Author: Ye Kai

Hong Kong's RWA is not a "setback," but a "return to normal"

In the past couple of months, many people have interpreted Hong Kong's "cooling" as a "pause." However, if we zoom out, it resembles more of a re-laying of the electrical grid: moving from the early "bubble frenzy" back to the financial norm of "assets on-chain." We call this path "returning to normal." The core change can be summarized in one sentence—embedding RWA tokenization into real finance and industry, rather than letting it drift outside of regulation.

(AI-generated image)

1. "Digital Asset Declaration 2.0": Redefining Tokenization as Assets and Tools

The key terms of Declaration 2.0 are not coins, but funds, trusts, gold, Hong Kong stocks, tax systems, secondary markets. Behind this string of keywords, it signifies that Hong Kong is redefining tokenization using familiar financial language:

Fund/Trust Structure: Money market funds, structured notes, and REITs are brought on-chain in the form of trusts, with tokens corresponding to clear beneficiary rights and information disclosure, avoiding "shell" and "hollow" structures.

Tax System Alignment: Transitioning from the "subscription and redemption era" to the "transfer era," the transfer arrangements for tokenized funds, stamp duty, and profits tax exemptions gradually reference traditional funds, directly opening the floodgates for compliant on-chain secondary markets.

Returning to Warehousing and Delivery: The LME (London Metal Exchange) has included Hong Kong in its global warehouse network, and the government encourages the application of tokenization and on-chain traceability in warehousing and physical tracking. Gold tokenization is no longer just a "symbol," but a combination of "warehouse receipts + clearing + delivery."

Broader Assets and Tools: From gold, non-ferrous metals, agricultural products, to the tokenization of trusts, indices, and Hong Kong stocks, it shows that Hong Kong views RWA tokenization as a toolbox rather than an investment field.

In summary: Declaration 2.0 transforms "on-chain performance" into "financial engineering," making RWA a new underlying infrastructure in Hong Kong's financial market.

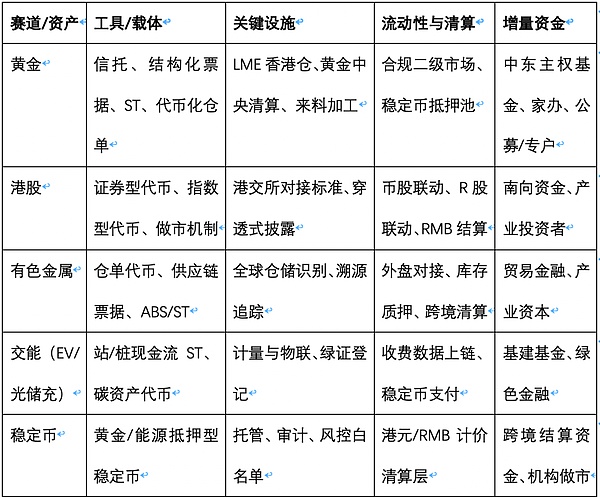

2. Huaxia Digital Capital's RWA 2.0: Financial Structure × Industrial Flywheel × Global Capital

Hong Kong's RWA 2.0 this time is not just about "moving assets on-chain," but about "simultaneously equipping financial structures, industrial ecosystems, and cross-border capital" with engines.

Financial Structure

Multi-Form Carriers: Trust funds + structured notes + security tokens (ST), the same underlying assets can correspond to different risk/term layers, adapting to funders' preferences.

Tokenization of Hong Kong Stocks + Stablecoins: Making Hong Kong stocks into compliant products that can be transferred on-chain, overlaying HKD/CNY stablecoins for settlement and collateral, bridging "on-chain trading—traditional price discovery—cross-border clearing."

R** Stock Linkage/Coin-Stock Linkage (Digital Treasury)**: Allowing enterprises to form linkages between "shares-tokens-own stablecoins/treasury assets," with governance and market value management migrating to an auditable Treasury framework on-chain.

Industrial Flywheel

Gold Tri-City Linkage: Dubai pricing and certification, Hong Kong clearing and delivery, Shenzhen Shui Bei processing, retail recovery, forming a closed loop of "mining—warehousing—refining—investment—delivery—retail—recovery."

Integration of Energy and Transportation (EV/Solar Storage Charging): Assetizing everything from charging stations to single piles; integrating cash flows from new energy vehicle fleet operations, charging electricity, carbon credits, and green certificates into an on-chain asset pool, achieving "investment, construction, operation, management, payment" integration.

Non-Ferrous Metals (Copper, Iron, Aluminum, etc.): Combining warehouse receipts + tracking + pledging to make financing for upstream inventory and midstream trade more transparent and transferable.

Secondary Market Connection: Referencing the "internal and external market" mechanism, connecting leading compliant exchanges with mainstream stablecoin platforms to create a cross-market liquidity hub.

Global Capital

Middle Eastern Funds and US Treasury Reflows: In the context of interest rate cycle switches and geopolitical adjustments, funds are seeking "cash flow, auditable, tradable" new asset pools. RWA 2.0 captures this liquidity through "structured layers + stablecoin collateral."

Incremental Capabilities of Chinese Institutions: Many RWA platforms only "go on-chain without financing." Huaxia Digital Capital emphasizes using the trio of trusts/notes/stablecoins to complete the closed loop of "asset side—capital side—structured carrier."

3. Gold is the Best "Demonstration Field": Policy Guidance + Industrial Penetration + Financial Clearing

Hong Kong's gold RWA narrative is no longer limited to "buying gold bars," but rather "building a market."

Warehousing and Delivery: The LME has included Hong Kong in its warehouse network, and the government encourages tokenization as a warehousing identification and traceability label, enhancing the auditability and turnover efficiency of inventory financing.

Clearing System and Interconnectivity: Proposing the establishment of a central clearing system for gold, inviting the Shanghai Gold Exchange to participate, paving the way for "Shanghai-Hong Kong gold collaboration"; the international board has already set up offshore clearing warehouses in Hong Kong and launched contracts for clearing in Hong Kong.

Production Capacity and Industrial Chain: Promoting refining in Hong Kong and "processing with materials from the mainland," linking "mining—refining—warehousing—delivery—retail—recovery" into a quantifiable cash flow network.

Product and Investor Access: Supporting tokenized gold investment products and public gold funds, improving investment tools for individuals and institutions.

The reason gold is suitable as a lever for RWA is that it combines three elements: global pricing, strong liquidity, and robust regulatory alignment, enabling the rapid transformation of "the concept of RWA" into "a tradable market."

4. Stablecoins: Upgrading from "Payment Tools" to "Industrial Clearing Layer"

The next incremental growth in Hong Kong may likely come from asset-backed stablecoins—especially gold stablecoins and energy/electricity stablecoins.

Use Case Upgrade: From "currency substitutes in wallets" to "cross-border clearing and collateral layers." When RWA assets can be collateralized, on-chain asset management and secondary trading will have a "unified measurement unit."

RMB** Scenarios**: RWA priced in RMB and tokenized Hong Kong stocks have more operational space in Hong Kong. They can both accommodate Chinese capital and industrial chains and serve cross-border settlements for the "Belt and Road Initiative."

Regulatory Essence: The essence of compliant stablecoins is "asset pool + risk isolation + payment mechanism + penetrating audit." RWA 2.0 emphasizes bringing "the credit of coins" back to "the credit of assets."

5. It’s not a question of "whether to retreat," but "who will return to normal"

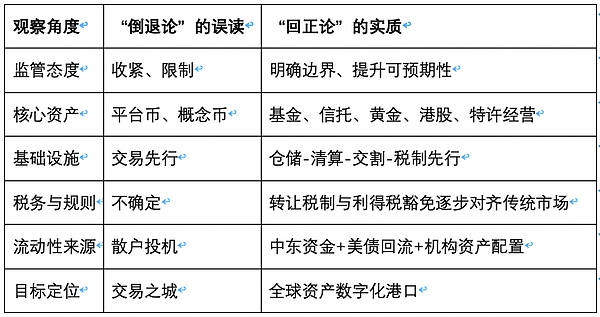

The "retreat theory" focuses on the superficial prosperity of the bubble period; the "return to normal theory" sees the reconstruction of regulation, tax systems, and market infrastructure. We use a comparison table to lay out the two narratives:

The conclusion is straightforward: Hong Kong is not retreating, but adjusting its pace from "sprinting" to "marathon."

6. Policy Intensification: Two New Circulars Implementing "Connecting Globally + Onboarding More"

Recently, Hong Kong released two circulars,

1.** Shared Liquidity Circular: Connecting Hong Kong's Order Book to Global "Brother Platforms"**

What is allowed?

Licensed platforms can integrate order books with their global affiliated platforms, merging into a comprehensive liquidity pool, achieving cross-platform trading and transactions, aiming to enhance market efficiency, deepen liquidity, narrow spreads, and optimize price discovery.

Qualified Entities and Compliance Boundaries

Can only interconnect with overseas licensed affiliated platforms;

The jurisdictions must be FATF network members and have regulatory standards that are generally consistent with international standards.

Trading and Settlement Mechanism (Core is "Settled Liquidity")

Establish shared order book rules: pre/post-trade processes, prepayment, instructions, settlement, breach management, participant rights and responsibilities, binding and enforceable on related parties and designated custodians.

Full prepayment + pre-trade verification: Only accept instructions for settlement assets that have been frozen at designated custodians.

Introduce DVP (Delivery Versus Payment) and set up intraday + end-of-day settlements, keeping "unsettled risk" within limits; institutional responses to on-chain congestion, cold/hot wallet switching, and fiat currency holidays.

Establish a customer compensation reserve fund (trust) in Hong Kong and configure insurance/compensation arrangements for theft/fraud/misappropriation, etc.

Unified market surveillance and data direct to the Securities and Futures Commission: Employing a consistent monitoring model, early warning, and disposal processes for related parties.

Retail protection: Opening to retail requires full disclosure and clear customer choice to participate; shared orders must have prior written approval.

Direct Implications for RWA 2.0

Price discovery becomes more "globally balanced": The spreads and slippage of RWA tokens (gold, non-ferrous, Hong Kong stock tokens) decrease, improving market-making capital efficiency.

Cross-market hedging and arbitrage available: Gold RWA can link the spot and on-chain warehouse receipt price differences of DMCC/HK/Shui Bei, combining stablecoin collateral + spot delivery for combined strategies.

Hard constraints promote "hard work": DVP, prepayment, custody, compensation funds, and unified surveillance compel the authenticity of warehouse receipts, clearing transparency, and asset preservation to be in place, aligning with our infrastructure route of "warehousing—clearing—delivery—tax system first."

2.** Product and Service Expansion Circular: Launching More Products, Removing the "12-Month" Threshold (Conditionally)**

Key Changes in the New Launch Rhythm

Professional Investor (PI) Side: Eliminating the 12-month track record requirement for virtual assets (including stablecoins); platforms must conduct due diligence and fully disclose risks for "less than 12 months."

Retail Side: Other virtual assets are still subject to the "12-month" requirement; however, stablecoins issued by licensed stablecoin issuers can bypass the 12-month limit directly to retail.

Tokenized Securities/Digital Securities: Already exempt from the 12-month rule, continuing to implement penetrating information disclosure and transfer restrictions.

Expansion of Distribution and Custody Scope

Clearly allowing platforms to distribute digital asset-related products and tokenized securities; for distribution, holding related products in trust/customer accounts at custodians in the name of the platform.

Allowing platforms to provide custody for digital assets not traded on the platform through affiliated entities (license conditions need to be revised); individual cases can proceed with custody of tokenized securities before completing the second-phase assessment, provided that measures for asset protection and whitelist transfer restrictions are ready.

Direct Implications for RWA 2.0

Faster Issuance: The PI side is no longer bound by the "12-month" restriction, allowing new types of RWA such as gold/non-ferrous metals/EV station cash flows to be onboarded more quickly, creating a continuous action of issuance—market making—financing.

Retail Gateway Opened for "Licensed Stablecoins": Providing a compliant path for gold stablecoins/energy and electricity stablecoins at the retail level; combined with the "asset pool + risk isolation + payment audit" model, it becomes a layer for cross-border clearing and collateral.

One-Stop "Distribution + Custody": Licensed exchanges can compliantly distribute tokenized securities and related products, and can provide custody for off-platform assets, packaging tokenized Hong Kong stocks + indices/notes + RWA warehouse receipts into composite assets for institutional and family office connections.

Upgraded Capital Experience: Professional/institutional investors can complete primary distribution, secondary trading, and custody at a single entry point, facilitating the implementation of R stock linkage/coin-stock linkage (digital treasury).

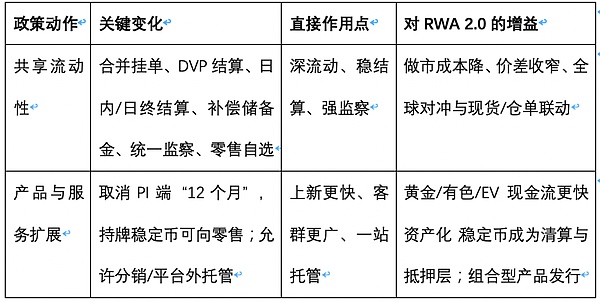

3. How do these two circulars "enhance" the aforementioned three main lines?

- "From Speculating on Coins to Assets" → "From Local to Global Assets"

Shared liquidity directly links Hong Kong's price discovery to global deep pools; the international price differences for gold/non-ferrous/Hong Kong stock tokens are absorbed more quickly, and the RMB/HKD stablecoin clearing scenarios are smoother.

- "Structural Engineering of RWA 2.0" → "Integration of Issuance—Distribution—Custody—Trading"

Platforms are authorized to distribute tokenized securities and related products, and can provide custody for off-platform assets; composite products (warehouse receipts + notes + indices) can be completed at one entry point, matching compliant configurations for Middle Eastern funds and US Treasury reflows.

- "Gold RWA Flywheel" → "Clearing-Level Model"

DVP, intraday/end-of-day settlements, and compensation reserves provide institutional levers for gold warehouse receipts and tokenized clearing; naturally coupling with the vision of a central clearing system for gold, helping to position Hong Kong as a global model for warehousing and delivery on the blockchain.

Summary: The "Alignment Relationship" Between the Two Circulars and the RWA Industry Closed Loop

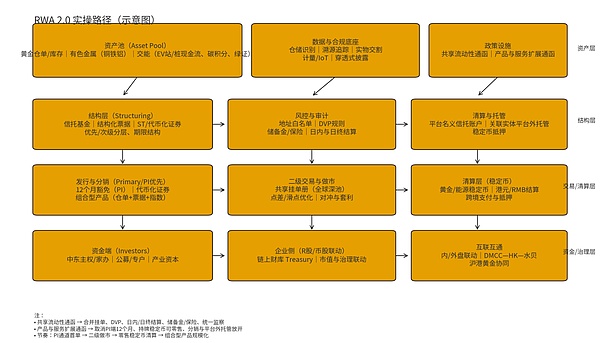

7. From Policy to Implementation: The Practical Path of RWA 2.0

The purpose of this diagram is not to cover everything, but to "grasp the main line": integrating "assets—facilities—clearing—capital" into a four-step process, forming a closed loop that is auditable, financeable, and tradable. The practical path requires the following key elements:

- Product Rhythm: First, utilize the "12-month exemption" for the PI channel and tokenized securities to create structured first orders + secondary market making for gold/non-ferrous/EV cash flows, then gradually open retail licensed stablecoin scenarios.

- Liquidity Engineering: Apply for shared order books, supported by unified surveillance + DVP + reserves and intraday settlement processes, institutionalizing cross-pool market-making parameters into a standardized SOP.

- Clearing and Custody: Use a combination of "trust accounts in the name of the platform + off-platform custody by affiliated entities" to facilitate the off-balance and on-balance conversion of warehouse receipts/notes/indices/stablecoins.

- Capital Organization: Link Middle Eastern funds/family offices with domestic industrial capital, organizing according to the three-layer method of "asset pool (warehouse receipts/contract cash flows) → structural layer (senior/junior) → clearing layer (stablecoins/HKD/RMB)."

8. Action Recommendations: Turning "Returning to Normal" into "Advantage"

For Government and Regulators

Continue to advance the clarification of the tax system for the transfer of tokenized funds and cross-border mutual recognition, enhancing the predictability of the secondary market.

Accelerate the establishment of a central clearing system for gold and the standardization of warehouse tokenization, creating "genuine and valuable" infrastructure as an international model.

Implement a "whitelist + full disclosure + custody audit" framework for stablecoins, providing a clear licensing path for industrial stablecoins.

For Institutions and Platforms

Use the three-layer structure of trusts/structured products/stablecoins as a lever, prioritizing categories with clear cash flows and verifiable inventories (gold, non-ferrous metals, charging stations).

Promote market value management and digital treasury governance for coin-stock linkage/R stock linkage, making "auditable on-chain treasuries" a standard feature of corporate digital finance.

Connect Middle Eastern capital with domestic industries, capturing "high-quality liquidity" with real assets and compliant structures.

For Industry Players

Treat "going on-chain" as a tool for financing and operational transparency, rather than "concept packaging."

Prioritize putting measurable and traceable elements on-chain (warehouse receipts, electricity, inventory, settlements), turning cash flow certificates into tradable assets.

Hong Kong's True Leap: From "City of Exchanges" to "Port of Asset Digitization"

As RWA tokenization becomes a new interface layer for real assets and real cash flows, and stablecoins become a new underlying layer for cross-border clearing and collateral, Hong Kong's role will naturally change: no longer just a bustling city of exchanges, but a global hub for RWA, clearing, and standards. This is not a retreat; it is a return to position; it is also an upgrade and shift in both institutional and industrial tracks.

Huaxia Digital Capital's judgment is clear: whoever first deepens and thoroughly implements "returning to normal" will hold the discourse power in the next round of international digital finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。