If we say that the track with the highest expected alpha returns in 2026 is likely still #AI+, it mainly leans towards the application side, such as AI + prediction markets, AI + x402 payment fields. These small yet beautiful AI applications may yield explosive alpha projects and tokens (beta is not discussed here).

Looking back at the history of #AI+Crypto since 2024, it has consistently been the most rapidly growing and highly discussed area among various tracks. From the early part of 2024, we highlighted tokens like #FET and #RNDR, to the 2025 wave of Agents represented by @virtualsio, which focused on AI applications + fair launch platforms for AI assets, and the #AI16Z framework protocol for AI Agents, to the interesting token analysis Agent tool by @aixbtagent. We witnessed their explosive growth and potential.

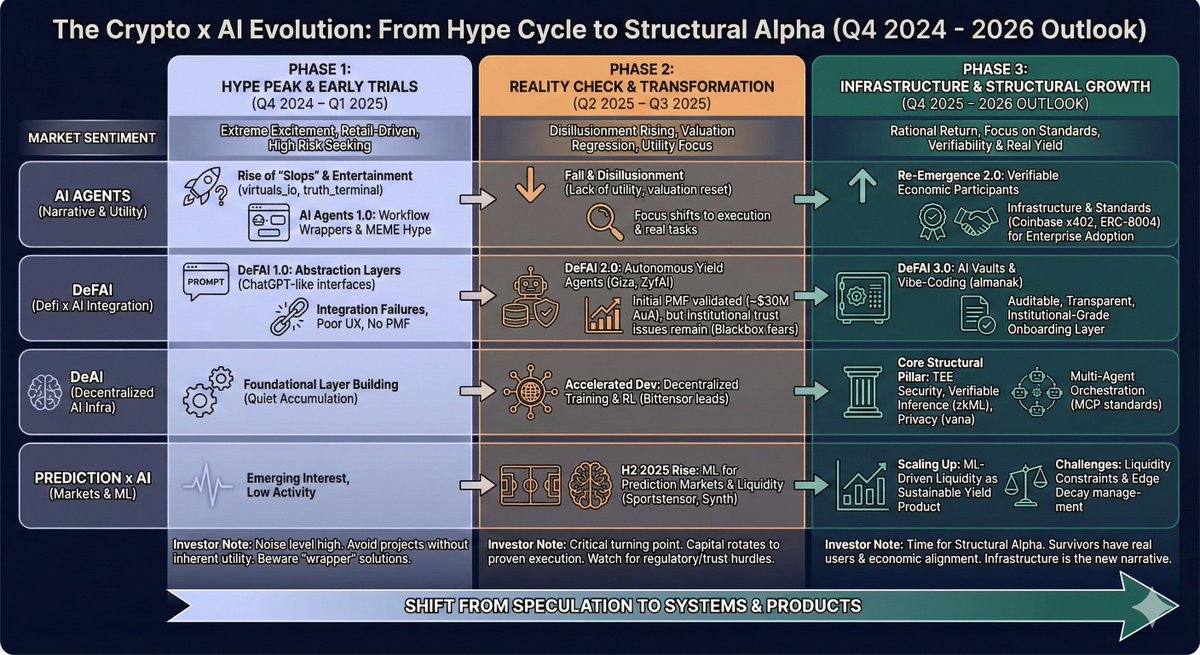

If we briefly review the growth of #AI from 2024 to 2025, the most alpha projects were born during this period, and I believe the future will be the same. It can be said that in the #AI track, 2024 was about imagination, 2025 was about validation, and 2026 will be the year of harvesting true PMF.

1️⃣ 2024: The AI × Crypto Explosion (False Prosperity)

At that time, the market was very FOMO, and the hype logic was simple: “#AI is the future, #Crypto is money, so AI + Crypto = the future of money.”

Thus, we saw the emergence of various AI+ projects, whether in the meme market or VC-invested AI projects:

AI × Gaming

AI × Entertainment

AI × Generative Content

AI × Voice or Video Agents

AI × Workflow or Efficiency Tools

My genuine feeling at that time was that most of these projects were created just for the sake of hype. If these projects did not issue tokens, no one would use them at all. Because what they were doing, Web2 AI companies had already done well, with GPT-4 and Midjourney covering everything. Users did not need chains or tokens; Crypto had no irreplaceability here.

The final result was that after a round of hype, there was no PMF, no retention, and they relied on subsidies to survive. In the end, it was either the end of the lifecycle or “lying dormant with updates.”

2️⃣ Early 2025: #DeFAI Emerges — AI Finally Finds Its Place in Crypto

The development of things always iterates and grows in the wilderness; wildfires cannot be extinguished, and spring winds bring new life. At this time, a new term emerged: #DeFAI (Decentralized Finance + AI).

This was a refreshing concept for me at the time. #DeFi was already incredibly complex: How to choose cross-chain bridges? Which DEX has good liquidity? Are the lending protocols on the new chain reliable? How to assess risks? Not to mention that newcomers find it headache-inducing; even seasoned investors need to study for a long time to sort out a clue.

Thus, the first batch of DeFAI projects appeared, such as #HeyAnon and #Wayfinder, which created a “ChatGPT-style interface”: you type “Help me swap ETH from Arbitrum to Base and deposit it into Aave to earn interest,” and it executes automatically.

It sounds beautiful, but the reality is harsh. If you have experienced it, you know the pain points; users have no idea what prompts they can ask, what they cannot ask, or how to ask. The UI interface was as chaotic as DApps in 2017. Execution was also prone to errors, with gas fees wasted and many other pain points. Although they optimized later, the user experience was still unsatisfactory.

The result? Most projects failed, and some transformed, such as #HeyAnon later pivoting to “trading assistant + prediction market tool.”

This should be considered the lesson of the first generation of DeFAI: having a “natural language interface” is not enough; it is essential to solve “execution reliability” and “user cognitive costs.”

3️⃣ Mid-2025: The Second Generation of #DeFAI — “Autonomous Yield Agents” Arrive

At this point, smart people began to change their thinking. Since users cannot use it, why not let AI take care of everything? Thus, “Autonomous Yield Agents” emerged, represented by @gizatechxyz's Giza.

You only need to: deposit assets (like 10 ETH), set your risk preference (“conservative” or “aggressive”), and authorize a “smart wallet” (with permission controls, such as “can only operate Aave, cannot transfer assets”). The rest, such as finding high-yield pools, automatic reinvestment, dynamic asset allocation, stop-loss, and take-profit, is entirely entrusted to the AI agent.

This was a significant advancement; currently, #Giza manages $30 million in assets and has generated $3 billion in trading volume! The second place, @ZyfAI_, has also achieved $8.5 million in TVL.

In essence, users do not want to “think about strategies”; they just want to “earn effortlessly with one click.” At this point, DeFAI hit the key pain point, solving some user problems and allowing a group to survive. However, large funds still hesitated to enter, as institutions feared AI “hallucinations” leading to erratic operations or being exploited by hackers, resulting in black box issues.

4️⃣ Late 2025: The Third Generation of DeFAI — “AI Vaults” + Auditable Smart Contracts

This time, another iteration occurred, with a new approach: AI does not directly operate but “writes code.” Projects like @almanak allow a group of AI agents to “vibe-code,” automatically generating a complete DeFi strategy smart contract within minutes.

To address the concerns of large funds regarding black boxes, this iteration has clear advantages:

✅ Contracts are public and auditable (like ordinary DeFi contracts)

✅ Strategy logic is transparent, no longer a black box

✅ Capital allocators (like hedge funds) can quickly test new strategies

This time, the difference is that institutions finally saw self-strategies that are controllable in risk and verifiable in logic, with the entire process being very transparent and clear.

DeFAI is now divided into three layers:

· Abstraction Layer: User-friendly for beginners, natural language interaction (like #Wayfinder)

· Agent Layer: One-click yield management (like #Giza)

· Strategy Layer: AI-generated auditable strategies (like #Almanak)

From this moment on, #DeFAI has basically completed all iterations and has truly become a market-fit and usable product.

5️⃣ Advantages and Explosive Points in 2026 — x402 & Prediction x AI

Currently, AI + Web3 has reached a bottleneck, but the emergence of Coinbase's x402 and the ERC-8004 proposed by ETH solves three things, which are also the biggest pain points in the Agent field today:

• Identity of the Agent

• Credibility of the Agent

• Settlement and collaboration of the Agent

The resolution of these pain points will allow AI Agents to no longer be “performers” but to become true participants in the on-chain economy. We see many interesting and representative projects, such as @AiMoNetwork, @questflow, @pinatacloud, @AurraCloud, @mrdnfinance, @itsgloriaai, @PayAINetwork, @daydreamsagents, etc.

Another relatively certain aspect for 2026 is: Prediction x AI, using AI to “level up” in prediction markets.

In fact, prediction markets are naturally suitable financial products for machine learning because they have clear win-lose logic, an immediate feedback mechanism, real monetary signals, and can also find arbitrage opportunities across multiple prediction platforms. Therefore, “AI making predictions” is more realistic than “AI making trades.” PM liquidity is small, but the edge is very real and more aligned with user needs.

Next year's World Cup will undoubtedly be a battleground for prediction markets, but these giants often have high valuations. Currently, the three giants, such as #Kalshi at $11 billion, #Polymarket at $8 billion, and @opinionlabsxyz should also be no less than $2 billion. Therefore, retail investors can enter and eat beta, but alpha opportunities are relatively slim.

Basically, the alpha opportunities in prediction markets will be given to Prediction x AI projects. Representative projects include: @crunchDAO, @FractionAI_xyz, @Polysights, @SportsTensor, etc.

In summary, looking back, the Crypto × AI landscape from 2024 to 2025 has undergone three reshuffles:

The first wave: AI Agent → Died from “false demand”

The second wave: DeFAI 1.0 (chat interface) → Died from “usability issues”

The third wave: DeFAI 2.0 and 3.0 + DeAI + Prediction AI → Found real users, real returns, and real economic models.

In 2026, perhaps the market will no longer focus on “how smart AI is,” but rather on “can AI help us make money,” focusing on “betting” and “arbitrage.” 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。