Author: Zhou, ChainCatcher

The cryptocurrency market continues to be sluggish. Since November, the price of Ethereum has dropped nearly 40% from its peak, and ETFs have seen continuous net outflows. In this round of systemic retreat, BitMine, the largest Ethereum treasury company, has become a focal point, with Peter Thiel's Founders Fund reducing its holdings of BMNR by half. Meanwhile, Cathie Wood's ARK Invest and JPMorgan have chosen to increase their positions against the trend.

The capital's torn attitude has put BitMine's "5% alchemy" on trial: 3.56 million ETH, a floating loss of $3 billion, and mNAV dropping to 0.8. As one of the last bastions of Ethereum buying power, how much longer can BitMine continue to buy? Is there a value mismatch? After the DAT flywheel stalled, who will take over ETH?

1. BitMine's 5% Alchemy: How Long Can the Funds Last?

As the second-largest cryptocurrency treasury company after MicroStrategy, BitMine had planned to purchase tokens equivalent to 5% of Ethereum's total flow in the future. On November 17, BitMine announced that its Ethereum holdings had reached 3.56 million ETH, accounting for nearly 3% of the circulating supply, surpassing half of its long-term target of 6 million ETH. Additionally, the company currently holds approximately $11.8 billion in crypto assets and cash, which includes 192 bitcoins, $607 million in uncollateralized cash, and 13.7 million shares of Eightco Holdings stock.

Since launching a large-scale coin accumulation plan in July, BitMine has become a market focus. During that time, the company's stock price rose in tandem with Ethereum's price, and the story of "using coins to boost market value" was seen by investors as a new model in the crypto space.

However, as the market cooled and liquidity tightened, market sentiment began to reverse. The drop in Ethereum's price has made BitMine's aggressive buying pace appear riskier, with a floating loss of nearly $3 billion calculated at an average purchase price of $4,009. Although Chairman Tom Lee has repeatedly expressed a bullish outlook on Ethereum and stated that he would continue to accumulate at lower levels, investors' focus has shifted from "how much more can be bought" to "how much longer can it last."

Currently, BitMine's cash reserves are approximately $607 million, with funding coming from two main channels.

First is the revenue from crypto assets. BitMine generates short-term cash flow through immersion-cooled bitcoin mining and consulting services while also positioning itself in Ethereum staking for long-term returns. The company states that its held ETH will be staked to generate approximately $400 million in net income.

Second is secondary market financing. The company has initiated an ATM stock sale program, which allows it to sell new shares for cash at any time without presetting price or scale. To date, the company has issued hundreds of millions of dollars in stock and attracted funding from several institutions, including well-known firms like ARK, JPMorgan, and Fidelity. Tom Lee stated that when institutions buy BMNR in large quantities, these funds will be used to purchase ETH.

Through the dual drive of accumulating ETH and generating revenue, BitMine attempts to reshape the logic of corporate capital allocation, but changes in the market environment are weakening the stability of this model.

In terms of stock price, BitMine (BMNR) is under pressure, having fallen about 80% from its July peak, with a current market value of approximately $9.2 billion, below its ETH holding value of $10.6 billion (based on ETH at $3,000), and mNAV dropping to 0.86. This discount reflects market concerns about the company's floating losses and the sustainability of its funds.

2. The Last Straw for ETH Price: Three Visible Purchasing Powers Diverging and Staking Retreating

From a macro perspective, the Federal Reserve has released hawkish signals, with the probability of a rate cut in December decreasing, and the overall cryptocurrency market remains weak, with a significant decline in risk appetite.

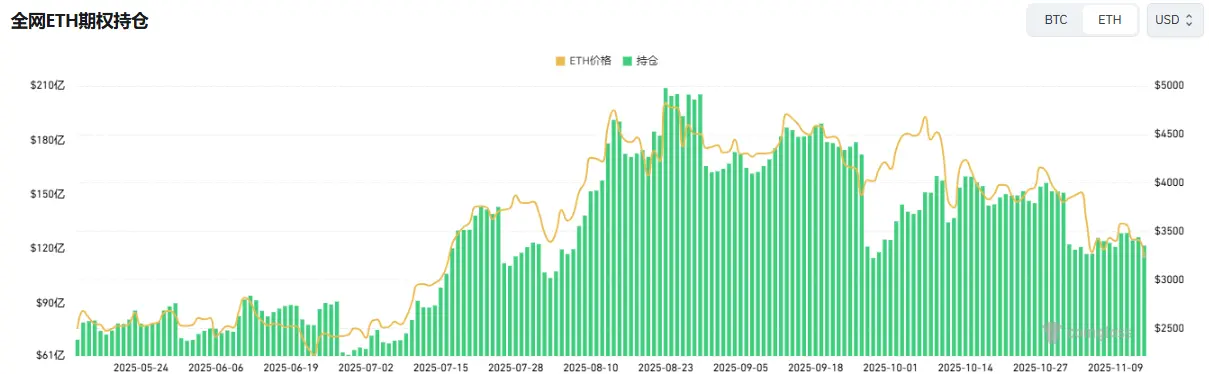

Currently, ETH has dipped below $3,000, down over 30% from its August peak of $4,900. This round of adjustment has refocused the market on a key question: if the forces supporting the price previously came from treasury companies and institutional accumulation, then after the buying power retreats, who will take over?

Among the visible market forces, the three main purchasing entities—ETFs, treasury companies, and on-chain funds—are showing divergent trends.

First, the inflow trend of Ethereum-related ETFs has significantly slowed. The current total ETF holdings are approximately 6.3586 million ETH, accounting for 5.25% of the total supply. According to SoSoValue data, as of mid-November, the total net assets of Ethereum spot ETFs were about $18.76 billion, with net outflows this month significantly exceeding inflows, with daily outflows reaching as high as $180 million. Compared to the sustained net inflow phase from July to August, the funding curve has shifted from a steady rise to a volatile decline.

This decline not only weakens the potential buying power but also reflects that market confidence has not fully recovered from the rhythm of the crash. ETF investors typically represent medium to long-term allocated funds, and their withdrawal indicates a slowdown in traditional financial channels' incremental demand for Ethereum. When ETFs no longer provide upward momentum, they may instead amplify volatility in the short term.

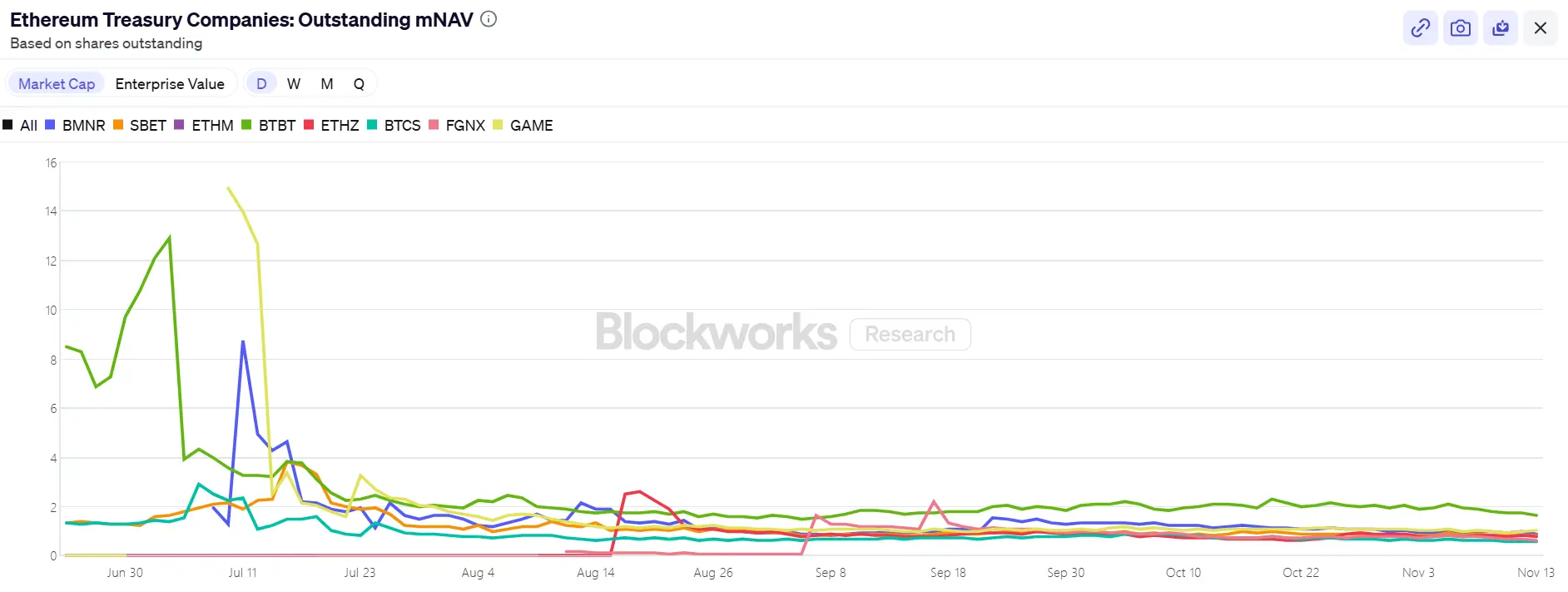

Second, digital asset treasury (DAT) companies have also entered a phase of divergence. Currently, the total strategic reserve of Ethereum held by treasury companies is 6.2393 million ETH, accounting for 5.15% of the supply. The pace of accumulation has noticeably slowed in recent months, with BitMine almost becoming the only major player still buying in large quantities. In the past week, BitMine has increased its holdings by 67,021 ETH, continuing its strategy of buying on dips; SharpLink has not made further purchases since acquiring 19,300 ETH on October 18, with an average cost of about $3,609, and is currently also in a floating loss position.

In contrast, some small and medium-sized treasury companies are being forced to contract. ETHZilla sold about 40,000 ETH at the end of October to repurchase shares, attempting to stabilize its stock price by selling part of its ETH to narrow the discount range.

This divergence indicates that the treasury industry is shifting from widespread expansion to structural adjustment. Leading companies can still maintain buying power through capital and confidence, while small and medium-sized companies are trapped in liquidity constraints and debt repayment pressures. The market's baton has shifted from broad incremental buying to a few "lone warriors" with capital advantages.

On the on-chain level, short-term fund leaders remain whales and high-frequency addresses, but they do not constitute a price support force. Recently, those who have consistently been bullish on ETH have faced liquidation, which has somewhat undermined trading confidence. According to Coinglass data, the total open interest in ETH contracts has nearly halved since the August peak, with leveraged funds rapidly contracting, indicating a simultaneous cooling of liquidity and speculative enthusiasm.

Additionally, recently activated Ethereum ICO wallet addresses that have been dormant for over ten years have begun to transfer out. Glassnode data reports that long-term holders (addresses holding for over 155 days) are currently selling about 45,000 ETH daily, equivalent to approximately $14 million. This is the highest level of selling since 2021, indicating a weakening of current bullish forces.

BitMEX co-founder Arthur Hayes recently stated that even though dollar liquidity has contracted since April 9, the inflow of ETFs and purchases by DAT have allowed Bitcoin to rise, but that state has now ended. The basis is not rich enough to sustain institutional investors' continued purchases of ETFs, and most DATs are trading at a discount below mNAV, leading investors to now avoid these derivative securities.

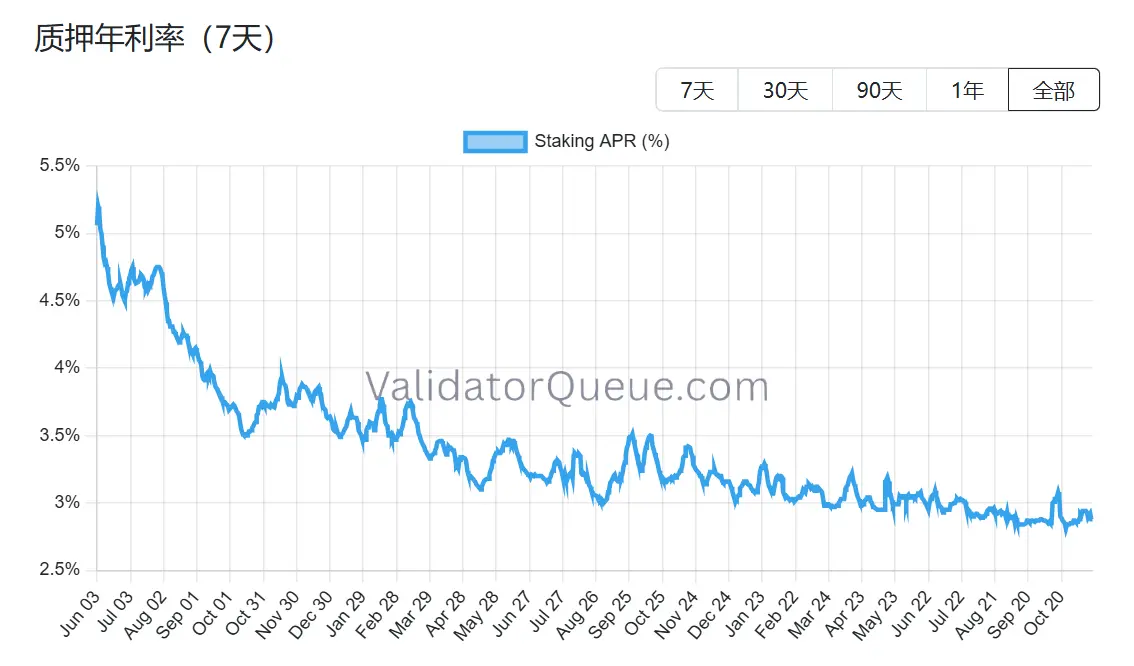

The same applies to Ethereum, especially since its staking ecosystem is also showing signs of retreat. Beaconchain data shows that the number of active Ethereum validators has decreased by about 10% since July, reaching the lowest level since April 2024. This is the first significant drop since the network transitioned from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) consensus mechanism in September 2022.

The decline is primarily due to two factors:

The decline is primarily due to two factors:

First, the rise in Ethereum's price this year has led to an unprecedented high in validators exiting the queue, as staking operators rush to unstake to realize profits.

Second, the decline in staking yields and the rise in borrowing costs have made leveraged staking unprofitable. Currently, Ethereum's annualized staking yield is about 2.9% APR, far below the historical high of 8.6% set in May 2023.

Against the backdrop of simultaneous pressure on the three main buying paths and the retreat of the staking ecosystem, Ethereum's next phase of price support faces structural challenges. While BitMine is still buying, it is nearly fighting alone; if even BitMine, this last pillar, cannot continue to buy, what the market will lose is not just a stock or a wave of funds, but possibly the foundational belief of the entire Ethereum narrative.

3. Is There a Value Mismatch in BitMine?

After discussing the funding chain and the retreat of buying power, a more fundamental question arises: Is BitMine's story really over? The current pricing given by the market clearly does not fully understand its structural differences.

Compared to MicroStrategy's path, BitMine chose a completely different approach from the beginning. MicroStrategy heavily relies on convertible bonds and preferred stock for fundraising in the secondary market, with annual interest burdens of hundreds of millions of dollars, and its profitability depends on the unilateral rise of Bitcoin; BitMine, while diluting equity through new stock issuance, has almost no interest-bearing debt, and its held ETH contributes approximately $400-500 million in staking income annually, which is relatively rigid cash flow and has far less correlation with price fluctuations than Strategy's debt costs.

More importantly, this income is not the endpoint. As one of the largest institutional ETH holders globally, BitMine can fully utilize staked ETH for restaking (earning an additional 1-2%), operating node infrastructure, locking in fixed income through yield tokenization (such as around 3.5% certainty returns), and even issuing institutional-grade ETH structured notes—operations that MicroStrategy's BTC holdings cannot achieve.

However, currently, BitMine (BMNR) has a market value in the U.S. stock market that is approximately 13% discounted compared to the value of its ETH holdings. Within the entire DAT sector, this discount is not the most exaggerated, but it is clearly lower than the historical pricing center for similar assets. Bear market sentiment amplifies the visual impact of floating losses, somewhat obscuring the value of income buffers and ecological options.

Recent institutional actions seem to have captured this deviation. On November 6, ARK Invest increased its holdings by 215,000 shares ($8.06 million); JPMorgan held 1.97 million shares at the end of the third quarter. This is not a blind bottom-fishing strategy but is based on the judgment of long-term compound growth in the ETH ecosystem. Once the price of Ethereum stabilizes or gently rebounds, the relative stability of income may allow BitMine's mNAV recovery path to be steeper than that of purely leveraged treasury companies.

Whether a value mismatch truly exists is already laid out on the table; the remaining question is when the market will be willing to pay for scarcity. The current discount is both a risk and the starting point of divergence. As Tom Lee said, the pain is temporary and will not change the super cycle of ETH. Of course, it may also not change BitMine's core role in this cycle.

Click to learn about ChainCatcher's job openings

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。