When Bitcoin futures prices fell below spot prices for the first time since March, panic and confusion spread throughout the market. A rare market signal is flashing, and historical experience suggests that extreme pessimism is often a prelude to the market's rebirth.

As Bitcoin futures prices dropped below spot prices for the first time since March this year, forming a rare negative basis, panic and confusion permeated the market. This futures discount phenomenon is typically seen as a key signal of exhausted leverage demand and pessimistic market sentiment.

Data shows that the CME Bitcoin futures main contract has fallen to $95,430, significantly below the spot price. Behind this seemingly pessimistic market structure lies historical patterns and opportunities.

1. Futures Premium Disappears, Sentiment Plummets to Freezing Point

The Bitcoin futures market is sending a rare signal—the basis has turned negative. This phenomenon means that the trading price of futures contracts is lower than the spot price, revealing a fundamental shift in market risk appetite.

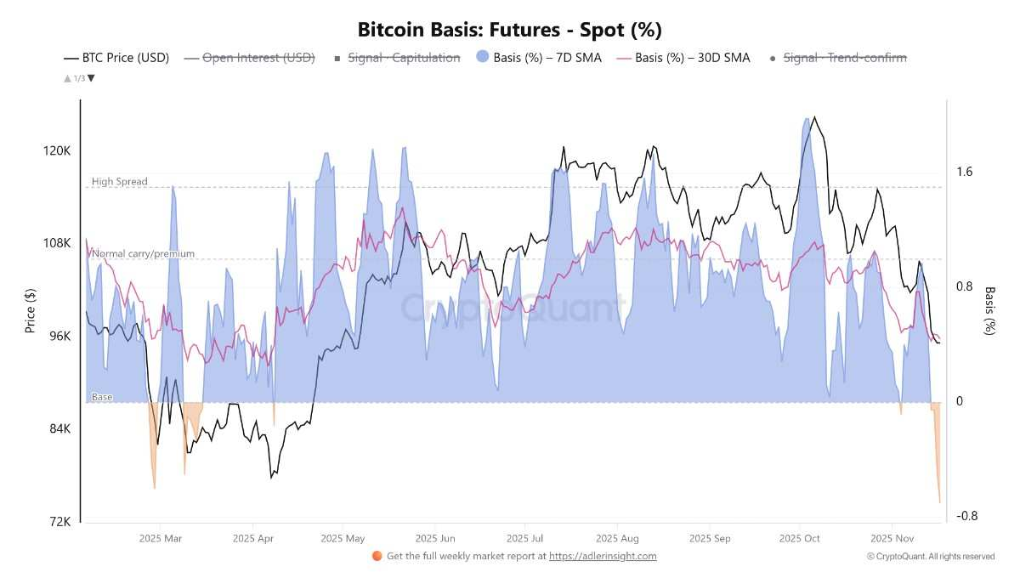

● According to CryptoQuant data, the Bitcoin basis has clearly shifted into negative territory. This change marks that the market has completely erased the optimistic premium represented by the positive basis that had persisted for several months.

● From a technical perspective, both the 7-day and 30-day moving averages are sloping downward, further confirming that bearish sentiment has dominated the futures market in the short term.

● Meanwhile, Bitcoin prices have fallen below the critical support level of $90,000, dropping 4.48% in the past 24 hours, continuing a weak pattern that has seen a nearly 30% decline over the past six weeks.

2. Underlying Logic: Leverage Evaporation and Market Structure Restructuring

● The core of the negative basis phenomenon lies in the sharp shrinkage of market leverage demand. When traders are no longer willing to hold leveraged long positions, the price of futures contracts will fall below the spot price, creating a discount.

● This shift in market structure is usually accompanied by panic liquidations from traders and collective unwinding of long positions. On-chain data analysis shows that Bitcoin is currently trading within the "benchmark area," which typically reflects increased selling pressure or reduced market risk exposure.

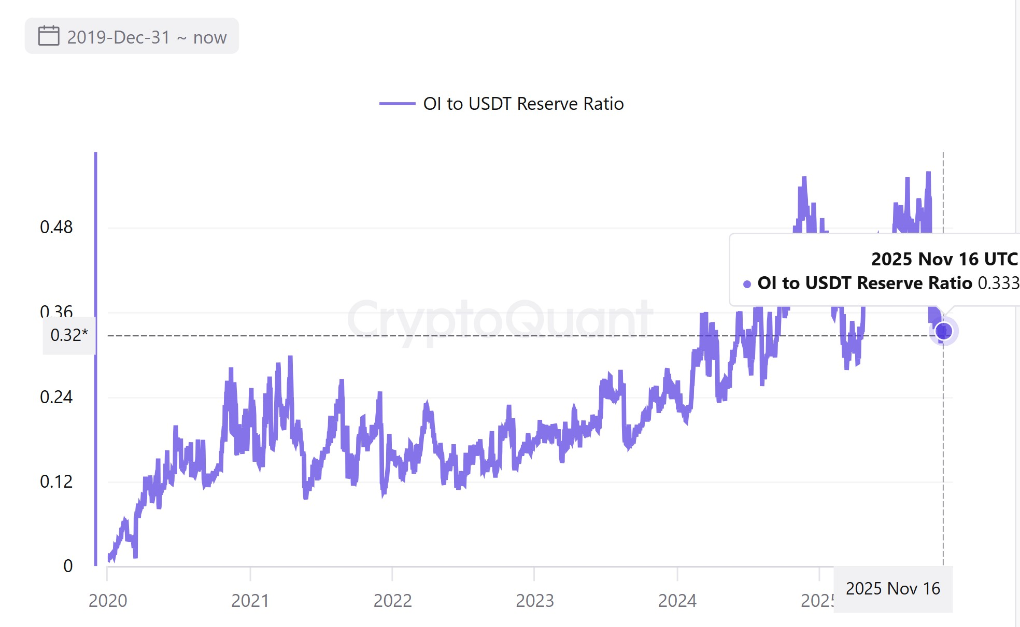

● At the same time, the BTC-USDT futures leverage ratio has reset to a healthy level of 0.3, indicating that the excessive leverage accumulated at market highs has been effectively cleared. This decline in leverage reduces the risk of large-scale forced liquidations in the future, building a healthier foundation for the market.

3. Historical Reflection: The Hidden Connection Between Negative Basis and Market Bottoms

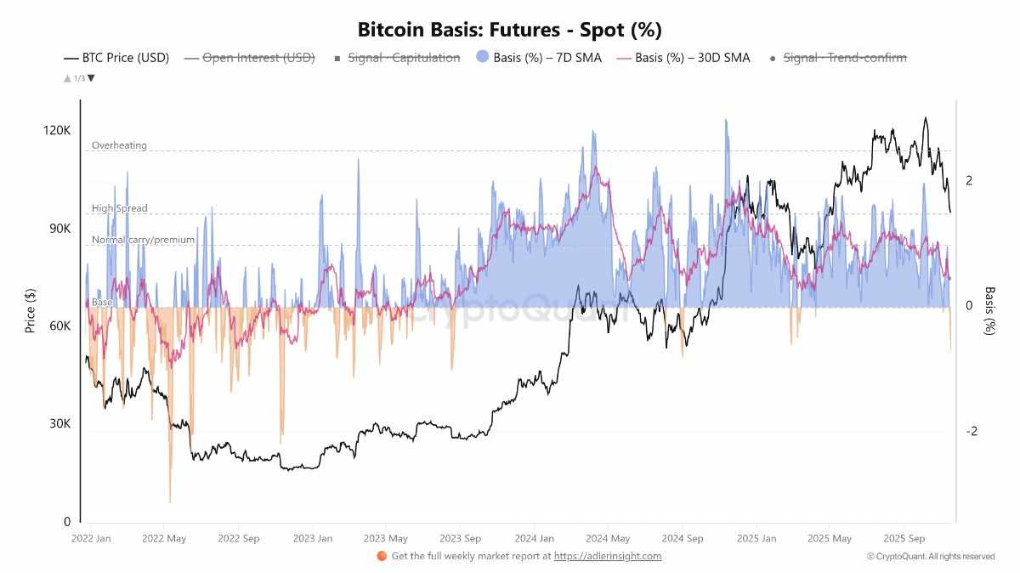

● Historical data reveals a key pattern: since August 2023, every time the 7-day moving average of the Bitcoin basis turned negative, it coincided with the bottom range of phase adjustments in bull markets. This pattern has been confirmed multiple times in the past, making the negative basis a sign of the market taking a "deep breath" during a frenzy, rather than a death knell for the trend.

● Of course, there are historical counterexamples—such as the negative basis in January 2022, which marked the beginning of a deeper bear market. The core of determining the current situation lies in identifying the macro cycle the market is in.

Currently, there is no clear evidence that the market has completely turned into a bear market, which means this signal is more likely pointing to a "sharp brake in a bull market" rather than a "turning downward."

4. Funding Rates and Market Sentiment Game

● In addition to the basis indicator, the "funding rate" in the perpetual contract market is another key barometer. When the funding rate is deeply negative, it means the market is filled with short positions, and shorts must pay fees to longs. This extreme situation can easily trigger a "short squeeze"—once prices start to rebound, shorts are forced to buy back, which can dramatically propel prices like rocket fuel.

● On the other hand, on-chain data also provides complex signals. The recent surge in BTC liquidity within cryptocurrency exchanges is often related to adjustments in positions by large players and liquidity pressures, usually accompanied by significant price volatility.

● On the surface, the surge in internal liquidity appears to be a bearish signal. However, when analyzed in conjunction with the negative basis and negative funding rate, it paints a picture of "the market structure undergoing a vigorous yet healthy cleansing."

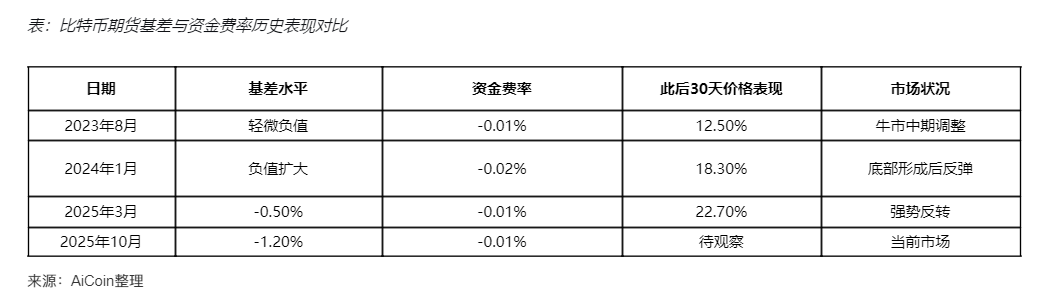

5. Historical Performance and Current Indicator Comparison

● From historical data, the simultaneous occurrence of negative basis and negative funding rates is often not a signal of a sustained bear market, but rather marks the formation of phase bottoms multiple times. The market performance in March 2025 is particularly typical, when the Bitcoin funding rate was extremely low, followed by a market surge of over 20%. The current market structure bears similarities to March 2025, with the funding rate turning negative again and the basis remaining in negative territory.

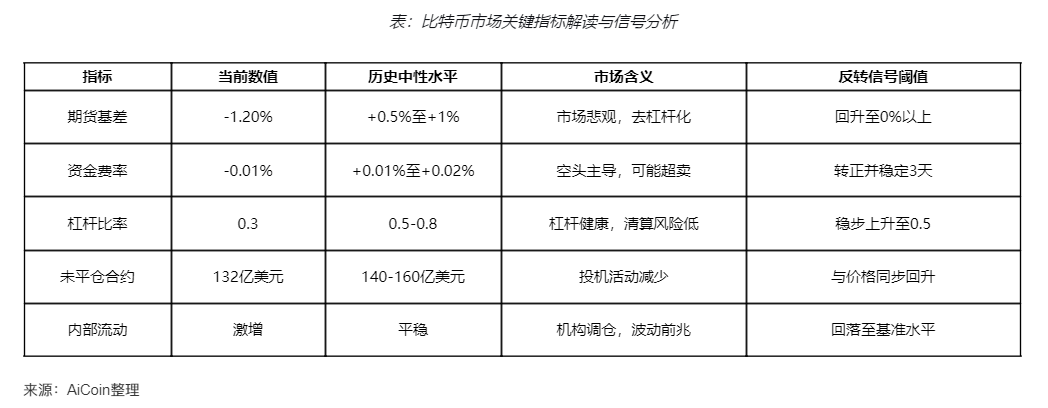

6. Key Data and Market Implications

According to the table analysis, multiple indicators show that the market has entered extreme territory, but there has not yet been a clear reversal signal. The key observation point is for the basis to rise above the range of 0% to 0.5%, which will be the first sign of confidence restoration.

7. How to Capture Certainty in Market Reversals

Market bottoms are a process, not a precise point. Currently, we are in this process. For investors, identifying the first signs of market confidence recovery is crucial.

● A basis rising above the range of 0% to 0.5% will be the first sign of confidence restoration. This level will indicate that market confidence is beginning to return, and leverage demand is re-entering moderately. For medium to long-term investors, the current "benchmark area" provides a rare opportunity for positioning. The strategy should focus on gradually building positions rather than waiting for the market to stabilize completely before chasing higher.

● The focus should not only be on spot but also on the additional price advantages offered by futures contracts in an extremely negative basis environment. The net unrealized profit (NUP) indicator for Bitcoin has dropped to 0.476, the lowest level since April 2025. Historical data shows that when this indicator falls below 0.5, it often signals that short-term market losses are nearing a bottom.

● Since the beginning of 2024, the range of 0.47 to 0.48 has successfully reversed three times, prior to Bitcoin's rise from $42,000 to $70,000, before the mid-2024 adjustment, and recently before the rebound to $110,000 in October.

As the Bitcoin futures basis rises above the critical range of 0%-0.5%, we will see the first signal of market confidence rebuilding. When the last over-leveraged trader is washed out, and panic selling has exhausted the last selling pressure, the market will welcome its most solid bottom.

History does not repeat itself simply, but it always carries similar rhythms. Currently, the market is at a critical point of transition between bulls and bears, and a reversal driven by "short squeezes" and confidence rebuilding may be quietly approaching.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。