Written by: ChandlerZ, Foresight News

The U.S. Department of Labor will release the U.S. non-farm employment data for November today. This data was originally scheduled for release on December 5, but was postponed due to the recent U.S. government shutdown.

On the eve of the non-farm employment data release, global assets collectively entered a "brake mode." The three major U.S. stock indices slightly declined, with the Nasdaq and tech stocks primarily experiencing a pullback, and AI concept stocks continuing to be sold off; U.S. Treasury volatility dropped to its lowest point since May of last year, with the yield on the 10-year U.S. Treasury bond only slightly down by 0.5 basis points, while the U.S. dollar index recorded a four-day decline, and the offshore yuan briefly rose above the 7.04 mark.

In this atmosphere where "stocks, bonds, and currencies are reluctant to take a direction," crypto assets also entered a correction, with Bitcoin briefly falling to the $85,000 mark and Ethereum temporarily dropping below $2,900. According to Coinglass data, $582 million was liquidated across the network in the past 24 hours, with $508 million in long positions and $74.37 million in short positions. Among them, Ethereum saw $186 million liquidated, while Bitcoin had $174 million liquidated.

It seems to be another "non-farm night," where investors are unwilling to heavily bet on any direction before the key data is released.

The Battle for the Fed Chair: Hassett vs. Warsh

Who will lead the Federal Reserve is becoming one of the key variables swinging the interest rate curve and inflation expectations. Hassett, who was originally seen as a shoo-in candidate, has recently faced significant undercurrents. Several heavyweight figures who can directly advise Trump have expressed caution about his potential leadership at the Fed, with their real concern not being Hassett's professional background, but rather his overly close relationship with Trump.

If the market perceives the new chair as more of an extension of the president rather than a relatively independent central bank leader, there may be a lack of sufficient resolve to tighten further when inflation rises in the future. This could lead to long-term U.S. Treasury yields expressing distrust in advance, ultimately raising government financing costs, which contrasts sharply with the White House's desire to maintain low interest rates and stable growth.

This concern has already been reflected in market expectations. Trump had previously signaled that he had an answer in mind, but later, in an interview with The Wall Street Journal, he backtracked, listing Hassett alongside former Fed governor Warsh as "front-runners," stating, "Both Kevins are excellent."

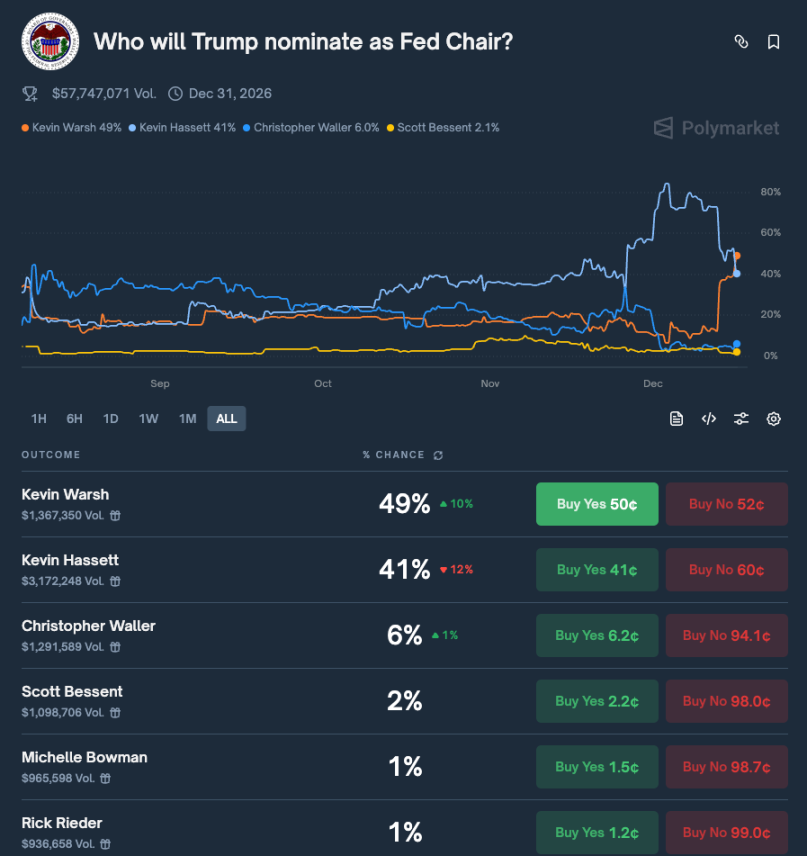

This statement immediately triggered a chain reaction in the prediction market. In the Polymarket prediction event "Who will Trump nominate as Fed Chair?", the market currently bets on Kevin Warsh having the highest probability of being selected at 49% (up 10%); Kevin Hassett ranks second at 41% (down 12%).

Interestingly, this shift in sentiment has not been achieved through public criticism of Hassett, but rather through the continuous elevation of Warsh. At a Wall Street event, JPMorgan CEO Jamie Dimon acknowledged both individuals' professional capabilities, but his attitude was interpreted by many attendees as "more favorable towards Warsh."

In response to the doubts, Hassett deliberately drew a line in a recent interview, emphasizing the Fed's independence in interest rate decisions, stating that the president's views would not carry equal weight with the governors and FOMC members, and that the final decision would still be reached through internal discussions. Trump, on the one hand, emphasized that he should be a smart voice that is listened to, hoping the new chair would closely communicate with him on interest rate issues, while on the other hand, he acknowledged that the Fed should not become a simple executor of presidential will.

This seemingly subtle combination of statements actually outlines a clear reality: whether Hassett or Warsh ultimately takes the position, the new Federal Reserve will operate under a stronger political spotlight, and the market will use long-term rates, inflation expectations, and even the dollar's movements to price this new balance of "political-monetary relations."

For Bitcoin, a highly sensitive macro asset, who becomes the next Fed chair will influence the market's judgment on the future real interest rate range, the boundaries of monetary easing, and the dollar cycle, all of which will ultimately leave a clear echo in Bitcoin's volatility and medium to long-term trends.

Past Non-Farm Scripts

Based on past experiences, every time there is a macro key point like non-farm data, the crypto market, especially Bitcoin, often follows a relatively fixed script. In the period leading up to the data release, the market typically enters a phase of initial contraction followed by an explosion, with leverage gradually cooling down and volatility being suppressed, as funds are more focused on betting on expectations; while on the night the data is released, a rapid back-and-forth occurs, quickly completing the repricing of the entire "employment-inflation-interest rate" chain. This time, the non-farm data is very likely to be no exception.

In terms of specific trading implications, the biggest significance of this non-farm data lies in how it reshapes the market's judgment on inflation stickiness and the path to interest rate cuts through employment and wage growth, thereby transmitting through the dollar index—U.S. Treasury yields—real interest rates to the crypto market. If the November non-farm employment and wage growth significantly exceed expectations, the market's confidence that inflation has entered a controllable decline will be weakened, potentially prolonging the duration of high interest rates, putting upward pressure on U.S. Treasury yields and real interest rates, and the dollar index may also end its previous streak of declines. In the context of tech stocks already under pressure and overall risk appetite cooling, Bitcoin is likely to face a new round of corrections, with the risks of high leverage and crowded long positions being forced to deleverage.

If the overall data roughly meets expectations, with employment and wages falling within a moderately cooling range, the market's narrative of a soft landing will remain stable, and U.S. Treasuries and the dollar are more likely to oscillate within existing ranges, with real interest rates only fluctuating within limited bounds. In this case, Bitcoin may experience a wide-ranging fluctuation on the day of the data release, but is likely to return to its original range afterward, with the true price determinants still being subsequent inflation data, the Fed's communication tone, and the repricing of the interest rate cut pace for next year.

However, if the non-farm employment and wage data are significantly weaker than expected, signaling a cooling job market, the market will tend to price in a more accommodative policy path in advance, bringing forward interest rate cut expectations, shifting the yield curve downward, and causing real interest rates to fall, putting pressure on the dollar. The mid-term logic for gold will be further reinforced in this environment, while Bitcoin often becomes the asset that responds first and most significantly to this repricing. Once funds confirm that weak data does not equate to a systemic recession, but rather creates space for easing, macro funds chasing elasticity and beta are likely to increase their positions in Bitcoin and mainstream crypto assets again.

But if the data is weak enough to trigger panic over a hard landing, the order of asset allocation is likely to shift to first reducing risk assets, then increasing positions in government bonds and cash, making it similarly difficult for Bitcoin to stand alone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。