The cryptocurrency market began a rapid rebound last night, with Bitcoin returning to $93,000 and briefly touching $93,660, erasing the decline from December 1. In 24 hours, it rose over 7%; Ethereum briefly broke through $3,000, reaching $3,070, with a 24-hour increase of over 10%. Data shows that in the past 24 hours, the total liquidation across the network was $435 million, with long positions liquidating $67.97 million and short positions liquidating $367 million, primarily from short positions.

Just a day ago, Bitcoin had just dropped to around $83,000, and within just 24 hours, it quickly rebounded to reclaim its losses. What exactly happened in such a short time with such significant fluctuations in the cryptocurrency market? Have the various positive factors expected in December begun to influence the cryptocurrency trends, and can the market regain confidence during this rebound?

1. The cryptocurrency market experienced "mixed emotions" in one day, quickly rebounding to recover losses

The cryptocurrency market began a rapid rebound last night, with Bitcoin returning to $93,000 and briefly touching $93,660, erasing the decline from December 1, with a 24-hour increase of over 7%; Ethereum followed suit, briefly breaking through $3,000 and reaching $3,070, recovering to levels before the drop on December 1, with a 24-hour increase of over 10%. Coinglass data shows that in the past 24 hours, the total liquidation across the network was $435 million, with long positions liquidating $67.97 million and short positions liquidating $367 million, primarily from short positions. Among them, BTC liquidated $215 million and ETH liquidated $89.97 million. Over 115,000 people were liquidated across the network, with the largest single liquidation occurring on Bybit-BTCUSD, valued at $10 million.

Just a day ago, the cryptocurrency market experienced a "plunge," with Bitcoin dropping to $83,000, only to quickly erase the previous decline. It is foreseeable that the significant positive factors expected in December, such as Vanguard Group allowing clients to trade cryptocurrency ETFs with $10 trillion in assets under management, the rising expectations of Federal Reserve interest rate cuts, a potential "dovish" successor to the chair, and the end of quantitative tightening, have begun to exert influence on the market, supporting a rapid rebound in cryptocurrencies and other risk assets.

2. Asset management giant Vanguard opens the door for Bitcoin ETFs, stimulating market rebound

Vanguard Group began allowing clients to trade cryptocurrency ETFs and mutual funds on its brokerage platform on Tuesday. This marks the first time this asset management giant, known for its conservative investment philosophy, has opened cryptocurrency investment channels to its 8 million self-directed brokerage clients. The company is one of the largest distributors of index funds globally, managing assets of approximately $10 trillion, with over 50 million clients, making it the second-largest asset management giant in the world, second only to BlackRock.

Vanguard stated that it would support most cryptocurrency ETFs and mutual funds that meet regulatory standards, similar to its support for gold and other niche asset classes. The company also mentioned that it currently has no plans to launch its own cryptocurrency products. Bloomberg analyst Eric Balchunas pointed out on social media that this is a typical "Vanguard effect," as Bitcoin surged immediately during the first trading day after Vanguard's shift, with BlackRock's IBIT surpassing $1 billion in trading volume within 30 minutes of opening, indicating that even conservative investors are looking to "spice up" their portfolios.

Previously, Vanguard had refused to enter the cryptocurrency space, believing that digital assets were too speculative and volatile, not aligning with its core philosophy of long-term balanced portfolios. This shift now reflects ongoing pressure from retail and institutional demand, as well as concerns about missing out on rapidly growing market opportunities. As BlackRock has achieved great success with its Bitcoin ETF, Vanguard's loosening stance on this emerging asset class will have profound implications for future capital flows.

3. Trump strongly hints at "dovish" Hassett taking over the Federal Reserve

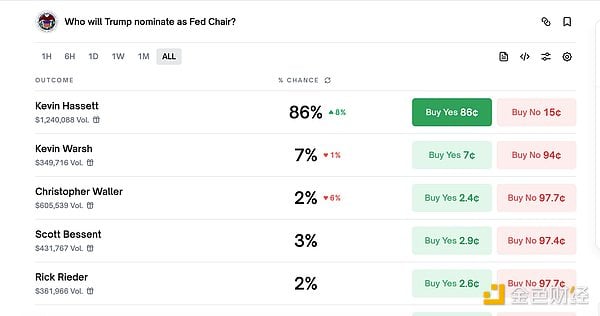

Recently, the possibility of Kevin Hassett, the director of the White House National Economic Council, taking over the Federal Reserve has been increasing. The Wall Street Journal reported that sources revealed the selection process for the Federal Reserve chair is still ongoing, but Trump has almost locked in Hassett. Hassett, known for his high loyalty to Trump and market recognition, is clearly leading among the final five candidates. Trump stated during a cabinet meeting on Tuesday that he would announce his chosen successor to Powell as Federal Reserve chair "early next year." Trump also mentioned that Treasury Secretary Mnuchin, who is leading the selection process, does not want to take on the role of Federal Reserve chair. Additionally, later on Tuesday at a White House event, Trump said, "I guess a potential Federal Reserve chair is also here. Can I say? Potential. He is a respected person, and I can tell you that. Thank you, Kevin." This statement was interpreted by the market as Trump personally hinting that Hassett is the top candidate to succeed the Federal Reserve chair. Polymarket data shows that the probability of Hassett being elected as Federal Reserve chair has risen to 86%.

Trump has always favored candidates who support low interest rates, and both Hassett and other candidates are open advocates for low rates. Although there are no clear public statements, Hassett is widely regarded as a supporter of cryptocurrencies. In June of this year, he disclosed that he holds at least $1 million in shares of Coinbase and received at least $50,001 in compensation for his role on the academic and regulatory advisory board of the exchange, which makes his ties to the cryptocurrency industry particularly close—a rarity for a potential Federal Reserve chair.

If the "dovish" candidate Hassett successfully takes over the Federal Reserve, it will have a significant impact on the direction of the Federal Reserve's upcoming interest rate policy, potentially indirectly stimulating the strength of the cryptocurrency market.

4. Federal Reserve interest rate cut expectations continue to rise, clarity expected next week

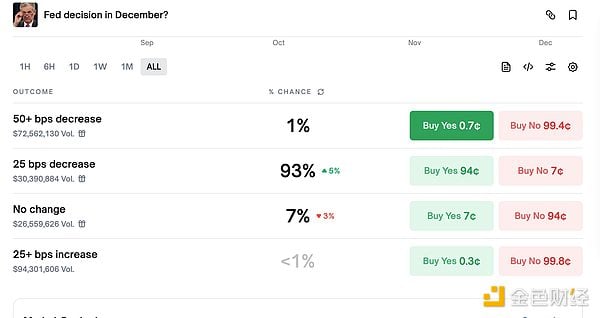

With potential "dovish" candidates like Kevin Hassett emerging for the next Federal Reserve chair, Trump reiterated that the Federal Reserve chair should cut interest rates. He reiterated his criticism of Powell and stated that even JPMorgan CEO Dimon said Powell should lower rates. CME's "FedWatch" data shows that the probability of a 25 basis point rate cut by the Federal Reserve in December has risen to 89.2%, while the probability of maintaining rates is 10.8%. The probability of the Federal Reserve cumulatively cutting rates by 25 basis points by January next year is 66.6%, with a 7.7% probability of maintaining rates, and a 25.7% probability of a cumulative 50 basis point cut. Additionally, Polymarket data shows that the probability of the Federal Reserve cutting rates by 25 basis points next week has risen to 93%, with the total trading volume in this prediction pool exceeding $223 million.

The expectations for a Federal Reserve rate cut in December continue to rise, and the market has almost concluded that the Federal Reserve will cut rates by 25 basis points, with clarity expected next week. This may further stimulate the asset market to continue strengthening before the final decision is made.

5. Federal Reserve ends quantitative tightening, injecting market liquidity

The Federal Reserve officially ended its 3.5-year quantitative tightening (QT) policy on December 1, halting the process of reducing its balance sheet (referred to as "balance sheet reduction"), while injecting $13.5 billion into the banking system through overnight repurchase operations. According to Federal Reserve economic data, this scale is the second-largest liquidity injection since the COVID-19 pandemic, even surpassing the peak during the "dot-com bubble." Since 2022, the Federal Reserve has withdrawn over $2 trillion from the market, and the current balance sheet has decreased to around $6.55 trillion. Some analysts point out that the cessation of "balance sheet reduction" marks a turning point in Federal Reserve policy: the end of the aggressive tightening policies post-COVID-19. This move aims to address liquidity risks and boost the U.S. economy.

With the Federal Reserve officially stopping the reduction of its balance sheet this month, liquidity is beginning to ease, providing Bitcoin and risk assets with a new liquidity shock.

6. Musk claims debt crisis is beneficial for Bitcoin, boosting market sentiment

Recently, Musk stated in an interview that the U.S. is rapidly heading towards a "debt crisis" that could trigger significant volatility in Bitcoin prices. Traders are preparing for major policy changes that the Federal Reserve may bring in December, and in this context, Musk predicts that in the future, "currency as a concept will no longer exist," and energy will become the only "real currency." Musk stated, "That's why I say Bitcoin is based on energy; after all, you can't create energy through legislation." He also mentioned, "The U.S. is significantly increasing the money supply through a deficit of about $2 trillion."

Musk previously helped Trump return to the White House by warning about the rising U.S. debt (which has now exceeded $38 trillion), but their relationship soured after Trump failed to control government spending. Although Musk's support for Bitcoin and cryptocurrencies is not as strong as during the peak of the COVID-19 pandemic, he continues to support Bitcoin and Dogecoin. After leaving the White House, Musk stated that the "American Party" he advocates will be more inclined to choose Bitcoin over the dollar, claiming that the dollar and other non-asset-backed currencies are "hopeless."

Musk's long-standing support for cryptocurrencies has always had a stimulating effect on the cryptocurrency market, and this time is no exception.

7. Market trend interpretation

Have the aforementioned positive factors begun to influence the trends of cryptocurrencies and other risk assets? Has the panic sentiment eased somewhat? Can investors regain confidence during this rebound? Let's take a look at the main interpretations of the market.

1. Grayscale Research states that Bitcoin is expected to reach a historical high in 2026. In a report released on Monday, Grayscale Capital pointed out that Bitcoin may not necessarily follow the so-called "four-year cycle"—the market generally believes that Bitcoin prices peak every four years (synchronized with its halving cycle) and then experience significant corrections. Grayscale noted that historical data shows that while long-term investors can achieve returns by holding assets through volatility, they often need to "endure sometimes quite challenging drawdowns" in the process. The institution added that during bull markets, drawdowns of 25% or more are quite common, and such drawdowns do not necessarily indicate the beginning of a long-term downward trend.

2. Coinbase Institutional states that with the end of quantitative tightening (QT), the Federal Reserve is re-entering the bond market, and the pressure of funds being withdrawn from the market may have passed. This is generally positive for risk assets (such as cryptocurrencies). In the current environment, the institution believes that high-probability opportunities are more inclined towards breakout trades rather than knife-catching.

3. Glassnode and Fasanara Digital jointly released the "Q4 Digital Asset Report," stating that the new funds for Bitcoin in Q4 reached $732 billion, with the one-year volatility nearly halved. The current market trading is becoming more stable, the scale is continuously expanding, and institutional participation has significantly increased.

4.4E Observation stated that Bitcoin quickly recovered all the losses caused by macro shocks. This strong rebound is mainly driven by two factors: first, the auction of Japan's 10-year government bonds has become a key stabilizer for global risk assets. Second, the market widely bets that Hassett has been "internally confirmed" to take over as the next chair of the Federal Reserve. Although the growth and inflation outlook for 2026 remains uncertain, the short-term policy tendency towards "dovishness" has boosted U.S. stocks and raised interest rate cut expectations, providing momentum for BTC's rebound. The rapid reversal of macro policy expectations and fluctuations in the bond market remain key variables dominating short-term trends. The strength of BTC's recovery after this round of adjustment still depends on policy signals, liquidity environment, and changes in the behavior of long-term holders. It is recommended to maintain a sense of rhythm and risk boundaries.

5. Tom Lee, Chairman and CEO of BitMine, remains optimistic about cryptocurrencies and the stock market. In an interview with CNBC, he stated that the biggest positive driving force from the Federal Reserve is expected in the coming weeks. Lee said, "I believe the biggest positive coming in the next few weeks will be from the Federal Reserve. The Fed is expected to cut rates in December, and it has also ended quantitative tightening. This has been quite a tailwind for market liquidity." As liquidity in the system is no longer being withdrawn, the speed of capital flowing into risk assets may begin to accelerate. Lee is particularly confident in Bitcoin. He believes that rising liquidity has historically been associated with stronger performance in "risk appetite" assets.

6. Yi Lihua, founder of Liquid Capital (formerly LD Capital), stated on social media that although BTC has returned to $93,000, BCH has reached a recent high, and WLFI has also surged and stabilized, ETH and the overall market are still lagging behind in relation to the stock market and various positive macro conditions. With the confirmation of another crypto-friendly new chair (of the Federal Reserve) following the SEC chair, the 60-day bear market in crypto may come to an end. This 60-day period was marked by severe liquidity decline in the entire industry due to the events of October 11, the resonance of the four-year cycle, Japan's interest rate hikes, and government shutdowns, among others. However, these negative factors have now been digested, and with the dual positives of interest rate cut expectations and crypto policies, the outlook for subsequent trends remains optimistic. Investment always requires not only wisdom but also patience.

7. QwQiao, co-founder of AllianceDAO, stated that if L1 tokens have the potential to become non-sovereign stores of value, it indicates that their prices are not severely overvalued and can also serve as effective hedging tools against Bitcoin. He still believes that Bitcoin is undoubtedly the best non-sovereign currency and the asset most likely to replace gold.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。