The market suddenly erupted into a frenzy of asset purchases, all stemming from a few dovish statements by Federal Reserve officials. On November 25, global financial markets experienced a comprehensive surge. Two senior officials from the Federal Reserve released clear signals for interest rate cuts, driving U.S. stocks, gold, crude oil, and even cryptocurrencies to rise collectively.

Federal Reserve Governor Waller and San Francisco Fed President Daly's dovish remarks caused market expectations for a rate cut in December to soar from 42% a week ago to 82.9%.

This broad-based rally in a recently sluggish market was like a bombshell, with the Nasdaq index soaring 2.7%, marking its best single-day performance since May; Bitcoin broke through $88,000; even traditional safe-haven asset gold surged over 1%.

I. Federal Reserve's Shift: Key Officials Speak Out

The dovish speeches from two heavyweight officials at the Federal Reserve directly ignited enthusiasm in global markets. Federal Reserve Governor Waller explicitly stated his support for a rate cut at the December policy meeting.

● Waller pointed out that most private sector data indicates a weak job market, and he believes the inflation issue is not severe, with the inflation rate excluding tariff impacts only around 2.4% or 2.5%.

● More critically, San Francisco Fed President Daly also expressed support for a rate cut in December on the same day. Daly explained her decision-making logic: the likelihood of a sudden deterioration in the job market is greater than a sudden rise in inflation, and it is also more difficult to control. Daly, a staunch ally of Fed Chair Powell, has consistently maintained a "neutral to hawkish" stance and rarely publicly opposes Powell's position.

● Analysts believe that when such figures come out in support of a rate cut, it is as significant as an official hint of a rate cut.

II. Market Reaction: Assets Surge Across the Board

Stimulated by the dovish signals from Federal Reserve officials, global markets experienced a "everything is rising" celebration.

● All three major U.S. stock indices closed higher, with the S&P 500 index rising 1.55%, marking its largest increase in six weeks; the Dow Jones increased by 0.44%; the Nasdaq index performed particularly well, surging 2.69%.

● Tech stocks led the market rebound. Tesla surged nearly 7%, Google soared over 6%, Amazon and Meta both rose over 3%, and Nvidia increased by 2.05%. The semiconductor sector performed exceptionally well, with the Philadelphia Semiconductor Index skyrocketing 4.63%.

● Chinese concept stocks also followed the broader market upward, with the Nasdaq Golden Dragon China Index closing up 2.82%. WeRide rose 14.72%, Pony.ai increased by 12.51%, Baidu rose by 7.44%, Bilibili increased by 6.80%, and Alibaba rose by 5.10%.

III. From Gold to Bitcoin

Not only the stock market, but other asset classes also surged.

● Gold rose strongly under the influence of heightened expectations for a Federal Reserve rate cut, with spot gold reaching a high of $4,099.03 per ounce, an intraday increase of 0.8%. Bart Melek, head of commodity strategy at TD Securities, interpreted: “The market is increasingly convinced that the Federal Reserve will initiate a rate cut in December. Lower interest rate expectations combined with a weak dollar are supporting gold prices.

● The crude oil market also reversed a three-day decline, closing up over 1%, moving away from a one-month low.

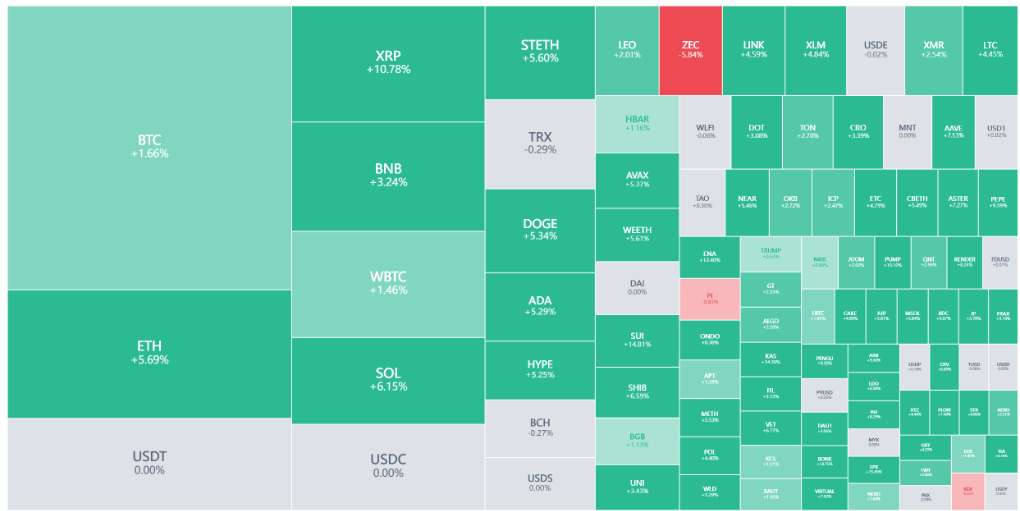

● In the cryptocurrency space, Bitcoin broke through the $88,000 mark, rising over 2%.

This synchronous rise of risk assets and safe-haven assets is quite rare in a normal market environment, but it played out in reality on Monday.

IV. Rate Cut Probability: Expectations Heat Up

With the continuous dovish statements from Federal Reserve officials, market expectations for a rate cut in December underwent a dramatic change.

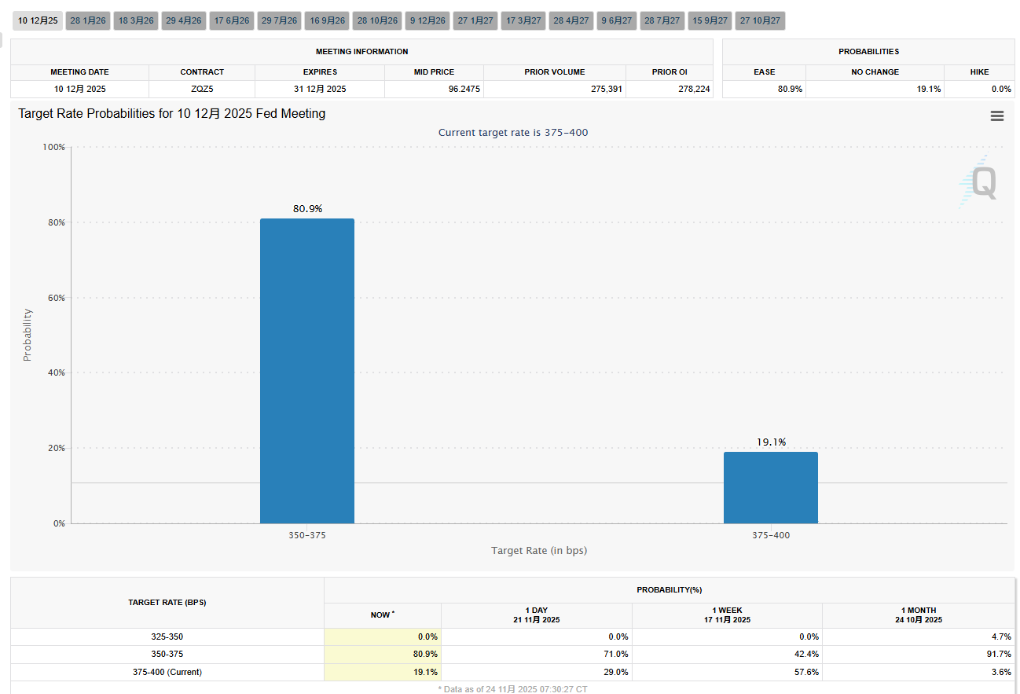

● According to the CME "FedWatch" tool, the probability of a 25 basis point rate cut by the Federal Reserve in December has surged to 82.9%, up from just 69.4% the day before.

● This shift is particularly astonishing, as just a week ago, the market's expectation for a December rate cut was only 42%.

● Looking further ahead, the market expects a cumulative probability of 65.4% for a 25 basis point rate cut by January next year, and the probability of a cumulative 50 basis point cut has also reached 22%.

This rapid shift demonstrates the significant influence of Federal Reserve officials' statements on market expectations.

V. U.S.-China Leaders' Call: Boosting Market Sentiment

In addition to the Federal Reserve's rate cut signals, the call between the U.S. and Chinese leaders also added positive factors to market sentiment. On the evening of November 24, Beijing time, the U.S. and Chinese leaders held a phone call.

● The Chinese side emphasized during the call that since the Busan meeting, China-U.S. relations have generally stabilized and improved, and both sides should maintain this momentum. The Chinese side also pointed out the need to adhere to the correct direction, expand the cooperation list, and reduce the problem list, striving for more positive progress to open new cooperation space for China-U.S. relations.

● The U.S. side stated that both sides are fully implementing the important consensus reached at the Busan meeting. Additionally, the two leaders reached a consensus on maintaining the post-war international order and discussed international hot issues such as the Ukraine crisis.

This news further boosted market risk appetite, adding momentum to the global asset rally.

VI. Market Outlook: A Data-Dependent Future

Although the market reacted enthusiastically to the Federal Reserve's rate cut, future trends remain uncertain.

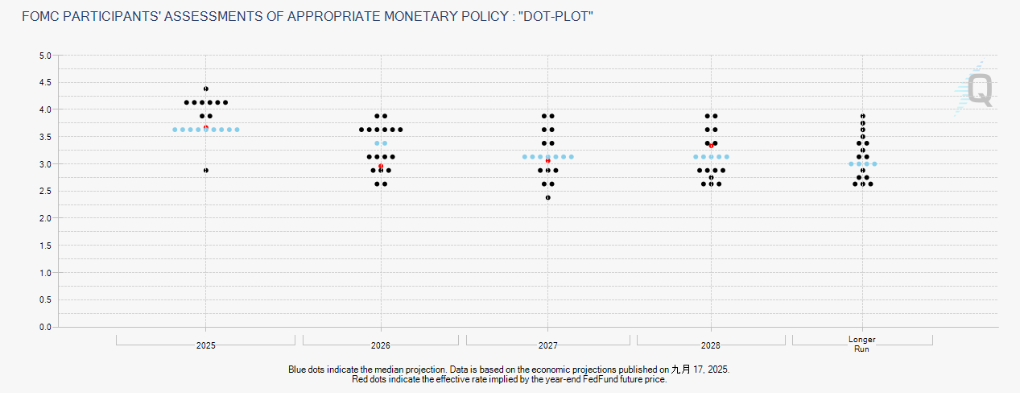

● Federal Reserve Governor Waller, while supporting a rate cut in December, also hinted that once the Federal Reserve obtains more comprehensive economic data in January, the decision-making approach may shift to rely more on a "meeting-by-meeting" rhythm.

● In an interview with Fox Business Channel, Waller stated: “Within the framework of the Federal Reserve's dual mandate, my biggest concern at the moment is the state of the labor market. Therefore, I support taking action to cut rates at the upcoming meeting.”

● Analysts warn that the sustainability of this rebound heavily depends on whether "data continues to worsen". This is known as the "post-cycle反逻辑"—the worse the economic data, the easier it is to sustain a short-term rally, as it intensifies market expectations for Federal Reserve intervention.

In this environment, the market rises quickly, but it can also fall particularly fast. Some analysts believe this week is not a "direction week," but a "volatility week."

The market has developed a deep reliance on the Federal Reserve—cry once, and they give you candy; fall once, and they give you rate cut expectations.

The Federal Reserve's rate cuts have shifted from an economic adjustment tool to a market stabilization mechanism, and whether this global asset collective celebration is the beginning of a sustainable bull market or yet another "rate cut illusion" remains to be seen.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。