I. Outlook

1. Summary of Macroeconomic Trends and Future Predictions

Last week, the core changes in the U.S. macro environment were the formal establishment of the Federal Reserve's policy stance and the confirmation of economic slowdown signals. On December 11, the Federal Reserve maintained interest rates as expected, but in its statement and economic forecasts, it clearly acknowledged the trends of falling inflation and cooling employment. The dot plot indicated an overall downward shift in future interest rate paths, signaling that "policy is nearing a turning point." Meanwhile, recent inflation and employment data did not show any rebound; although service inflation remains relatively high, it is marginally slowing down, and the labor market continues to cool, making the judgment of a "soft landing but slowing growth" more solid.

Looking ahead, the macro focus will shift from "whether to pivot" to "when and at what speed to cut rates." After confirming the policy ceiling in the December meeting, as long as subsequent inflation does not show significant reversals and employment continues to weaken, the probability of the Federal Reserve starting to cut rates in early 2026 will continue to rise. For the market, interest rates are no longer the biggest uncertainty; the real variable is the speed of economic decline: if the slowdown is mild, risk assets are expected to gradually recover; if data weakens rapidly, it may trigger a repricing of recession risks. Overall, the U.S. macro environment has entered an "observation period after confirming the policy pivot."

2. Market Movements and Warnings in the Crypto Industry

Last week, the cryptocurrency market experienced brief fluctuations following the Federal Reserve's December interest rate decision, but overall it remained weak. Bitcoin saw a spike and subsequent drop around the announcement of the interest rate decision, failing to effectively stabilize in the $95,000–$100,000 range, and retreated to low-level fluctuations during the week, indicating that the market did not give positive pricing to the "confirmation of the policy pivot." Despite the Federal Reserve signaling a dovish stance, in the context of confirmed economic slowdown and a lack of recovery in risk appetite, incremental capital remains cautious, with limited ETF inflows and persistently low trading volumes. Altcoins generally underperformed BTC, with most sectors continuing to decline, and the market structure remains defensive.

In terms of warnings, the current crypto market is still in a phase of weak liquidity and sensitive sentiment. If Bitcoin continues to fail to recover and stabilize above $100,000, the mid-term downward trend will be difficult to reverse, and the "bear market expectations" on the sentiment level may further solidify; at the same time, with the year-end approaching, institutional settlements and risk convergence demands may amplify short-term volatility. Only with a clearer interest rate cut timetable at the macro level or an overall recovery of risk assets can the crypto market potentially break out of the current weak range. Until then, caution is still needed regarding the risk of further declines after a weak rebound.

3. Industry and Sector Hotspots

A total of $17 million was raised, led by YZiLabs, with participation from star VCs like OKX, for the zero-knowledge verification network zkPass, which is an innovative protocol combining 3P-TLS (three-party TLS) + MPC (multi-party computation) + IZK (interactive zero-knowledge proof); a total of $33.55 million was raised, with participation from well-known institutions like Sui, Beam, and Polychain, for Bluefin, a decentralized order book-based exchange aimed at professional and novice traders.

II. Market Hotspot Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. Brief Analysis of the $17 Million Raised, Led by YZiLabs, with Participation from Star VCs like OKX—The Zero-Knowledge Verification Network zkPass that Securely Verifies Web2 Private Data for Entry into Web3

Introduction

zkPass is an innovative protocol that combines 3P-TLS (three-party TLS) + MPC (multi-party computation) + IZK (interactive zero-knowledge proof). Its goal is to solve the problem of Web2 private data being unable to be reliably brought into Web3:

Users can obtain private data from websites using HTTPS and prove to third parties that "this data indeed comes from a specific website and meets certain conditions" without disclosing the data itself.

In other words:

zkPass = Web2 Private Data → Verifiable → Privately Entering Web3 Infrastructure

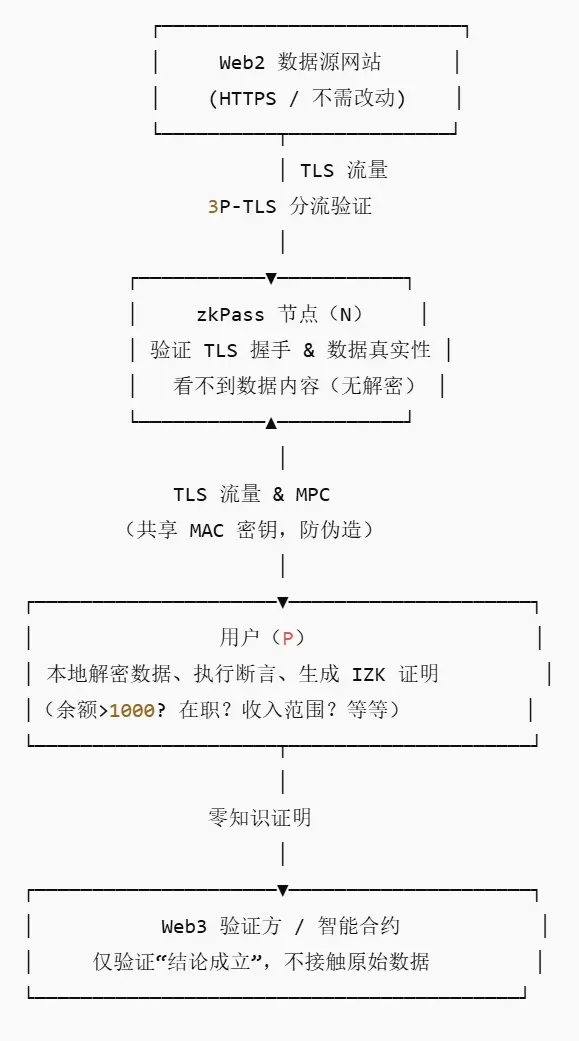

Core Mechanism Overview

In the traditional model:

User → Verifier → Website

This leads to:

User privacy exposure

Websites unable to provide customized verification

Verifiers can see all user data → High privacy risk

zkPass reverses the structure:

Users directly access HTTPS data sources (websites) locally, then locally generate zero-knowledge proofs for verifiers, proving only the conclusion without exposing data.

To achieve this process, zkPass introduces:

3P-TLS: Extending TLS to a three-party protocol (User + zkPass Node + Data Source). The node verifies the authenticity of the data but cannot decrypt the private content.

MPC: Users and nodes share a MAC key to prevent data tampering. The node cannot see the content but can ensure that the data has not been forged.

IZK: Users execute assertions on the data (e.g., "balance > 1000") and generate large-scale interactive zero-knowledge proofs.

Complete flowchart of zkPass (ASCII clear flow)

2. 3P-TLS (Three-Party TLS)

The white paper describes the complete handshake process of real TLS and transforms it into a three-party version:

Three-party structure:

P (Prover/User)

N (Node)

S (DataSource/Website)

Features:

Users and nodes share a MAC key → Users cannot forge website responses

Nodes do not have decryption keys → Cannot read content

Websites still only need ordinary HTTPS, no changes required

This mechanism allows zkPass to be plug-and-play compatible with all internet websites.

3. MPC (Multi-Party Computation)

Used to ensure:

Users cannot forge data

Nodes cannot see data

Session MAC keys are jointly generated by users and nodes

Security is achieved using Oblivious Transfer (OT) and Garbled Circuits (GC)

GC is used to compute the TLS session key (Pre-Master Secret), ensuring that both parties only see their own fields.

4. IZK (Interactive ZKP) Interactive Zero-Knowledge Proof

Due to limited browser memory, large SNARK/STARK is not applicable. Therefore, zkPass adopts:

VOLE-based IZK:

No trusted setup required

Can submit circuits in chunks

Can be generated in the browser

Can handle millions to billions of gate circuits

The phased process of IZK includes:

Preprocessing (random VOLE)

Online proof (circuit step-by-step computation)

Multi-gate verification

Output verification

This solution can run on ordinary user devices.

5. Circuit Factory

zkPass has built a modular circuit system to avoid memory explosion caused by giant circuits.

Includes:

Bristol circuits (basic circuits)

Modular circuits (reusable repeating modules)

Hash verification circuits

JSON parsing optimization circuits (parsing off-chain, verification on-chain)

Assert circuit set (equal to/greater than/contains/range assertions)

For example: Only need to prove "salary > 5000" without disclosing the specific salary amount.

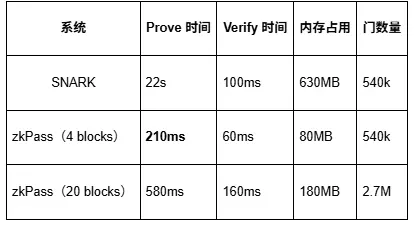

6. Benchmark Performance Comparison

zkPass is over 100 times faster than traditional SNARK, with 80% less memory usage.

Tron Comments

The core advantage of zkPass lies in its construction of a zero-knowledge proof network that verifies the authenticity of Web2 data without requiring website cooperation and without exposing any user privacy. Through the combination of 3P-TLS, MPC, and ZK technologies, it balances security, scalability, and a strong coverage of Web2 data, enabling Web3 applications to reliably call real-world data and achieve non-disclosure verification in scenarios such as identity, credit, assets, and behavior. At the same time, the network design is decentralized, auditable, and tamper-resistant, greatly enhancing the trust foundation across Web2/Web3.

However, its disadvantages include a complex overall architecture, high dependence on cryptographic infrastructure, and potential challenges in user understanding costs, verification costs, ecological maturity, and adaptability to changes in website TLS in the early stages; additionally, large-scale adoption requires developer education and continuous support from ecosystem partners.

1.2. Interpretation of the $33.55 Million Raised, with Participation from Well-Known Institutions like Sui, Beam, and Polychain—The Professional Decentralized Order Book Exchange Bluefin that Reshapes On-Chain Trading Experience

Introduction

Bluefin is a decentralized order book-based exchange aimed at professional and novice traders. It focuses on security and transparency and is committed to reshaping the user experience of on-chain trading platforms.

The project has received support and investment from top institutions such as Polychain, SIG, Brevan Howard Digital, and Tower Research.

Architecture Overview

1. Bluefin's Centralized Liquidity Market Maker (CLMM)

This is a cutting-edge protocol designed to optimize capital efficiency, deepen market liquidity, and provide a seamless trading experience.

Whether you are a beginner or a professional trader, Bluefin's CLMM can provide you with powerful tools to help you formulate more efficient strategies in decentralized trading.

Main features

Minimal Slippage:

The CLMM design optimizes price depth, maintaining stable prices even for large transactions.Real-Time Pricing:

The system provides accurate exchange rates and expected minimum output values before execution.Multiple Token Pairs:

Users can freely choose from multiple token combinations for exchange.

Working Mechanism

In Bluefin, exchanges are not matched through a traditional order book but interact directly with liquidity pools:

Users exchange one token for another;

Liquidity providers (LP) earn fees by injecting funds into the pool;

Transactions are completed instantly within the pool, without waiting for order matching.

Unlike the traditional model, Bluefin's Concentrated Liquidity Pool allows LPs to concentrate liquidity within specified price ranges and withdraw accumulated fees and rewards at any time without needing to withdraw liquidity.

Fee Mechanism (Swap Fees)

All transaction fees are allocated to LPs within the active price range.

When the price exceeds this range, liquidity temporarily becomes "inactive," stopping the fee calculation until the price returns.

LPs can withdraw fees at any time without exiting their funds. This ensures fairness and efficiency in fee distribution.

Price Impact

Refers to the impact of a single transaction on the price of tokens within the pool.

The larger the transaction amount and the shallower the liquidity, the more significant the price impact.

The CLMM significantly reduces price volatility through deeper price liquidity distribution.

Slippage Protection

Slippage is the difference between the expected price and the actual transaction price.

Users can customize slippage tolerance; if the price deviation exceeds the set range, the transaction is automatically canceled to prevent losses due to market fluctuations.

Liquidity Pools

Concentrated Liquidity:

LPs can concentrate liquidity within specified price ranges rather than covering the entire price range (0, ∞), significantly improving capital efficiency. This mechanism is particularly effective for stablecoin trading pairs due to smaller price fluctuations.

Active Liquidity:

Only liquidity within the current market price range is considered "active" and can generate fees. Once the price exceeds the set range, that portion of liquidity will pause earnings until the price returns to that range.

Fee Tiers:

Bluefin allows multiple pools with different fee rates for the same token pair (e.g., 0.01%, 0.1%, 0.2%) to match assets with varying volatility and risk levels.

Stablecoin pools tend to have lower fees.

High-volatility assets adopt higher fees to compensate LPs for risk.

Price Ticks:

The CLMM divides prices into small intervals (approximately 0.01% per step). Each Tick is a boundary of a liquidity range; when the price enters that range, the corresponding liquidity is activated. Denser Ticks help achieve high-precision trading and low slippage for stablecoin pairs.

Position NFT:

Each concentrated liquidity position is represented by an NFT, recording the position's

Pool address

Price range

Amount of liquidity. This NFT serves as proof for claiming fees and rewards and is destroyed after the position is closed.

Active Liquidity-Based Rewards Model:

Bluefin's incentive mechanism distributes rewards based on the proportion of LP contributions within active price ranges, encouraging LPs to concentrate funds in the most frequently traded price ranges, making the pool's TVL more efficient.

Protocol Fees:

To support Bluefin's long-term sustainability, 20% of the fees from each transaction go to the protocol treasury to fund platform development, maintenance, and optimization.

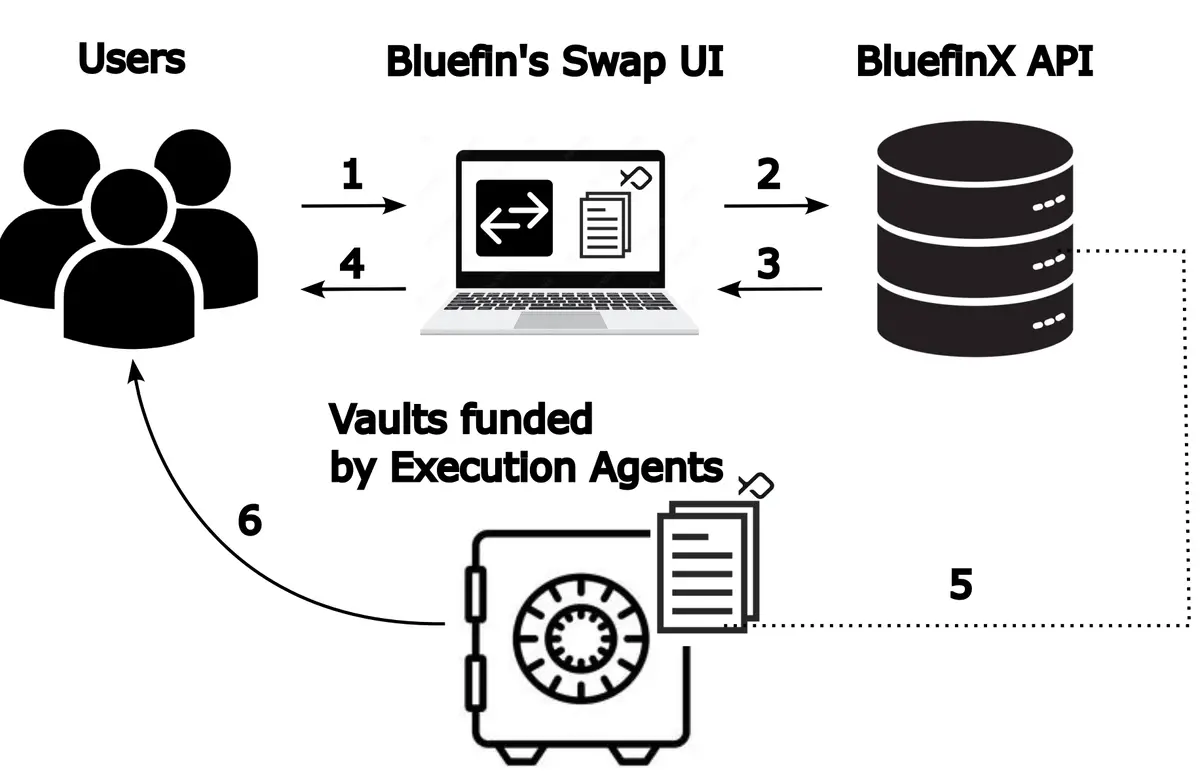

2. BluefinX — A Decentralized RFQ Execution Network for Zero Slippage and Low-Cost On-Chain Trading Experience

BluefinX is a new product launched by Bluefin, connecting Bluefin's spot CLMM with a group of decentralized execution agents (Execution Agents) through a permissionless RFQ (Request for Quote) system, optimizing trade execution via a protocol-controlled auction mechanism.

How It Works

In BluefinX, multiple execution agents simultaneously quote the user's trade request, and the system automatically selects the best bid, completing a "micro auction" off-chain before executing the trade on-chain.

This mechanism ensures that users receive the most efficient and fair exchange results on the Bluefin platform.

User Experience Advantages

The design of BluefinX ensures that every Swap balances speed and security:

High-Speed Execution: The RFQ process is completed off-chain, eliminating the need to wait for block confirmations.

Zero Slippage: Users can see the final fixed exchange amount before signing.

MEV Protection: Prevents bots from front-running or reordering transactions.

No Gas Fees: All transaction costs are borne by the execution agents.

Best Swap Price: The multi-agent bidding mechanism automatically selects the best quote for users.

Tron Comments

Advantages:

BluefinX, centered around the RFQ bidding mechanism, constructs a decentralized execution agent network, allowing each transaction to achieve the best price through off-chain bidding. It features innovations such as zero slippage, MEV protection, and no gas costs, providing users with a smooth experience comparable to centralized exchanges while maintaining decentralized transparency. By integrating with Bluefin CLMM, BluefinX optimizes liquidity usage and trade execution efficiency, setting a new standard for high-performance on-chain trading in the Sui ecosystem.

Disadvantages:

BluefinX's complex architecture relies on the activity and reputation of multiple execution agents, which may face issues of insufficient liquidity coverage or delayed quotes in the early stages. Additionally, its off-chain bidding and API calling mechanisms may encounter synchronization risks in extreme network conditions. As the network scales, the stability of system governance and agent incentive mechanisms will require time to validate.

2. Detailed Explanation of Key Projects of the Week

2.1. Detailed Explanation of Vitalik's Platform, with Investments from OKX, Stareware, Foresight, and Bixin—Kakarot, a Next-Generation Proof Engine for Seamless Transition of Any EVM Chain to ZK

Introduction

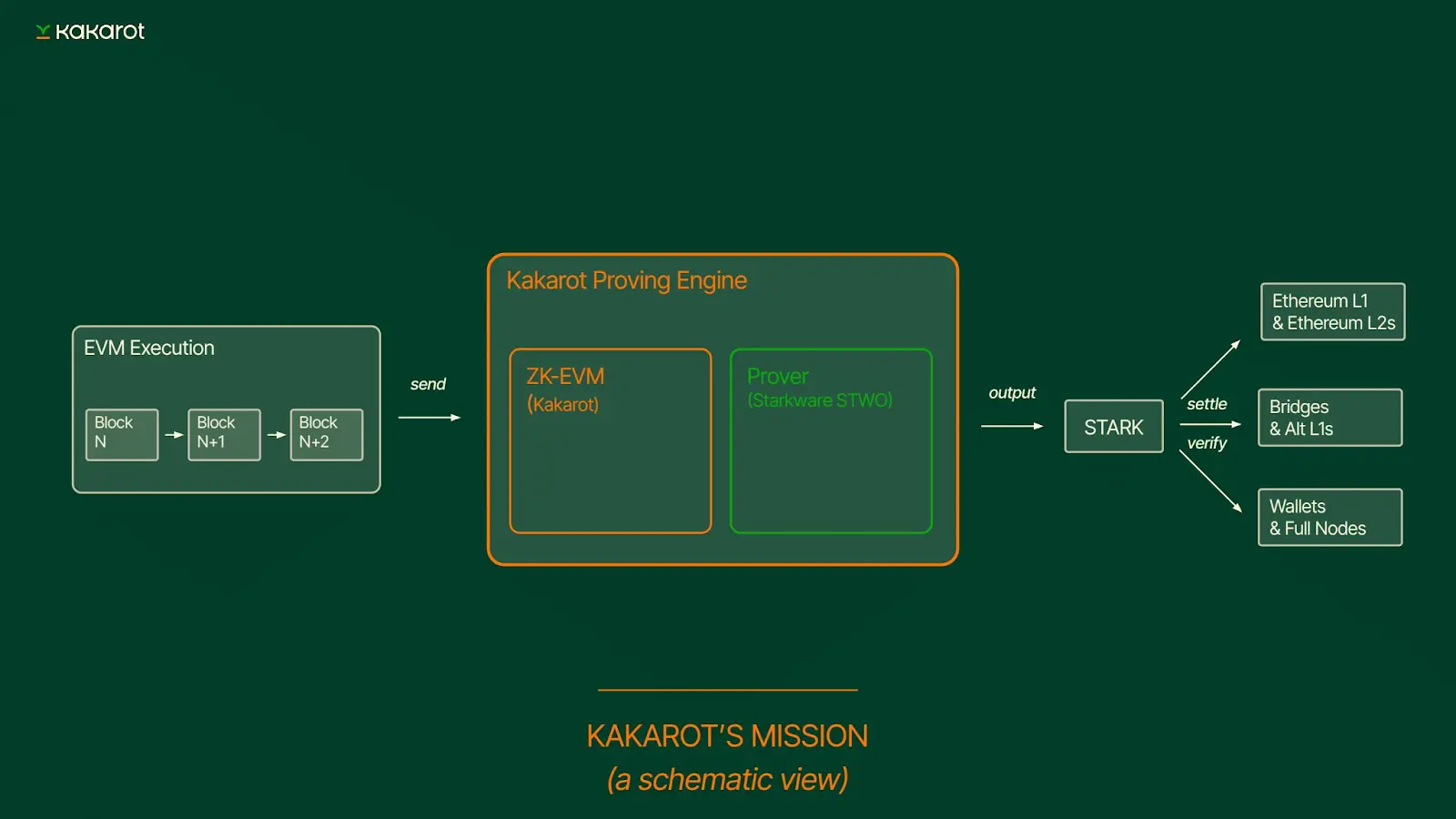

Kakarot, developed by KKRT Labs, is a lightweight, efficient, and state-of-the-art ZK-EVM proving engine.

This engine can generate zero-knowledge proofs for Ethereum's execution layer and consensus layer, achieving the "SNARKification of Ethereum," enabling it to have scalability and processing capabilities comparable to Visa.

Kakarot is built on Cairo, a virtual machine (ZK-VM) developed by StarkWare that supports STARK zero-knowledge proofs.

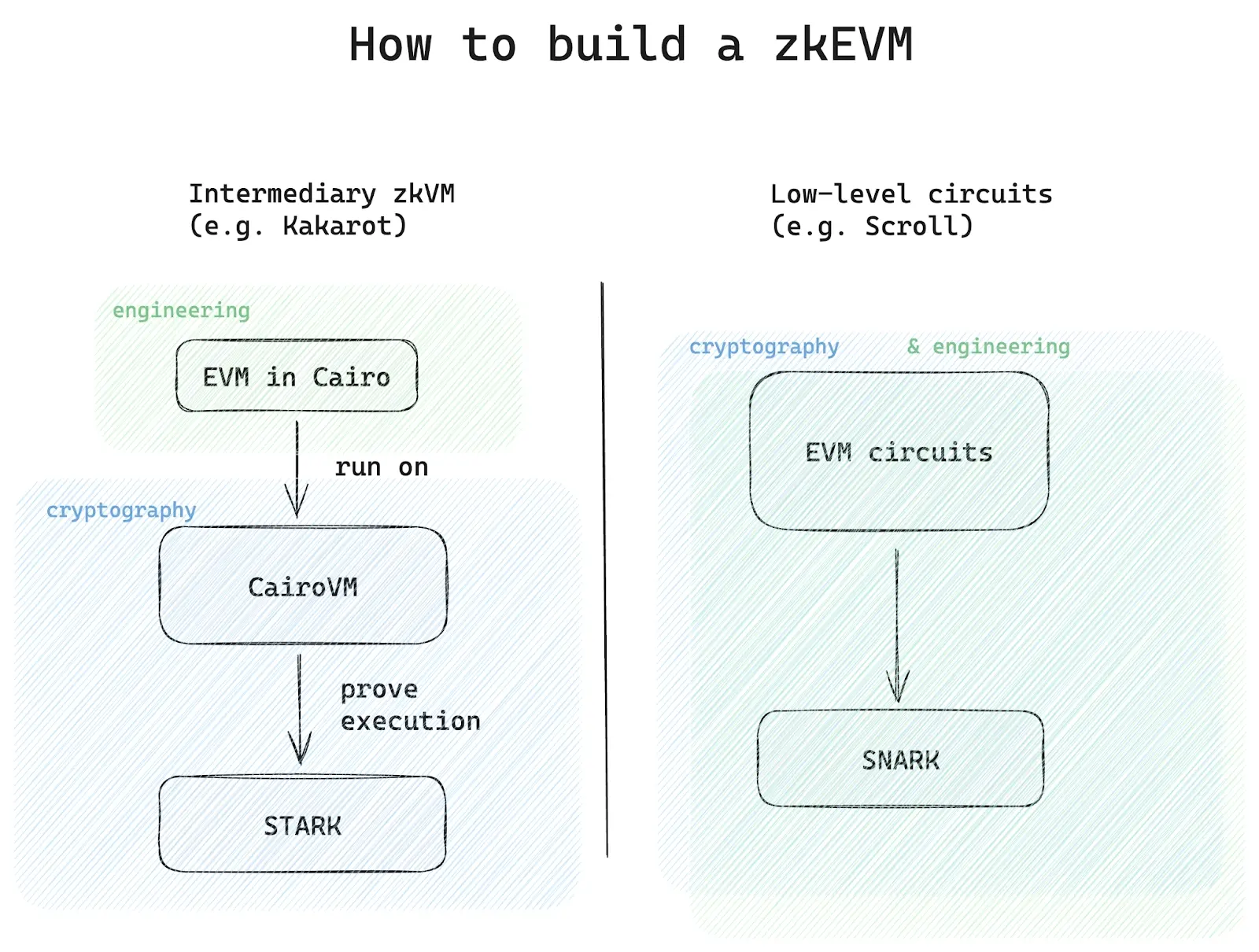

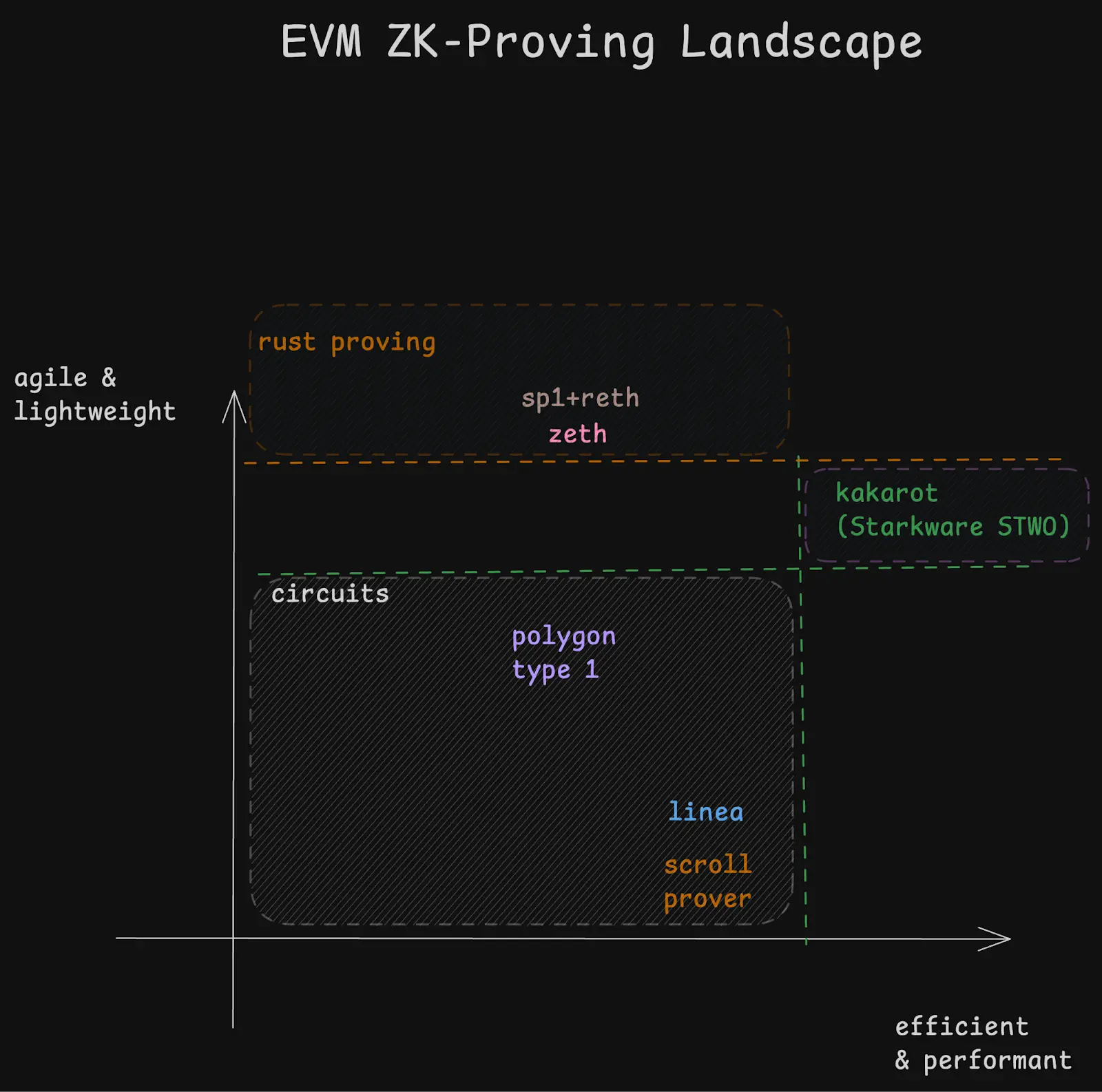

Architecture Overview

Kakarot is a provable EVM built using Cairo, which is a zero-knowledge virtual machine (ZK-VM) launched by Starkware that supports STARK proofs.

Reasons for Choosing ZK-VM

There are mainly two ways to build zero-knowledge applications (ZK-Applications) or zero-knowledge infrastructure (ZK-Infrastructure):

Using a ZK-VM (zero-knowledge virtual machine);

Writing dedicated ZK circuits (ZK-circuits).

Differences Between ZK-VM and ZK-Circuit

A ZK-VM is a virtual machine that can automatically generate ZK proofs during execution, proving that the computation is correct.

A ZK-Circuit is a mathematical model of a specific process, breaking down the computation into logical operation units, similar to the logic gates of electronic circuits.

In 2022-2023, almost all ZK-EVMs (such as Scroll, Linea, ZKSync) were based on ZK circuits. These circuits were built for single tasks, so they initially ran faster.

However, they have significant drawbacks:

High development difficulty;

Complex auditing;

High maintenance costs;

As ZK technology evolves, their performance advantages are being replaced by modern ZK-VMs.

In contrast, ZK-VMs are more flexible and can be optimized for different tasks. Developers can create ZK applications as easily as writing regular code and enhance performance by adding built-in modules or specialized opcodes.

These modules can perform low-level optimizations for specific computations, allowing the ZK-VM to achieve performance that is close to or even matches that of dedicated circuits. As Vitalik mentioned in his article, this "Glue + Coprocessor architecture" represents a new direction for zero-knowledge computation.

For nearly all application layer and foundational layer scenarios, the ZK-VM excels over ZK-Circuit in the following dimensions:

Development speed, maintenance difficulty, audit feasibility, proof costs, and optimization potential.

Reasons for Choosing CairoVM

CairoVM, released in 2020, is the first Turing-complete ZK virtual machine. It enables the development of ZK infrastructure through code (Cairo language) rather than building circuits.

Cairo is a provable domain-specific language (ZK-DSL), meaning that all programs written in Cairo can be verified through STARK proofs and can be compatible with other proof systems that support Cairo Assembly in the future.

The Rise of the RISC-V Ecosystem

Recently, RISC-V-based ZK-VMs have gained attention because they support common languages (such as Rust), lowering the learning curve for ZK development.

However, we believe that CairoVM still has a decisive performance advantage:

CairoVM is better at arithmetic operations;

RISC-V is more inclined towards bitwise operations.

Given that STARK and most finite field cryptography primarily rely on arithmetic operations, we believe CairoVM will maintain its leading performance in the medium term.

Key Metrics for Measuring ZK Capability

In the ZK field, how quickly a team can "prove existing software" is a core competitive advantage.

For example:

To make an existing Ethereum execution engine (like revm) provable, ideally, the migration should be completed within a few days. The development efficiency and flexibility of CairoVM make this goal achievable.

Kakarot: Seamlessly Transitioning Any EVM Chain to ZK

Kakarot can generate zero-knowledge proofs (ZK Proofs) for all Ethereum-equivalent chains, allowing any EVM chain to easily transition to a zero-knowledge architecture (ZK), significantly enhancing scalability while ensuring security.

This service is called Keth — a chain-agnostic EVM proof service that supports real-time proof generation.

Through Keth, Kakarot aims to bring critical value to the entire Ethereum ecosystem:

Assist Optimistic Rollups in smoothly transitioning to ZK-Rollups;

Strengthen the proof system of existing ZK-Rollups;

Support ZK Bridges and ZK infrastructure (such as full nodes);

Promote the adoption of ZK technology at the Ethereum L1 layer.

Keth: Chain-Agnostic EVM Proof Engine

Keth aims to become a "ZK Proving Powerhouse," capable of STARKifying any EVM network.

Main application scenarios:

Assist Optimistic Rollups in transitioning to ZK-Rollups;

Provide existing ZK-Rollups with a lower-cost, higher-performance prover stack;

Promote all Rollups to Stage 2 — supporting a multi-proof architecture, with Keth being one of them.

With Keth, each EVM ZK-Rollup can simultaneously adopt multiple proof systems (such as Risc-Zero, Succinct, Kakarot) to jointly verify network states, ensuring system security and consistency while avoiding single points of failure.

Towards the Era of "ZK-Everything"

The emergence of Keth is driving the blockchain into a new phase — "ZK-Everything."

In this system:

All bridges, wallets, and full nodes will be powered by zero-knowledge proofs;

The cost of Rollup infrastructure will be significantly reduced;

User sovereignty will be enhanced: users can verify proofs locally without trusting any centralized service provider.

Performance Metrics

Early benchmarks show that the StarkWare STWO proof technology used by Keth can achieve computational speeds of several tens of MHz per second, improving performance by several orders of magnitude compared to existing solutions.

Tron Comments

Advantages:

Kakarot, as a modular ZK-EVM built on CairoVM, has significant advantages in being lightweight, efficient, and easy to maintain. It allows for more flexible development, auditing, and Ethereum upgrade adaptation through a ZK-VM rather than dedicated circuits (ZK-circuits). Additionally, relying on StarkWare STARK technology, Kakarot can continuously benefit from performance improvements in zero-knowledge proofs (such as the STWO Prover, which is expected to bring a thousandfold efficiency increase). Its chain-agnostic proof service Keth further enables any EVM chain to smoothly transition to ZK mode, achieving cross-chain interoperability and secure scalability, thus promoting the future of "ZK-Everything."

Disadvantages:

Kakarot is still in its early stages, relying on the maturity of the Cairo ecosystem and the evolution of StarkWare's underlying technology. While its performance and compatibility are strong, it may face competition from RISC-V ZK-VMs in the short term, as well as issues related to insufficient ecosystem tools and developer resources. Additionally, the complexity of ZK technology and high computational costs remain barriers to widespread adoption in the initial stages.

### 3. Industry Data Analysis

1. Overall Market Performance

1.1. Price Trends of Spot BTC vs ETH

BTC

ETH

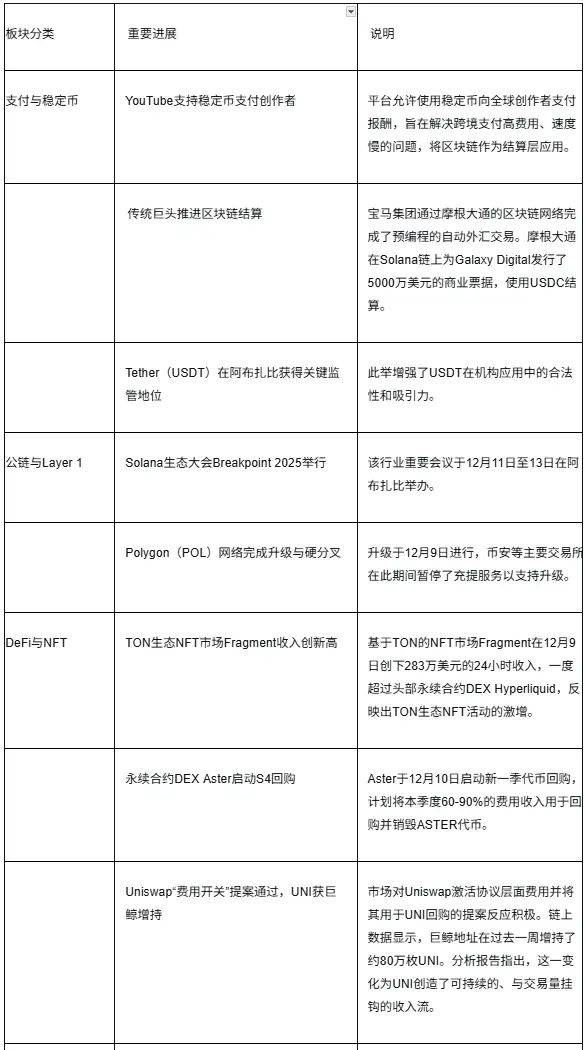

2. Summary of Hot Sectors

### 4. Macroeconomic Data Review and Key Data Release Points for Next Week

The core information from the Federal Reserve's interest rate decision announced in December can be summarized as "interest rates remain unchanged, but the policy inflection point has been officially confirmed." The Federal Reserve held steady as expected, acknowledging that inflation is receding and the job market is cooling, while also lowering future interest rate path expectations in the dot plot, signaling that the rate hike cycle has ended and the next step will shift towards rate cuts. However, the statement and press conference still emphasized vigilance against service inflation and wage growth to avoid excessive market pricing of easing. Overall, this meeting provided directional "dovish confirmation" for the market but did not offer a clear timetable for rate cuts, indicating that policy has entered an observation period, with subsequent pacing highly dependent on the further weakening of economic data.

Important data releases this week:

December 16: U.S. November unemployment rate; U.S. November seasonally adjusted non-farm payrolls

December 18: U.S. November unadjusted CPI year-on-year

### 5. Regulatory Policies

United States: Promoting the Application of Digital Assets in Traditional Financial Markets

The U.S. Commodity Futures Trading Commission (CFTC) took a series of measures this week that are seen as "open-minded" towards the crypto market.

Launching a Tokenized Collateral Pilot: On December 8, the CFTC announced the launch of the "Digital Asset Pilot Program for Tokenized Collateral in the Derivatives Market." This pilot allows specific non-securities digital assets (including Bitcoin, Ethereum, and stablecoin USDC) to be used as eligible collateral for derivatives trading regulated by the CFTC.

Issuing New Guidelines and Revoking Old Regulations: The CFTC simultaneously released the "Regulatory Guidelines for Tokenized Collateral" and revoked the previously issued Advisory No. 20-34 from 2020, which had restricted futures brokers from accepting virtual currencies as client collateral. The CFTC's acting chair stated that this move aims to eliminate "outdated and overly complex" guidance that hinders industry innovation.

European Union and Member States: Implementation and Discrepancies under the MiCA Framework

The EU's Markets in Crypto-Assets Regulation (MiCA) continues to advance, but there are disputes among member states regarding specific implementations.

Regulatory Power Dispute in Poland: The Polish parliament upheld its previous veto of a domestic crypto bill aimed at implementing MiCA. Subsequently, the government submitted a nearly identical bill to the parliament again. The core of the dispute lies in the bill's plan to grant market regulatory authority to Poland's own financial regulatory body, which conflicts with the calls from some EU member states for more centralized regulation by the European Securities and Markets Authority (ESMA).

Italy Sets Strict Compliance Deadlines: Italian market regulators have set strict MiCA compliance deadlines for virtual asset service providers, requiring them to seek authorization or exit the market by December 30, 2025.

Japan: Fundamental Shift in Regulatory Framework Planning

On December 10, Japan's Financial Services Agency released a comprehensive report outlining significant adjustments planned for the cryptocurrency regulatory framework.

Legal Basis Shift: The plan is to shift the legal basis for regulating crypto assets from the current Payment Services Act to the Financial Instruments and Exchange Act. This indicates a change in regulatory attitude from viewing them as "means of payment" to viewing them as "investment tools," aimed at enhancing user protection.

Supporting Strengthening Measures: The new framework is expected to strengthen information disclosure requirements for initial exchange offerings, empower regulatory bodies with more robust tools to combat unregistered overseas platforms, and explicitly prohibit insider trading.

China: Industry Associations Jointly Strengthen Risk Warnings

In mainland China, relevant financial industry associations jointly issued risk warnings regarding virtual currencies this week.

Seven Associations Issue Risk Warnings: On December 12, seven national-level financial industry associations, including the China Internet Finance Association and the China Banking Association, jointly released a notice reiterating that activities related to virtual currencies are considered illegal financial activities.

Clear Business Bans: Member units (including banks, payment institutions, securities, and fund companies) are prohibited from engaging in or providing any services related to virtual currencies or tokenized real-world assets, including trading, settlement, and marketing.

Warning the Public of Risks: The public is advised to stay away from various virtual currency business activities, remain vigilant against fraud risks, and be clearly informed that it is also illegal for overseas service providers to offer services domestically.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。