Blackrock is taking another swing at ethereum ( ETH) exposure, this time filing with the U.S. Securities and Exchange Commission (SEC) for the Ishares Staked Ethereum Trust ETF — a product designed to reflect ETH’s price while capturing staking rewards through third-party validator services.

At its core, Ethereum’s proof-of-stake (PoS) system relies on validators rather than energy-intensive mining. Anyone can lock up ETH to support the network’s consensus rules, and in return, they earn rewards for keeping it secure. This staking function is effectively the backbone of Ethereum post-Merge — a hybrid of economic incentive and skin-in-the-game governance.

Today, roughly 35.64 million ETH sit staked, representing nearly 30% of the entire token supply. That mountain of locked collateral highlights just how much capital has migrated from speculative trading into yield-bearing participation.

And yes, the yield matters: typical staking rewards hover around 2.5%–3.5% APY, though setups capturing maximum extractable value (MEV) and priority fees can tilt results upward, sometimes landing closer to 5%–5.7%. As always, validator uptime, fees, and performance keep everyone honest — and keep that APY anything but uniform.

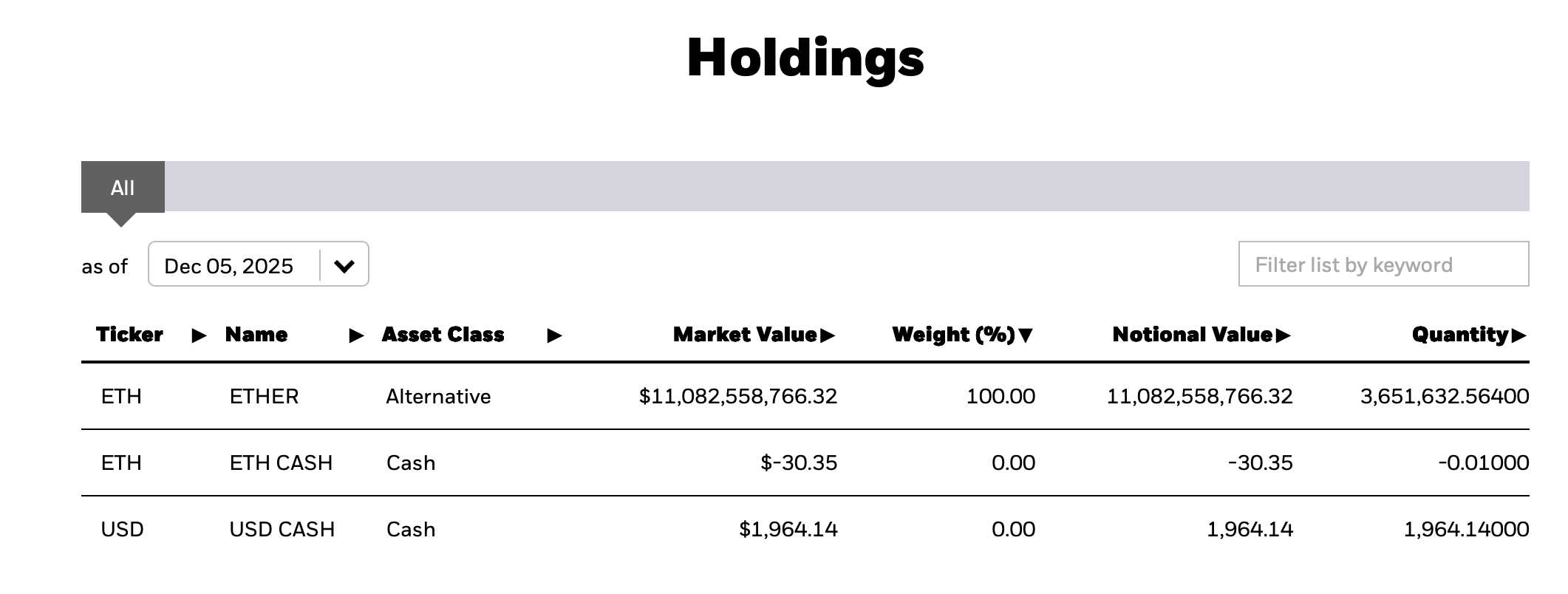

Blackrock’s ETHA fund commands a stash of 3.651 million ether. Source: Ishare’s web portal.

Enter Blackrock’s latest filing. The Ishares Staked Ethereum Trust would run through a passive grantor-trust structure, staking roughly 70%–90% of its ETH holdings under normal conditions, while maintaining a “liquidity sleeve” for redemptions. The ETF is engineered to mirror ETH’s price plus staking rewards, minus inevitable fees and operational costs. It does not use leverage, derivatives, or active trading — a notable contrast to the more adventurous corners of Ethereum’s decentralized finance (DeFi) economy.

Also read: Report: SEC Ends Biden Era Probe: Ondo Cleared for Rapid Tokenization Growth

Custody would fall to Coinbase Custody Trust Company, with Anchorage Digital standing by as an alternative. Staking itself would be outsourced to vetted third-party providers selected for uptime and minimal slashing history. The trust avoids running any validators directly — a choice that keeps operations predictable, if not particularly glamorous.

The ETF would list on Nasdaq under the ticker ETHB once (and if) regulators approve it. But that approval process remains a puzzle of its own. The SEC has not yet laid out a standardized framework for staked-asset ETFs, and questions around ETH’s legal classification still hover in the background like an unwanted houseguest. Still, the filing signals that institutional players consider staked ETH exposure too large to ignore.

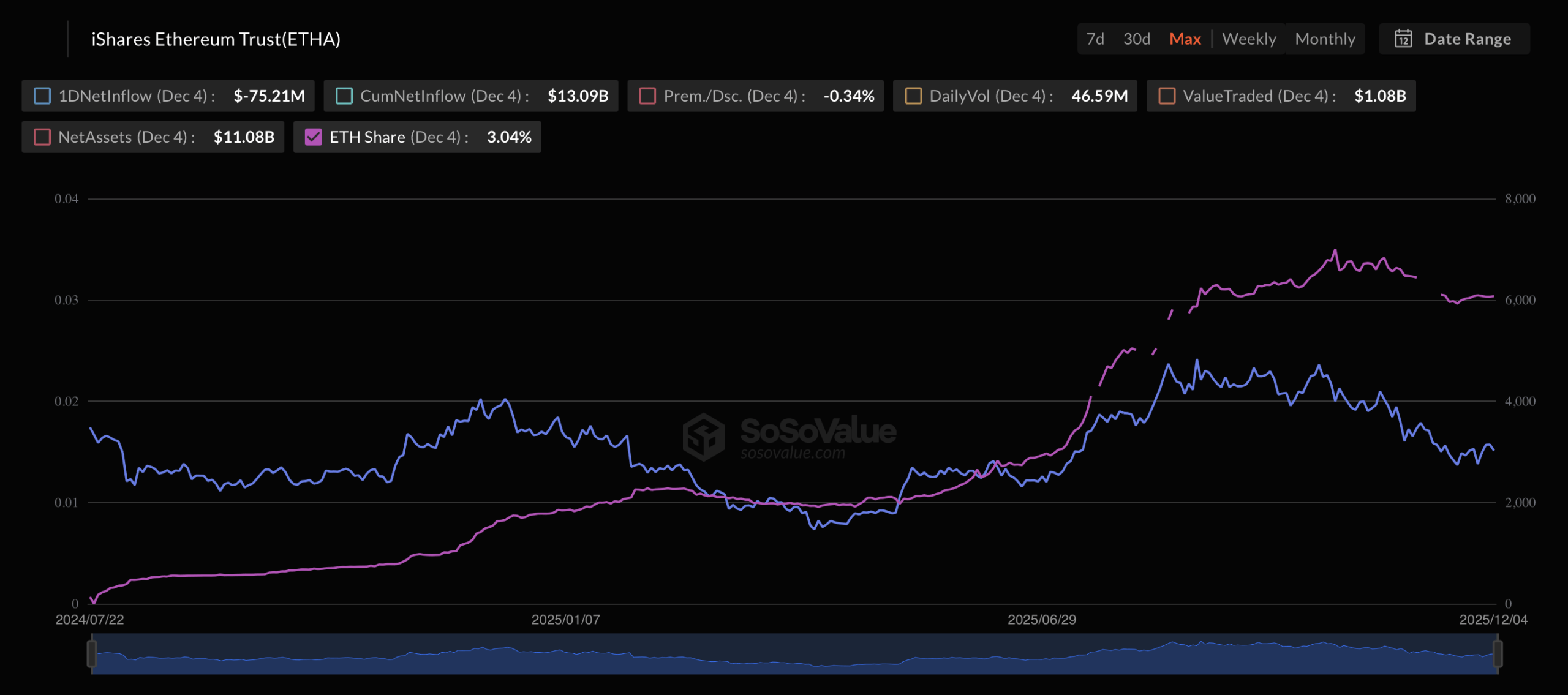

Blackrock’s ETHA stats via sosovalue.com.

The filing builds on Blackrock’s earlier success with its spot ether ETF, which has $11 billion in assets under management (AUM) according to sosovalue.com stats. And with billions in ETH already locked in validators, the timing for a yield-driven investment vehicle feels deliberately opportunistic.

If approved, ETHB could become a new on-ramp for institutions looking to participate in staking without navigating node software, validator maintenance, or dreaded downtime penalties. But as always, the rewards come packaged with a list of risks — from slashing to regulatory uncertainty — all neatly spelled out in the large filing.

Whether this trust becomes another flagship product or another regulatory casualty is still an open question. For now, the move confirms that the appetite for ETH-based yield products is growing faster than the SEC’s clarity on them.

- What is the Ishares Staked Ethereum Trust ETF?

It’s a proposed Blackrock fund designed to track ETH’s price while adding staking rewards through third-party validators. - How much ETH is currently staked?

Roughly 35.64 million ETH are locked with validators, representing nearly 30% of the supply. - What is the typical staking APY for Ethereum?

Staking generally yields about 2.5%–3.5% APY, with higher returns possible when MEV and priority fees are captured. - Why does Ethereum’s staking APY vary?

Yields shift based on how much ETH is staked, validator performance, MEV capture, and provider fees.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。