This article really resonates with me; no wonder it's my largest holding! 🧐 #SOL

He raised a soul-searching key question:

"Who is the 'most commonly used public chain'?"

Using data 📊 to support the results:

Who trades the most? → #Solana

Who has the most users? → #Solana

Who has the most frequent capital flow? → #Solana

Who has the fastest growing TVL? → #Solana

Who has the highest increase in fee income? → #Solana

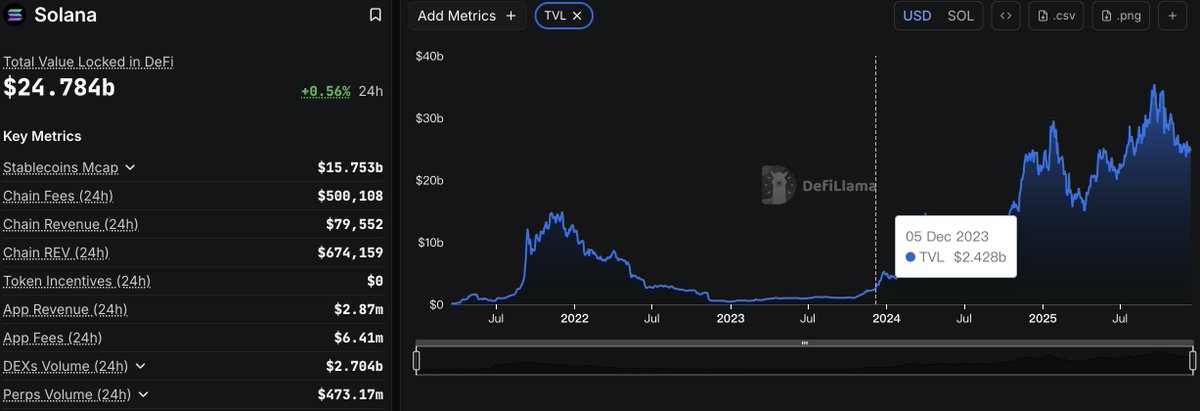

1️⃣ TVL: 10x explosive growth

At the beginning of 2023, Solana's TVL accounted for less than 1% (0.7%) of the entire industry, and now it has soared to over 9.5%.

During the same period, Arbitrum, Optimism, and Polygon, the Ethereum L2s, either stagnated or saw their shares halved.

Capital isn't foolish; a 10x increase in TVL indicates that real money believes this place can make a profit and is worth staying.

2️⃣ Transaction volume: Solana did 5 times the work of ETH

During the "meme coin frenzy" at the beginning of 2025, the number of transactions processed by Solana in a single day was 5 times that of the Ethereum mainnet.

Over the past two years, 82% of all on-chain transactions occurred on Solana—despite Base and BSC taking a small share recently, it remains the absolute leader.

Some say: "Isn't it all just bots doing the transactions?"

Answer: Bots still have to pay gas fees. And you can tell just by looking at the user numbers…

3️⃣ User numbers: From 6% to 28%

The user share of the Ethereum mainnet dropped from 20% to 6%, a decline of 70%.

The user share of Solana surged from 6% to 28%, nearly a 5-fold increase.

While L2s have taken away some Ethereum users, the biggest winners are actually BSC and Solana—especially the latter, which has attracted a large number of new users with its low barriers and high performance.

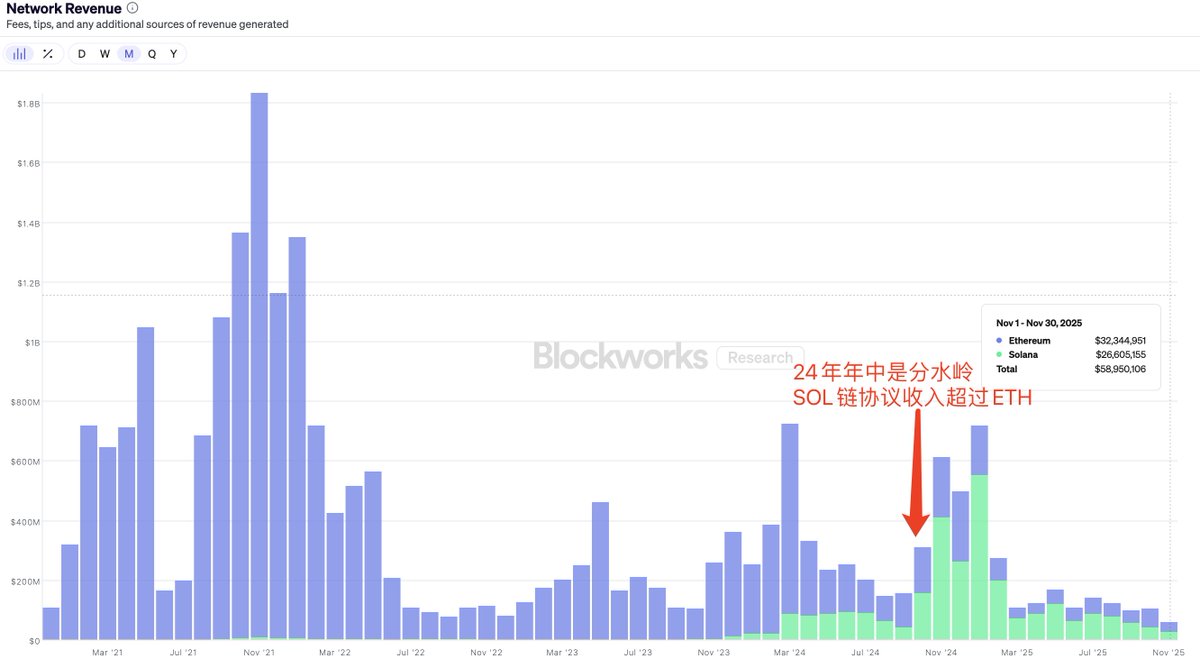

4️⃣ Fee income: From "drizzle" to "level playing field"

In January 2023, Solana accounted for only 0.17% of the total network fees, which was almost negligible.

Now? 22.4%, and monthly fee income often matches that of Ethereum (both accounting for about 40% of the total network).

Don't underestimate this number. Solana's gas fees are cheap, and if it can still collect this much money, it indicates that the transaction volume is absurdly high—cheap + high frequency = real demand.

5️⃣ Capital flow: Transfer scale comparable to Ethereum

Many people think Solana is all about "meme coins inflating transactions," but the data does not support this.

Solana has consistently accounted for nearly 30% of the total on-chain transfer value, comparable to the Ethereum mainnet.

At the peak in January 2025, 75% of on-chain capital flow was on Solana, while Ethereum only had 12%—a 6-fold difference.

This article provides a well-reasoned analysis of the historical process and development of #SOL, truly deserving! #SOL is currently my largest holding! 🫡

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。