Author: Chloe, ChainCatcher

Recently, Binance has once again been embroiled in a scandal involving internal employees suspected of insider trading. On December 7, a Binance employee took advantage of their position to promote a newly issued token on official social media, thereby earning personal benefits. This is not the first instance of internal corruption at Binance; a similar case occurred in March this year. Despite the official emphasis on zero tolerance and active responses, the market criticizes that altcoins have indeed become a funding trap, where retail investors must contend not only with institutions but also guard against internal employees exploiting their positions for profit.

Just after the token launch, the official account posts related content

On December 7, a token named "Year of the Yellow Fruit" (abbreviated as YEAR) was launched on the BNB Chain at 1:29 PM. Less than a minute later, Binance Futures' official X account @BinanceFutures posted related tweets at 1:30 PM, with text and images suggesting the token's potential.

According to data, the token surged over 900% after the post was published, peaking at $0.0061, with a fully diluted valuation (FDV) reaching $6 million, before dropping over 75.3% to $0.001507 before the deadline. The coincidental timing of the post has raised community suspicions that the employee who published it attempted to manipulate the market for personal gain.

According to DLNews, the inspiration for the Year of the Yellow Fruit token originally came from a post made by the official Binance account on December 4, titled "2026: the year of the yellow fruit," which quoted former Goldman Sachs executive Raoul Pal and Coin Bureau founder Nic Puckrin during their speeches at the Binance Blockchain Week conference, encouraging traders to "plant and expect a harvest," aligning closely with the images and text released by the internal employee.

In response to the incident, Binance stated that a preliminary investigation has confirmed that an internal employee is suspected of using their position for personal gain. The implicated employee has been suspended, and Binance has proactively contacted relevant authorities in the employee's jurisdiction to seek legal action. Additionally, users who provide valid reports will be rewarded with a total of $100,000 distributed based on the bounty promise.

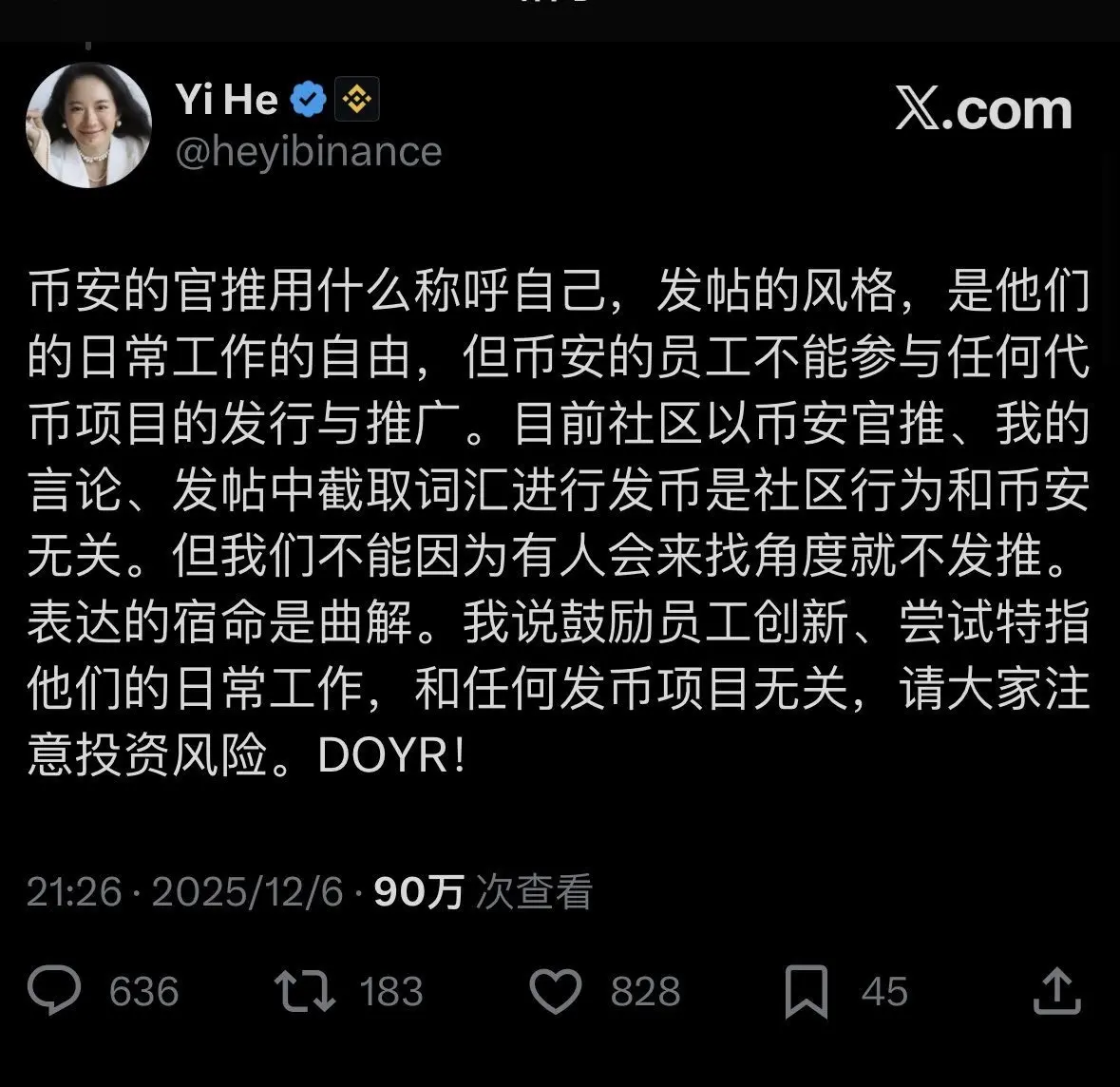

Ironically, just a day before the incident, He Yi posted that Binance employees are not allowed to participate in any token issuance or promotion, only for an internal employee to be exposed for insider trading the very next day.

The underlying issue reflected here is that, due to the lack of KYC for on-chain addresses, exchanges find it difficult to monitor all operational behaviors of employees in the absence of regulation. Even with full monitoring of work computers and phones, there remains significant room for insider trading operations. Similar cases have occurred at mainstream exchanges like Coinbase and OKX.

Two insider trading incidents in a year, challenges in internal risk control at exchanges

In March this year, a Binance employee, Freddie Ng (a former business developer for BNB Chain, later joined the Binance Wallet team), was found to have insider information about the upcoming rise of the UUU token and was suspected of trading based on that information. He purchased approximately $312,000 worth of UUU tokens using 10 BNB through his secondary wallet (0xEDb0…) and subsequently transferred all tokens to a money laundering wallet (0x44a…).

At the token's peak price, he sold the first transaction through a Bitget wallet, profiting 181.4 BNB, equivalent to $110,000. The remaining UUU tokens were dispersed to eight different addresses, each worth tens of thousands of dollars. However, the investigation revealed that the funds in the secondary wallet had originated from his real-name wallet freddieng.bnb (0x77C…) 121 days prior, a slip that ultimately exposed his identity in the case.

Following Binance's investigation, the employee was also suspended and handed over for legal processing, with the whistleblower receiving a $10,000 reward. The two incidents occurred just nine months apart, highlighting the challenges of internal control at Binance.

However, Binance is not the only exchange with internal control issues. In 2022, U.S. authorities charged a former product manager at Coinbase and two accomplices, stating that they used insider information about tokens set to launch to trade at least 25 assets before public announcements, illegally profiting over $1 million.

Additionally, recent reports indicate that several Coinbase shareholders have filed a lawsuit in Delaware, accusing Coinbase CEO Brian Armstrong and board member Marc Andreessen of leading a cover-up and personally profiting from stock sales.

Shareholders claim that Coinbase's leadership was aware of serious issues within the company but intentionally or recklessly concealed information, leading to inflated stock prices. In early 2023, Coinbase reached a $100 million settlement with the New York Department of Financial Services over KYC and AML procedure violations, with executives accused of being aware during the investigation yet issuing misleading statements claiming compliance.

Moreover, insiders were aware as early as January of this year about a serious data breach where hackers accessed customer sensitive data through a third-party vendor, but this was not disclosed until May, resulting in a concealment period of several months that left shareholders and investors unaware of the risks. During this concealment period, executives sold approximately $4.2 billion worth of Coinbase stock at peak prices, with plaintiffs claiming that misleading statements and information concealment by executives directly inflated stock prices, allowing insiders to reap substantial profits and potentially avoiding billions in losses.

In addition to Binance and Coinbase, OKX has also recently revealed an internal anti-corruption case. According to a post by @BroLeonAus, an account made unusual purchases of a certain token before an announcement on OKX, despite having almost no record of altcoin operations. The account suddenly bought in before the positive news was released and quickly sold after the news landed, making only a 10% profit, about $2,000. Initially, OKX's internal investigation yielded no results, but months later, it was discovered that the insider account had conducted internal transfers with a senior employee's account, revealing that it was actually the account of the senior employee's wife, leading to the employee's dismissal.

In this case, if the employee's wife had operated on-chain or had not conducted internal transfers that exposed the situation, this case might have remained buried in obscurity.

This indicates that the cases exposed are always a minority. Regardless of how exchanges proclaim their policies, the inherent characteristics of blockchain technology provide convenient conditions for insider traders.

Although on-chain data is public, who can identify which addresses belong to exchange employees or related accounts among the vast number of addresses? In a regulatory vacuum, exchanges are both rule-makers and enforcers, as well as beneficiaries, creating a power structure that inherently sows the seeds of systemic risk. The so-called zero-tolerance policy and whistleblower reward mechanism appear more like a public relations crisis management cover, only appearing belatedly when matters are exposed and cannot be concealed, while those that remain undiscovered may represent a much larger part of the iceberg.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。