Original | Odaily Planet Daily (@OdailyChina)

On November 24, the crypto media Unchained published an investigative report revealing a supplementary agreement signed between Berachain and Nova Digital Fund, a subsidiary of Brevan Howard, during Berachain's Series B financing in 2024. The document shows that Nova has the right to demand a full refund of its $25 million investment from the foundation at any time within one year after the TGE (Token Generation Event), specifically from February 6, 2025, to February 6, 2026.

Less than 24 hours later, Berachain co-founder Smokey the Bera published a lengthy response, stating that the report was "incomplete and inaccurate." The situation is still unfolding, and Odaily Planet Daily has compiled the key context of the event.

From "Bear Chain Myth" to "Valuation Cliff"

Berachain is an emerging public chain built on the Cosmos SDK, with a cultural narrative centered around "bears," and supports a complete EVM. In 2024, the project completed a Series B financing round totaling approximately $42 million, with a valuation exceeding $1.2 billion. Nova Digital, as one of the lead investors, invested $25 million at a price of $3/BERA, alongside notable crypto VC Framework Ventures.

On February 6, 2025, BERA was listed on major exchanges like Binance and Upbit, reaching a peak price of $15.5 at launch. However, the good times were short-lived, and the current price has dropped to just $1.02, a decline of 93%.

Under normal circumstances, without the protection of the "supplementary agreement," Nova, like all early institutions, would face a paper loss of about 66%, amounting to approximately $16.67 million. But now, they hold a "get out of jail free card" that allows them to exit at any time.

This is what truly stings the community.

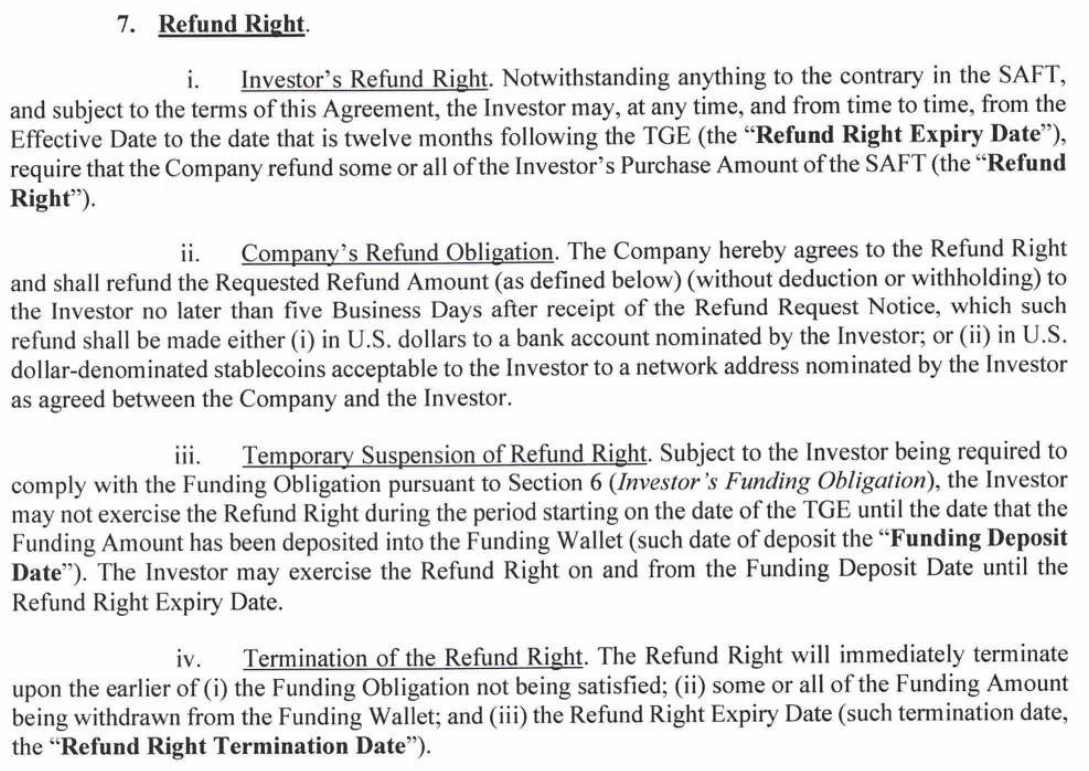

What Exactly Does the "No Loss" Clause State?

According to the documents disclosed by Unchained, the investment agreement between Berachain and Nova includes a standard SAFT agreement along with a supplementary agreement that contains a refund right. The core content of this agreement includes:

- Nova must deposit $5 million into Berachain within 30 days after the TGE (as a liquidity commitment).

- Then, within one year after the TGE (by February 6, 2026), Nova can demand a full refund of $25 million from the Berachain Foundation at any time.

Unchained stated that they could not verify whether Nova actually deposited the $5 million or if they had exercised the refund right.

This effectively gives Nova a "no loss" lottery ticket: when the price hits $15.5, they can cash in on five times the profit; when it drops to $1, they can walk away, leaving the losses to retail investors, community contributors, and ordinary investors who have no "supplementary agreement" protection.

Smokey's Response: Compliance Requirements vs. Community Doubts

Berachain co-founder @SmokeyTheBera has clarified in a post that Unchained's report is "incomplete and inaccurate," with some information coming from "disgruntled former employees."

Smokey stated that signing this supplementary agreement was not to guarantee that Nova would not lose its principal, but rather a risk mitigation clause required by Nova's compliance team. If Berachain ultimately fails to complete the TGE listing, locking BERA would not meet Nova's liquidity strategy requirements, hence the need for a "failure protection" clause. Nova remains one of the largest holders of Berachain, holding both locked BERA from the Series B round and a significant amount of BERA tokens purchased on the open market. They have consistently "increased their exposure" throughout the market cycle and provided real liquidity support.

In other words: Smokey emphasized that this is a compliance requirement rather than a "privilege protection."

However, the controversy did not stop there. Another focal point is:

Did other Series B investors know? Does this constitute a violation of the Most Favored Nation (MFN) clause?

Smokey claimed that no MFN (Most Favored Nation) clauses were issued to any investors in the Series B financing, so there is no issue of "hiding from other investors."

However, Framework Ventures co-founder Vance Spencer publicly stated that he was "completely unaware" and expressed that "if true, it would be very disappointing." This directly contradicts Smokey's claim that "all investors received the same set of documents."

Fair, but Unequal

In a cautious financing environment, it is not uncommon for project parties to offer additional "insurance" to attract large VCs. Berachain may have provided extra "insurance" to attract significant VC participation (like Nova) in the financing.

The project party uses the refund right to reduce the downside risk for VCs in exchange for funding support for development and liquidity injection. As the lead investor, Nova committed to providing liquidity (by depositing $5 million), which helps stabilize the market after the project goes live. But essentially, this turns Nova's investment into "zero risk": if BERA performs well, they profit; if it performs poorly, they can get a full refund, while ordinary investors have no recourse. This controversy once again exposes the information asymmetry and power imbalance in the structure of crypto financing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。