Last week, the most talked-about topic globally was "the end of the U.S. government shutdown." After all, the global capital markets are closely watching the actions of the U.S. government, and when it reopens, it signifies potential policy changes.

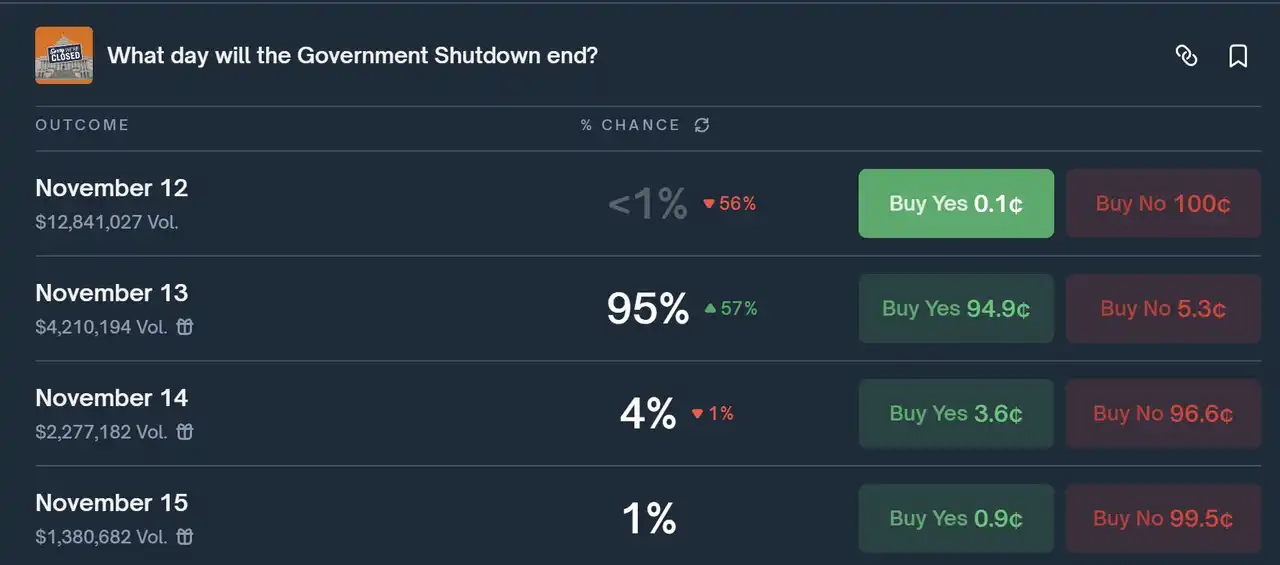

On the largest prediction market, Polymarket, the market related to "when will the government reopen" saw over $100 million in trading volume, reflecting the market's attention. Interestingly, many people predicted the correct outcome but still lost money.

Let's rewind to November 12. On this day, positive news kept coming: first, the White House press conference conveyed an optimistic signal, indicating that "the end of the government shutdown is likely to happen on Wednesday (November 12)." Then, on the evening of the 12th, President Trump officially signed the bill to end the shutdown, broadcast live on television.

This ultimate certainty event, like other political events, triggered a strong market reaction immediately: the price of the Yes shares for "the shutdown ends on November 12" on Polymarket skyrocketed, peaking at $0.97. In the logic of prediction markets, this means the market consensus believed there was a 97% chance of this happening. Since the maximum price can only reach $1, or a 100% probability, buying at $0.97 only yields a final 3% profit, but this 3% is a guaranteed win with no risk, as the event has already been confirmed.

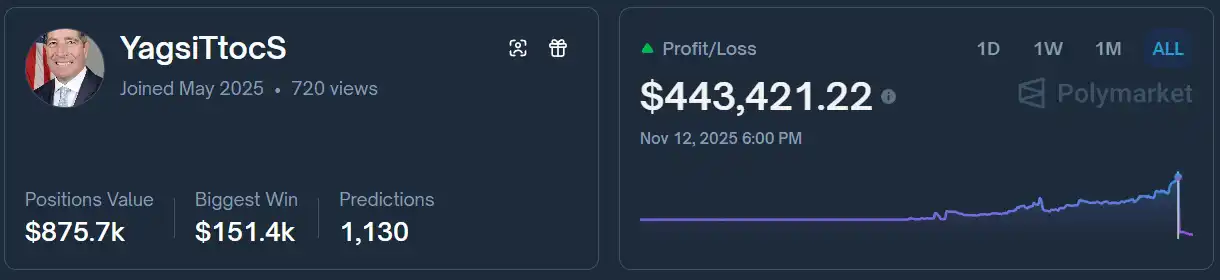

In this frenzy of buying, the largest investor was a trader named YagsiTtocS (formerly known as Halfapound). He is a star figure in Polymarket's political sector, having participated in over 1,000 different markets from August to November 12, accumulating nearly $400,000 in profits, with a steadily rising profit curve and almost no losses.

(According to Polymarket's personal homepage, as of 6 PM on November 12, his historical trading profit curve was outstanding, with no significant drawdowns.)

Looking at his previous trading logic, it is evident that besides arbitrage, he is very skilled at quickly buying in large quantities during significant, high-certainty news events.

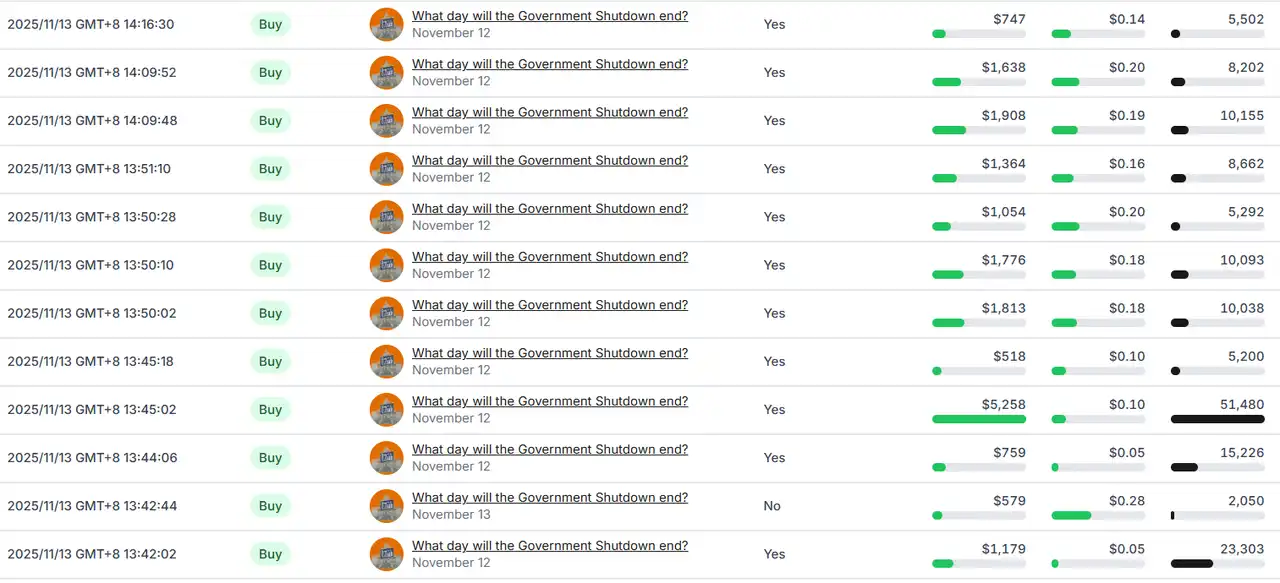

In YagsiTtocS's view, the confirmation of the government reopening on the 12th perfectly aligned with his trading logic. Thus, he invested over $500,000, betting heavily on Yes at an average price of about $0.60. After Trump signed the bill, the price of Yes rose to $0.97. To him, this gamble was over; all that remained was to wait for the system to automatically settle his profits. He even continued to buy at high prices, believing this was no longer a subjective trade with risk, but rather "zero-risk short-term high-yield investment."

As midnight approached: an incomprehensible reversal

However, the story took a sharp turn from here.

After 10 PM that night, following Trump's signing of the bill and all news reporting the end of the shutdown, a strange scene unfolded in the market: the price of Yes did not rise but fell instead. This meant that some believed the market would settle as No on the 12th!

This left many confused: the president had signed, the news had reported it, so why did some still think the shutdown "would not end" on the 12th?

The answer lies in the "market rules" that many traders tend to overlook.

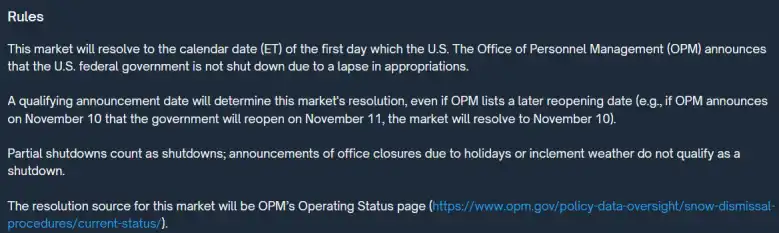

The settlement of each market on Polymarket does not rely on what we generally consider "facts," but rather on a clearly defined, singular official information source. For the market "When will the government shutdown end," the rules explicitly state: the final arbiter is not the president's signature nor any news headline, but the U.S. Office of Personnel Management (OPM) announcing the "government operating status" on its official website.

The above image is a screenshot from Polymarket's market execution rules: the date when OPM first announces "the federal government has ended the shutdown" (Eastern Time) is the standard. Specifically:

- The date of OPM's announcement is the standard, not the actual reopening date (for example: if announced on November 10 that the reopening is on November 11, the market will determine the reopening date as November 10);

- Partial shutdowns are also considered shutdowns;

- All status determinations are based on the OPM website's operating status page (https://www.opm.gov/policy-data-oversight/snow-dismissal-procedures/current-status/)

In simple terms: only when the OPM website says "the government is open" will there be a settlement result in the market; if it does not say so, even if the president says it, it is invalid under Polymarket's rules.

Due to the lag in government processes, the status on the OPM website was not updated immediately after Trump signed the bill.

The constraints of the rules and the collapse of emotions

At this moment, the most agonizing was YagsiTtocS. With only an hour left until midnight, his $500,000 was hanging by a thin line of rules.

As the date switched from the 12th to the 13th, the OPM website remained unchanged, and the corresponding market price for Yes on the 12th on Polymarket had already collapsed, dropping from $0.97 to below $0.05. Yet, YagsiTtocS seemed unable to accept this reality: in the early hours of the 13th, he continued to buy the already doomed Yes for the 12th, with prices ranging from $0.05 to $0.30. This was no longer a strategy but a "gambler's" operation driven by anger, unwillingness, and luck, attempting to "average down" to fight against the cold rules, further expanding his ultimate losses.

When the market finally settled, YagsiTtocS incurred losses exceeding $500,000, making him the biggest loser in this market. This trade not only wiped out all his historical profits but also left him with a total loss exceeding $150,000, dropping him from the top of the platform's profit leaderboard to outside the top one million.

The victor who understood the rules

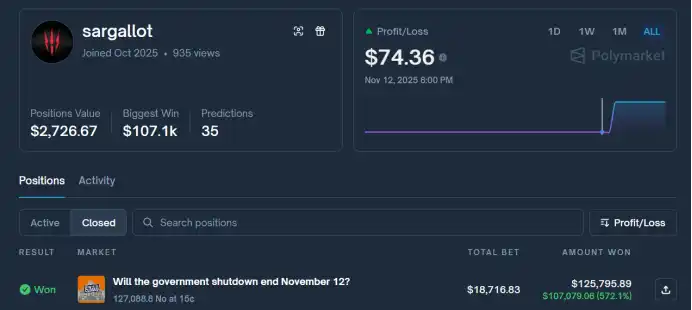

On the other side of this tragedy stood a trader named sargallot. Compared to YagsiTtocS's star aura, he was previously inconspicuous, with an average trading volume of only about $200. As of November 12, his total profit was below $100. However, this seemingly ordinary trader became the biggest winner in this market, profiting over $100,000 by employing a completely different trading method from YagsiTtocS.

The secret to sargallot's success was simple: he read the rules carefully.

He realized that this market was not betting on "when the shutdown actually ends," but rather "when the OPM website updates its status," and he anticipated the possibility of administrative delays. Thus, on the evening of the 12th, when everyone was celebrating the news and driving the price of No down to $0.07, he calmly bought in large quantities. When the OPM website failed to update in the early hours of the 13th, at 00:02, he sold out at $0.99, achieving astonishing returns at a minimal cost.

A gamble, two outcomes. The star trader lost everything despite "predicting correctly," while the unknown trader reaped a windfall by "understanding the rules." The $500,000 spent may well represent the most brutal and core lesson of this market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。