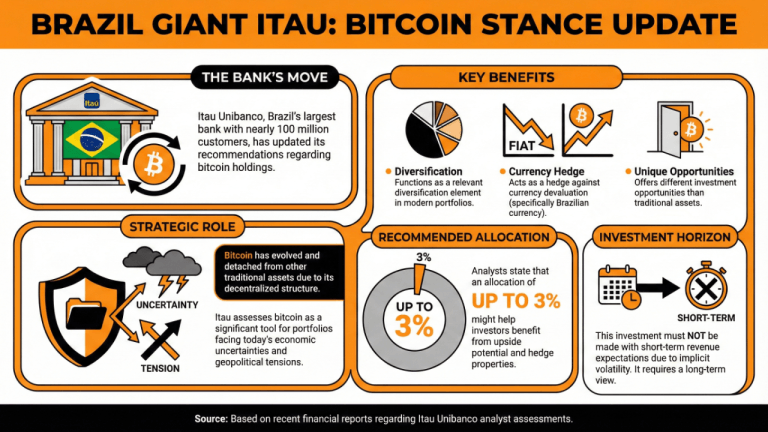

Itau Unibanco, the largest bank in Brazil, with nearly 100 million customers, has updated its recommendations regarding bitcoin holdings.

In a recent report, Itau assesses bitcoin as a diversification tool and a hedge against currency devaluation. The document highlights that bitcoin has evolved and can function as a relevant element in portfolios that suffer from changes derived from today’s economic uncertainties and geopolitical tensions.

For Itau’s analysts, bitcoin has detached from other assets and, due to its decentralized structure, offers different investment opportunities than these. In this sense, they state that an allocation of up to 3% might help investors benefit from the upside that bitcoin might still enjoy and its properties as a Brazilian currency hedge.

Furthermore, the bank states that this investment must not be made with a short-term expectation of revenue, as risk assets tend to perform poorly in short-term periods due to their implicit volatility.

Itau’s new conception of bitcoin and its latest portfolio recommendations signal a change in how traditional institutions view bitcoin, even as the prime cryptocurrency has remained flat this year.

What’s more relevant is that the losses for Brazilian investors using reais to invest in bitcoin are even steeper, as the dollar has performed poorly compared to the Brazilian currency this year.

Read more: Largest Bank in Brazil Itau Unibanco Opens Cryptocurrency Trading to All Users

Nonetheless, Itau still considers that not entering the bitcoin market is now the risk, given the positive developments regarding bitcoin regulation and adoption. The bank offers direct bitcoin exposure service through exchange-traded funds (ETFs).

With the establishment of a comprehensive crypto regulation slated for next February, analysts state that bitcoin is poised to keep growing as an investment asset in Brazilian portfolios, aided by a newfound support from financial institutions.

What recent update did Itau Unibanco provide regarding bitcoin?

Itau Unibanco now views bitcoin as a diversification tool and a hedge against currency devaluation, recommending an allocation of up to 3% in investment portfolios.How has Itau’s perspective on bitcoin changed?

The bank acknowledges that bitcoin has detached from other assets and offers unique investment opportunities amid economic uncertainties and geopolitical tensions.What caution does Itau advise regarding bitcoin investments?

Investors are warned not to expect short-term revenue from bitcoin, as risk assets typically perform poorly in the short term due to inherent volatility.What does this mean for the future of bitcoin investments in Brazil?

With comprehensive crypto regulations expected in February, analysts believe bitcoin is likely to gain traction as a significant investment asset in Brazilian portfolios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。