The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome all coin friends to follow and like, and I refuse any market smoke screens!

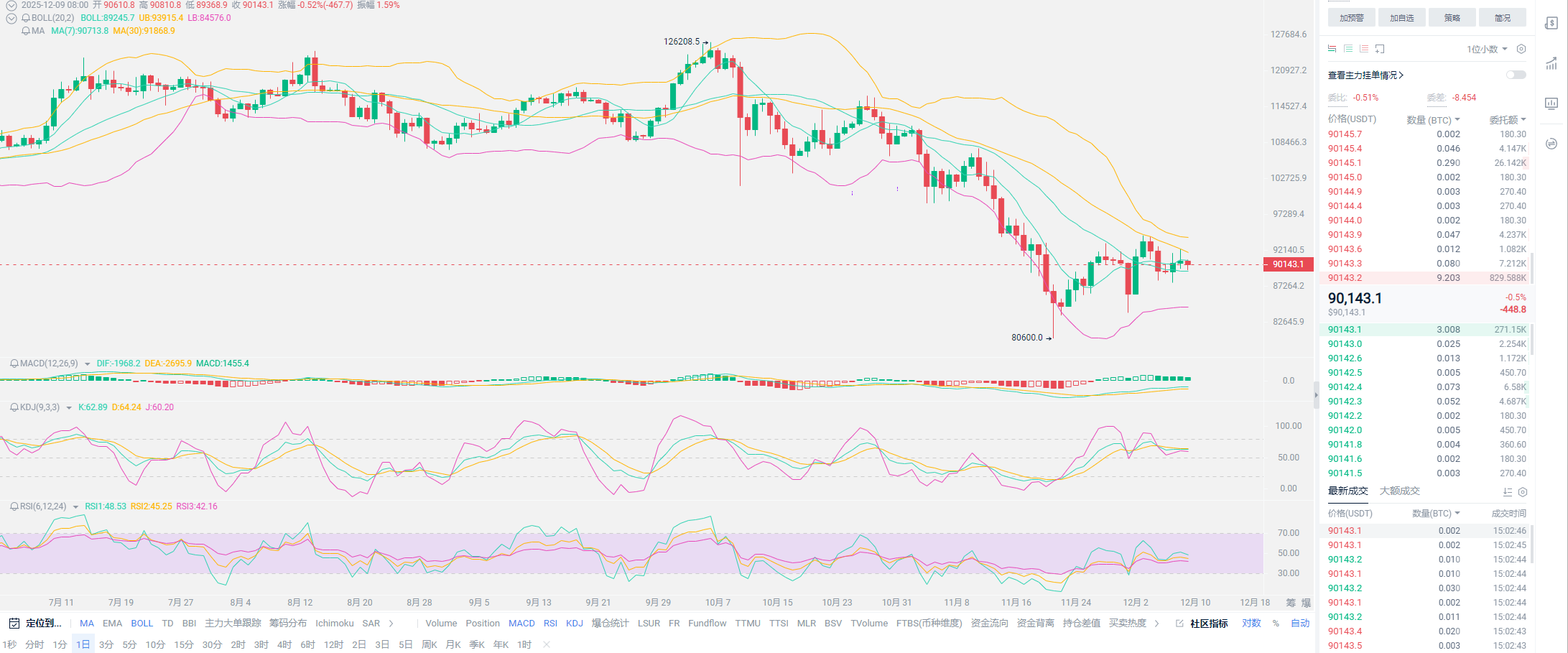

A wave of decline starting with 87 has made many friends panic, feeling that the market is extremely worried about the bears, fearing any slight movement could reverse the trend. The occurrence of this situation makes Lao Cui feel somewhat at ease; at least there is no longer blind optimism, perhaps this is also a signal of market reversal. While everyone is focused on the domestic market, the Americans suddenly revealed that they might start: Reserve Management Purchases (RMP) in January 2026. Simply put, it’s a rephrased version of quantitative easing. According to predictions from Wall Street investment banks like Evercore ISI and Goldman Sachs, RMP may be implemented in January 2026, with a scale of purchasing about $35 billion in short-term government bonds each month, resulting in a net monthly growth of about $20 billion in the Federal Reserve's balance sheet. Lao Cui defines this as liquidity injection. Why not directly state it as quantitative easing? Perhaps this is also the concern of Trump regarding opposing voices; once this strategy is implemented, there will be no bearish trend.

As the year-end approaches, let’s return to our old topic. Some friends even think that the appreciation of the CNY is good news. I have talked about exchange rate issues before; if you don’t quite understand, you can take another look. Today, I will mainly discuss the conclusion: the appreciation of the CNY is beneficial for imports because it will lower import costs, such as energy, gold, and natural gas. However, it is not beneficial for exports; as import costs decrease, export costs will naturally increase, and we happen to be the largest exporting country. The key point is that we are currently in a phase of debt deflation, which requires interest, and interest needs profits to hedge, while our profits come more from exports. Therefore, appreciation will lead to a decline in exports. At the same time, if everyone views the issue from the perspective of debt deflation, the appreciation of the CNY represents the appreciation of all assets, including the appreciation of assets priced in A shares. The most critical question is, does real estate currently belong to assets or liabilities?

There is not much difference between the two; debt is also part of assets, and real estate brings us future liabilities. Therefore, the appreciation of the CNY will also lead to the appreciation of liabilities, which indicates that the pillars may have already entered a phase of abandonment. Just look at Vanke, without elaborating. This has led to a series of chain reactions, with Shenzhen launching a firewall to sever ties with Vanke to avoid letting domestic investors take the fall. At the same time, these appreciation issues will lead to increased financing costs, meaning the cost of borrowing new to pay off old debts has increased, and this appreciation will cause the previously borrowed portions to appreciate. The key issue remains exports; exports will lose competitiveness due to exchange rate issues. So why are we appreciating? It still comes down to tariffs, so everyone can clarify their thoughts. Since the U.S. lowered interest rates in September last year, we have started to appreciate.

Throughout this process, our domestic market is actually unstable, which is also what Lao Cui has always emphasized. The current economic situation is not good. It has always been a short-term rise followed by a gradual decline. All funds are almost being withdrawn from government bonds; too much influx will be constrained. Buying government bonds can only be defined as locking in future returns, not present ones. The emergence of this issue may lead you to think it reflects optimism about the future, but Lao Cui does not agree. If there is true optimism about the future, you should be holding cash now, not primarily allocating to government bonds. If the future economic situation is good, most people would prefer to invest in A shares or stable assets like gold. Buying bonds is merely a hope to outpace inflation, so getting rich through bond purchases is fundamentally impossible. Tariffs have actually given us a breather; whether we appreciate or depreciate, tariffs have already arrived. Regardless of how you do it, the Americans have directly severed your goods trade. Taking advantage of this opportunity, the cost of appreciation has become lower.

Everyone should not get the direction wrong; whether appreciation or depreciation, the only thing that can be harmed is the trade between the two countries. Currently, in foreign trade, more settlements are done through other means, ultimately returning to the market itself. Just remember one result: appreciation will lead to a decrease in the currency circulating in the market, which is not good news for the economy. Stability in exchange rates is a good indicator of economic development, and you should not only focus on domestic strategies. Look at the actual performance of the giants; Jack Ma has been laying out exchanges and purchasing ETH (at a relatively high price, basically above 3000) since last year, and just this year, he obtained trading licenses in Hong Kong and Singapore, even acquiring stablecoin trading licenses. These layouts almost mean formally entering the crypto space, competing with major powers, and cooperating with international giants. Speculating on conclusions is not what we should do; we should start from actual clues. The future of the crypto space is still ahead.

Lao Cui's summary: Many friends will fall into a phase of confusion, always feeling that domestic strategies are a fatal blow to the crypto space. You can also think from another perspective; once these strategies are officially implemented, isn’t it a good thing for us? Understanding the reasons behind the implementation of a strategy is crucial. The focus of domestic strategies is more on inflow capital and illegal exchanges. Normal trading does not fall into this category; cleaning up illegal U traders is indeed necessary, and a clean-up can leave behind the good ones. As mentioned above, whether it’s exchange rates, tariffs, or other capital interventions and struggles, they actually have little impact on the crypto space. Pay attention to trends, but more importantly, watch for interest rate cuts and the change in the Federal Reserve chairmanship along with Japan's interest rate hike strategy. The change in the Federal Reserve chairmanship is also very important; if the person speculated to take office is indeed a close ally of Trump, then the rate cuts will become more aggressive, and the paper data will be extremely strong. The crypto space currently belongs to dollar assets, and this market will definitely explode. What you need to do at this stage is to hold on, endure, and seek survival in despair. A bull market will definitely erupt again, Bitcoin will reach new historical highs, and contract users should not intervene near interest rate cuts; if you do, you can only go long.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and ends up frequently trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。