1. From "Investment Benchmark" to Strategic Silence

As the largest holder of Bitcoin among Nasdaq-listed companies, MicroStrategy's "debt financing - buy and hold" model has always been its most distinctive label. The company's Executive Chairman, Michael Saylor, even stated, "Our most important product is Bitcoin." However, this benchmark enterprise, regarded as the "stabilizing force" in the cryptocurrency market, chose to remain silent at a critical moment.

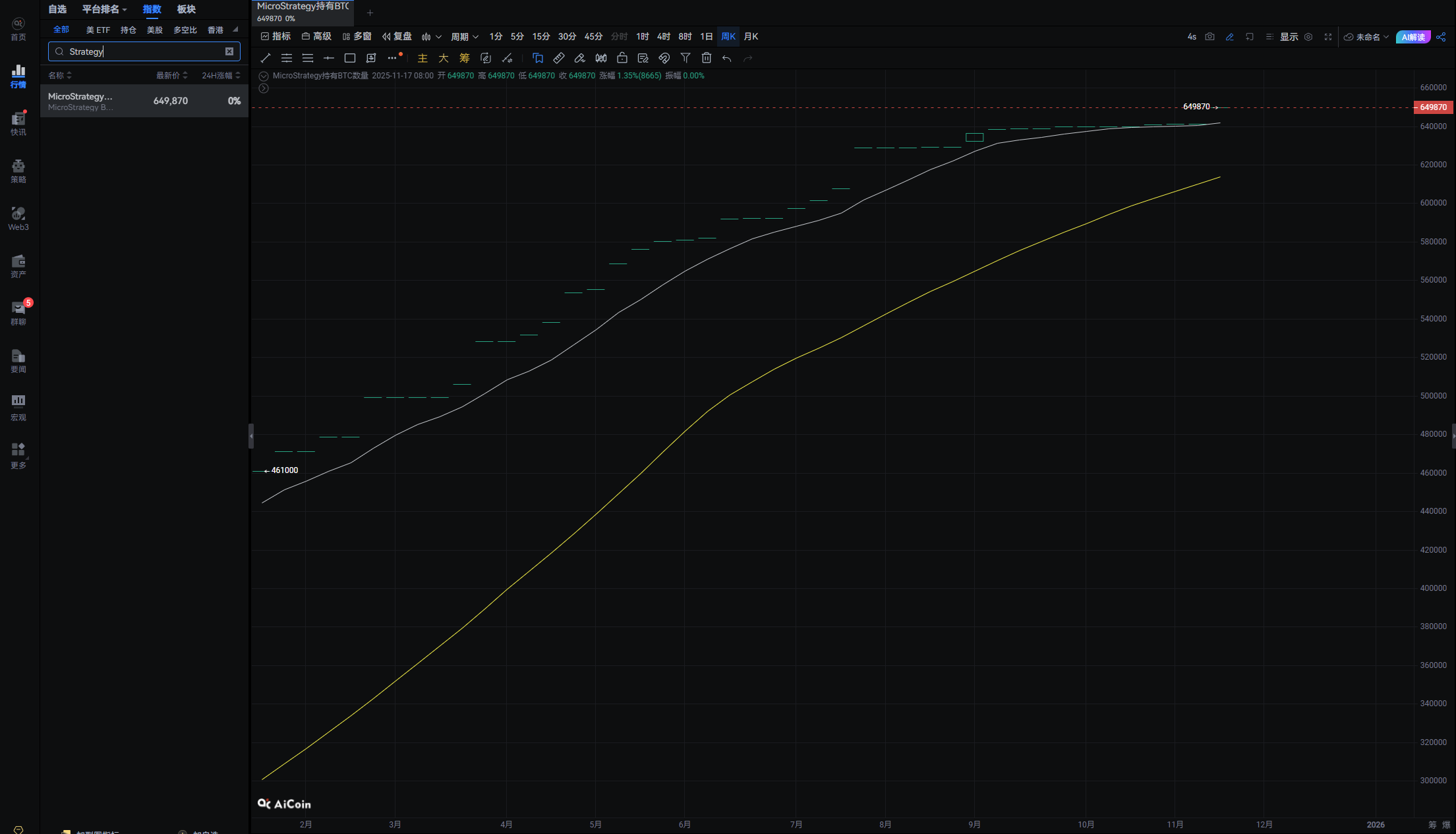

In the past 24 hours, MicroStrategy has not disclosed any new purchase records. On November 17, the company announced an investment of $835.6 million to acquire 8,178 Bitcoins. This acquisition significantly exceeded its previous weekly investment of 400 to 500 Bitcoins. The total Bitcoin holdings have now increased to 649,870, valued at nearly $56 billion. It is reported that the average purchase price for its Bitcoins was $74,430. Currently, the trading price of Bitcoin is around $86,000, meaning MicroStrategy's Bitcoin investment has still risen by nearly 16%.

Data shows that MicroStrategy only increased its Bitcoin holdings by 9,062 in November, a staggering 93.26% drop compared to 134,480 purchases during the same period last year. Although Saylor himself quoted the lyrics "I Won't ₿ack Down" on social media to express determination, this silence has still sparked numerous speculations in the market. A cryptocurrency analyst commented, "The market has become accustomed to MicroStrategy's weekly 'check-ins'; when this predictability suddenly disappears, especially during a market downturn, investors' anxiety will be amplified immediately." As of the time of writing, the company's stock price has retreated about 70% from its peak, but it remains the publicly listed company with the largest Bitcoin holdings, totaling 649,870 BTC, with a market price still about 1.2 times its net asset value.

2. A Comprehensive Test of Market Confidence

Although the pause in purchases has limited direct financial impact, it has conducted a comprehensive stress test on market confidence.

In terms of price, Bitcoin's fluctuations near the critical support level of $82,000 have noticeably intensified. According to data, the open interest in Bitcoin in the derivatives market increased by 5% in the past 24 hours, but the funding rate turned slightly negative, indicating that short-selling pressure is strengthening.

Regarding related assets, MicroStrategy's stock fell over 3% in pre-market trading. Notably, the stock's decline this year has far exceeded that of Bitcoin itself, challenging its narrative as a "Bitcoin proxy." Meanwhile, shares of several Bitcoin mining companies also dropped about 4%, reflecting the transmission effect of sentiment.

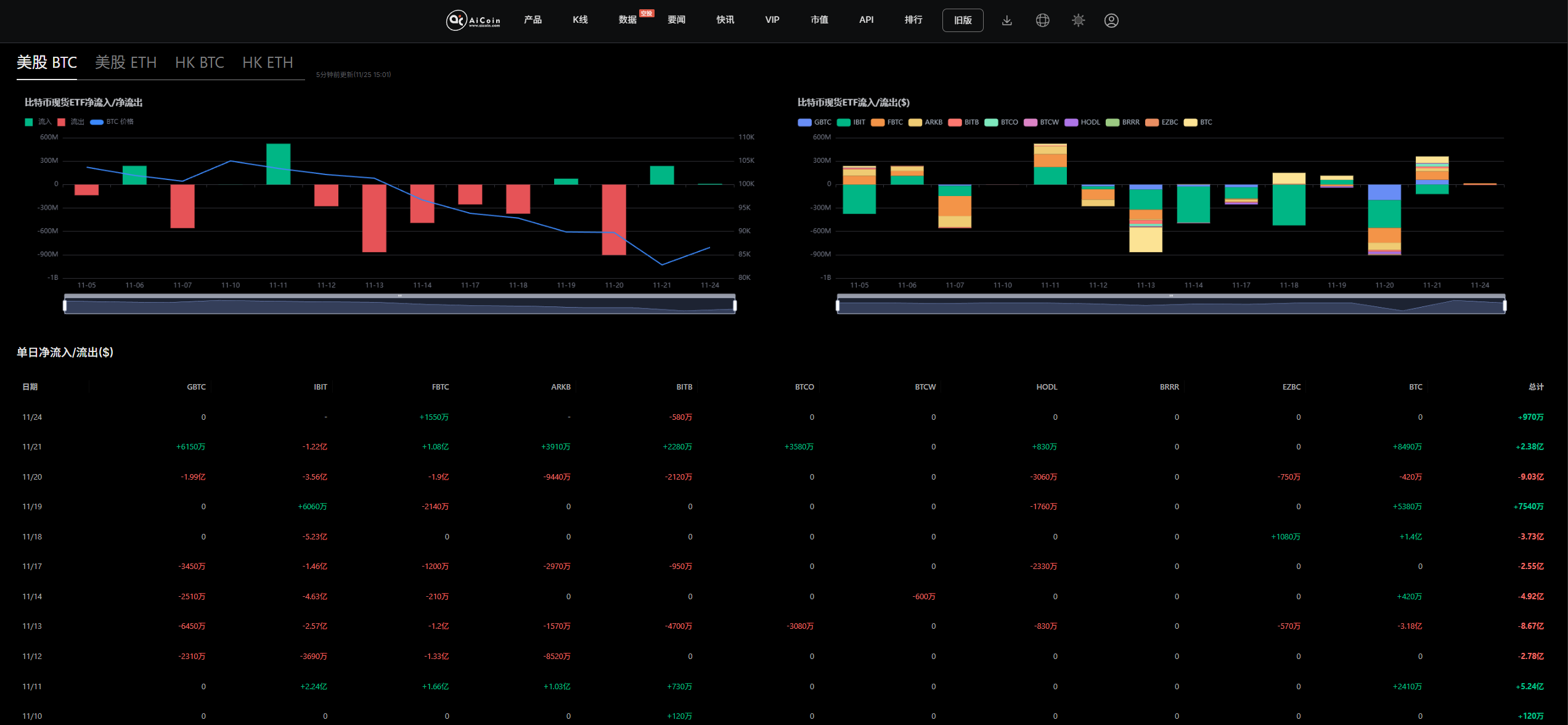

There is a noteworthy shift in capital flows. Market analysis indicates that institutional funds may be moving from high-risk "proxy plays" to more direct Bitcoin exposure. Spot Bitcoin ETFs are gradually replacing MicroStrategy's traditional role, becoming a new choice for institutional allocation.

However, on-chain data also reveals positive signals. The issuance of Bitcoin-backed credit instruments has seen significant growth recently, soaring from $3-4 million in mid-September to nearly $20 million by the end of November. This change indicates an increasing recognition of Bitcoin as a high-quality collateral, which may provide new financing channels for future purchases.

3. The Hanging Sword of the Market

The primary risk comes from the potential large-scale withdrawal of passive funds. Reports suggest that index provider MSCI is considering a new rule that could exclude companies holding more than 50% of their balance sheet in digital assets from its main indices. MicroStrategy's market performance has been relatively poor, and with the recent market downturn, MSCI may remove the company from key stock indices on January 15, 2026. Analysts estimate that if MicroStrategy is excluded from major indices, it could trigger a stock sell-off worth between $28 billion and $110 billion. Such a concentrated sell-off would not only severely depress the company's stock price but could also create a negative feedback loop of "collateral value decline - reduced financing ability," further constraining its ability to purchase Bitcoin.

Secondly, the "financing-accumulation" business model itself is facing sustainability questions. JPMorgan has warned that if Bitcoin prices drop another 15%, MicroStrategy's Bitcoin holdings will face paper losses. Meanwhile, the company's stock price has fallen about 70% from its peak, making its most adept method of "equity financing" increasingly costly. The cliff-like drop in November's purchase volume has led investors to question whether this once-revered business model has reached its ceiling.

4. Key Signals and Observation Points

The next one to two weeks will be a critical period for judging market direction, and investors need to focus on two core signals:

1) MicroStrategy's subsequent actions. The market is closely watching whether Saylor will break his silence and how he will explain this pause in purchases. If he resumes buying in the coming week and provides convincing reasons, market sentiment may quickly recover. Conversely, if this silence continues, it may reinforce market expectations of obstacles to its business model.

2) The capital flow of spot Bitcoin ETFs. As MicroStrategy's "buying machine" may be shutting down, whether spot Bitcoin ETFs can continue to attract net inflows will be an important litmus test for measuring institutional demand's resilience. If the ETFs can effectively absorb or even exceed the demand gap left by MicroStrategy, market concerns will be greatly alleviated.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。