JPMorgan predicts that the global market in 2026 will be dominated by an AI supercycle, uneven monetary policies, and differentiated economic structures, supporting a rise in global stock markets and projecting the S&P 500 to reach 7,500 points.

Written by: Zhang Yaqi

Source: Wall Street Watch

According to the annual outlook report released by JPMorgan on the 5th, the global market in 2026 will be profoundly reshaped by three core forces: unequal monetary policies, a surge in AI adoption, and increasingly severe multidimensional differentiation in markets and economies.

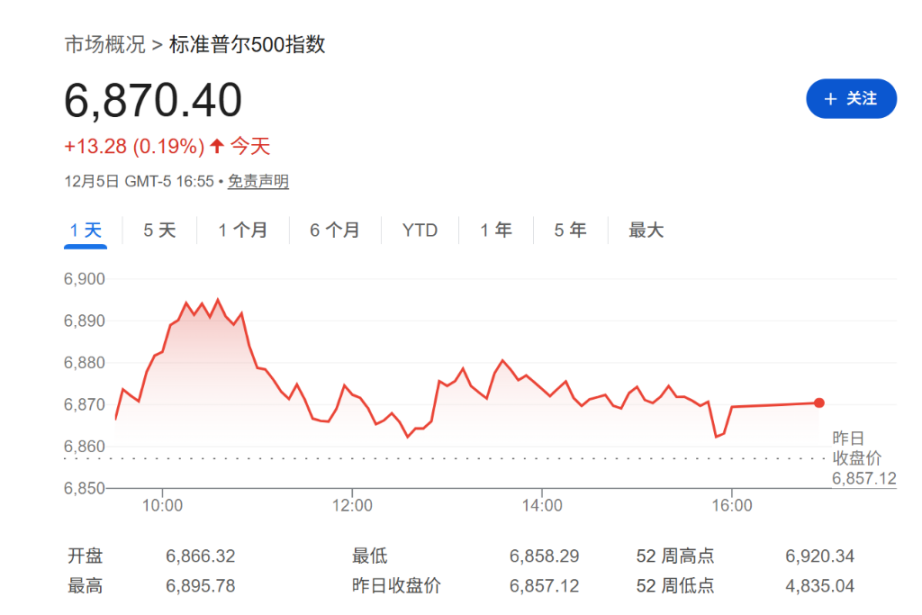

According to reports from the trading desk, despite the complex macro environment, JPMorgan maintains a positive outlook on the global stock market, setting a target price of 7,500 points for the S&P 500 index by the end of 2026. Strategists believe that the "AI supercycle" is driving record capital expenditures and profit expansion, which will be the most critical investment theme in the coming year. If the Federal Reserve further eases policies due to improving inflation, the S&P 500 index could even break 8,000 points in 2026. As of the time of writing, S&P 500 futures rose 0.19 to 6,870 points.

Regarding monetary policy, JPMorgan predicts that the Federal Reserve will cut interest rates by 25 basis points in December this year and January next year, then pause, maintaining this "asymmetric bias" in the first half of 2026. This policy path will lead to significant differentiation among central banks in developed markets: apart from the Federal Reserve and the Bank of England, which are expected to cut rates, central banks in the Eurozone, Scandinavia, and Australia are expected to remain on hold in 2026. This differentiation is expected to exert downward pressure on the dollar, but the decline will be limited by the relative strength of the U.S. economy.

JPMorgan's global market strategy team emphasizes that 2026 will be characterized by "multidimensional polarization": the stock market will differentiate between AI and non-AI sectors, the U.S. economy will show a split between strong capital expenditures and weak labor demand, and consumer spending will exhibit an unhealthy "K-shaped" trend.

AI Supercycle and Economic Differentiation

JPMorgan views 2026 not only as a year of surging AI adoption but also as a critical period for reshaping investment, productivity, and industry leadership. The ongoing expansion of AI is driving a global capital expenditure boom. The report notes that although the U.S. faces labor challenges in some areas, corporate investment is being strongly driven by AI trends. The bank believes that the momentum of the AI industry is spreading geographically and across sectors, extending from technology and utilities to banking, healthcare, and logistics.

This technology-driven growth is also exacerbating internal economic structural rifts. JPMorgan describes a "K-shaped economy," where corporate capital expenditures (Capex) are strong, while household consumption expenditures are severely differentiated. While the new government's deregulation agenda may unleash new business vitality, the impact of tariff policies may be offset, and the productivity gains from AI and declining energy prices will partially counteract the inflationary effects of tariffs.

In terms of economic growth, JPMorgan forecasts a global GDP growth rate of 2.5% in 2026, roughly in line with 2.7% in 2025. The U.S. GDP growth rate is expected to remain at 2.0%, while the Eurozone is projected to drop to 1.3%. The report indicates that the global growth outlook remains resilient, mainly due to loose monetary and fiscal policies and a reduction in market concerns about U.S. policies. The bank expects U.S. inflation to remain sticky, with core PCE inflation rising slightly from 3.0% in 2025 to 3.1% in 2026.

The "synchronization" of monetary policy has become a thing of the past. JPMorgan anticipates that the pace of easing in developed markets will be highly uneven. The Federal Reserve is expected to stabilize the neutral interest rate around 3% after completing its "insurance rate cuts." In contrast, the Bank of England is expected to cut rates further in December 2025, March 2026, and June 2026. In the Eurozone and Japan, policy rates are expected to face different pressures, particularly as the Bank of Japan, despite its cautious stance, still faces upward pressure on yen rates.

Cross-Asset Strategy: Bearish on Oil, Extremely Bullish on Gold

Based on the above macro judgments, JPMorgan has put forward distinct views on cross-asset allocation:

Bonds and Interest Rates: The U.S. 10-year Treasury yield is expected to experience a dip followed by a rise, with a mid-year target of 4.25% and an end-of-year target of 4.35%. Given the expectation of the Federal Reserve pausing rate cuts, strategists recommend underweighting the middle of the U.S. Treasury yield curve (2-year / 5-year / 10-year).

Foreign Exchange: Maintaining a bearish view on the dollar, believing that the Federal Reserve's asymmetric policy bias in the first half of 2026 will suppress the dollar's strength. The bank is bearish on the yen, expecting the USD/JPY to rise to 164 in the fourth quarter of 2026. In emerging markets, the bank is optimistic about high-yield currencies such as the Brazilian real (BRL), Mexican peso (MXN), and South African rand (ZAR).

Commodities: JPMorgan is bearish on oil, believing that supply-demand imbalances will lead to a decline in oil prices, forecasting an average price of Brent crude oil at only $58 per barrel in 2026. Conversely, the bank maintains a structurally bullish outlook on precious metals, setting a target price of an astonishing $5,000 per ounce for gold in the fourth quarter of 2026, while also being optimistic about silver, copper (mainly driven by AI power demand), and aluminum.

JPMorgan has outlined key scenario assumptions. In the optimistic "upside risk" scenario, the AI theme further broadens, or there is "painless disinflation," where productivity gains offset inflationary pressures, allowing the Federal Reserve to complete interest rate normalization. Additionally, if the U.S. government relaxes regulations or global fiscal easing brings multiplier effects, it could drive economic growth beyond expectations.

In the negative "downside risk" scenario, the main threats include a genuine macroeconomic slowdown, skepticism about AI leading to a pullback in tech stocks, and a sudden shift in Federal Reserve policy. Particularly in the case of persistent inflation stickiness, if the Federal Reserve is forced to abandon its asymmetric bias and shift to tightening, it could lead to liquidity tightening, thereby impacting high beta assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。