the Global Complementary Tax at progressive rates. The SII points out that if the cryptocurrency transaction is a non-business acquisition by an individual, the taxable amount should be calculated according to general income tax rules, including the difference between the transfer price and purchase cost.

For non-resident taxpayers, income from cryptocurrency transactions occurring in Chile or sourced from Chile is generally subject to Additional Tax, but no specific rulings detailing the taxation method have been found in public literature. Therefore, in practice, the relevant income of non-residents should still be presumed to be subject to Additional Tax based on the tax law framework.

2.3 Value Added Tax (IVA)

According to SII rulings, due to the lack of physicality of crypto assets, their buying and selling do not fall under the taxable scope of tangible goods sales under the "Sales and Services Tax Law," and therefore are generally not subject to the 19% IVA.

At the same time, for intermediary services or commission fees provided by exchanges or platforms, the SII indicated in the FAQ that these services "may be subject to IVA," requiring the issuance of corresponding invoices or receipts.

3 Chile's Crypto Regulation Structure and Future Trends

To better understand the position of tax policies within Chile's cryptocurrency asset regulatory system, this section will review the formation and evolution of the regulatory framework from an institutional perspective, focusing on its basic structure, main rules, and the latest revision dynamics.

3.1 Early Regulatory Construction

From 2018 to 2020, Chile's regulatory authorities gradually explored the regulatory framework for crypto assets during this early stage. The regulatory characteristics during this period were generally preliminary, mainly focusing on the legal characterization of crypto assets and guidelines for tax treatment.

In 2018, the SII made its first authoritative response regarding the tax characterization of crypto assets through "General Letter No. 963 (2018)" (Oficio NO.963/2018), stating that the income obtained from buying and selling crypto assets falls under the category of general income as listed in the "Income Tax Law" (Art. 20 Nº5). This clarified the applicable framework for income tax (distinguishing between individuals and corporations, etc.). This ruling laid the foundation for subsequent tax practices (such as cost recognition and treatment of frequent traders).

Subsequently, in 2020, the SII further provided more detailed administrative guidance on cost calculation methods, fee deductions, and high-frequency trading situations through "General Letter No. 1474 (2020)" (Oficio NO.1474/2020), addressing numerous daily trading and tax reporting issues in the market (such as accounting recognition and cost methods).

3.2 Current Regulatory Framework

As mentioned above, Chile's systematic regulation of crypto assets began with the "Fintech Law" in 2023, and thus the current regulatory framework for crypto assets established by Chilean authorities is based on this law.

The regulatory enforcement is primarily led by the CMF, which is responsible for formulating general rules for the financial service categories listed in the "Fintech Law" (such as alternative trading systems, financial instrument custody, financial instrument intermediation, etc.) and implementing registration and authorization procedures. The "General Rule No. 502" issued by the CMF details the registration, authorization, governance, risk management, and capital requirements for financial service providers (financial service providers/virtual asset service providers), thereby transforming the abstract requirements of the "Fintech Law" into executable compliance thresholds. At the same time, the "Tax Compliance Law" (Ley NO. 21.713) enacted in 2024 strengthened the SII's powers in valuation, data acquisition, and anti-avoidance, emphasizing the ability to review complex transactions and non-market pricing, which indirectly increased the tax compliance risks associated with crypto asset transactions.

The Central Bank of Chile (Banco Central de Chile, BCCh) has exclusive functions in monetary policy, payment systems, and the determination of legal tender status, and it collaborates with the CMF on issues related to "payment-type digital assets" (such as stablecoins or retail central bank digital currencies). The division of labor between the BCCh and CMF is reflected in: the CMF focusing on regulatory compliance in capital markets and financial services; the BCCh concentrating on publicly circulating payment methods and financial stability risks, with both maintaining policy collaboration on overlapping issues.

Taxation and anti-money laundering/anti-terrorist financing and cross-border intelligence tasks are undertaken by the SII and the Chilean Financial Intelligence Unit (Unidad de Análisis Financiero, UAF). The SII provides guidance on the tax characterization and practical handling of crypto assets (such as treating crypto assets as intangible assets, income tax treatment of transfer events, and tax treatment of transaction fees) through a series of official documents and FAQs, while the UAF is responsible for reporting suspicious transactions related to anti-money laundering/anti-terrorist financing and cross-border intelligence and for inter-agency collaboration.

Overall, under the macro guidance of the "Fintech Law," Chile's regulatory framework presents a governance structure of "three powers in coordination, each performing its duties": (1) the CMF is responsible for market access, governance, and ongoing supervision; (2) the BCCh addresses monetary/payment stability issues; (3) the SII and UAF are responsible for tax and anti-money laundering compliance, respectively. This multi-agency collaborative governance model aims to balance encouraging financial innovation with ensuring market integrity.

3.3 Current Major Rules

Chile places the core regulatory rules for fintech and crypto-related services under the "Fintech Law" and the "General Rule No. 502" established by the CMF: the former defines the categories of regulated financial services and regulatory objectives, while the latter implements registration, authorization, governance, and ongoing compliance requirements. The specific rules can be summarized into four categories.

The first and most significant compliance threshold is registration and market access. Anyone providing financial services designated by the "Fintech Law" (including alternative trading systems, financial instrument custody, and financial instrument intermediation) must register with the CMF and obtain authorization; the registration application must submit documents on corporate governance, management team qualifications, business model, capital structure, and risk management. Foreign entities may apply for entry if they meet the conditions. This system aims to bring over-the-counter or unregulated activities into the regulatory view, thereby increasing market transparency from the source.

The second requirement focuses on corporate governance, capital, and operational capacity. "General Rule No. 502" sets clear standards for governance independence, client asset segregation, business continuity plans, and minimum capital or collateral, and requires the submission of a third-party opinion report on operational capacity as part of the review materials. The regulation emphasizes reducing systemic risks arising from custody and entrusted services through these requirements while establishing a baseline for investor protection.

The third category of rules pertains to anti-money laundering/anti-terrorist financing and information disclosure obligations. Chile's UAF has clear requirements for reporting suspicious transactions, customer due diligence, and real-name systems. Virtual asset service providers and other regulated financial service providers must execute transaction monitoring and report suspicious activities according to UAF and CMF standards; at the same time, the SII's tax guidelines require the retention of complete transaction records and valuation documents to facilitate tax compliance checks.

Finally, the regulation emphasizes ongoing supervision and enforcement consequences. The CMF maintains the deterrent effect of the rules through routine inspections, information requests, and administrative sanctions (including fines and revocation of registration) against non-compliance; at the same time, the 2024 tax reform enhanced the SII's investigative powers in valuation and anti-avoidance, indicating that in the intersection of taxation and regulation (such as large related-party over-the-counter transaction transfers), there will be stricter compliance and audit risks. In this regard, enterprises need to prioritize compliance governance, valuation methods, and tax due diligence as equally important tasks.

3.4 Recent Revisions and Future Focus Points

Since 2024, the pace of regulatory revisions has noticeably accelerated. In December 2024, the CMF revised "General Rule No. 502," refining the registration and authorization procedures and the supporting documents required for applications, thereby improving the efficiency of regulatory agency reviews and reducing interpretative space (for example, clarifying the positioning and submission requirements for third-party operational capacity opinions). At the same time, the "Tax Compliance Law" passed in 2024 significantly enhanced the SII's powers in valuation, information collection, and anti-avoidance, indicating that issues related to large over-the-counter transactions, related-party transfers, and valuation adjustments under extreme price fluctuations will see increased intensity and complexity in tax audits.

The regulation of "payment-type" digital assets (especially stablecoins) and central bank digital currencies (CBDCs) has become a core focus for the next stage of regulation. The BCCh has initiated concept validation and pilot work for CBDCs and has proposed specialized research on the regulation of stablecoins as payment methods; both the practical sector and regulators are preparing to incorporate tokens with strong payment functions into the monetary/payment regulatory framework, which is likely to be driven collaboratively by the BCCh and CMF. Therefore, for tokens issued or operated for payment purposes, issuers and virtual asset service providers offering related services need to assess potential licensing, capital, and liquidity requirements in advance.

In terms of anti-money laundering/anti-terrorist financing and cross-border intelligence cooperation, the Financial Action Task Force's guidelines for virtual assets and virtual asset service providers continue to form the international compliance benchmark. Chilean regulatory agencies have clearly aligned the design of registration, due diligence, and reporting obligations with the risk-based methodology of the Financial Action Task Force, so virtual asset service providers should quickly implement technical and procedural connections for customer identification, transaction information transmission, and cross-border cooperation to avoid compliance gaps in cross-border transactions.

In summary, the future focus of Chile's crypto asset regulation can be roughly categorized into three aspects: first, in terms of valuation and tax audits, the SII is expected to strengthen the review of high-risk transactions and gradually promote the unification of valuation and reporting standards; second, the regulatory positioning of payment-type tokens will become clearer, especially regarding stablecoins and CBDCs, with the possibility of stricter rules and higher thresholds for issuance and use; finally, international compliance collaboration and technical integration will become a trend, and virtual asset service providers (VASPs) need to gradually implement transaction information reporting and "travel rule" requirements that comply with the Financial Action Task Force (FATF) and international standards.

For market participants, the practical implications can be summarized in three points: 1. Establish stricter valuation mechanisms and a complete transaction documentation retention system; 2. Prepare liquidity and capital planning in advance when involving payment or exchange scenarios; 3. Optimize technical architecture to support cross-border information exchange and compliance reporting, reducing potential operational and regulatory risks.

4 Conclusion

With the rapid expansion of the Chilean crypto market, the country has established a regulatory system for crypto assets that combines completeness and transparency through tax rulings, legislation, and regulatory measures. On the tax front, the SII has clearly defined the nature and transaction handling of crypto assets, providing businesses and individual investors with actionable tax guidance; on the regulatory front, the CMF and anti-money laundering and terrorist financing units have formed an interconnected regulatory mechanism, making the compliance framework more systematic and operable. The establishment of this system has allowed Chile to demonstrate significant institutional competitiveness in the region. On one hand, clear rules and regulatory pathways enhance market predictability and legal security; on the other hand, layered regulation and a gradual implementation mechanism provide moderate flexibility for various fintech companies, balancing innovation and risk control.

Looking ahead, as international reporting standards gradually take effect, the Chilean market is expected to further align with global regulatory standards, attracting more institutional investors and compliant projects into the local market. For investors, Chile has become one of the few destinations in Latin America that can simultaneously offer institutional transparency, clear compliance pathways, and policy continuity for crypto asset investments, and its regulatory evolution will continue to set a benchmark for financial innovation in the region.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。