Market Background: Is the Trend Fading or a Necessary Adjustment?

In the past few weeks, anyone who has paid even slight attention to the cryptocurrency market may have noticed a clear trend: weakness. Chart movements have flattened, momentum has waned, and market sentiment has shifted from euphoria to caution. At first glance, the situation seems straightforward—“ETF funds are flowing out, and the market is declining.” However, when viewed through a broader cyclical lens, the situation becomes more complex.

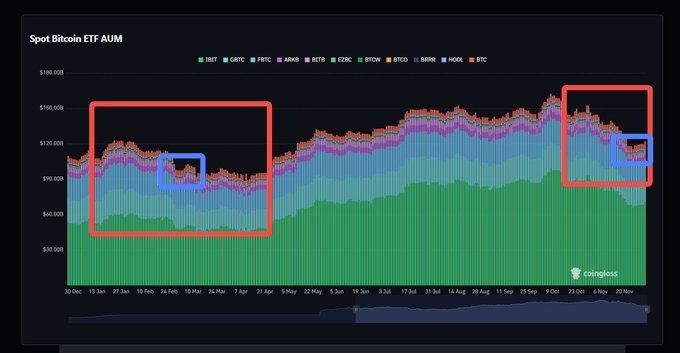

One of the main reasons for the current slowdown in Bitcoin prices is undoubtedly the outflow of funds from spot Bitcoin ETFs. Unlike the volatility driven by retail investors, the flow of ETF funds primarily comes from large asset allocators—family offices, pension funds, and institutional investors allocating capital across multiple global markets. In October, Bitcoin prices briefly touched the $120,000 range, followed by a significant drop in early November, which, from a traditional capital perspective, altered the risk-return balance. As safer investment vehicles like bonds returned and gold regained market dominance, some funds naturally withdrew from the Bitcoin market.

Despite these fluctuations, the market structure does not indicate the beginning of a new multi-year bear market. Instead, this trend resembles a mid-cycle adjustment—similar to the situation from January to April this year—rather than the market sentiment collapse seen during the actual bear market cycle from 2021 to 2023.

ETF Positions: The Most Important Signal Right Now

When assessing ETF performance, two indicators are more important than any others:

- Total BTC held by ETFs (structural capital)

- Daily net inflow/outflow (short-term sentiment)

Overall, the first indicator shows a significant decline in total holdings towards the right side of the dataset. This change is significant because the operation of ETF funds is fundamentally different from the short-term liquidity of stablecoins. When institutions (especially asset management companies like BlackRock) purchase Bitcoin through ETFs, these holdings are typically custodied and effectively removed from circulation. These purchases resemble long-term structural demand, which over time effectively raises the price floor of Bitcoin.

In contrast, stablecoin buyers are usually exchanges, market makers, or native cryptocurrency funds. Their funds are stored on-chain, waiting for market conditions to improve. They rotate, observe, and wait for opportunities, but rarely fully liquidate. This is why the market capitalization of stablecoins continues to grow while the proportion allocated to ETFs has declined.

Interestingly, by comparing the recent decline in ETF holdings with previous market trends, a familiar rhythm can be observed. In the circled areas of the chart—the drop in December 2024 and the pullback from January to April—the patterns are almost identical: a sharp adjustment followed by a slower stabilization period.

Notably, the previous adjustment lasted about four months, while the current adjustment has only lasted about one month. Therefore, although there has been a slight rebound in inflow momentum since November 25, it still appears to be in the early stages of reaccumulation rather than a definitive reversal.

Net Inflow: A Signal to Watch, It's Too Early to Celebrate

The second ETF indicator—the daily net inflow/outflow line—provides a short-term tactical perspective. Similarly, the shift here, while subtle, is significant. Since November 25, inflows have slightly turned positive again. However, the scale of inflows remains small and the intensity unstable. Historically, before a significant trend reversal occurs, ETF inflows not only recover but accelerate significantly.

Currently, there are no signs of an accelerated upward movement in the market. On the contrary, the current situation resembles institutional investors "testing the waters," similar to how savvy investors operate near structural price turning points. Moreover, just like in the previous cycle, even if inflows turn positive, Bitcoin still experienced multiple pullbacks before the next bull market resumed.

So, while the direction is improving, confidence is still lacking.

Stablecoin Liquidity: A Supporting Parallel Indicator

On the other hand, the supply of stablecoins continues to grow slowly. This is crucial because stablecoins represent idle cryptocurrency purchasing power—these funds are waiting on-chain for signals rather than flowing out of the ecosystem. The operation of these funds differs from ETF allocations. They do not require traditional compliance processes or board approvals and are less influenced by macro asset rotations like bonds or gold.

Instead, they represent patient capital.

The slow but steady rise in stablecoin prices indicates that native cryptocurrency investors have not left—they are observing, waiting, and preparing.

This is one of the most evident reasons why the current market structure does not align with a complete market collapse. In a true bear market, funds do not remain in stablecoins—they exit the entire ecosystem entirely.

What This Means for the Cycle

In summary, the market has not signaled the beginning of a new long-term bear market. Instead, it seems to be undergoing:

Mid-cycle adjustment + valuation reset.

It shares many characteristics with the pullback in early 2025:

- Fear rather than euphoria

- Reduced ETF exposure

- Accumulation of stablecoins

- Lateral movement after a sharp correction

The market is still searching for direction, but early signs suggest that this phase is closer to consolidation rather than a collapse.

What Needs to Happen Next

To confirm a market recovery, one final signal is needed—and that signal is not Bitcoin.

It is the flow of Ethereum ETF funds.

If Ethereum begins to show consistent inflows averaging $1 billion or more per day for over ten consecutive days, it would indicate a return of confidence, not just curiosity. This would mark a shift from hesitation to conviction and could confirm the end of the pullback.

Until then, the most reasonable expectation is that the market will continue to fluctuate, further test support levels, and gradually build strength before ultimately leading to the next decisive move.

Final View

Despite the uncertainty, the current structure points to continuation rather than reversal. The cycle is not over; it is being readjusted. Traditional capital is cautiously rotating, while native cryptocurrency capital is on the sidelines, and the market is approaching a point that must yield to a clear direction.

In other words:

This is not the beginning of a bear market.

This is a time when only those with strong conviction remain alert in a bull market, while others wait for evidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。